March 2025

Clinical Trials Matching Software Market (By Components: Services, Software; By End-User: Clinical Research Organizations (CRO), Pharmaceutical and biotechnology Companies, Medical Device Firms; By Deployment Mode: On-Premise, Web and Cloud based) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

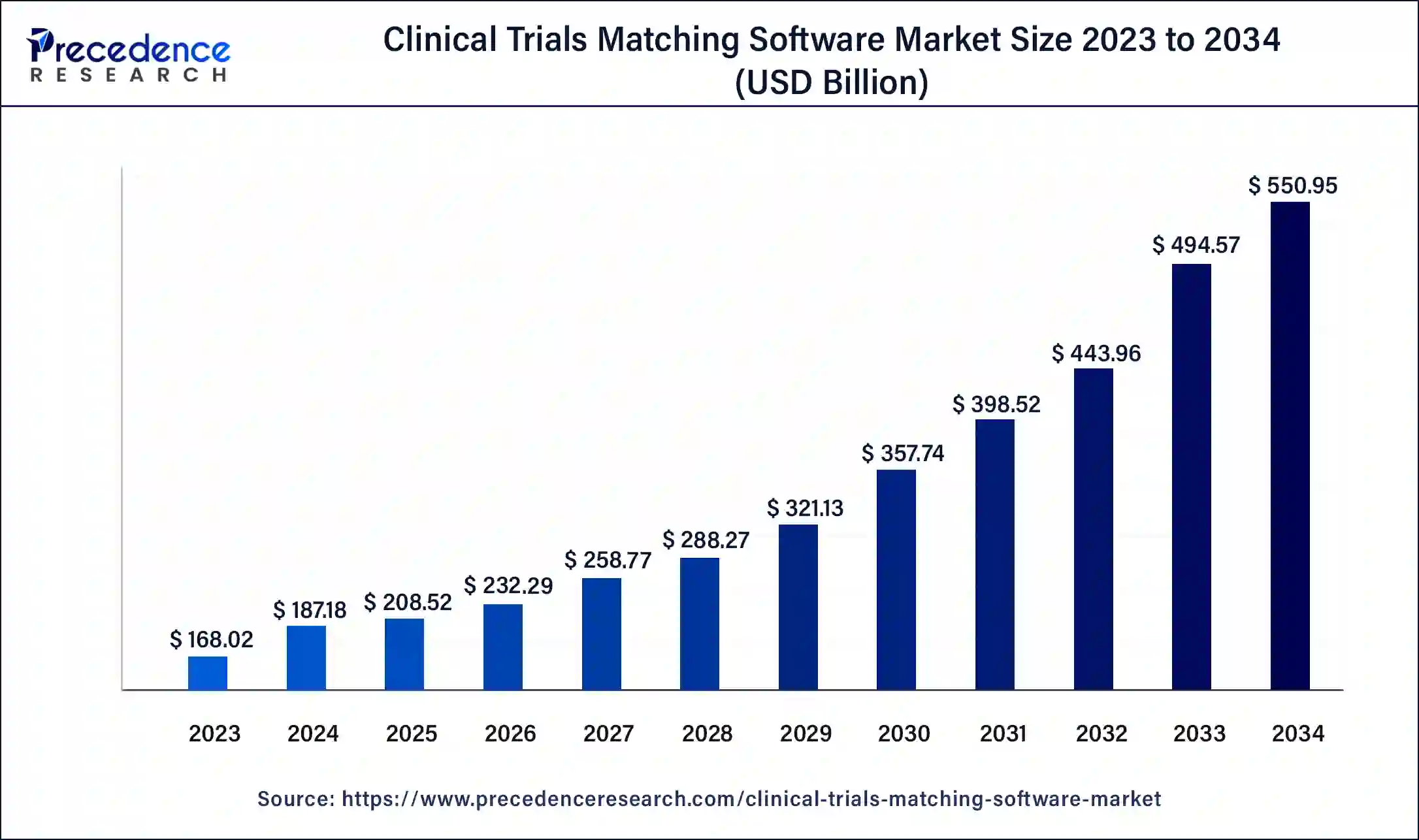

The global clinical trials matching software market size was USD 168.02 million in 2023, accounted for USD 187.18 million in 2024, and is expected to reach around USD 550.95 million by 2034, expanding at a CAGR of 11.4% from 2024 to 2034. The North America clinical trials matching software market size reached USD 85.69 million in 2023.

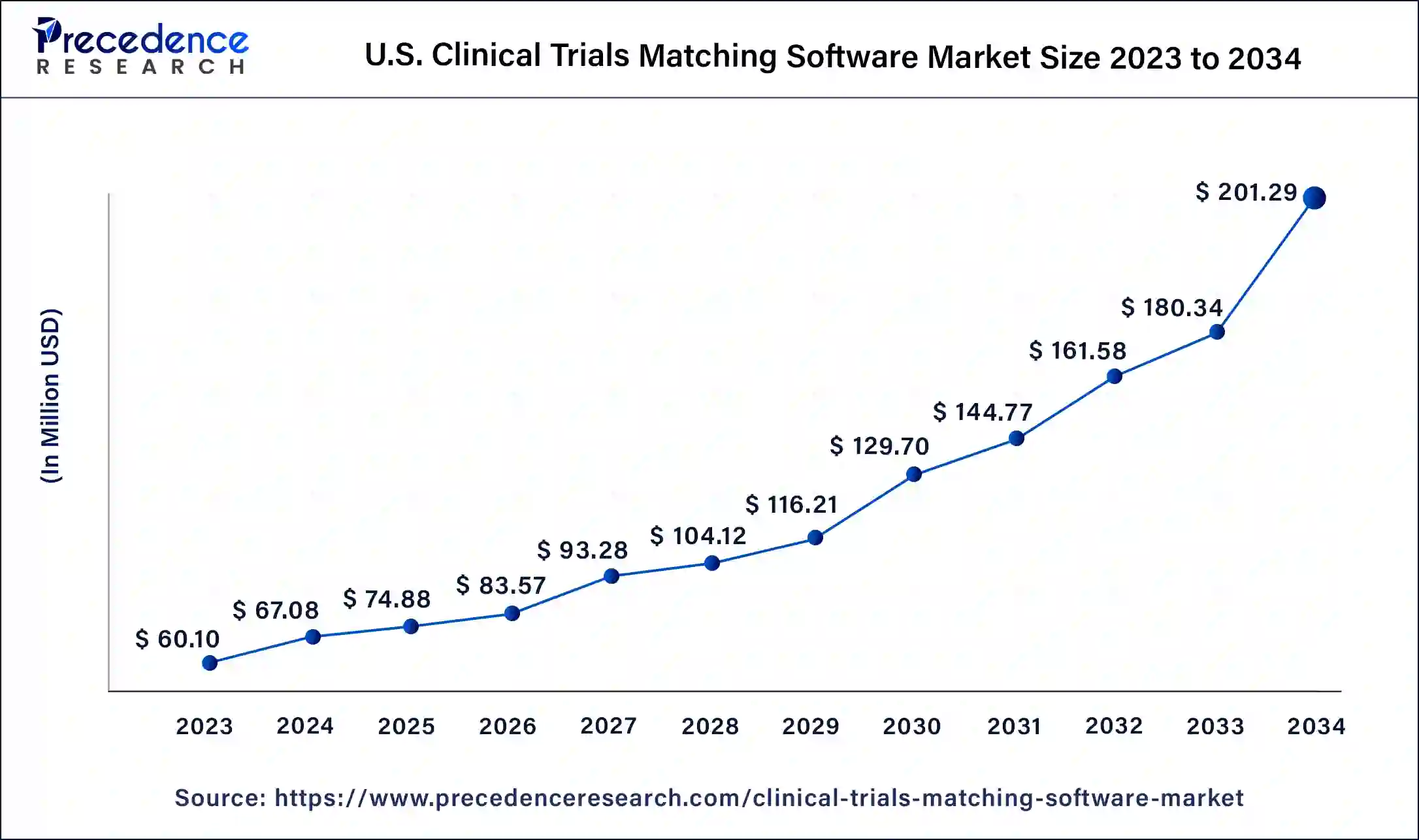

The U.S. clinical trials matching software market size was estimated at USD 60.10 million in 2023 and is predicted to be worth around USD 201.29 million by 2034, at a CAGR of 11.6% from 2024 to 2034.

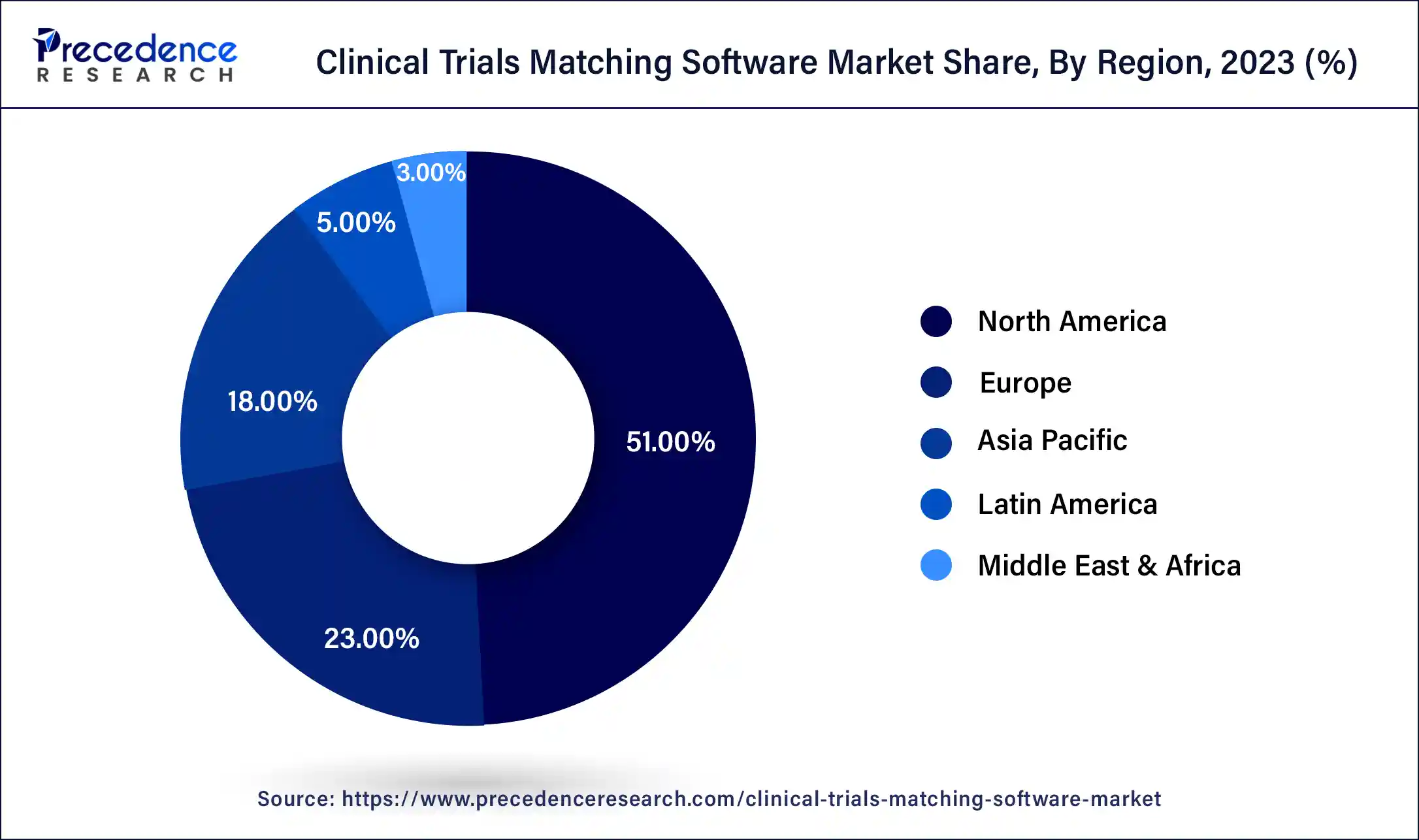

North America dominated the global clinical trials matching software market and accounted for more than 51% of revenue share in 2021. The growth is credited to the adoption of drug trial matching systems by the pharma and biotechnology companies in the United States. Additionally, the supportive government initiatives toward IT, and the increasing adoption of clinical trial matching software and patient matching software are helping to the market growth in this region.

For instance, according to the World Health Organization (WHO) International Clinical Trials Registry Platform (ICTRP), the United States reported the highest number of clinical trials during 1999-2021. Europe is expected to hold significant market share for the clinical trials matching software market, owing to increasing research and development events in the pharmaceutical and biotechnology sector. Major clinical trial companies are partnering with technology service vendors to integrate advanced technologies into the clinical trial process.

Asia Pacific is about to record the rapid CAGR during the forecast period due to the availability of a large number of patients in the region. A large number of companies are aiming to place their research and development activities in Asia Pacific, thereby supporting to the market growth in this region. This growth can be attributed to a rise in the number of healthcare IT projects, a growing economy and an overall improvement in healthcare infrastructure, especially developing countries, such as India and china.

Latin America & Middle East and Africa (LAMEA) is the lowest clinical trial matching software market due to adequate technology, healthcare infrastructure, few players working in the clinical trial market, and low per capita incomes in underdeveloped regions in Africa.

Biotech companies, clinical research organizations, medical device manufacturers, and pharmaceutical manufacturers regularly conduct drug trials to test the safety and efficiency of trials, new drugs, diagnostics, and therapies. The growing prevalence of chronic disease and the increasing need for drug trials are anticipated to drive the growth of the clinical trials matching software market. Clinical trials matching software are time-consuming and cost-effective. Therefore, trials are progressively being conducted in developing regions, as the availability of patient recruitment and trials matching is an important part of drug trials. Clinical trial matching software is one of the most recent expansions in research.

The COVID-19 pandemic led this market to drive significantly globally. Investors are collaborating directly with drug trial-matched software vendors for the advancement of technology and to find solutions for their research purpose. This technology matches patients with drug trials in a simple process for both patients and donors and can also guide patient recruitment. North America is expected to generate the highest revenue share in the global clinical trial matching software in upcoming years.

| Report Coverage | Details |

| Market Size in 2023 | USD 168.02 Million |

| Market Size in 2024 | USD 187.18 Million |

| Market Size by 2034 | USD 550.95 Million |

| Growth Rate from 2024 to 2034 | CAGR of 11.4% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2034 |

| Segments Covered | By Components, By End-User, By Deployment Mode |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Increasing clinical trial activities is expected to drive market growth

The increasing clinical trial activities globally is anticipated to drive the clinical trials matching software market during the forecast period. The number of clinical trials has risen significantly over the few decades. This is due to the increased infiltration of advanced healthcare technologies coupled with the growing demand for innovative drugs with greater effectiveness. However, a clinical trial matching system is cost-effective and fast, as clinical trials are used to collect and organize data that can also be shared with multiple healthcare providers and distributed across multiple systems. This technology can assist with location identification and recruitment, as well as monitoring and tracing of patient registrations and databases.

Thus, the increasing number of drug trial activities is propelling the clinical trial-matching software market. For instance, according to the World Health Organization (WHO) International Clinical Trials Registry Platform (ICTRP), for the duration of 1999-2021 the United States (157,620) registered the maximum number of drug trials, followed by China (80,330) and japan (57,750)

The high cost of matching software’s hampering the growth of the clinical trial matching software market

The high cost of matching systems is hindering the market growth of the clinical trial matching software market. Initiation, contractual term commitment, per user, per the study, training, support and maintenance, validation/ 21 part 11 compliance, and system integration fees cumulatively rise the overall cost requires for the adoption of the clinical trial matching software solutions. Both on-premises systems and SaaS systems include setup fees.

Additional configuration and customization costs are charged to companies based on specific organizational and research requirements. Different cost structures are observed depending on the number of users and the number of sites considered. There are also some fees or terms to consider for clinical trial matching software, as well as routine system maintenance and upgrades.

The supportive government initiatives and companies collaborations for clinical trials matching the software market creating new opportunities.

The supportive government initiatives and various companies partnerships for the Clinical trial matching software market is likely to drive the entry for new participants in the future, driven by awareness and adoption of a growing number of trial activities and technology process. Rapid advancement in technology further encourages market participants to focus significantly on a new applications and the development of innovative devices. In addition, the increasing number of companies offering updated and customized features is contributing to the growth of the market during the forecast period.

However, software developers and companies will likely to depend on partnerships, mergers, collaborations and acquisitions to hold their market position. For instance, in December 2021, Optima pharma, one of the top European CRO, acquired SSS international. The acquisitions support the company to expand its portfolio of Clinical Research study.

Based on the components, the global clinical trials matching software market is segmented into services and software. The software segment is expected to hold a large revenue share in the forecast period for global clinical trial matching software. The growth of this segment is backed by high usage and increased adoption of drug trials. Many biotechs, pharma, and other clinical research organization companies, life science organizations are promoting to conduct of complex drug trials. These trials aim to discover new drugs and medical products. In addition, increase in drug trial activity and the proliferation of multisite drug trials, there is a requirement for effective tools to easily manage research, maintain accurate data, and manage aspects of drug trials.

The use of software tools allows investors to efficiently manage drug trials. For instance, in January 2021, as part of the Cancer Research UK’s (CRUK) UpSMART Accelerator, digital ECMT has created and developed clinical trial matching software to support clinical decision-making, profile matching genetics of tumor patients with optimal drug trials, supporting their precision medicine research.

However, the service segment is anticipated to hold considerable growth during the forecast period, owing to the rise in the number of drug trials and the growth of the healthcare insurance industry.

Based on the End-User, the global clinical trials matching software market is segmented into clinical research organizations, pharmaceutical and biotechnology companies, and medical device firms. The pharmaceutical and biotechnology companies segment accounted more than 41% of revenue share in 2021 and is expected to dominate the market with significant revenue share in forecast period for global clinical trials matching software. The growth of this segment is attributed to the large number of drug trials needed to launch the product. This CRO segment is expected to grow at the fastest CAGR during the forecast period.

Clinical research organizations (CROs) provide drug development services through pharmacovigilance, commercialization, and post-approval services to manufacturing organizations with low research and development funds. An investor contracts with the CRO, a project-by-project basis, for drug trials. Companies that cannot afford to conduct extensive drug trials prefer to outsource these services. As a result, the demand for CRO is growing rapidly.

Based on Deployment mode, the global clinical trials matching software market is segmented into on-premises, web, and cloud-based. The web and cloud-based segment dominated the global clinical trials matching software market and accounted for a significant revenue share in the market, owing to the cloud computing model, which is easier to maintain without maintenance cost. Since in-house server infrastructure is not needed, improvement costs are reduced. Referral time is greatly reduced and is accessible from anywhere. Sharing data is very convenient and allows partnerships on various projects.

The on-premises model needs in-house infrastructure, IT support, software license, and longer integration time. Therefore, this model is more expensive and less popular. On the other hand, organizations with highly confidential data, including governments and financial institutions, need the security and privacy of the on-premises environment.

Segments Covered in the Report

By Components

By End-User

By Deployment Mode

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

February 2025

January 2025