November 2024

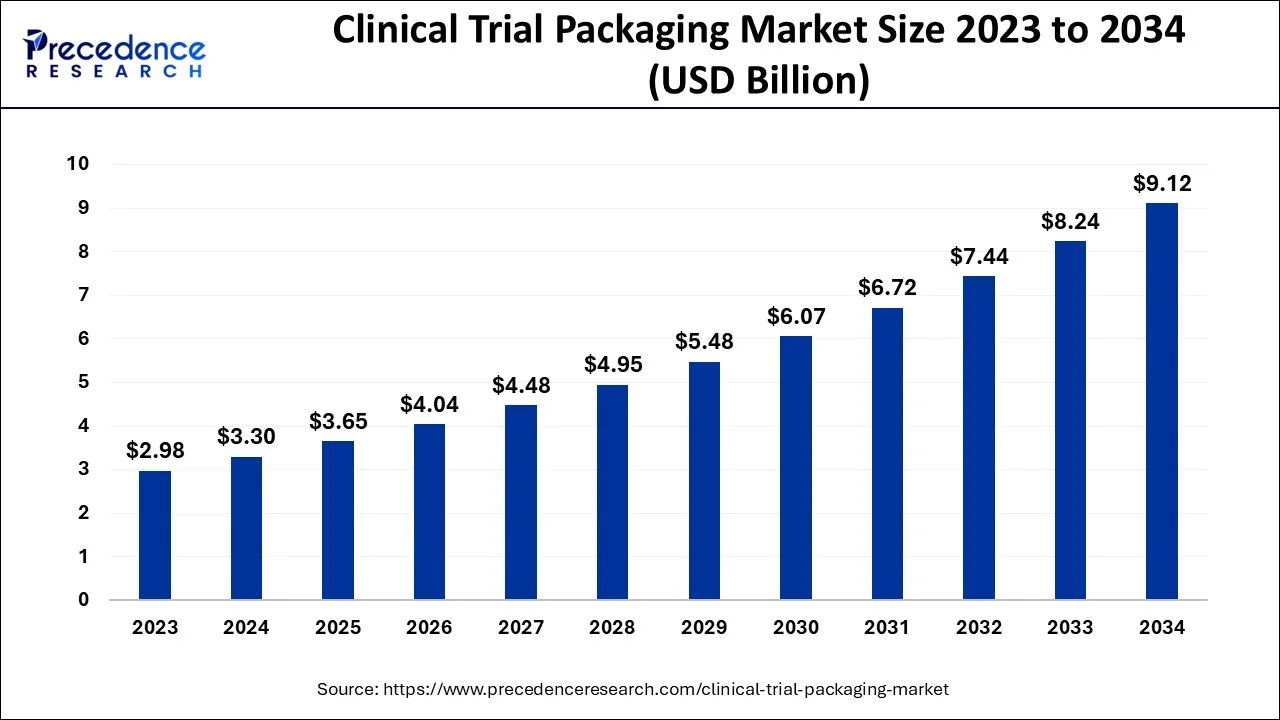

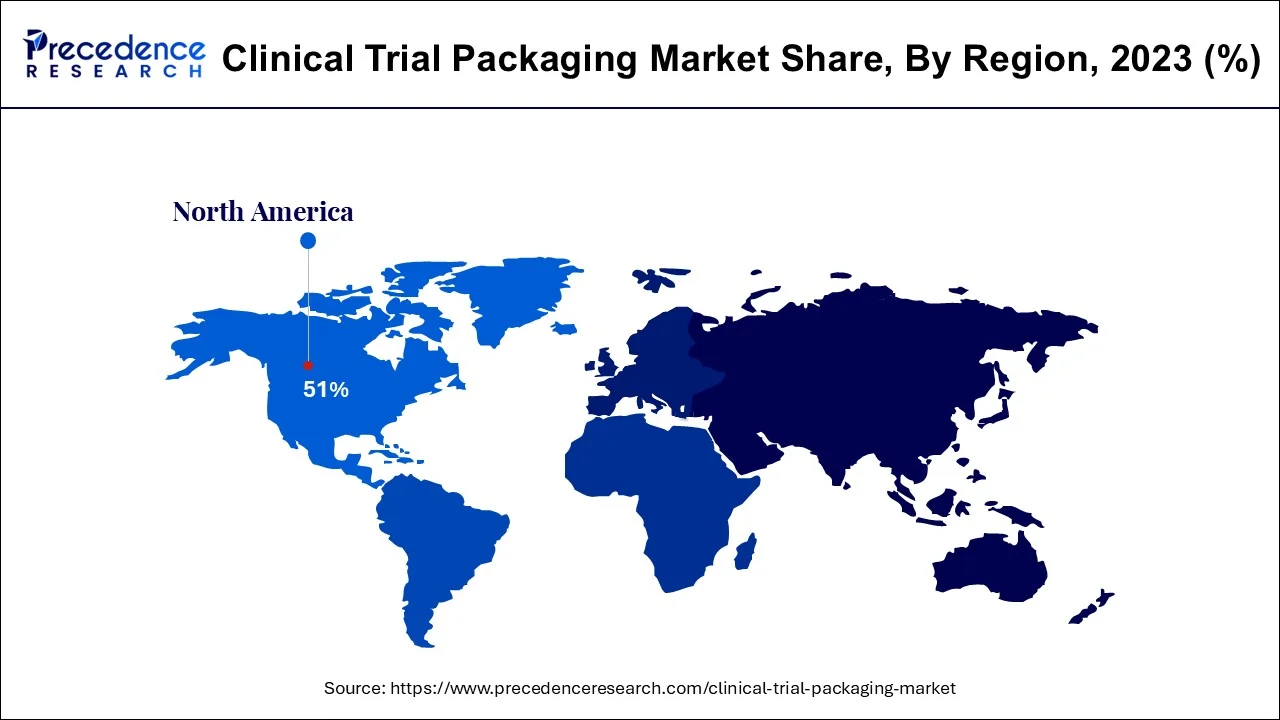

The global clinical trial packaging market size accounted for USD 3.30 billion in 2024, grew to USD 3.65 billion in 2025 and is predicted to surpass around USD 9.12 billion by 2034, representing a healthy CAGR of 10.70% between 2024 and 2034. The North America clinical trial packaging market size is calculated at USD 1.68 billion in 2024 and is expected to grow at a fastest CAGR of 10.81% during the forecast year.

The global clinical trial packaging market size is estimated at USD 3.30 billion in 2024 and is anticipated to reach around USD 9.12 billion by 2034, expanding at a CAGR of 10.70% from 2024 to 2034.

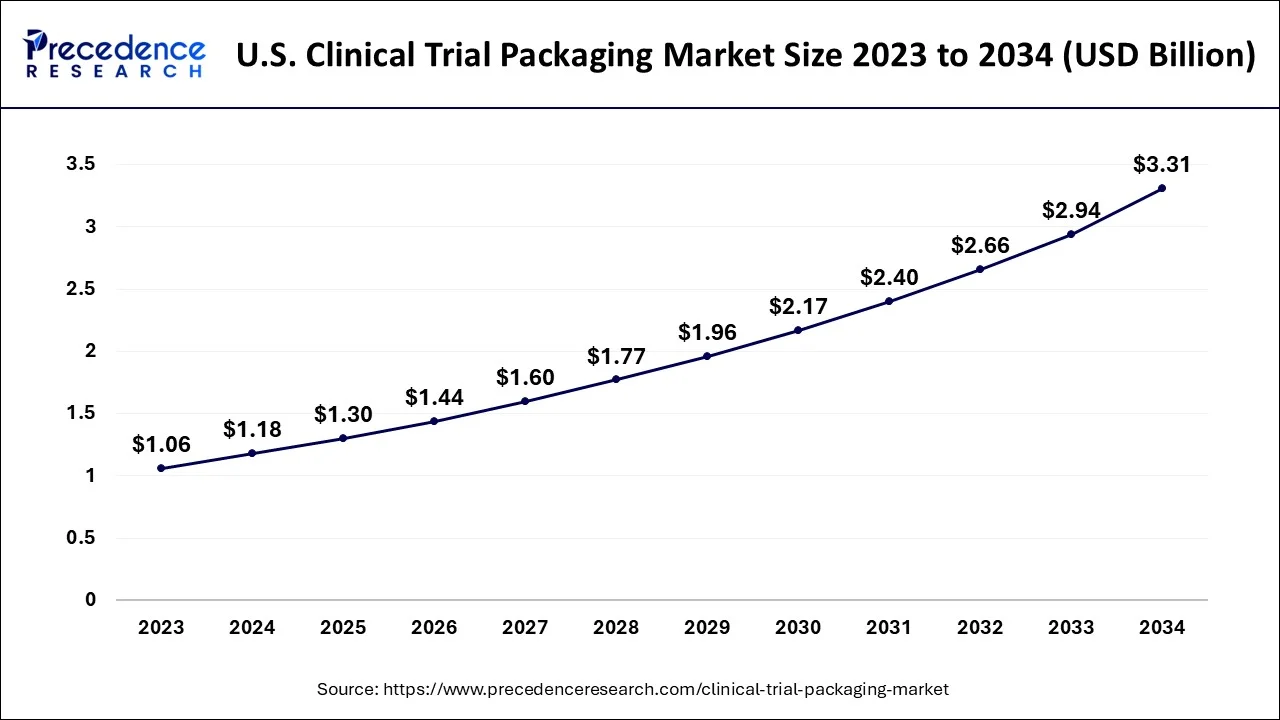

The U.S. clinical trial packaging market size is evaluated at USD 1.18 billion in 2024 and is predicted to be worth around USD 3.31 billion by 2034, rising at a CAGR of 10.91% from 2024 to 2034.

The primary forces driving the clinical trial packaging market's optimistic growth prospects are the region's well-established pharmaceutical industry and the extremely friendly regulatory environment for R&D activities. North America is anticipated to rule over the projected period with a market share of more than 51%.

In the Asia Pacific area, there is likely to be considerable growth potential for clinical trial packaging. Leading pharmaceutical companies and rising economies with expanding production capacities are driving the APAC clinical trial packaging market.

Clinical trials are scientific examinations done to find better ways to screen for illnesses, diagnose them, and treat them. These clinical investigations may also show which therapeutic modalities are superior for specific illnesses or patient demographics. Clinical trials generate high-quality data that may be used to guide healthcare choices. The goal of clinical trials is to advance science. As a result, these studies follow stringent scientific standards that protect patients and assist in the creation of reliable clinical trial data. Since clinical packaging is used for research, functionality and utility are of highest importance. Rarely, such as in blind research when maintaining anonymity is crucial to the test's conclusion, visuals may even be completely ignored. Clinical batch packaging uses primary and secondary packing services. Pharmaceutical packaging products are becoming increasingly popular in international trade

The global market for clinical trial packaging has grown significantly over the past few years as a consequence of the rise in demand for clinical trial packaging. To help the industry establish a long-term solution and expand, the top producers of clinical trial packaging are investing in R&D. Through expanded distribution channels, mergers, and acquisitions, manufacturers in the clinical trial packaging industry are largely concentrating on extending their geographic reach. The growing importance of booklet labels is one of the changes in clinical trial packaging.

The COVID-19 epidemic had a favorable effect on clinical trial packaging since it raised demand for the packaging because to the enormous rise in vaccine development. Leading pharmaceutical firms conduct several clinical studies continuously to create and introduce new vaccines against the COVID-19 virus. Leading pharmaceutical firms have launched a large number of research trials to combat the pandemic as a result of the revolutionary COVID-19's widespread global distribution. As a result, there is a huge market for clinical trial packaging and other pharmaceutical packaging solutions.

Sustainability has been one of the most often debated subjects in the packaging value chain over the past ten years as a result of shifting regulatory requirements and a growing market demand for sustainable packaging solutions. Consumer behavior and purchasing decisions are still influenced by a variety of variables, particularly in the retail sector and, to some extent, the pharmaceutical business. Given that a number of market players are leaning toward the adoption of sustainable packaging materials, it is anticipated that a growing customer preference for sustainable packaging will continue to be one of the main factors likely to influence the development of the global for clinical trial packaging over the projected period.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.30 Billion |

| Market Size by 2034 | USD 9.12 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.70% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Clinical Trial Type, Packaging Type, Material, End User and Geography |

The therapeutic and preventative category in the overall clinical trial materials and supplies market is predicted to develop at the quickest CAGR during the forecast period based on the kind of clinical research. A few of the drivers driving the market for clinical trial materials and supplies for therapeutic and preventative studies are the rising frequency of illnesses, the consolidation of biopharmaceutical businesses, and rising pharmaceutical companies' expenditure in R&D.

The markets for vaccines, medication development, therapeutic devices, biosimilars, therapeutic diagnostics, and therapeutic procedures are further divided into the therapeutic and preventive categories. Due to the rise in the prevalence of rare illnesses and the increasing burden of sickness on a population, the drug development segment is anticipated to expand at the quickest CAGR over this time.

The market was dominated by the bags & pouches segment in terms of revenue in 2023, while the others sector is predicted to grow at the highest CAGR during the forecast period. Over the last year, there has been a noticeable rise in the demand for blood bags, which are used to preserve blood and blood components. As the number of COVID-19 patients climbed, there was a two-fold rise in the need for convalescent plasma. In addition to COVID-19, other health-related problems are also driving up demand for intravenous (IV) and dialysis bags.

The plastic category led the clinical trial packaging market in 2023, while metal was expected to develop at the highest CAGR going forward. Polyvinyl Chloride (PVC), Polyethylene (PE), and other categories make up the type of plastic material. Additional types of polyethylene (PE) categories include high-density polyethylene (HDPE), low-density polyethylene (LDPE), and polypropylene (PP). The plastics sector was anticipated to account for more than half of the market by 2023.

Over the next seven years, the same market category is predicted to provide a total incremental potential of US$ 470 Mn with a 1.7x rise in value. Plastic packaging is being used more and more in clinical trials because it is convenient to utilize during transportation operations, affordable, and durable. Therefore, it is anticipated that the trend of using plastic packaging solutions would provide considerable commercial potential in the clinical trial packaging market throughout the projection period. Over the course of the projected period, it is anticipated that markets for PE sub-segments including HDPE & LDPE would grow rapidly.

By Clinical Trial Type

By Packaging Type

By Material

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

January 2025

January 2025