January 2025

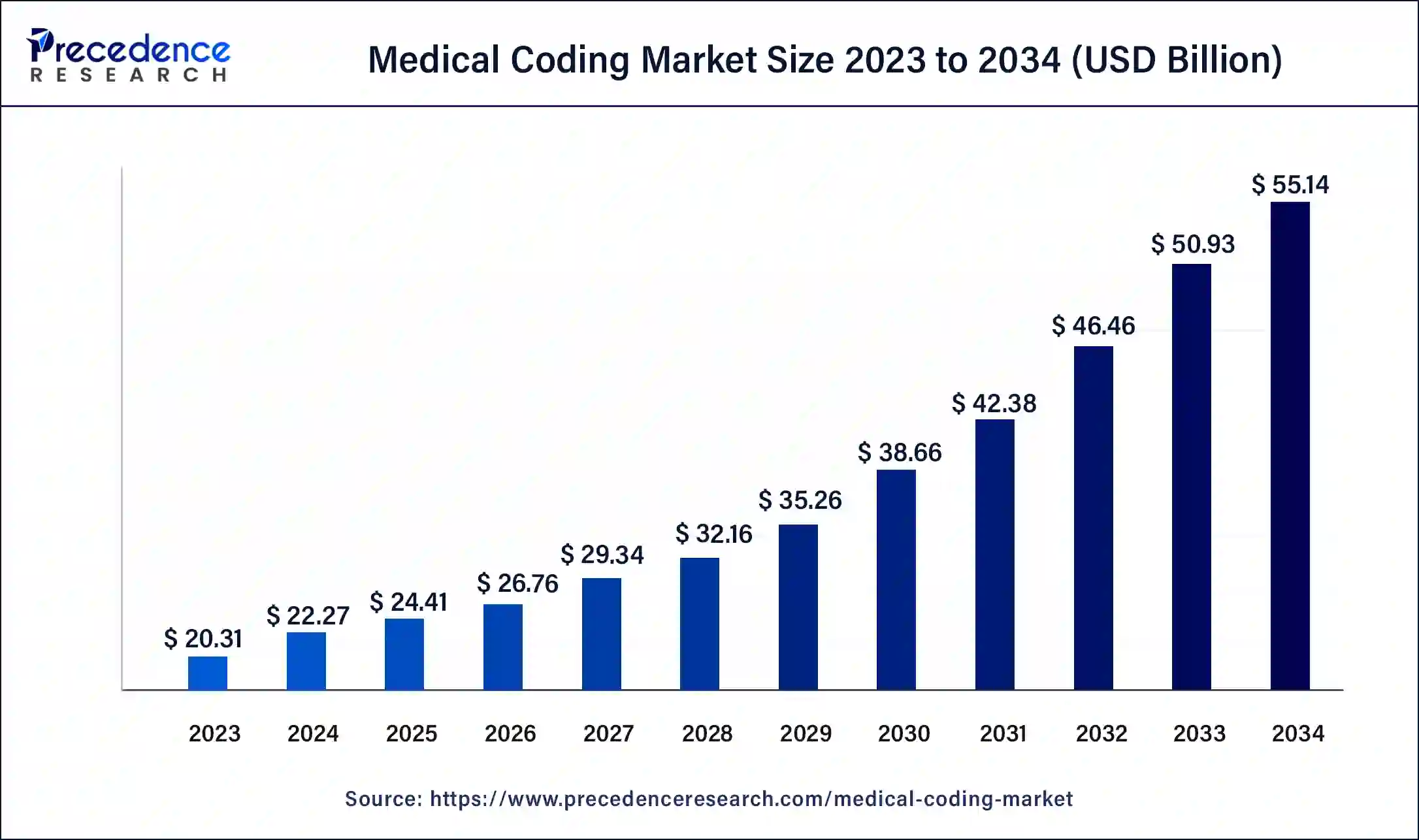

The global medical coding market size was USD 20.31 billion in 2023, estimated at USD 22.27 billion in 2024 and is anticipated to reach around USD 55.14 billion by 2034, expanding at a CAGR of 9.49% from 2024 to 2034.

The global medical coding market size accounted for USD 22.27 billion in 2024 and is predicted to reach around USD 55.14 billion by 2034, growing at a CAGR of 9.49% from 2024 to 2034. The medical coding market is driven by the expanding use of telemedicine services for outpatient treatment.

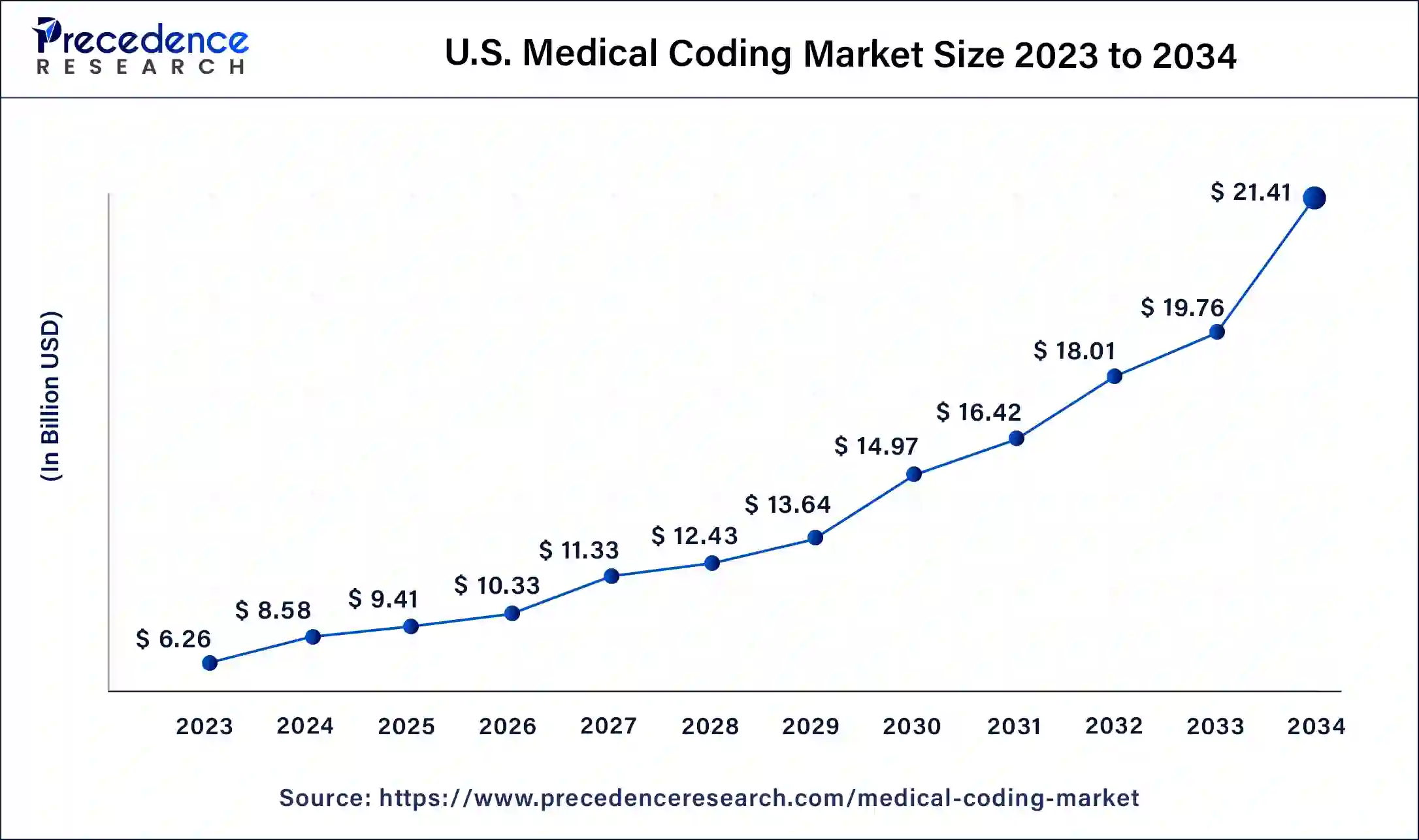

The U.S. medical coding market size was estimated at USD 6.26 billion in 2023 and is predicted to be worth around USD 21.41 billion by 2034, at a CAGR of 9.58% from 2024 to 2034.

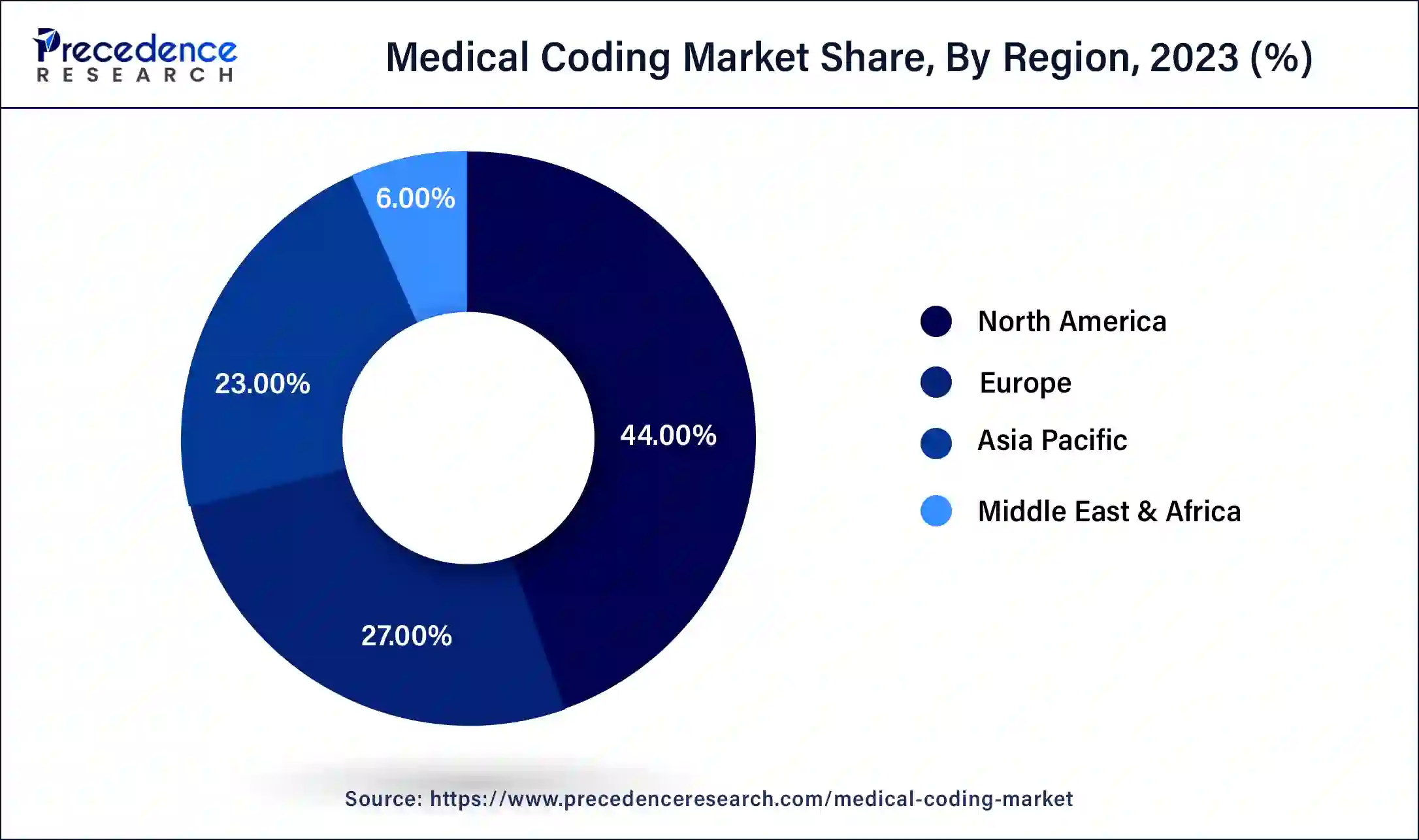

North America had the largest market share in 2023 in the medical coding market. Despite worries about rising healthcare prices, North America's healthcare spending is increasing steadily. Medical coding is in high demand due to the region's aging population, expanding population, and high prevalence of chronic illnesses. To maximize revenue cycle management, reduce financial risk, and guarantee correct patient encounter recording, healthcare organizations invest in coding services.

Asia-Pacific is observed to be the fastest growing medical coding market during the forecast period. There is a developing need for high-quality healthcare services throughout the region due to rising earnings and greater healthcare awareness. To manage patient records and billing procedures, this demand is driving the growth of healthcare institutions, including hospitals, clinics, and specialized centers. As a result, there is an increasing need for effective medical coding. Accurate medical coding is more important as health insurance coverage spreads throughout Asia-Pacific because it helps with insurance claim processing and provider reimbursement. Accurate medical coding is crucial for prompt payment and claims processing because insurance companies use it to determine whether operations and treatments are medically necessary.

Europe holds a considerable share in the medical coding market in 2023. European governments set aside large sums of money for medical services, including medical billing and coding. The need for effective medical coding solutions rises with healthcare spending growing to meet the demands of an aging population and medical developments.

Medical coding translates medical equipment, services, diagnoses, and procedures into universal alphanumeric codes. In the healthcare sector, these codes are used for billing, reimbursement, statistical analysis, and quality assessment. The medical coding business is substantial because it is essential to maintaining accurate and effective communication between government organizations, insurance companies, and healthcare providers.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 9.49% |

| Medical Coding Market Size in 2023 | USD 20.31 Billion |

| Medical Coding Market Size in 2024 | USD 22.27 Billion |

| Medical Coding Market Size by 2034 | USD 55.14 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Classification System, Component, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for advanced healthcare billing systems

Healthcare firms place significant emphasis on data analytics and reporting skills in an era when data-driven decision-making is becoming increasingly prevalent. Advanced healthcare billing systems offer robust analytics features, offering valuable insights into revenue cycle performance, claim denials, billing trends, and reimbursement rates. Healthcare providers can use these data to pinpoint areas that need improvement, streamline billing procedures, improve financial results, and eventually steer the medical coding industry.

Rising adoption of telehealth services for outpatient care

The number of medical records created has increased with telemedicine consultations. Data generated by each telehealth session must be precisely recorded and coded to be used for billing and reimbursement. As a result, there is a growing need for medical coding services to guarantee adherence to insurance policies and healthcare laws. For population health management, quality improvement programs, and healthcare analytics, the data produced by telehealth contacts is priceless. Accurate medical coding ensures that this data is reliable and can be effectively used for decision-making. Therefore, healthcare companies use solid coding procedures and systems to preserve data integrity and take advantage of insights gained from telehealth encounters.

Errors in medical coding

Medical coding is required to preserve correct medical records, which are necessary for data analysis, research, and decision-making. Clinical coding errors may jeopardize Healthcare data's integrity, rendering it unusable for analytical reasons. This makes it more difficult to spot patterns, evaluate the populace's health, and enhance healthcare delivery systems. Moreover, erroneous data might distort study results and impede the progress of medicine.

Insurance companies may reject claims or underpay claims due to incorrect coding. Healthcare providers suffer financially when claims are denied or underpaid, which results in lost revenue and lower profitability. This may discourage medical facilities from using new technology or making more investments in medical coding services, which would expand the market for medical coding.

Increasing demand for skilled medical coders

The healthcare sector has become more complicated due to changing laws, insurance needs, and technological developments. Consequently, there is an increasing demand for experts who can precisely convert medical operations, diagnoses, and treatments into widely used alphanumeric codes. Competent medical coders guarantee that healthcare practitioners are paid appropriately for their services while adhering to legal requirements. This promotes the market for medical coding expansion.

The Healthcare Common Procedure Code System (HCPCS) segment shows a significant share in the medical coding market in 2023. Medicare, Medicaid, and other insurers use a system of standardized codes called the Healthcare Common Procedure Coding System (HCPCS) for invoicing and processing health insurance claims. The Current Procedure Terminology (CPT) coding system of the American Medical Association serves as the foundation for HCPCS. Healthcare facilities and insurers benefit from more accurate and efficient billing because of this common coding language. Patients can also read an itemized list of codes used for operations, services, and materials being invoiced, which helps make medical bills easier to understand for them.

The International Classification of Diseases (ICD) segment shows a notable growth in the medical coding market during the forecast period. Through data that is recorded and coded with the ICD, the ICD serves a wide range of purposes globally and offers vital information on the scope, causes, and effects of human disease and death worldwide. ICD-coded clinical terminology is the foundation for health records, disease data, and cause-of-death certificates in primary, secondary, and tertiary care settings. Payment systems, service planning, the management of quality and safety, and health services research are all supported by these data and statistics.

It makes it possible to systematically record, analyze, evaluate, and compare mortality and morbidity data from many locations and countries at different times. In addition to health statistics, it guarantees semantic interoperability and reusability of recorded data for decision support, resource allocation, reimbursement, guidance, and other use cases.

The outsourced segment had a significant share in the medical coding market in 2023. Global healthcare demand has increased due to the population's aging and the rise in chronic illnesses. Due to the drive to improve revenue cycles and streamline operations, healthcare providers are now more dependent on outside medical coding services. Healthcare firms now have access to a worldwide talent pool of qualified coders and coding professionals because of the globalization of outsourcing services. By taking advantage of time zone variations and overseas resources, outsourcing companies can shorten turnaround times for coding projects and offer round-the-clock coding help. This finally spurs the market for medical coding to expand.

The in-house segment shows a notable growth rate in the medical coding market during the forecast period. Within the healthcare facility, in-house coding teams can react to shifting demands and priorities faster. The delays frequently linked to outsourcing agreements uncheck their ability to promptly adjust to variations in patient load, coding specifications, or regulatory revisions. Due to this agility and responsiveness, healthcare companies may maintain effective revenue cycle management and prevent backlogs or bottlenecks in the coding process.

The hospitals segment dominated the medical coding market in 2023. Since the billing process begins with coding, accuracy is crucial to including all supporting documentation. Additionally, coders are aware of the consequences of under- or over-coding for more expensive services than the diagnosis, which could lead to a lower payment. A healthcare facility that engages in this activity could face penalties or other legal repercussions because it is deemed fraudulent. As a result, medical coders comprehend clinical documentation quite well. They have a basic understanding of human anatomy and physiology. They can infer the information needed to assign precise codes, which leads to the formulation of the insurance claim for payment of given services.

Specialized coding departments or teams of certified professional coders (CPCs) or coding specialists are joined in hospitals. These experts know anatomy, physiology, coding requirements, and medical terminology. Hospitals invest in cutting-edge coding software and technologies to improve accuracy, reduce compliance risks, and expedite the coding process. Furthermore, many hospitals use electronic health record (EHR) systems combined with coding modules to make the documentation and coding process more accessible.

The diagnostic centers segment is observed to be the fastest growing in the medical coding market during the forecast period. Medical coding automation improves accuracy and reduces human error. Diagnostic centers know how important it is to spend money on effective coding solutions to enhance the efficiency of their revenue cycle management. By automating coding operations, maximizing resource use, reducing administrative costs, and speeding up reimbursements, they can increase overall operational efficiency and profitability.

Segments Covered in the Report

By Classification System

By Component

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025