January 2025

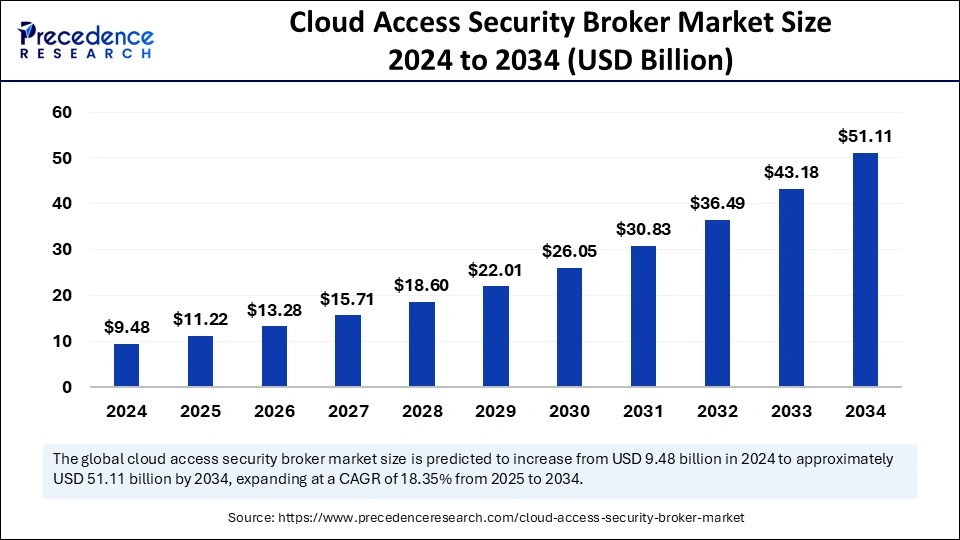

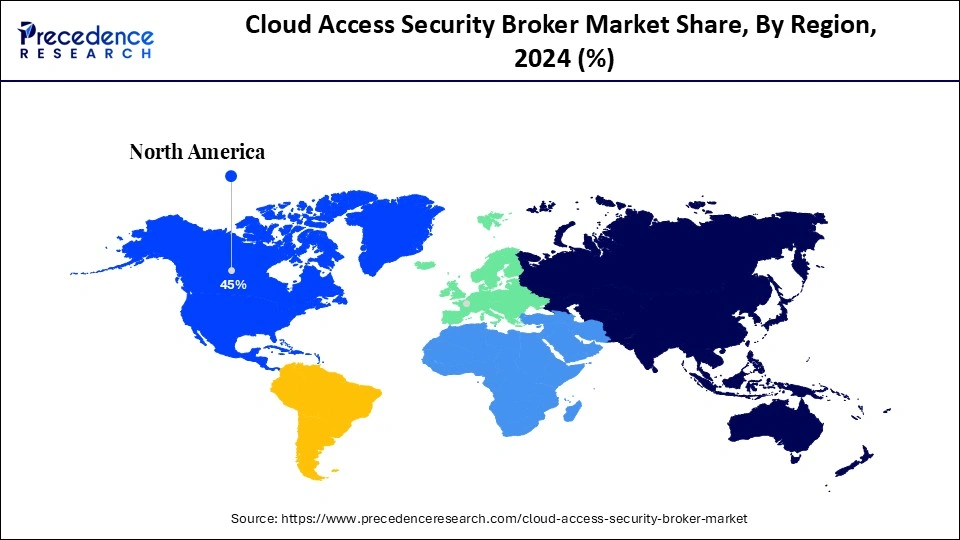

The global cloud access security broker market size is evaluated at USD 11.22 billion in 2025 and is forecasted to hit around USD 51.11 billion by 2034, growing at a CAGR of 18.35% from 2025 to 2034. The North America market size was accounted at USD 4.27 billion in 2024 and is expanding at a CAGR of 18.47% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cloud access security broker market size was calculated at USD 9.48 billion in 2024 and is predicted to increase from USD 11.22 billion in 2025 to approximately USD 51.11 billion by 2034, expanding at a CAGR of 18.35% from 2025 to 2034. The rising adoption of SaaS is increasing the demand for cloud access security broker (CASB) solutions, which is boosting the growth of the cloud access security broker market.

Artificial intelligence (AI) plays an important role in cloud access security brokers. AI has different functions and applications in this field that can help optimize and boost the processes of CASB solutions. AI-driven tools can be utilized to find unusual patterns in different processes like data access and user behavior. This analysis helps in the possible flagging of suspicious activities or cyber threats before they happen, helping the professionals take steps to improve security. AI technology can help with the automation of threat response. If and when the threats are detected, AI driven systems can deploy pre-conceived security measures that help minimize the risk as well as damage from the cyberattacks. With AI technology, real-time data analysis is possible, which helps experts make informed decisions and boost security systems. AI offers benefits like improved threat detection and risk assessment, which help enhance the efficiency of these solutions.

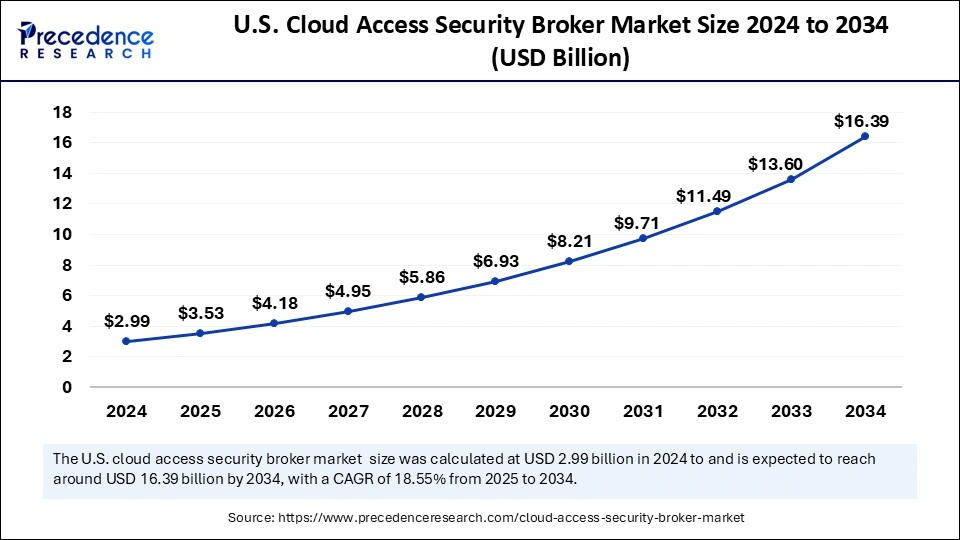

The U.S. cloud access security broker market size was evaluated at USD 2.99 billion in 2024 and is projected to be worth around USD 16.39 billion by 2034, growing at a CAGR of 18.55% from 2025 to 2034.

North America held the largest share of the cloud access security broker market in 2024. The widespread adoption of cloud computing and other cloud-based services/systems is a key factor contributing to the region’s dominance. The strong presence of major market players in North America further bolstered the market growth. The region also boasts leading tech giants, supporting market growth. Many sectors in North America are shifting to cloud systems, which creates a necessity for solutions like CASB. A well-established and developed cloud infrastructure enables easier integration of CASB solutions.

The U.S. plays an important role in the North American cloud access security broker market. There is a high adoption of cloud solutions in the country. The rising stringency regarding data privacy and security measures is further driving market growth. Moreover, the increasing number of cyberattacks contributes to market expansion.

Asia Pacific is poised for the fastest growth in the upcoming period. The growth of the market in the region can be attributed to the rising adoption of cloud-based services. The rising instances of cyberattacks and data breaches are compelling companies from different sectors to invest in robust security solutions, boosting the demand for CASB solutions. Countries like China, India, and Japan are expected to play a major role in market growth. These countries have stringent data privacy regulations. With the rising demand for cloud computing from various industries, the need for CASB solutions is increasing.

Europe is expected to witness notable growth during the forecast period. Stringent regulations regarding data protection in Europe are a major factor supporting market growth. The rising adoption of cloud solutions and integration of advanced technologies will help this market grow. Many European organizations are steadily deploying CASB solutions to ensure regulatory compliance, data privacy, and security. Growing concerns about data sovereignty in the UK are boosting the integration of advanced cybersecurity solutions, including CASB, driving market growth in the region.

The cloud access security broker market is witnessing rapid growth due to the rising adoption of cloud computing across different industries. With the shift toward cloud services, there are growing concerns about data safety, privacy, and security. This has led to the growing utilization of cloud access security broker (CASB) solutions to protect the data. An increase in regulatory compliance regarding the safety of data by the government and other agencies is helping drive market growth. These solutions enable user behavior analysis and real-time threat detection monitoring, which help safeguard the infrastructure against cyberattacks. The increasing concerns regarding cyberattacks in various sectors like banking, healthcare, and government are boosting the adoption of CASB solutions. Ongoing technological advancements are enhancing the performance and reliability of CASB solutions, supporting market growth. Moreover, the growing popularity of zero-trust security frameworks that require dynamic access control boosts market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 51.11 Billion |

| Market Size in 2025 | USD 11.22 Billion |

| Market Size in 2024 | USD 9.48 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.35% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Deployment Mode, Enterprise Size, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing Number of Cyber Threats

The increasing number of cyber threats is a major factor driving the growth of the cloud access security broker market. The constant rise in the number of cyberattacks, along with the growing complexity of these threats, is a serious concern among organizations across the world. For instance, in Q2 of 2024, companies experience an average of 1,636 cyberattacks per week. This shows a 30% year-over-year increase. Such a staggering rise in numbers encouraged companies to invest in strengthening and implementing advanced security solutions like cloud access security broker (CASB). It is essential for organizations to have advanced security measures in place to restrict and minimize cyber threats. Stringent regulatory frameworks to ensure data protection also boost the demand for these solutions. In 2025, about 93% of worldwide organizations are anticipated to increase their spending on cybersecurity.

High Deployment Costs

The high costs associated with CASB solutions are a key factor restraining the growth of the cloud access security broker market. The initial expense of installing these solutions involves costs associated with hardware and cloud infrastructure and licensing fees. These costs create barriers, especially for small and medium-sized organizations. Such enterprises often have limited resources. This leads to slower and limited adoption of CASB solutions into small and medium-sized companies, restraining the growth of this market.

Technological Advancements

Ongoing technological advancements create immense opportunities for innovation and the development of new features for the cloud access security broker market. With the integration of advanced technologies, like AI and machine learning (ML), it is possible to easily identify threats. These advancements further improve the scope of the applications of CASB solutions in different sectors. Technological advancements further boost the accuracy, reliability, efficiency, and safety of CASB solutions, offering users robust protection from cyber threats.

The data security segment led the cloud access security broker market with the largest share in 2024. This is mainly due to the increased volume of sensitive information that is being regularly stored and processed in the cloud infrastructure. With the rise in the adoption of cloud-based services across various industries, the necessity of data security solutions has increased. These solutions offer advanced security features for cloud environment. Governments worldwide have imposed stringent regulations regarding data privacy and security, compelling organizations to shift toward CASB solutions to secure data.

The threat protection segment is expected to grow rapidly in the coming years. This is mainly due to the steady rise in the number of cyberattacks across the world. The increasing complexity and sophistication of cyber threats is encouraging the integration of security solutions like CASB to prevent threats. Threat protection solutions enable real-time monitoring of threats, aiding in proactive decision making.

The SaaS segment dominated the cloud access security broker market in 2024. This is mainly due to the heightened adoption of SaaS solutions among organizations from different industries. SaaS offers a seamless approach to integration for cloud-based solutions, which makes it a popular choice. SaaS-based CASB offers enhanced efficiency and scalability.

The PaaS segment is projected to expand at the fastest rate during the forecast period. PaaS environment consists of new security risks like API security gaps and container vulnerabilities, creating a need for advanced security measures. With a growing focus on microservices architecture, secure DevOps, and cloud workload security, the demand for CASB for this environment is growing. The increasing digital transformation will aid the segment’s growth.

The large enterprises segment led the cloud access security broker market in 2024. These organizations depend heavily on cloud-based applications, which is a key factor bolstering the growth of this segment. The high volume of data these organizations manage requires robust security solutions. Large enterprises run across multiple locations, which makes utilizing cloud-based systems easier to ensure protection for all locations. The CASB solutions offer these organizations scope for enforcing granular controls, encryption, and DLP. The increased necessity for robust security solutions that offer real-time analysis, advanced safety, and threat detection further bolstered the growth of this segment.

The small & medium size enterprises (SMEs) segment is expected to show the quickest growth in the coming years. There is high adoption of cloud-based services among SMEs, which is boosting the segment’s growth. With the constant rise in the number of cyberattacks, SMEs are investing in cloud-based security solutions to enhance data security. CASB offers cost-effective security solutions that are scalable for these organizations.

The BFSI segment dominated the cloud access security broker market in 2024. The growth of the segment is driven by the dependence of the banking and financial sector on cloud-based solutions. This industry requires efficient security solutions to ensure the privacy and protection of their and customer data on the cloud from cyberattacks. The implementation of CASB solutions is widespread in this sector because cybercriminals often target them. These solutions offer enhanced safety to data, preventing data breaches. The ongoing safety requirements and adoption of advanced cloud security solutions further support segmental growth.

The manufacturing segment is likely to grow at a significant rate during the projection period. With the increasing integration of advanced technologies, like the Internet of Things (IoT), automation, and cloud solutions, into this sector, the demand for CASB solutions is increasing. With a rapid transition to Industry 4.0, this sector heavily depends on cloud platforms to fulfill certain functions. This digital transformation also brings challenges related to cybersecurity. Such factors will help this segment’s growth in the forecast period.

By Solution

By Deployment Mode

By Enterprise Size

By End-Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025