January 2025

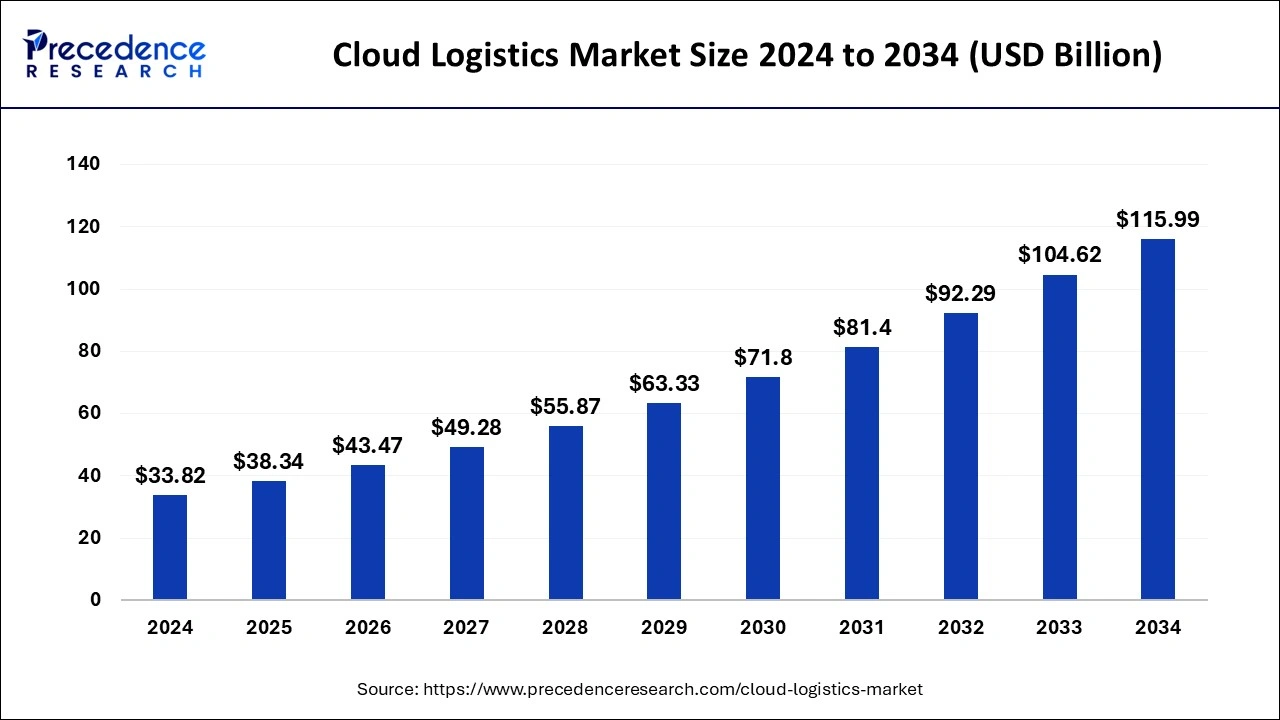

The global cloud logistics market size is calculated at USD 38.34 billion in 2025 and is forecasted to reach around USD 115.99 billion by 2034, accelerating at a CAGR of 13.12% from 2025 to 2034. The North America cloud logistics market size surpassed USD 10.15 billion in 2024 and is expanding at a CAGR of 13.15% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cloud logistics market size was estimated at USD 33.82 billion in 2024 and is predicted to increase from USD 38.34 billion in 2025 to approximately USD 115.99 billion by 2034, expanding at a CAGR of 13.12% from 2025 to 2034.

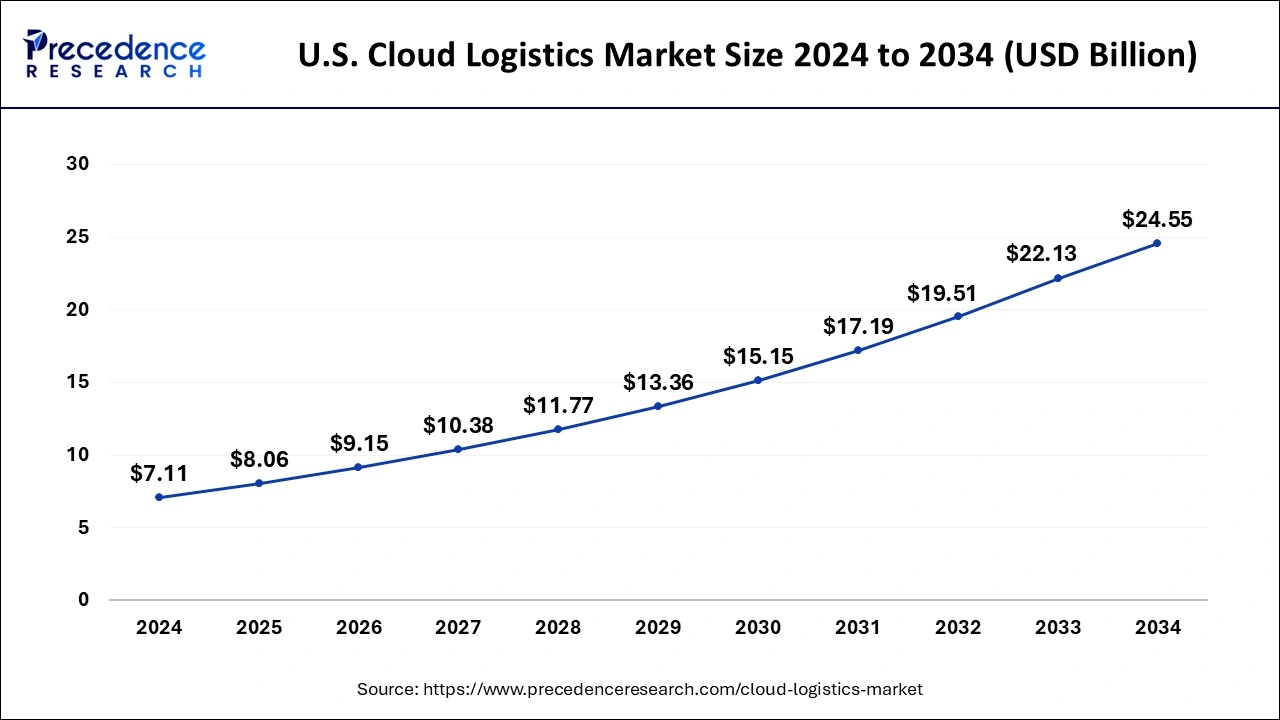

The U.S. cloud logistics market size was estimated at USD 7.11 billion in 2024 and is predicted to be worth around USD 24.55 billion by 2034 at a CAGR of 13.19% from 2025 to 2034.

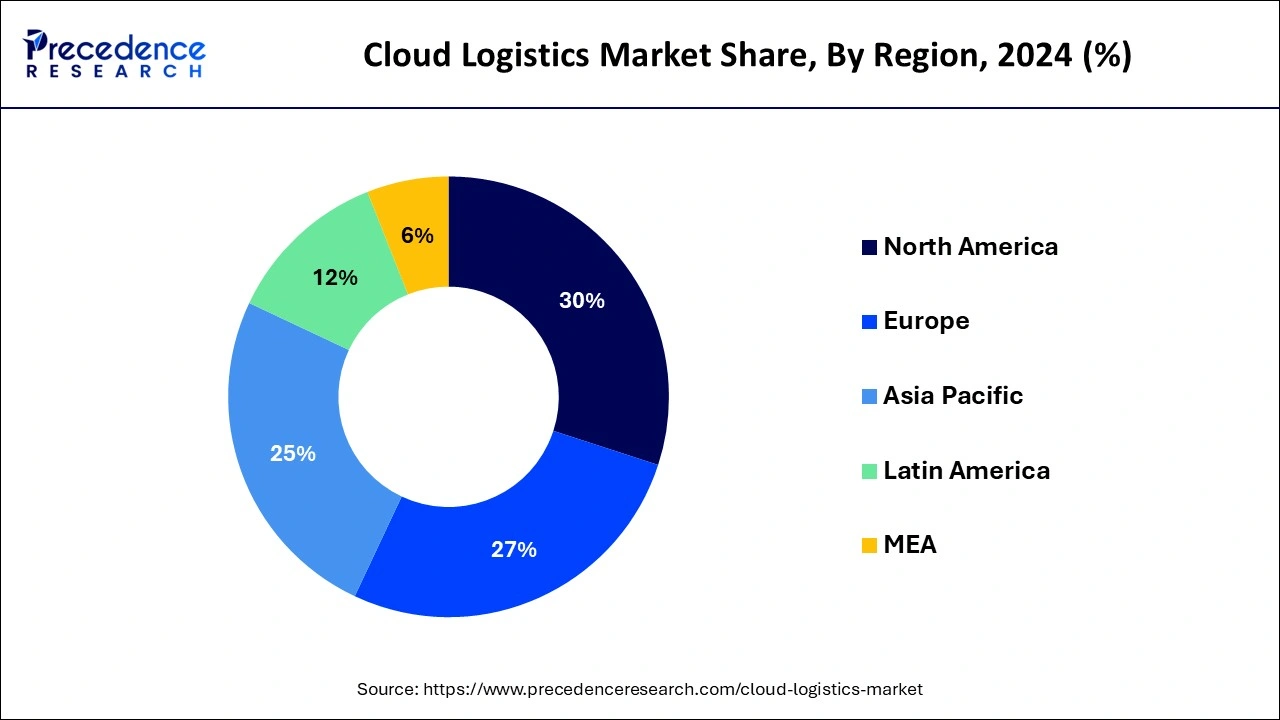

North America held the largest share of 30% in the cloud logistics market in 2024 due to several factors. The region boasts a mature infrastructure for cloud computing, widespread adoption of advanced technologies, and a strong focus on innovation. Additionally, North American businesses prioritize supply chain optimization and efficiency, driving the demand for cloud-based logistics solutions. Moreover, the presence of leading cloud service providers and tech giants in the region further contributes to its dominance in the market, attracting investments and fostering continuous growth.

Asia-Pacific is primed for substantial growth in the cloud logistics market due to several factors. Rapid industrialization, expanding e-commerce activities, and increasing adoption of digital technologies are driving demand for advanced logistics solutions. Additionally, the region's vast population and diverse economies create opportunities for cloud logistics providers to address varied supply chain needs. As businesses in Asia-Pacific seek to enhance efficiency, scalability, and visibility in their logistics operations, the demand for cloud-based solutions is expected to surge, propelling market growth in the region.

Meanwhile, Europe is experiencing notable growth in the cloud logistics market due to several factors. These include increasing digitalization efforts across industries, rising demand for real-time visibility and transparency in supply chain operations, and the adoption of advanced technologies such as IoT and predictive analytics. Additionally, Europe's focus on sustainability and regulatory compliance is driving the adoption of cloud logistics solutions that offer efficiency gains and environmental benefits, contributing to the region's growth in this market.

Cloud logistics refers to the use of cloud computing technology to manage and optimize various aspects of logistics and supply chain operations. Instead of relying on traditional on-premises systems, cloud logistics leverages internet-based platforms to store, process, and analyze data related to inventory management, transportation, warehousing, and distribution. By harnessing the power of the cloud, companies can gain real-time visibility into their supply chains, improve coordination among different stakeholders, and make data-driven decisions to enhance efficiency and reduce costs. Cloud logistics solutions offer scalability, flexibility, and accessibility, allowing businesses to adapt quickly to changing market conditions and customer demands. Overall, cloud logistics revolutionizes the way companies manage their supply chains, offering advanced tools and insights to streamline operations and drive competitive advantage in today's fast-paced global marketplace.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.12% |

| Market Size in 2025 | USD 38.34 Billion |

| Market Size by 2034 | USD 115.99 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By OS Type, By Enterprise Size, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Real-time visibility and transparency

Real-time visibility and transparency are pivotal factors surging demand for cloud logistics solutions. These capabilities empower businesses with instantaneous insights into their supply chain operations, allowing them to track shipments, monitor inventory levels, and identify potential bottlenecks in real-time. By providing a comprehensive view of the entire supply chain network, cloud logistics platforms enhance decision-making processes, enabling companies to respond swiftly to disruptions and optimize their operations for maximum efficiency.

Moreover, in today's fast-paced business environment, customers increasingly demand transparency and visibility throughout the supply chain. Cloud logistics solutions fulfill this need by offering real-time updates and status information, thereby enhancing customer satisfaction and loyalty. As businesses strive to meet these evolving customer expectations and navigate the complexities of global supply chains, the demand for cloud logistics solutions continues to rise, driving growth in the market as companies seek to leverage these technologies to gain a competitive edge and drive operational excellence.

Reliability and downtime

Reliability and downtime present significant restraints for the cloud logistics market, as businesses rely heavily on uninterrupted access to critical supply chain data and applications. Any service outage or downtime can disrupt operations, leading to delays in order fulfillment, shipment tracking, and communication with partners and customers. Such disruptions not only impact operational efficiency but also erode customer trust and satisfaction, potentially resulting in financial losses and damage to reputation.

Moreover, the dependency on internet connectivity for cloud logistics solutions exposes businesses to inherent risks associated with network outages and connectivity issues. Despite advancements in infrastructure and redundancy measures, the possibility of service disruptions remains a concern for organizations, particularly those operating in regions with unreliable internet access or facing cyber threats. Consequently, businesses may hesitate to fully embrace cloud logistics solutions due to apprehensions about reliability and the potential consequences of downtime on their supply chain operations and overall business performance.

Predictive analytics

Predictive analytics is revolutionizing the cloud logistics market by offering opportunities to enhance supply chain efficiency and responsiveness. By leveraging historical data, machine learning algorithms, and real-time insights, predictive analytics enables businesses to forecast demand, identify potential risks, and optimize logistics operations. This proactive approach empowers companies to anticipate fluctuations in customer demand, streamline inventory management, and improve resource allocation, ultimately reducing costs and enhancing customer satisfaction.

Furthermore, predictive analytics in cloud logistics opens doors to advanced decision-making capabilities. By accurately predicting future trends and events, businesses can make informed decisions regarding production schedules, transportation routes, and inventory levels. This not only minimizes operational risks but also enables companies to capitalize on emerging opportunities, such as market demand spikes or supply chain disruptions. As a result, predictive analytics becomes a valuable tool for driving innovation, optimizing supply chain performance, and gaining a competitive edge in the dynamic landscape of cloud logistics.

The public segment held the highest market share of 29% based on the type. In the cloud logistics market, the public segment refers to services offered by third-party providers accessible to the public over the Internet. These providers host and manage logistics software and infrastructure, allowing businesses to access scalable, on-demand logistics solutions without the need for upfront investments in hardware or software. A key trend in the public segment of the cloud logistics market is the increasing adoption of software as a service (SaaS) solutions, which offer subscription-based access to cloud-based logistics platforms, driving flexibility and cost-effectiveness for businesses of all sizes.

The private segment is anticipated to witness rapid growth at a significant CAGR of 14.3% during the projected period. In the cloud logistics market, the private segment refers to cloud-based logistics solutions that are exclusively owned and operated by a single organization. Private cloud logistics systems offer enhanced security and control over data and infrastructure compared to public alternatives. A growing trend in the private segment involves increased adoption by large enterprises and organizations with sensitive data, seeking to leverage the benefits of cloud technology while maintaining strict compliance with industry regulations and data privacy standards. This trend reflects a continued emphasis on data security and control in cloud logistics implementations.

The web-based OS segment has held a 53% market share in 2024. Web-based operating systems (OS) are those that primarily function through web browsers, allowing users to access applications and data stored on remote servers. In the cloud logistics market, web-based OS facilitate seamless access to logistics management platforms, enabling real-time tracking, inventory management, and collaboration among supply chain stakeholders. A growing trend in this segment includes the integration of web-based OS with cloud logistics solutions to enhance accessibility and scalability for users.

The native OS segment is anticipated to witness rapid growth over the projected period. In the cloud logistics market, the native OS segment refers to operating systems that are specifically designed for a particular platform or device, such as iOS for Apple devices or Android for smartphones. Businesses are increasingly adopting native OS solutions in cloud logistics to ensure seamless integration and optimized performance across their chosen devices, leading to enhanced user experience and operational efficiency. Trends indicate a growing preference for native OS solutions in cloud logistics, driven by the need for streamlined operations and improved compatibility with mobile devices.

As businesses seek to leverage the benefits of cloud-based logistics platforms on various operating systems, native OS solutions continue to gain traction, offering tailored experiences and maximizing the effectiveness of supply chain management processes.

The large enterprises segment has held 66% market share in 2024. Large enterprises in the cloud logistics market are typically defined as businesses with extensive operations and significant logistical needs. They often manage complex supply chains spanning multiple regions or industries. In recent trends, large enterprises are increasingly adopting cloud logistics solutions to streamline operations, improve supply chain visibility, and enhance overall efficiency, leveraging advanced technologies like real-time tracking and predictive analytics to optimize their logistics processes.

The small & medium enterprises segment is anticipated to witness rapid growth over the projected period. Small and medium enterprises (SMEs) in the cloud logistics market typically refer to businesses with a relatively small workforce and revenue compared to larger corporations. These enterprises often face resource constraints but seek cost-effective solutions to streamline their supply chain operations. Recent trends show increasing adoption of cloud logistics among SMEs, driven by the need for real-time visibility, scalability, and cost savings in managing their logistics processes efficiently.

The retail segment has held a 22% share in the cloud logistics market in 2024. In the retail segment, cloud logistics refers to the use of internet-based platforms to manage inventory, orders, and deliveries efficiently. Retailers are increasingly adopting cloud logistics solutions to streamline operations, improve inventory visibility, and enhance customer service. Key trends include real-time inventory tracking, automated order fulfillment, and integration with e-commerce platforms to meet growing consumer demands for faster and more reliable shipping options.

The healthcare segment is anticipated to witness rapid growth over the projected period. In the healthcare segment, cloud logistics refers to the use of cloud-based solutions to streamline the management of medical supplies, equipment, and pharmaceuticals. Trends in this sector include increased adoption of cloud-based inventory management systems, real-time tracking of medical shipments, and the integration of IoT devices for monitoring temperature-sensitive products during transportation, ensuring patient safety and efficient healthcare delivery.

By Type

By OS Type

By Enterprise Size

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025