January 2025

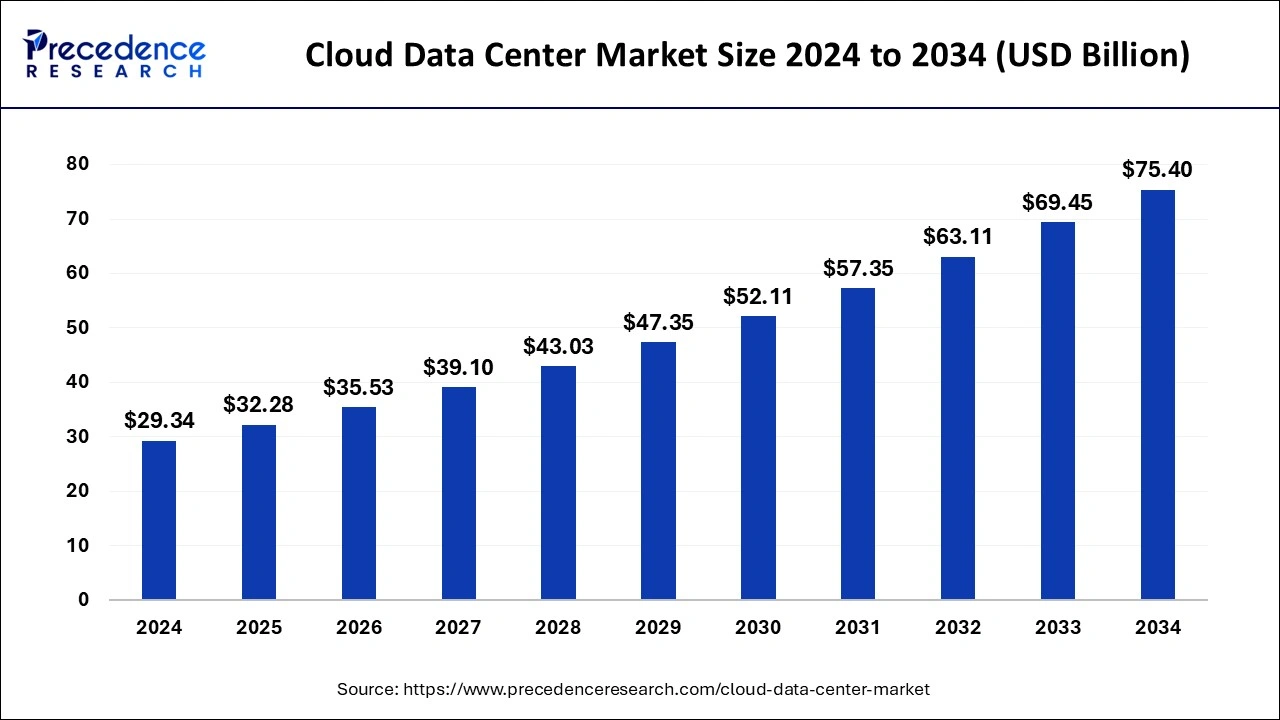

The global cloud data center market size is calculated at USD 32.28 billion in 2025 and is forecasted to reach around USD 75.40 billion by 2034, accelerating at a CAGR of 9.90% from 2025 to 2034. The North America cloud data center market size surpassed USD 12.32 billion in 2024 and is expanding at a CAGR of 10.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cloud data center market size was estimated at USD 29.34 billion in 2024 and is predicted to increase from USD 32.28 billion in 2025 to approximately USD 75.40 billion by 2034, expanding at a CAGR of 9.90% from 2025 to 2034. Government initiatives supporting the progress of cloud computing technologies are expected to drive market growth significantly.

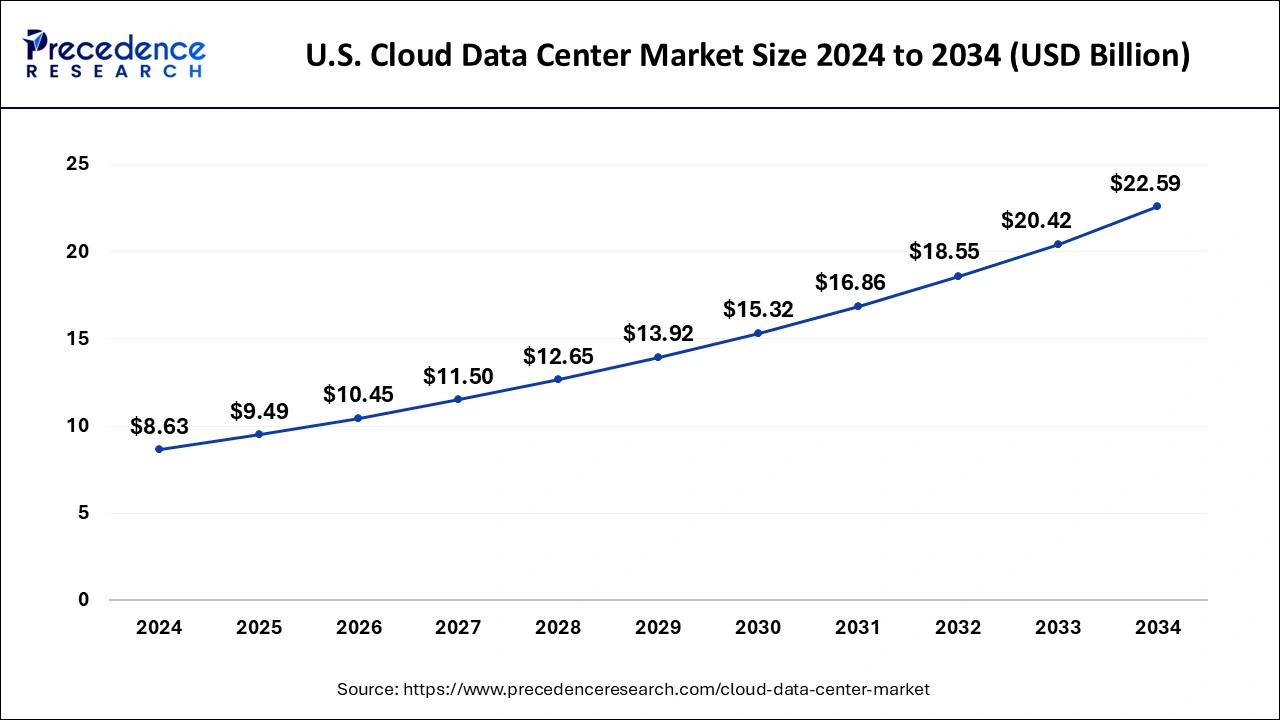

The U.S. cloud data center market size was valued at USD 8.63 billion in 2024 and is anticipated to reach around USD 22.59 billion by 2034, poised to grow at a CAGR of 10.10% from 2025 to 2034.

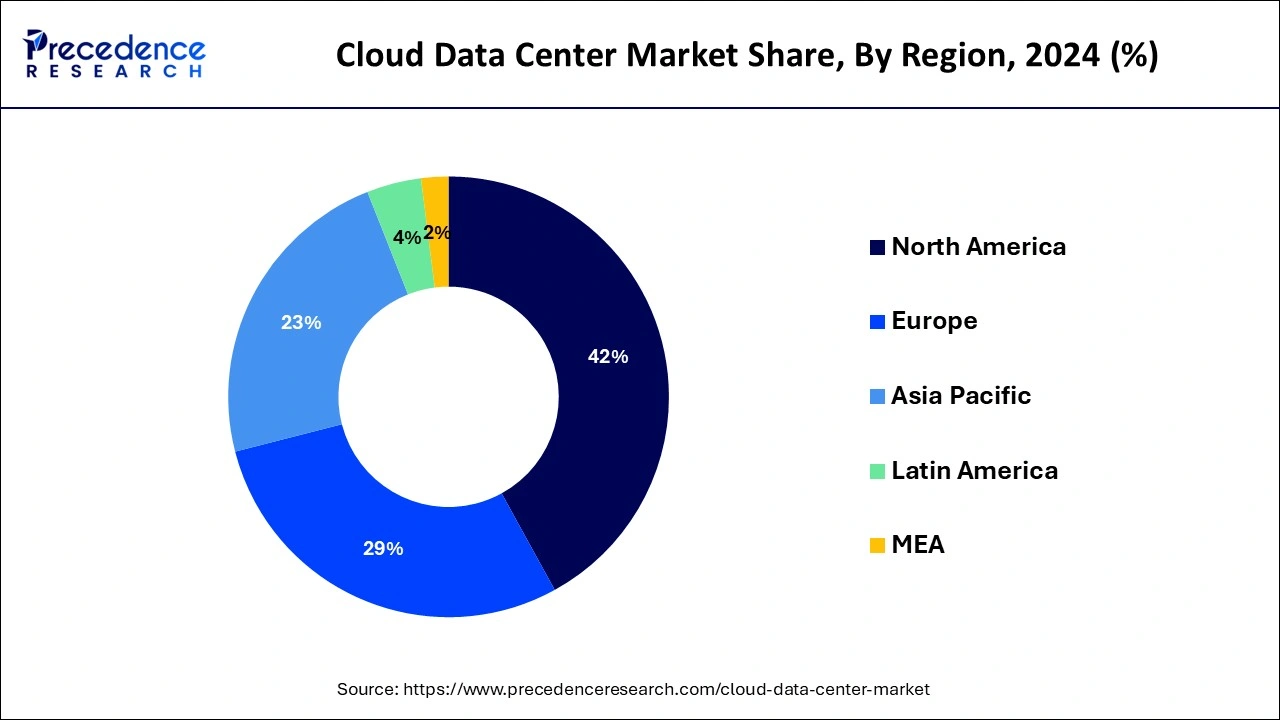

North America held the largest share of the, primarily due to its highly developed IT infrastructure, technological advancements, and early embrace of cloud computing. Major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) have a significant presence, reinforcing the region's dominance. The robust connectivity, favorable regulatory environment, and the presence of multinational corporations with extensive data needs contribute to North America's strong market position. Additionally, a tech-savvy business environment and a skilled workforce have fueled the widespread adoption of cloud-based services in the region.

One of the largest and fastest-growing economies globally, the United States, is expected to drive the growth of public cloud-based data centers. The IT industry, the largest private sector employer, extensively utilizes data centers, contributing to market expansion. The country has witnessed a surge in hyper-scale platforms, necessitating data center services for these platforms. Moreover, various acquisitions and mergers promote market growth in the U.S.

Asia-Pacific is expected to experience significant growth in the cloud data center market. This is due to businesses' widespread adoption of cloud-based services in the region. The increasing prevalence of digitalization and significantly growing mobile technologies promote the market’s growth. The expansion of the e-commerce sector is observed to supplement the growth of the market in the upcoming period. Multiple organizations are focused on the transition of work-force with the adoption of cloud-based technologies, this factor is observed to fuel the growth of the market.

The cloud data center market offers centralized facility designed to provide a scalable and flexible infrastructure for hosting and managing data in the cloud. It offers virtualized resources on-demand, eliminating the need for physical servers and on-premises data storage. Cloud data centers provide various services such as cloud computing, data storage, and data analytics using a network of servers, storage systems, and networking equipment. They enable businesses to quickly scale their infrastructure, reduce costs, and optimize their IT operations according to changing needs.

Cloud data centers guarantee heightened availability, data security, and dependable performance for businesses functioning in the cloud. Moreover, cloud computing projects offer streamlined management with automatic issue resolution, comprehensive security management, and budgeting based on actual data consumption. Governments in various countries, including India, prioritize enhancing cloud computing infrastructure for e-governance initiatives and implementing programs to boost skill sets to support digitalization.

| Report Coverage | Details |

| Market Size by 2034 | USD 75.40 Billion |

| Market Size by 2025 | USD 32.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.90% |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Deployment type, Organization Size, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Hybrid cloud environments

Adoption of hybrid cloud environments is observed to drive the growth of the cloud data center market. There is a substantial surge in demand for cloud data centers capable of effectively supporting and integrating within hybrid cloud environments as organizations prioritize a blend of private and public cloud solutions. Data centers facilitate seamless integration, data mobility, and efficient resource allocation, serving as the foundation of these hybrid setups. Businesses increasingly leverage hybrid cloud strategies, combining on-premises infrastructure with cloud services to improve flexibility and scalability.

Challenges regarding data security

The challenges faced by the cloud data center market include apprehensions about data security, privacy concerns, and regulatory compliance. High initial investments and ongoing maintenance costs associated with establishing and running data centers contribute to the limitations. Issues such as limited network bandwidth, latency, and the potential for service disruptions can impede market growth. Vendor lock-in and interoperability challenges must be addressed for businesses planning infrastructure migration to the cloud. Furthermore, environmental considerations and the growing preference for renewable energy sources can influence the market's trajectory.

Edge computing solutions and cloud data center expansion

The widespread adoption of edge computing solutions primarily propels the growth for the cloud data center market. With organizations increasingly decentralizing data processing, edge computing brings computational capabilities closer to end-users. This minimizes latency and improves the efficiency of real-time applications. The growing requirement for swift decision-making, particularly in areas like IoT devices and autonomous systems, drives the demand for distributed edge data centers. This trend contributes to establishing a robust market for compact and high-performance infrastructure.

Adoption of emerging cloud technology

The increasing adoption of emerging cloud technology is a significant opportunity for the cloud data center market, contributing to overall market growth. Cloud technology offers flexibility, accessibility with various devices, and efficient data recovery. Its high-speed capabilities facilitate business growth. With growing workloads in data centers due to increased demand for application performance, storage needs, mobile data use, and internet usage, organizations worldwide are transitioning to cloud data storage. The rise of public cloud usage is attributed to lower costs and easier maintenance, allowing small and medium-sized businesses to scale efficiently and control expenses based on their infrastructure needs.

The cloud data center market is categorized into three models including infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS). The software-as-a-service (SaaS) segment is poised for substantial growth in the forecast period. This anticipation is driven by various factors, including the increasing adoption of cloud-based software solutions by businesses seeking cost-effective and scalable alternatives to traditional on-premises software. The SaaS model provides flexibility, easy accessibility, and seamless updates. Moreover, the growing demand for specific SaaS applications such as customer relationship management (CRM), enterprise resource planning (ERP), and recent advancements in SaaS is expected to propel the segment's growth.

Logility, Inc., a prominent provider of prescriptive supply chain planning solutions, has introduced enhanced features to its cloud-based Logility® Digital Supply Chain Platform. The new functionality incorporates artificial intelligence (AI), machine learning (ML), and automation to consistently monitor, analyze, and revise activities in digital supply chains.

The infrastructure-as-a-service (IaaS) segment is experiencing rapid growth in the market. It offers direct access to cloud servers and storage, providing the flexibility to scale computing resources based on requirements and address data traffic concerns. The segment is observed to expand at a notable rate owing to the technological advancements in the sector.

The hybrid cloud segment dominated the cloud data center market in 2024. This surge is propelled by the increasing adoption of hybrid cloud solutions among businesses aiming to strike a balance between on-premises infrastructure and cloud-based services. The hybrid cloud model provides flexibility in utilizing private and public clouds, enabling organizations to optimize workload placement, enhance data security, and achieve cost efficiency. It is particularly advantageous for businesses with regulatory compliance requirements and those needing seamless integration of legacy systems with cloud environments.

The public cloud data center segment shows notable growth during the forecast period. Numerous small and medium-sized businesses (SMBs) and emerging startups, constrained by limited budgets, are opting for public cloud data centers. This choice helps minimize the expenses of establishing an on-premises data storage infrastructure. Leading cloud technology providers are actively expanding their services to facilitate this segment's growth further.

The large enterprises segment held the dominating share of the cloud data center market in 2024. This is attributed to various factors, such as large organizations' increasing adoption of digital transformation initiatives, their demand for scalable and flexible IT infrastructure, and their capacity to invest in advanced technologies. With their extensive data storage and processing needs, large enterprises are well-suited for embracing cloud data center solutions. Additionally, the growth of this segment in the forecast period is contributed to by the advantages of cost optimization, enhanced security and improved operational efficiency offered by cloud data centers.

The BFSI (Banking, financial services, and insurance) segment dominated the global cloud data center market in 2024, holding the largest market share. This is attributed to the sector's increased adoption of cloud-based services for data storage, processing, and security tasks. Cloud data centers provide the BFSI sector with advantages such as improved operational efficiency, cost-effectiveness, scalability, and enhanced data protection. Furthermore, the sector's growing requirements for advanced analytics, regulatory compliance and disaster recovery solutions contribute to its reliance on cloud data centers, establishing it as the leading market segment.

The colocation segment is predicted to grow significantly over the forecast period. Colocation involves clients moving their servers and hardware to a data center, where they can use the facility's internet, cooling, electricity, and security systems. The reliable network connections in colocation data centers ensure that clients' essential applications run smoothly without interruptions.

By Service

By Deployment

By Organization Size

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025