March 2025

The global clinical risk grouping solution market size surpassed USD 682.12 million in 2023 and is estimated to increase from USD 760.84 million in 2024 to approximately USD 2,267.76 million by 2034. It is projected to grow at a CAGR of 11.54% from 2024 to 2034.

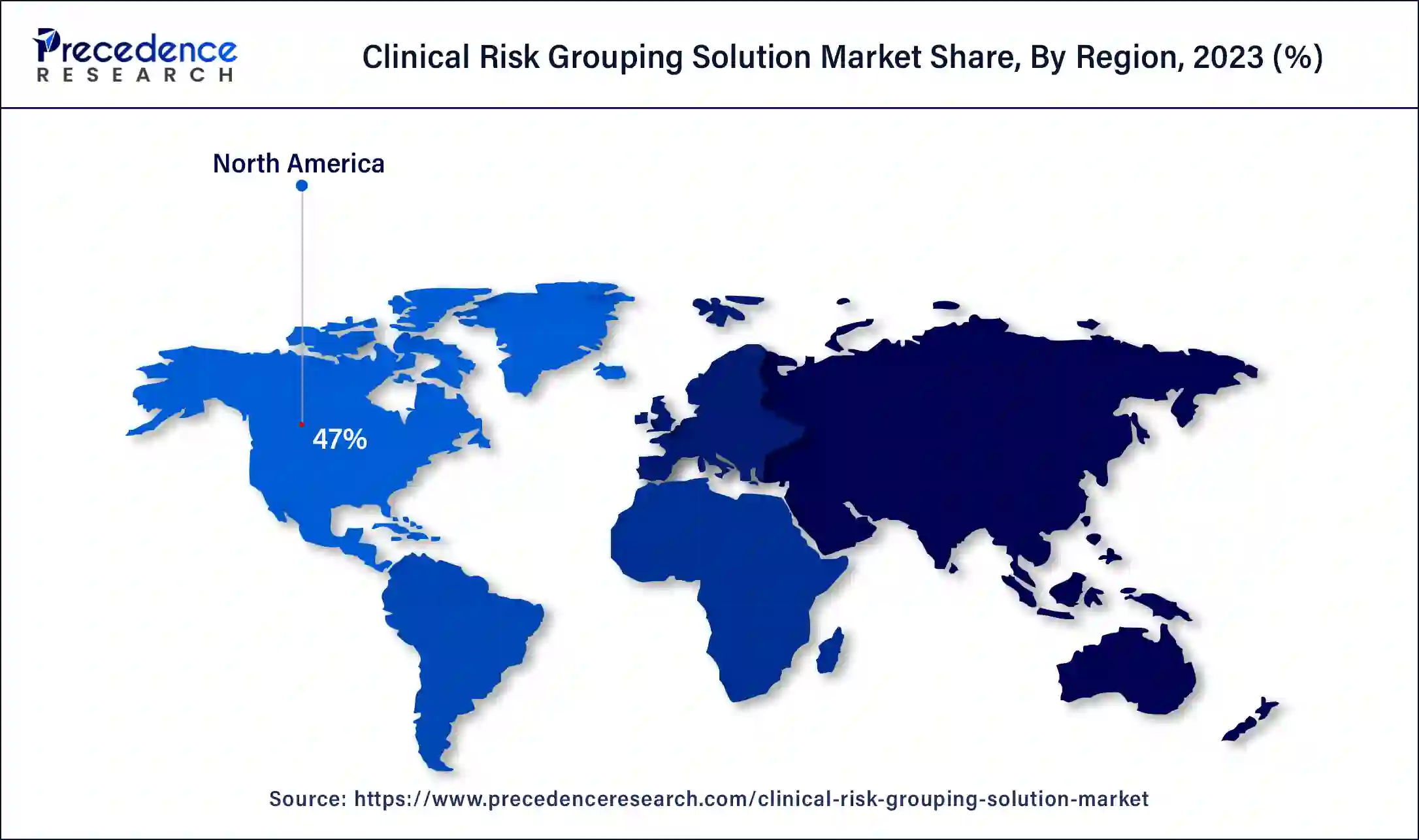

The global clinical risk grouping solution market size is projected to be worth around USD 2,267.76 million by 2034 from USD 760.84 million in 2024, at a CAGR of 11.54% from 2024 to 2034. The North America clinical risk grouping solution market size reached USD 320.60 million in 2023. A global increase in healthcare expenditure due to a rising prevalence of chronic diseases like cancer, diabetes, and cardiovascular conditions and the availability of data due to increased digitization in the healthcare industry is fueling growth in the clinical risk grouping solution market.

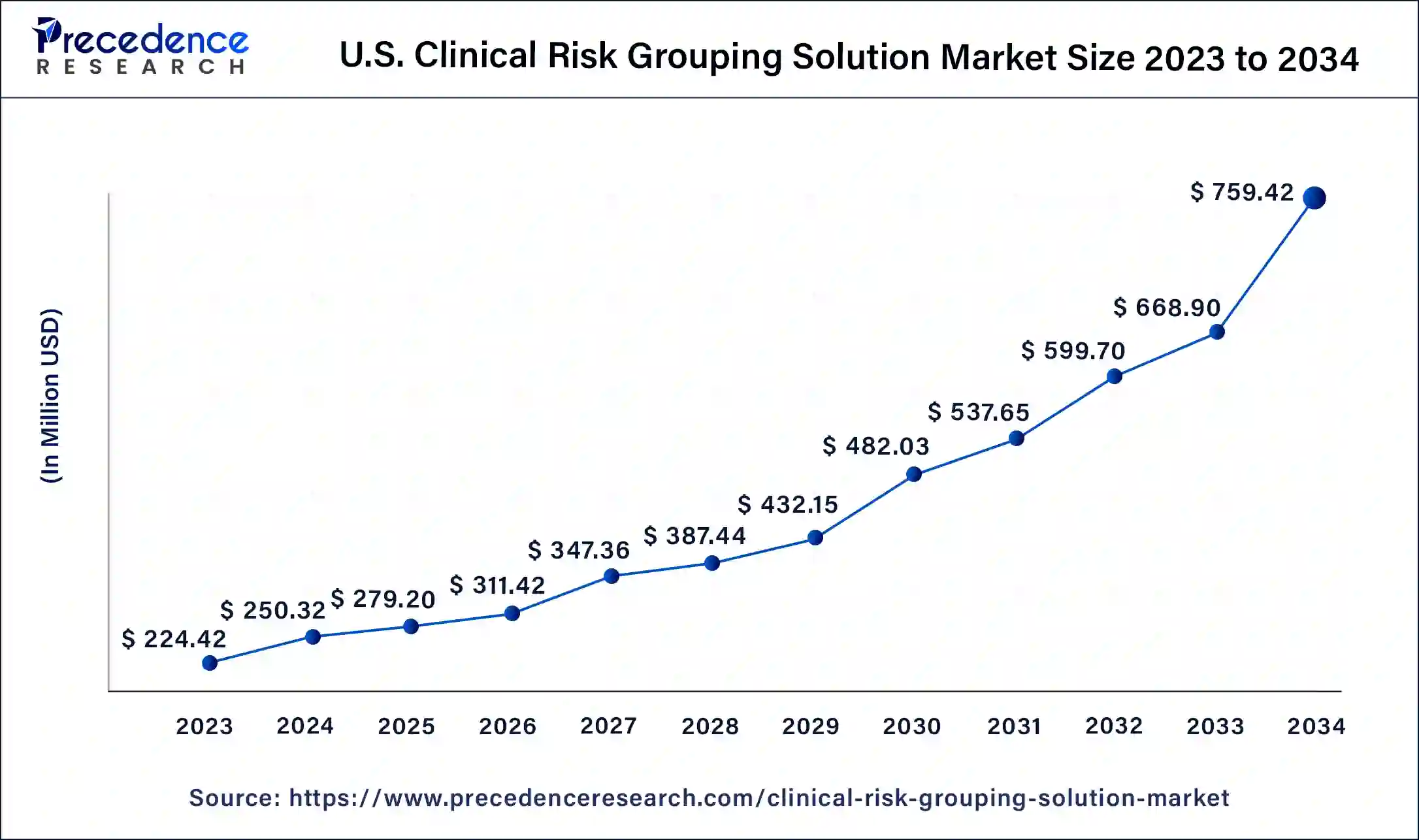

The U.S. clinical risk grouping solution market size was exhibited at USD 224.42 million in 2023 and is projected to be worth around USD 759.42 million by 2034, poised to grow at a CAGR of 11.71% from 2024 to 2034.

North America took up the largest share of the clinical risk grouping solution market in 2023 due to the large-scale adoption of value-based care models, which encourage providers to place a higher emphasis on health management and preventative rather than curative medicine. A robust, digitized healthcare infrastructure provides several opportunities for data collection and, in turn, analytics necessary for the market.

The presence of a large, at-risk population for cardiovascular diseases and diabetes due to issues like obesity is pushing government investment into predictive modeling and advanced analytics. The opioid epidemic in the United States is fueling improved data collection to guide resource allocation and identification of populations predisposed to pharmaceutical drug and substance abuse. Insights from analytics are being used to push regulatory changes related to controlled substances and increase safer prescribing. This drives the region's clinical risk grouping solution market.

Asia Pacific is expected to host the fastest-growing clinical risk grouping solution market in the forecasted period. National healthcare reforms in countries like China are one of the factors driving industry growth in the region. The substantial consumption of tobacco in the country has led to high incidences of stroke, ischemic heart disease, and lung cancer. This has led to increased government expenditure and the development of digital health technology to enhance the efficiency of healthcare by adopting clinical risk grouping solutions.

An aging population in countries like Japan in the region is bolstering demand in the clinical risk grouping solution industry. The presence of a strong healthcare infrastructure in Japan and a focus on preventative treatment is driving growth in the market. Japanese healthcare practitioners are increasingly implementing risk management solutions to ease healthcare expenditure.

Government initiatives in telemedicine are driven by high smartphone penetration and advances in wireless technology in countries like South Korea. This provides opportunities for on-demand services using health-tracking apps and remote interactions. These services are proving especially relevant in underserved regions and places lacking specialists to help reduce costs. An aging population is also leading to an increasing need for risk stratification. Telehealth technology is also gaining traction in other emerging economies where healthcare systems are expanding.

Clinical risk grouping solutions are population classification systems that use inpatient and outpatient diagnosis and procedure codes, functional health status, and pharmaceutical data to assign a person to a single, severity-adjusted group. Clinical risk grouping systems use clinical hierarchy models to organize patients into retrospective and prospective groups based on health statuses to define the burden of illness. These systems help identify vulnerable groups in a population by identifying comorbidities and measuring an individual’s health parameters over time.

Clinical risk grouping mechanisms are used to assign payment weights based on severity levels helping healthcare providers determine the expected level of resources each condition requires, and insurance firms decide on premiums and payout models.

The demand for the clinical risk grouping solution market is driven by the growing focus on social determinants of health, which are non-medical factors that influence health outcomes and affect quality of life. Clinical risk grouping systems automate administrative processes like billing and coding, easing the burden on clinicians and identifying patterns early on, which helps prevent health hazards through timely intervention.

The current lack of data availability leads to unreliable accuracy of risk predictions. Coupled with the high cost of implementation, these factors restrict growth in the space. However, the emergence of AI and big data provides many opportunities to streamline the clinical risk grouping solutions market by cutting down on healthcare costs.

How Will AI Support Clinical Risk Grouping Solution Market?

AI can tailor risk assessments to individual patients by integrating data from various sources such as electronic health records (EHRs), wearable devices, and even social determinants of health. This personalized approach allows for more precise identification of at-risk patients, enabling targeted interventions that can prevent adverse outcomes and improve patient care. With the help of AI, clinical risk grouping solutions can evolve to include real-time monitoring of patient data. AI algorithms can continuously analyze incoming data, such as vital signs or biometric information, to detect early signs of deterioration or potential complications. This allows healthcare providers to intervene sooner, potentially preventing hospitalizations or other serious health events.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,267.76 Million |

| Market Size in 2023 | USD 682.12 Million |

| Market Size in 2024 | USD 760.84 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.54% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Development, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing incidence of chronic illnesses like cancers, cardiovascular disease, and diabetes

An aging population and rising risk factors like obesity and exposure to pollution caused by urbanization and socioeconomic changes are leading to a demand for optimizing processes in the healthcare space. Moreover, clinical risk grouping systems allow healthcare providers to take a proactive approach towards preventative care, identifying high-risk population groups and allowing them to implement early interventions and tailor treatment plans to patient needs. This aids the growth of the clinical risk grouping solution market.

Focus on value-based care models

Another major factor fuelling growth in the clinical risk grouping solution market is the emphasis on value-based care models. Value-based care models focus on integrated care, where multiple healthcare providers work together to address an individual’s overall physical and mental health rather than zeroing in on specific diseases or singular health issues.

This shift is also apparent in billing and reimbursement models, where industry actors are moving to value-based models and away from fee-for-service. Large healthcare providers are also focusing more on preventative care and allocating more resources to early interventions by stratifying patients based on risk profiles. For instance, in the United States, outcome-based payment programs are increasingly used by organizations like the Blue Cross and Blue Shield, and they are being integrated into state Medicaid programs in Texas and New York, as well as national health plans.

Push towards EHRs and clinical documentation improvement

Healthcare providers are increasingly switching to electronic health records (EHRs) and implementing other clinical documentation improvement initiatives. EHRs are helping create region-wide databases, which are useful during assessments in the clinical risk grouping solution market.

Interoperability within healthcare systems raises data and privacy concerns

Interoperability issues arising from conflicting regulations within regions make data consolidation difficult. The sensitive nature of patient health information has raised several data privacy concerns among regulators since not all data collection systems are integrated with good data protection mechanisms.

Poor access control, especially with third-party applications, has also raised privacy concerns. Human errors such as accessing data through personal devices and sharing information with unauthorized individuals are all factors that lead to privacy breaches. These concerns are leading to slower adoption rates among healthcare providers.

High cost of clinical risk grouping solutions and regulations

Clinical risk grouping solutions have a high upfront cost, dissuading some healthcare providers. Concerns around data protection have also pushed governments to implement stricter regulations around data storage and access, further increasing the cost of compliance, which is usually borne by end-users. These factors are all contributing to challenges in the clinical risk grouping solution market.

The advent of artificial intelligence and big data

The increasing use of artificial intelligence or machine learning in predictive analytics improves risk assessment accuracy and efficiently implements proactive intervention measures. The global demand for healthcare services is increasing substantially, with many countries experiencing a shortage of physicians, nurses, and other healthcare workers. A combination of higher processing speeds, large data libraries, and a growing talent pool is expected to lead to the rapid development of AI tools catering to the healthcare sector. As a result, the sector is increasingly recognizing the importance of AI-powered tools in improving operations and cutting costs.

AI-based technology will allow for continuous monitoring, leading to earlier diagnosis and more personalized treatments. This will reduce doctor visits and hospitalizations. AI tools are expected to supplement healthcare practitioners through clinical decision support. Using big data analytics to better clinical risk grouping solutions is a significant opportunity.

The scorecards & data visualization tools segment dominated the clinical risk grouping solution market in 2023. Data visualization tools can transform data collected through EHRs into actionable insights. Given the high volume and complexity of healthcare data, visualization tools allow healthcare professionals to evaluate more efficiently. Data visualization eases pattern and trend recognition and supports data-driven decision-making, ultimately improving patient outcomes.

The private cloud segment dominated the global clinical risk grouping solution market in 2023. The increasing number of private facilities provided by third-party service providers is contributing to the segment. Rising costs in the healthcare sector are pushing providers to outsource data storage.

The hybrid cloud segment is expected to grow at the fastest rate in the clinical risk grouping solution market during the forecast period. Hybrid clouds are computing environments that integrate on-premise data centers with public clouds, allowing data and applications to be shared between them. With increasing government regulation on healthcare data worldwide, certain types of data are only allowed to be stored on-premises, while less sensitive data is stored on public clouds. This kind of hybrid structure allows organizations to tap into the flexibility of public storage while meeting regulatory standards.

The hospitals segment held the largest share of the clinical risk grouping solution market in 2023. A rise in healthcare expenditure worldwide is prompting many patients to be treated in hospitals, generating enormous amounts of data that are plugged into clinical risk grouping systems to get actionable insights. Government agencies are increasingly relying on this data to efficiently allocate future healthcare expenditures.

The healthcare payer segment is set to witness the fastest growth in the clinical risk grouping solution market during the forecast period due to the high demand for advanced predictive analytics. Predictive analytics are allowing healthcare payers to make more effective operational and pricing decisions by accurately predicting trends.

Segments Covered in the Report

By Product

By Development

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

February 2025

January 2025