Clinical Documentation Improvement Market Size and Forecast 2025 to 2034

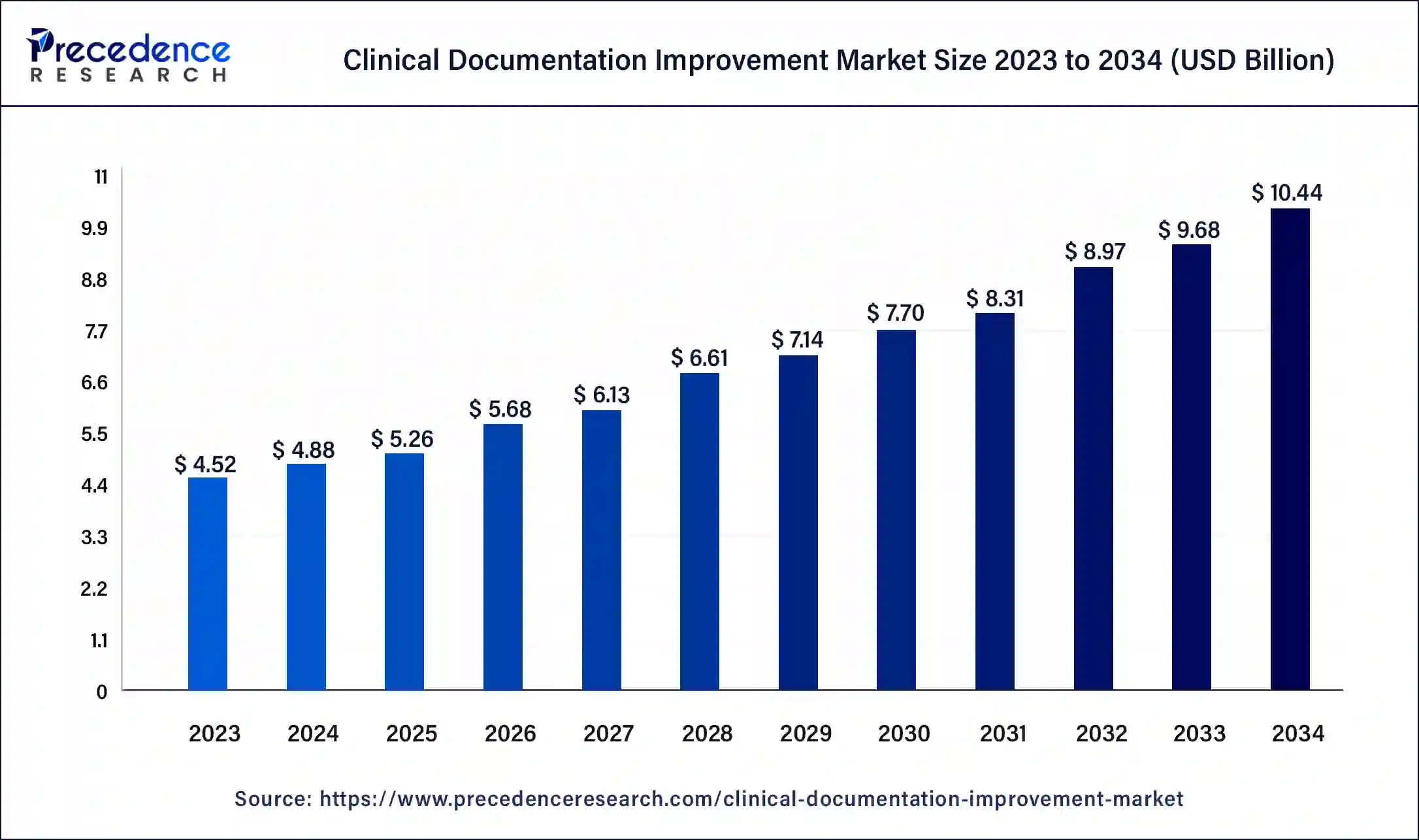

The global clinical documentation improvement market size was estimated at USD 4.88 billion in 2024 and is predicted to increase from USD 5.26 billion in 2025 to approximately USD 10.44 billion by 2034, expanding at a CAGR of 7.90% from 2025 to 2034.The rising need for mid-RCM (revenue cycle management) services, management of large amounts of healthcare data, and the widespread adoption of standardized documentation protocols have led to the growth of the clinical documentation improvement market.

Clinical Documentation Improvement Market Key Takeaways

- The global clinical documentation improvement market was valued at USD 4.88 billion in 2024.

- It is projected to reach USD 10.44 billion by 2034.

- The market is expected to grow at a CAGR of 7.90% from 2025 to 2034.

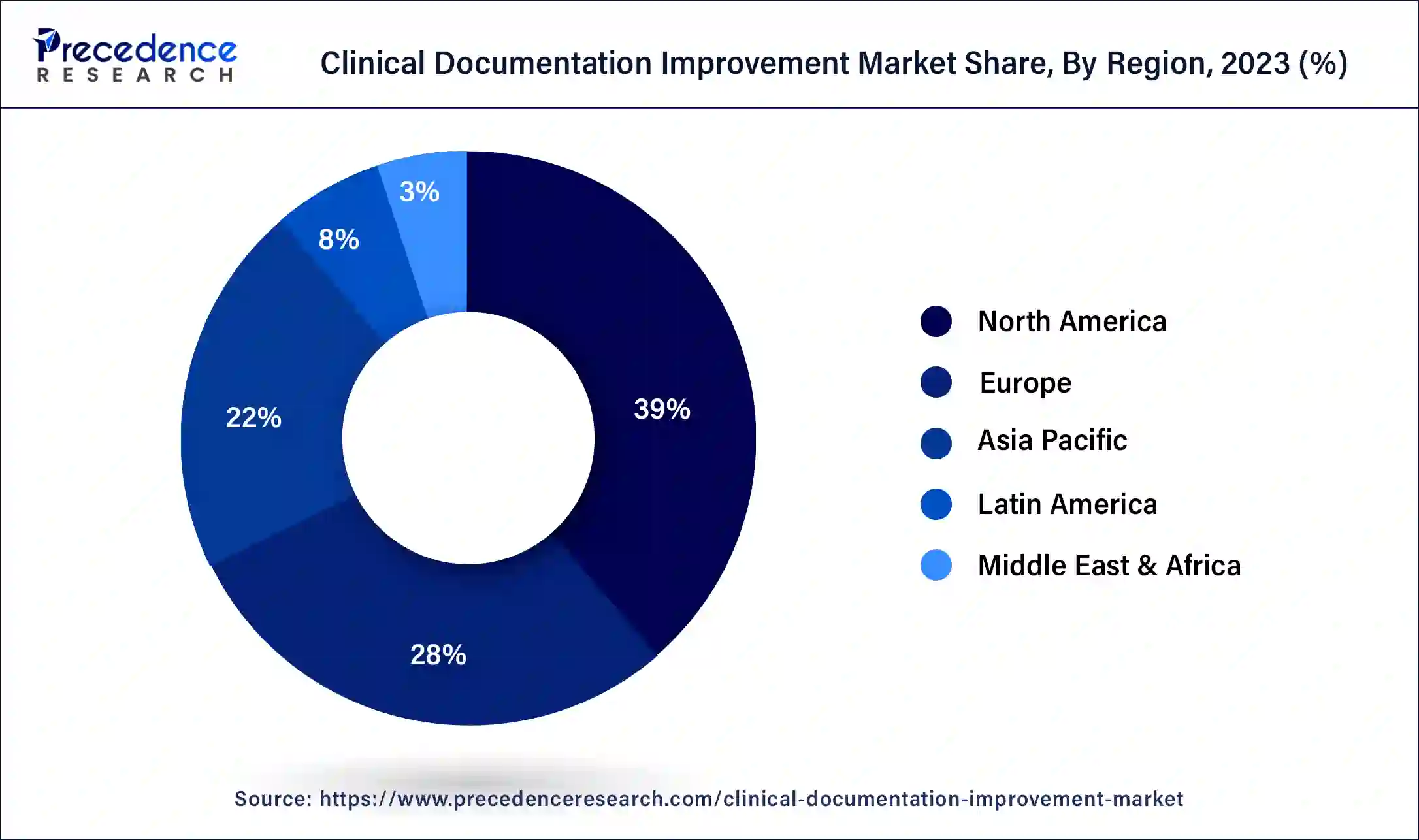

- North America dominated the clinical documentation improvement market with the largest revenue share of 39% in 2024.

- Asia Pacific is expected to host the fastest-growing market during the foreseeable future.

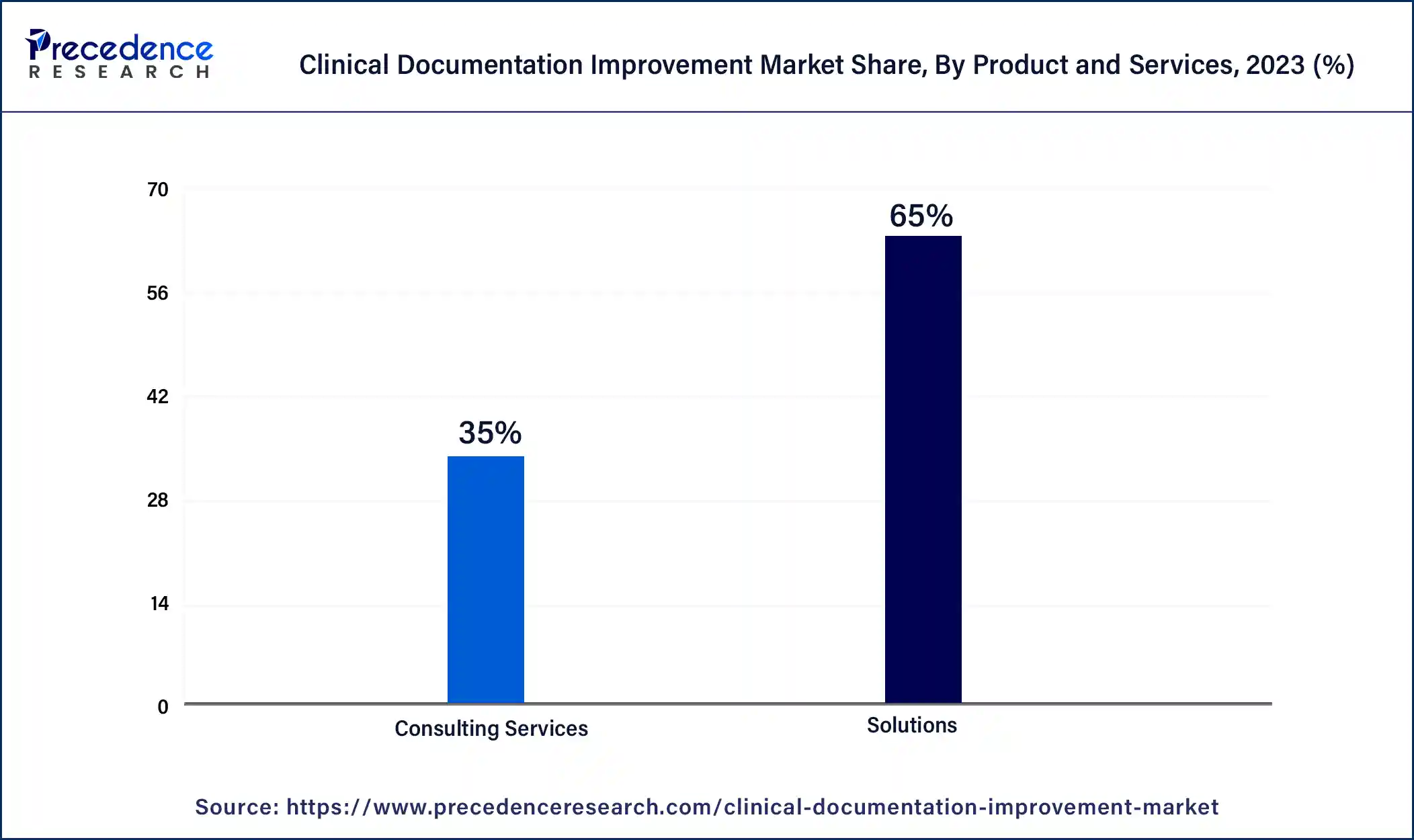

- By product and services, the solutions segment has contributed more than 65% of revenue share in 2024.

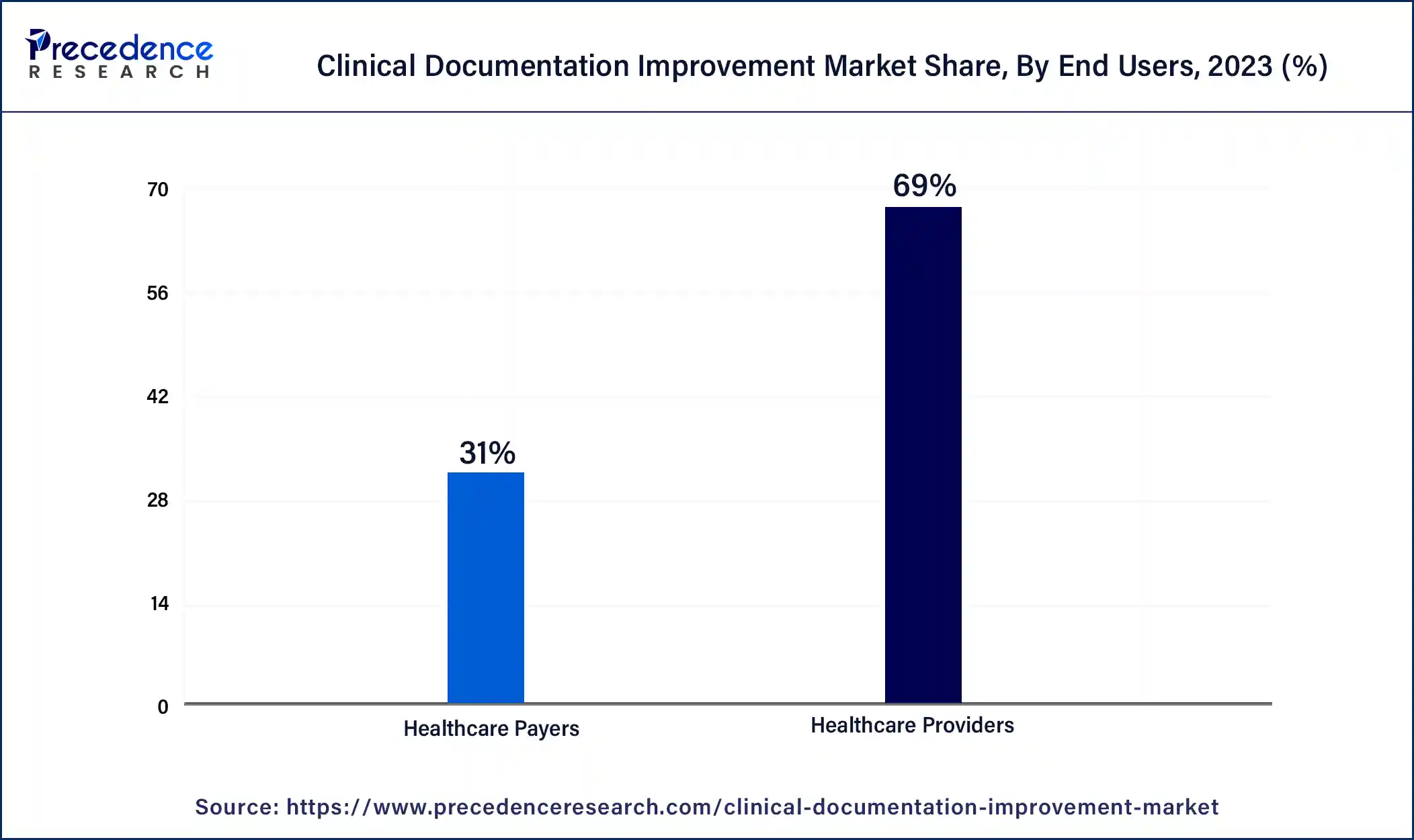

- By end user, the healthcare providers segment has held the largest revenue share of 69% in 2024.

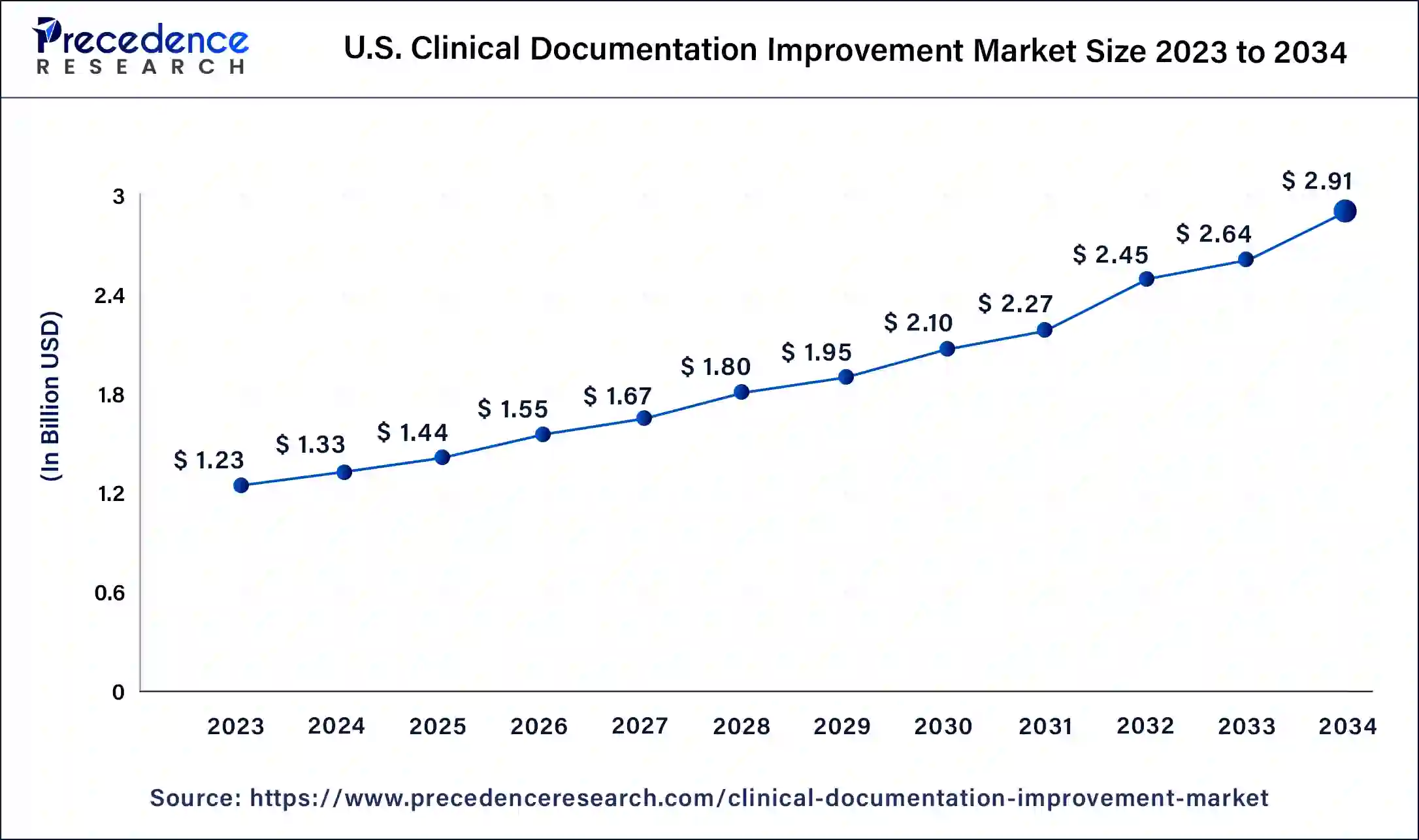

U.S. Clinical Documentation Improvement Market Size and Growth 2025 to 2034

The U.S. clinical documentation improvement market size was exhibited at USD 1.33 billion in 2024 and is projected to be worth around USD 2.19 billion by 2034, poised to grow at a CAGR of 8.14% from 2025 to 2034.

North America held the largest share of the clinical documentation improvement market in 2024. The high adoption of mid-RCMs and other CDI solutions in the region's robust healthcare sector, along with significant government funding in research and development, are some of the factors. In the United States, a high standardization in coding was brought about by the DRG system overhaul in 2007 when the Centers for Medicare & Medicaid Services (CMS) introduced Medicare Severity Diagnosis Related Groups (MS-DRGs). MS-DRGs were a classification system used to categorize and reimburse healthcare providers for inpatient hospital services. MS-DRGs collected a lot more information in comparison to the earlier DRG, assigning a unique code to each patient based on their major diagnosis, secondary diagnosis, age, sex, medical procedures performed, and discharge status.

North America dominated the clinical communication and collaboration market due to technological advancements in healthcare infrastructure and awareness regarding optimization of the digital medium for healthcare purposes. The advanced infrastructure provides individuals with the topmost clinical facility that helps prevent diseases like breast and colorectal cancer.

Early detection assists in identifying and prescribing medication for rare diseases, and clinical communication significantly improves the prevention of diseases, as they provide personalized treatment plans through digital solutions that include telehealth, telemedicine, and mobile applications. In addition, Canada also plays a crucial role as it provides patients with telehealth and personalized care through streamlined processes.

Approximately 92% of the United States population is covered by health insurance, which accounts for over 300 million people in 2022. The high insurance penetration in the region necessitates accurate information collection and coding for precise billing and insurance reimbursement claims. The United States government has also initiated initiatives to improve insurance, such as Medicare and Medicaid. In 2022, Medicare provided health insurance for 65 million individuals, with more than 57 million people aged 65 and older and approximately 8 million younger people.

Asia Pacific is expected to host the fastest-growing clinical documentation improvement market during the foreseeable future. The rise in healthcare sector expenditure and improving healthcare infrastructure in the region, along with the development of medical tourism in countries like Thailand, Malaysia, Singapore, and India, is pushing demand for healthcare information technology solutions in the medical sector. The healthcare travel sector is recovering post-pandemic, and ASEAN governments are introducing several initiatives to boost the sector.

In Asia Pacific, the clinical communication and collaboration market is also experiencing rapid growth, fueled by a combination of factors including a diverse and growing patient population base, the presence of prestigious hospitals, high levels of medical tourism, and an increasing emphasis on a sustainable healthcare system. These dynamics contribute to the region's elevated demand for the healthcare system, particularly within the digitalization and high-end sectors.

Asia Pacific consumers exhibit a wide range of preferences, from those seeking affordable treatment to those desiring personalized telehealth, such as telemedicine and virtual care platforms. Moreover, India is home to numerous digital healthcare solutions and government initiatives, which reinforce a strong presence in the market for high-quality, digitalized healthcare infrastructure.

Market Overview

Clinical documentation refers to patient information collected to enter into medical records maintained by a healthcare provider. It is a repository of information related to a person's health and includes several physical and pathological parameters. The information may be collected by a physician, dentist, nurse, or any other healthcare professional. Clinical documentation in the context of CDI usually refers to entries made by healthcare providers interacting with patients during a consultation. Documentation of this nature may include laboratory tests, diagnostic tests, and/or consultation notes written by specialists in a patient's medical records.

How the Clinical Documentation Improvement Market is Growing with the Expanding Healthcare Industry?

The implementation of clinical documentation improvement systems enhances communication between physicians, surgeons, nurses, and pharmacists. These systems are also now being expanded to include patient relatives to keep them updated on procedures. The rising CDI adoption rates in outpatient facilities are resulting in quicker recovery and cost-effective treatments.

Clinical documentation improvement (CDI) is the process of enhancing the quality of medical information collected to ensure accuracy and comprehensiveness. CDI incorporates several different steps, including a review of pathology, diagnostic findings, and missing documentation. A CDI professional usually has a background in both clinical and medical coding. Clinical documentation improvement is playing an increasingly crucial role in the healthcare industry, with a rising number of hospitals reported to experience substantial revenue increases and documented quality improvements within half a year of launching CDI initiatives. CDI programs have been a major part of healthcare systems worldwide even before digital documentation was introduced.

The clinical documentation improvement market improves the accuracy of information collection, coding, and billing for both inpatient and outpatient facilities, which results in more accurate billing and insurance reimbursement claims. CDI specialists help streamline these processes and ensure both time and cost efficiencies are met. Hospitals and other healthcare facilities are subject to scrutiny through audits to ensure compliance and prevent fraud or abuse. Lack of adequate awareness and education about CDI systems can impact the quality of healthcare provided. Resource constraints, underinvestment, and the complexity of regulatory standards surrounding CDI initiatives are factors restricting growth in the clinical documentation improvement market.

CDI programs are also crucial to the overall well-being of patients. Thorough collection and coding help healthcare providers gather all required information to make an informed diagnosis, leading to an improvement in patient outcomes and ensuring quality of care. The clinical documentation improvement market systems that span both inpatient and outpatient care facilities ensure continuity and efficient collaboration between various healthcare providers to provide the highest standard of treatment and shorter stays for the patient. Existing market players are looking to artificial intelligence (AI), natural language processing (NLP), and advancements in healthcare information technology to improve the efficiency and easy adoption of clinical documentation improvement globally.

Clinical Documentation Improvement Market Growth Factors

- Electronic health record systems are gaining popularity worldwide, creating scope for clinical documentation improvement solutions to streamline processes and enhance efficiency for patient care and billing.

- Healthcare systems are increasingly required to comply with certain regulatory requirements from respective governments. CDIs help ensure accuracy in coding and documentation, helping healthcare providers comply with existing rules and avoid fines and/or prosecution.

- The advent of insurance providers looking for holistic clinical documentation to accurately determine insurance premiums and pay-outs is fueling growth in the clinical documentation improvement market.

- The growing amount of data collected by healthcare providers necessitates the adoption of more advanced healthcare data management systems, leading to growth in the clinical documentation improvement market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.44 Billion |

| Market Size in 2025 | USD 5.26 billion |

| Market Size in 2024 | USD 4.88 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.90% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product & Service, End users, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Enhanced IT systems are being increasingly adopted by healthcare providers

Healthcare providers are increasingly using technology-driven frameworks to upgrade their facilities and switch to electronic health records. EHRs uploaded to a central cloud-based system ensure widespread accessibility and enhance healthcare interoperability among different providers as well as insurance companies. EHR tools help ease clinician burden and reduce the use of human scribes, who tend to have higher turnover rates and generally cost more. The clinical documentation improvement market streamlines the revenue cycle processes. Accurate estimates and quick reimbursements rely on both charge capture and correct clinical information inputs into value-based payment systems through methods such as MS-DRGs.

Restraints

Complexity of clinical documentation improvement systems

The clinical documentation improvement market is becoming increasingly complex, with stricter regulations and compliance guidelines imposed by governments. Clinical documentation as a process is manual, tedious, and prone to error. Complexity in implemented clinical documentation systems leads to further deterioration in documentation quality and, in turn, poor coding. Inaccurate coding can lead to delayed reimbursements, distorted patient bills, and rejected or denied insurance claims. These factors lead to higher fines and penalties during audits.

High initial investment and resource constraints

Implementing clinical documentation improvement systems requires high initial investment, training of current staff, and the hiring of CDI professionals. Resource limitations among healthcare providers, such as staffing shortages and budgetary constraints, are challenges in the clinical documentation improvement market.

Opportunities

Emergence of AI and natural language processing

Clinical documentation improvement has seen a significant boost thanks to developments in artificial intelligence and natural language processing. NLP helps computers and other digital devices recognize, understand, and generate text by combining computational linguistics, statistical modeling, and machine learning. AI brings with it opportunities to analyze large quantities of medical data to find discrepancies in coding and make diagnostic recommendations based on clinician notes.

AI-driven automated data entry and documentation systems can reduce errors occurring from manual data entry. AI can also be used to transcribe physician voice and clinical notes and enter information into the EHR. AI-based voice recognition software can also be used to perform hands-free dictation during the patient visit, minimizing distractions from the consultation. Supplementing clinician expertise with such AI tools will help eliminate some administrative burdens and improve staff productivity in the healthcare sector.

CDI evaluation and revitalization programs through data integration and interoperability

Clinical documentation improvement programs need regular re-evaluations to capture missed opportunities and improve accuracy in physician documentation, severity of illness (SOI), and risk of mortality (ROM) scores. Opportunities exist in the space with a demand for education programs for clinical documentation specialists and coding professionals to improve existing processes. Along with these education and revitalization programs, seamless patient care and reimbursements rely on interconnected hospital IT systems. Data integration and interoperability lead to a more comprehensive understanding of patient health by connecting hospital data silos. Data integration drives are also great opportunities for firms in the clinical documentation improvement market.

Product & Service Insights

The solutions segment dominated the clinical documentation improvement market in 2024. Accurately capturing patient data, documenting clinical procedures, coding diagnoses and treatments all makeup solutions while including clinical coding and data capturing. High-quality documentation facilitated by CDI solutions improves patient care by providing clearer and more precise medical records, aiding in better diagnosis and treatment planning.

Accurate documentation directly impacts hospital revenue cycles by ensuring proper coding and billing, leading to improved reimbursement rates and financial performance, making investment in CDI solutions financially advantageous. Solutions offering advanced technologies such as natural language processing (NLP) and artificial intelligence (AI) significantly enhance documentation accuracy and efficiency, making them highly attractive to healthcare providers.

End-user Insights

The healthcare providers segment held the largest share of the clinical documentation improvement market in 2024. A global increase in healthcare expenditure across nations and the rise of medical tourism in areas such as Asian countries is leading to the setting up of several state-of-the-art hospitals. The large number of patients treated in hospitals generates enormous amounts of data requiring clinical documentation systems to handle. There is also a high demand for collaborative care due to rising comorbidities. CDIs help hospitals maximize revenues through the minimization of coding errors and improving the efficiency of claims and reimbursement cycles.

The development of robotic surgery, laparoscopic procedures, and advanced imaging has led to a massive expansion of the range and safety of outpatient procedures. Government investment in outpatient facilities and the influx of private practices in the space are fueling growth in this segment. The advent of value-based payment models is also leading to the rising popularity of outpatient care facilities.

Clinical Documentation Improvement Market Companies

- 3M Company

- Optum

- Nuance

- Dolbey Systems

- Streamline Health

- Vitalware

- Chartwise

- Craneware

- Epic Systems

- Flash Code

Recent Developments

- In October 2024, Suki, an artificial intelligence provider for healthcare, raised USD 70 million and was able to raise a maximum funding of USD 165 million. Hedosophia and Venrock were the main participants as investors.

- In February 2025, Mount Sinai Medical Center incorporated AI into its healthcare system to enhance the patient-centric experience and create an efficient and streamlined approach for clinical communication. In addition, the centre has previously launched AI initiatives to improve clinical documentation.

- In March 2024, generative AI company Abridge announced a strategic collaboration with NVIDIA to improve clinician workflows and patient care through AI-powered solutions. Abridge also received investment from NVIDIA's venture capital branch, NVentures.

- In October 2023, eClinicalWorks launched a new AI-powered clinical documentation software. Sunoh.ai listens to patients during medical appointments so that providers can focus on conversations without having to write down notes.

- In April 2023, Amazon Web Services (AWS) announced a partnership with 3M Health Information Systems to advance collaboration on the M*Modal virtual assistant technology. 3M received access to Amazon's AWS Machine Learning and generative AI services Amazon Bedrock, Amazon Comprehend Medical, and Amazon Transcribe to refine the ambient clinical documentation virtual assistant.

Segments Covered in the Report

By Product & Service

- Solutions

- Clinical Documentation

- Clinical Coding

- Charge Capture

- Clinical Documentation Improvement

- Others

- Consulting Services

By End users

- Healthcare Providers

- Inpatient Settings

- Outpatient Settings

- Healthcare Payers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344