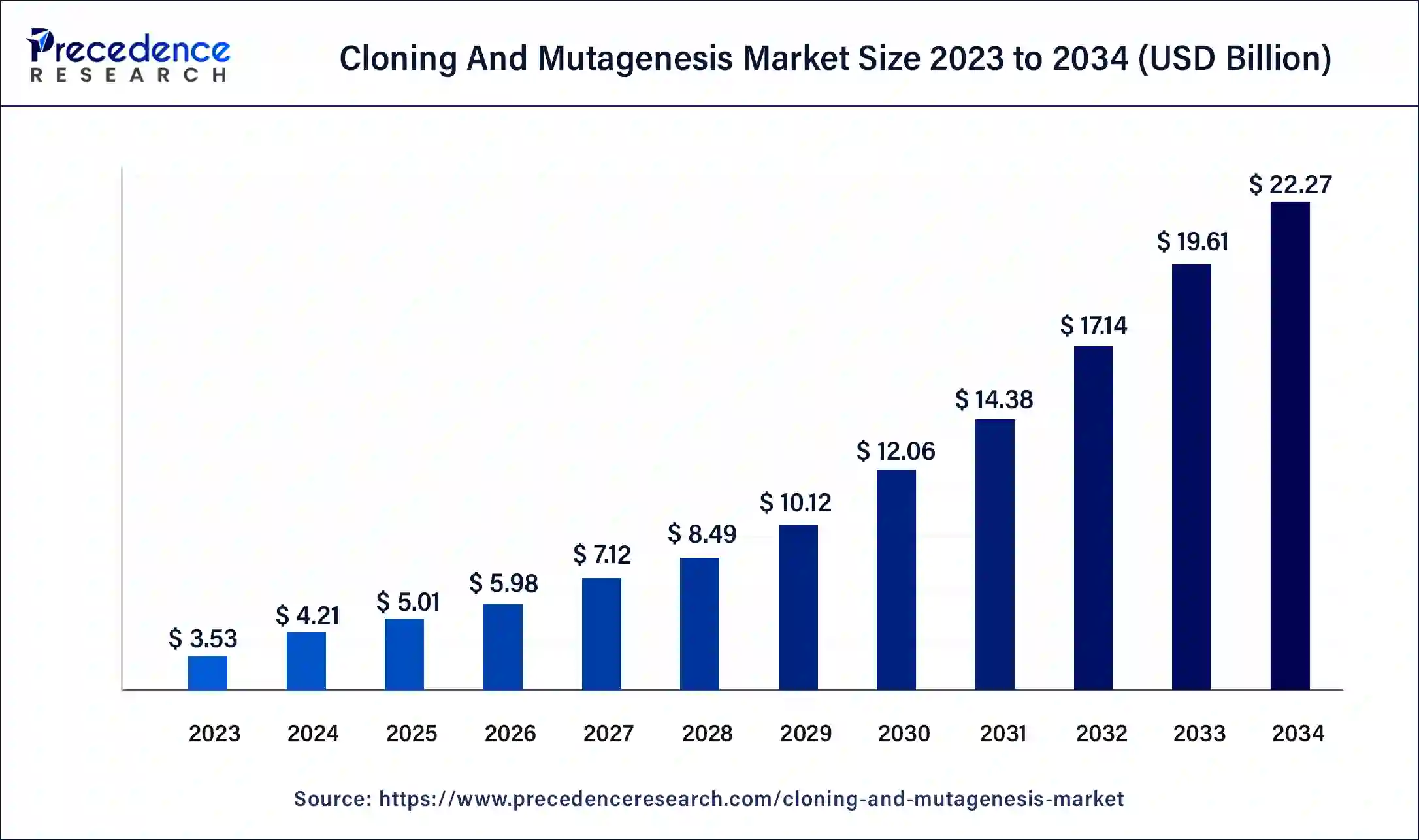

The global cloning and mutagenesis market size was USD 3.53 billion in 2023, estimated at USD 4.21 billion in 2024 and is anticipated to reach around USD 22.27 billion by 2034, expanding at a CAGR of 18.12% from 2024 to 2034.

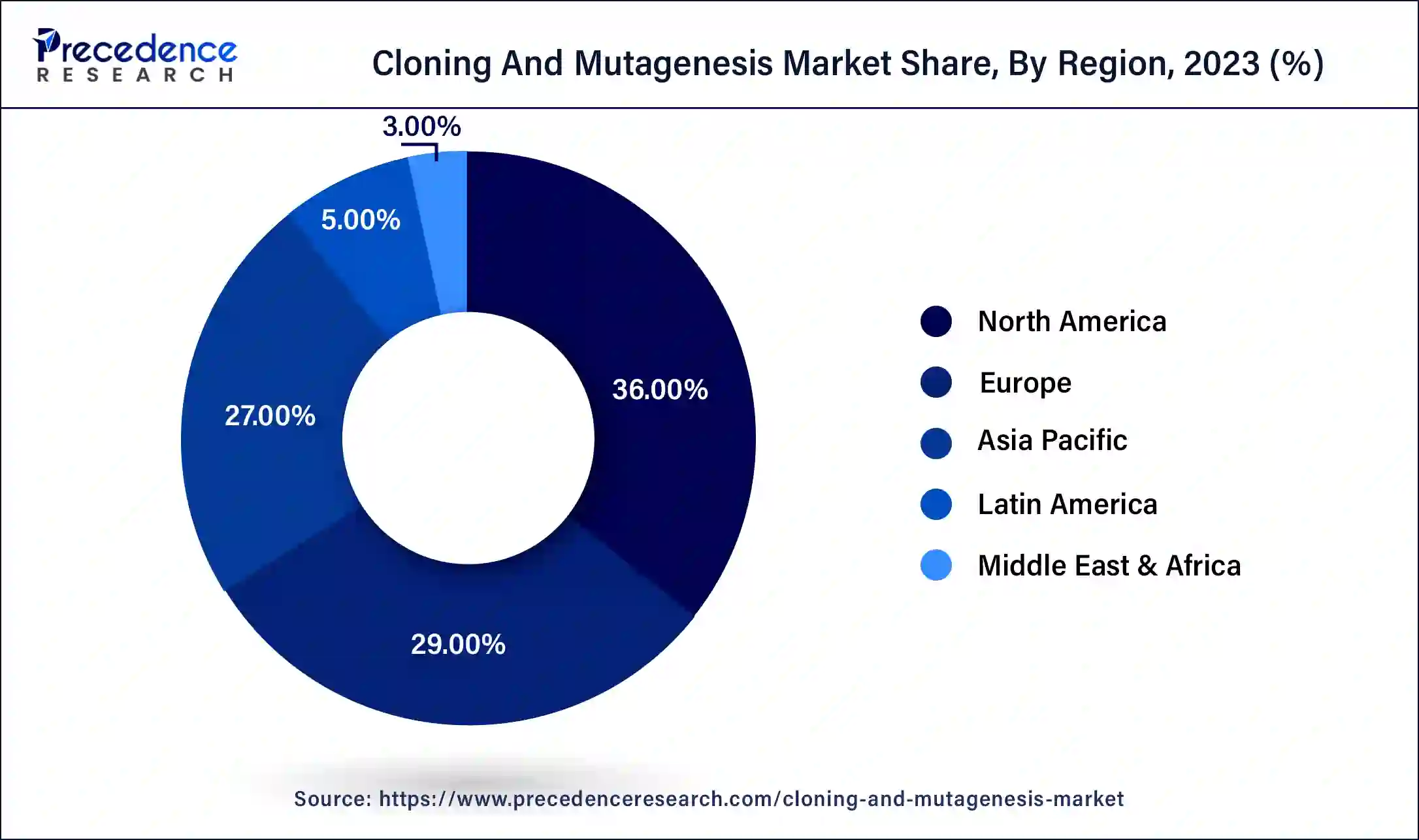

The global cloning and mutagenesis market size accounted for USD 4.21 billion in 2024 and is expected to reach around USD 22.27 billion by 2034, growing at a solid CAGR of 18.12% from 2024 to 2034. The North American cloning and mutagenesis market size reached USD 1.27 billion in 2023.

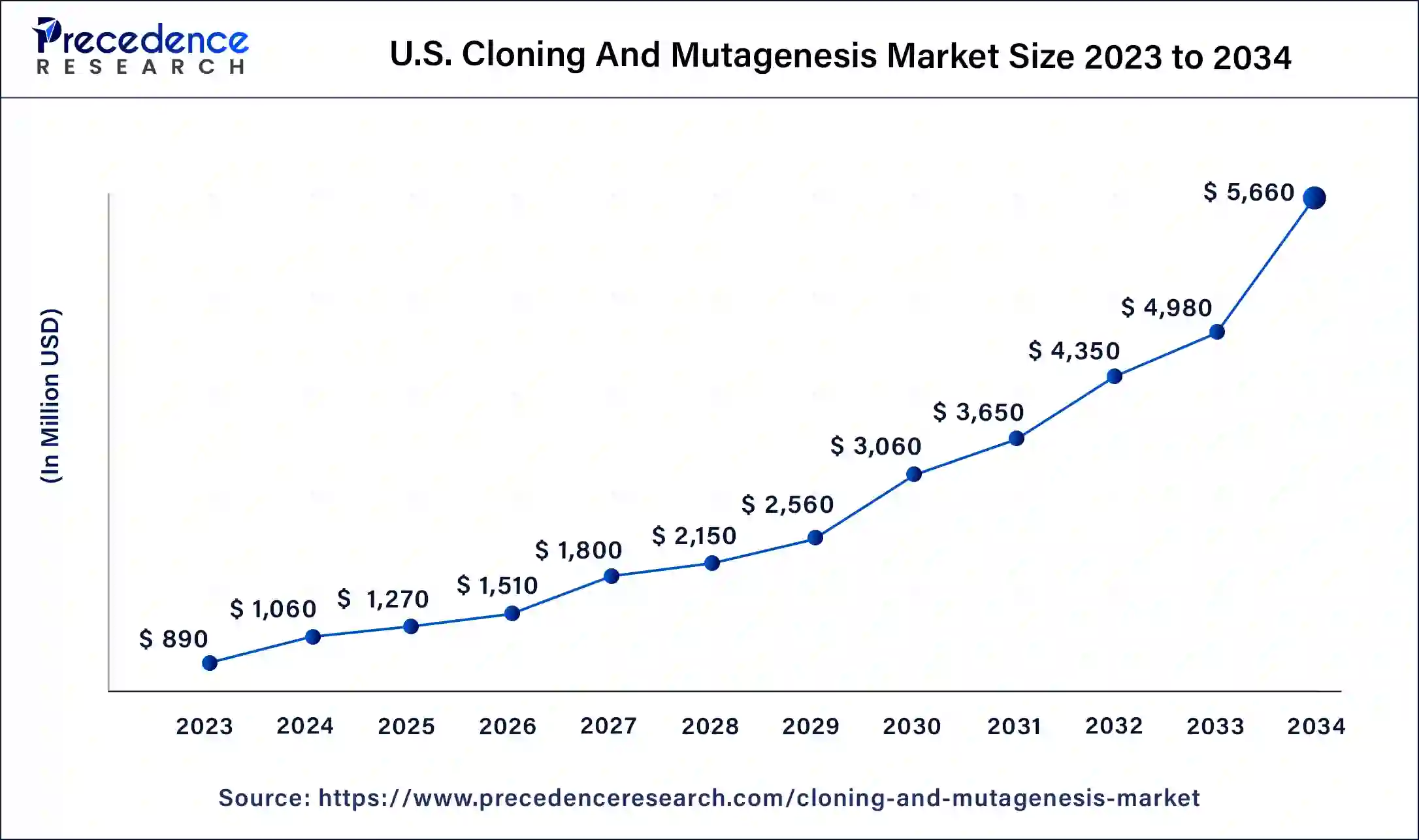

The global cloning and mutagenesis market size was valued at USD 890 million in 2023 and is predicted to be worth around USD 5660 million by 2034, poised to grow at a CAGR of 18.24% from 2024 to 2034.

North America is expected to dominate the market during the forecast period. The growth in the region is attributed to the rising geriatric population coupled with the increasing prevalence of the chronic disease. For instance, according to the Administration on Aging (AoA), in the US, there were 54.1 million people 65 and over as of 2019. More than one in seven Americans or 16% of the population are Americans. Since 2009, there have been 14.4 million more older Americans than there were in 2009, a rise of 36% compared to a 3% rise in the population under 65.

The number of Americans aged 45 to 64 increased by 4% between 2009 and 2019, from 80.3 million to 83.3 million. Americans aged 60 and over climbed from 55.7 million to 74.6 million, a 34% rise. In addition, according to the Journal of the American College of Cardiology, it is expected that cardiovascular risk factors and disease will rise significantly by 2060. Moreover, the growing prevalence of chronic obstructive pulmonary disease in the US is expected to drive market growth over the forecast period. For instance, according to the secondary analysis, COPD affects 12.5 million Americans, and it is the third leading cause of death in the US.

The Asia Pacific is growing at the highest CAGR during the forecast period. The growing prevalence of cancer in countries like India and China is expected to drive market expansion in the region. For instance, as per the US Department of Health and Human Services (HHS), 14,61,427 incident cases of cancer were determined to be the projected total in India for 2022.

In India 1 out of 9 people has a lifelong risk of developing cancer. The most common cancer in men and women were lung and breast cancer. According to the estimates, there will be 12.8% more cancer instances in 2025 than there were in 2020. Moreover, the growing heart failure in the countries like India and China is further driving the market growth.

The frequency of HF cases in China has significantly increased between 1990 and 2019. More specifically, there were 7.03 million prevalent cases overall in 1990 and 18.51 million instances in 2019. Thus, this is expected to propel the cloning and mutagenesis industry during the forecast period.

Cloning is the process of making genetically identical duplicates of an organism, either spontaneously or intentionally. The process of mutagenesis is when the genetic structure of an organism is changed, resulting in a mutation. Mutagenesis occurs when DNA is purposefully altered to create mutant proteins, genes, or strains of an organism in a lab setting. Two of the best techniques used to study the connections between protein structure and function are cloning and mutagenesis. They are applied to verify mutational effects both in vitro and in vivo.

The global cloning and mutagenesis industry is anticipated to increase as a result of the expanding use of cloning in several genetic applications, such as reproductive cloning. Both the prevalence of genetic and chronic illnesses and the demand for personalized therapy are predicted to rise. Cloning and mutagenesis technologies are becoming more and more essential as funding for research and development to cure genetic problems and other diseases, including cancer and HIV, increases.

The rise in hereditary and chronic illness prevalence, the rise in demand for personalized medication, and the rise in new companies joining the market are the main drivers of the global market. Favorable funding conditions for gene synthesis and cloning services, technological developments in the cloning sector, and a surge in complementary commercial operations all contribute to the industry's growth.

| Report Coverage | Details |

| Market Size in 2023 | USD 3.53 Billion |

| Market Size in 2024 | USD 4.21 Billion |

| Market Size by 2032 | USD 22.27 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 18.12% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, End-User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The growing attention on protein engineering for drug development

The market's growth prospects are strengthening due to the increasing attention being paid to protein engineering for therapeutic development. The fundamental techniques used in protein engineering during medication development include cloning and mutagenesis. These methods support the development of therapeutic proteins by enabling the insertion, deletion, or replacement of nucleotides in protein sequences.

High cost of cell and gene therapy

Researchers contend that patients are unable to obtain cell and gene therapies due to high production costs, and that industry-wide capacity increase and manufacturing method optimization would be beneficial. Cell and gene therapy is expensive. The Institute for Clinical and Economic Review (ICER) found that the average cost of a single dose of gene therapy is between USD $1 million and USD $2 million. Similar to this, cell therapy has an average cost per treatment of USD $1 million, though costs vary greatly depending on the product and the indication. Consequently, this is anticipated to limit market growth throughout the anticipated timeframe.

Rising demand for genetically modified products

Growing consumer demand for GM products, such as crops, is propelling market expansion. Insect-resistant and herbicide-tolerant seeds that have undergone genetic modification have become extremely popular, and crops have quickly adapted to them, aiding in the expansion of the agricultural sector. Cloning and mutagenesis have made it possible to modify crops' genetic makeup, increase soil production, and effectively combat pests.

For instance, the Genetic Engineering Appraisal Committee (GEAC) authorized the commercial release of GM mustard in October 2022. This program is anticipated to spur crop development to satisfy dietary needs. In the upcoming years, it is anticipated that the development of novel genetic resources and genome modification methods like cloning and mutagenesis will advance knowledge of plant biology.

Based on the product, the global cloning and mutagenesis market is segmented into cloning kits, mutagenesis kits and others. The cloning kits segment is expected to hold the largest market share during the forecast period. Cloning kits are used in a variety of fields, including biopharmaceuticals, gene therapy and gene analysis. These kits are commonly used in the biopharmaceutical sector to create human proteins with biological uses.

To treat and prevent strokes, Tissue Plasminogen Activator (TPA) is employed. Additionally, cloning kits are also used in gene analysis to create recombinant and synthetic versions of genes that aid biologists in comprehending the role of the normal gene in an organism's function. Thus, this is expected to fuel the segment growth during the forecast period.

The mutagenesis kits segment is expected to grow at the highest CAGR during the forecast period. Mutagenesis kits are used to clone DNA, study the effects of mutagens, and design proteins. Additionally, these kits are utilized in medical settings to treat and research conditions like cancer and HIV, as well as to assist individuals who are immunocompromised. As a result, the market is being driven by the growing use of mutagenesis kits in biomedical research, which is boosting kit usage in R&D activities.

Based on the technology, the market is bifurcated into Topo PCR Cloning, Blunt End Cloning, Seamless Cloning, Site-directed Mutagenesis and Others. The Topo PCR Cloning segment is expected to dominate the market during the forecast period. This technology uses DNA topoisomerase biological activity to clone DNA fragments into particular vectors. This method has several benefits over conventional TA cloning, including ligation and restriction-free cloning, straightforward primer design, no need for post-PCR steps, and higher efficiency. Because of this, TOPO PCR cloning is seeing increased use across a variety of end users, including pharmaceutical and biotechnology companies and academic and research institutions.

The Site-directed Mutagenesis segment is expected to grow at a significant rate over the forecast period. The DNA sequence of a gene can be intentionally and specifically modified through the use of site-directed mutagenesis technology. By enabling precise gene and protein modification, this approach has applications in genetic research, gene technology and protein engineering. Furthermore, leading market companies are offering innovative site-directed mutagenesis-based kits that streamline and expedite the process.

For instance, the Phusion Site-Directed Mutagenesis Kit from Thermo Fisher Scientific Inc. is a productive and adaptable tool for adding point mutations, insertions, or deletions into any kind of plasmid DNA. Thus, this is expected to propel the segment revenue over the forecast period.

The biopharmaceutical and pharmaceutical companies segment dominated the market in 2023. The segment's growth is attributed to the increasing emphasis on drug discovery and development by biopharmaceutical and pharmaceutical companies. Cloning and mutagenesis techniques are helpful in therapeutics and drug discovery, offering new cells for tissue engineering and transplantation.

The CROs and CMOs segment is anticipated to grow at the fastest rate over the forecast period. Several pharmaceutical companies outsource cloning and mutagenesis to CROs and CMOs for different purposes. These outsourcing initiatives can reduce time and increase productivity. The rising need to outsource cloning and mutagenesis services for the development of personalized medicines is likely to contribute to segmental growth.

Segments Covered in the Report:

By Product

By Technology

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client