July 2024

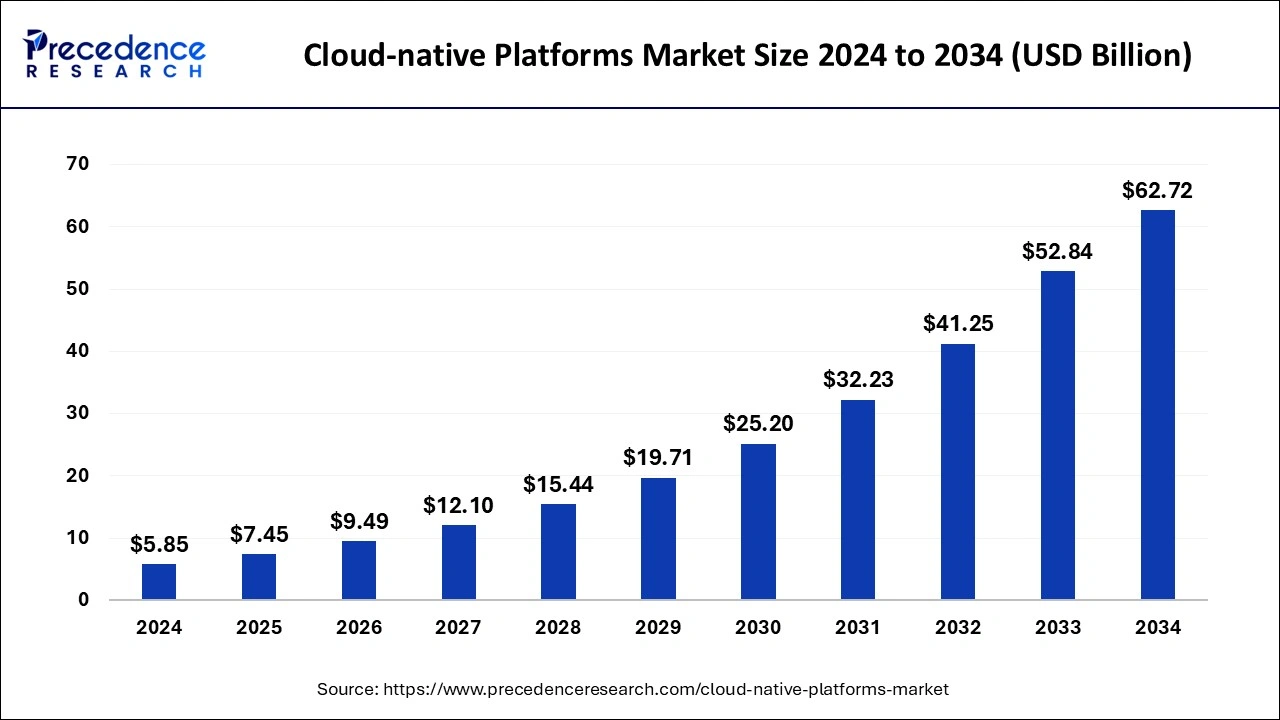

The global cloud-native platforms market size is calculated at USD 7.45 billion in 2025 and is forecasted to reach around USD 62.72 billion by 2034, accelerating at a CAGR of 26.77% from 2025 to 2034. The North America cloud-native platforms market size surpassed USD 2.40 billion in 2024 and is expanding at a CAGR of 26.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cloud-native platforms market size was estimated at USD 5.85 billion in 2024 and is predicted to increase from USD 7.45 billion in 2025 to approximately USD 62.72 billion by 2034, expanding at a CAGR of 26.77% from 2025 to 2034.

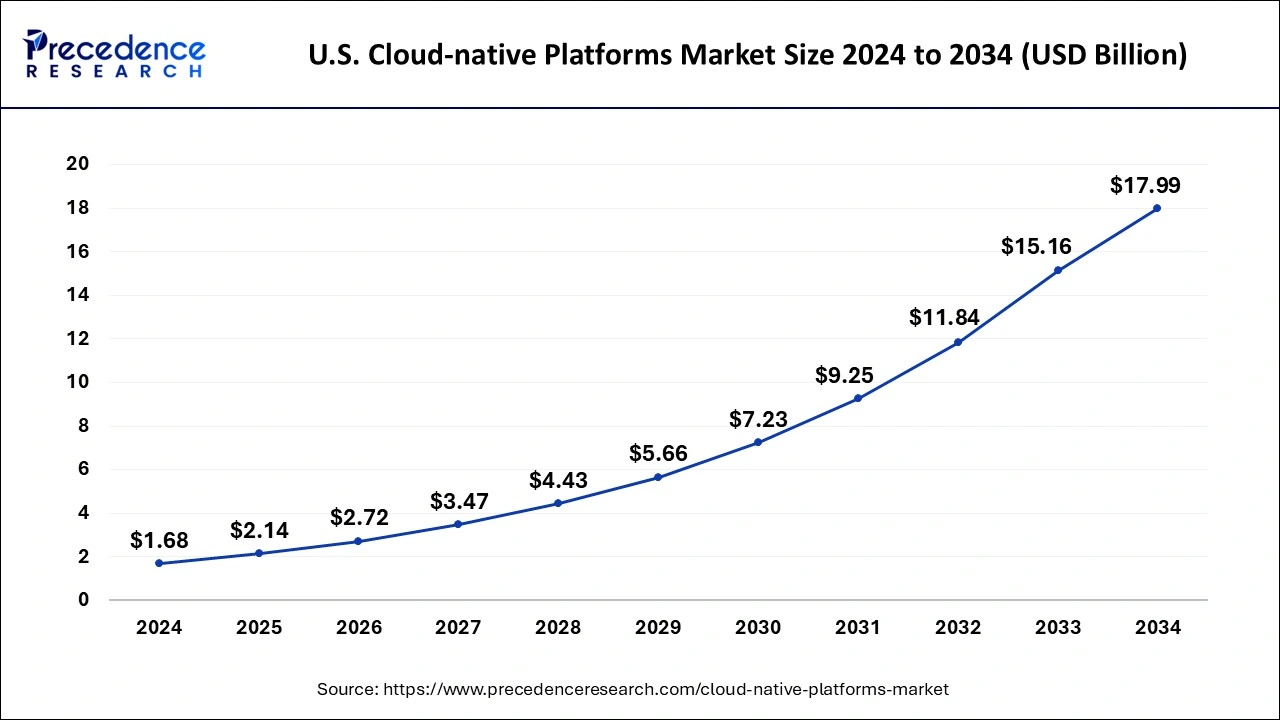

The U.S. cloud-native platforms market size was estimated at USD 1.68 billion in 2024 and is anticipated to reach around USD 17.99 billion by 2034, poised to grow at a CAGR of 26.76% from 2025 to 2034.

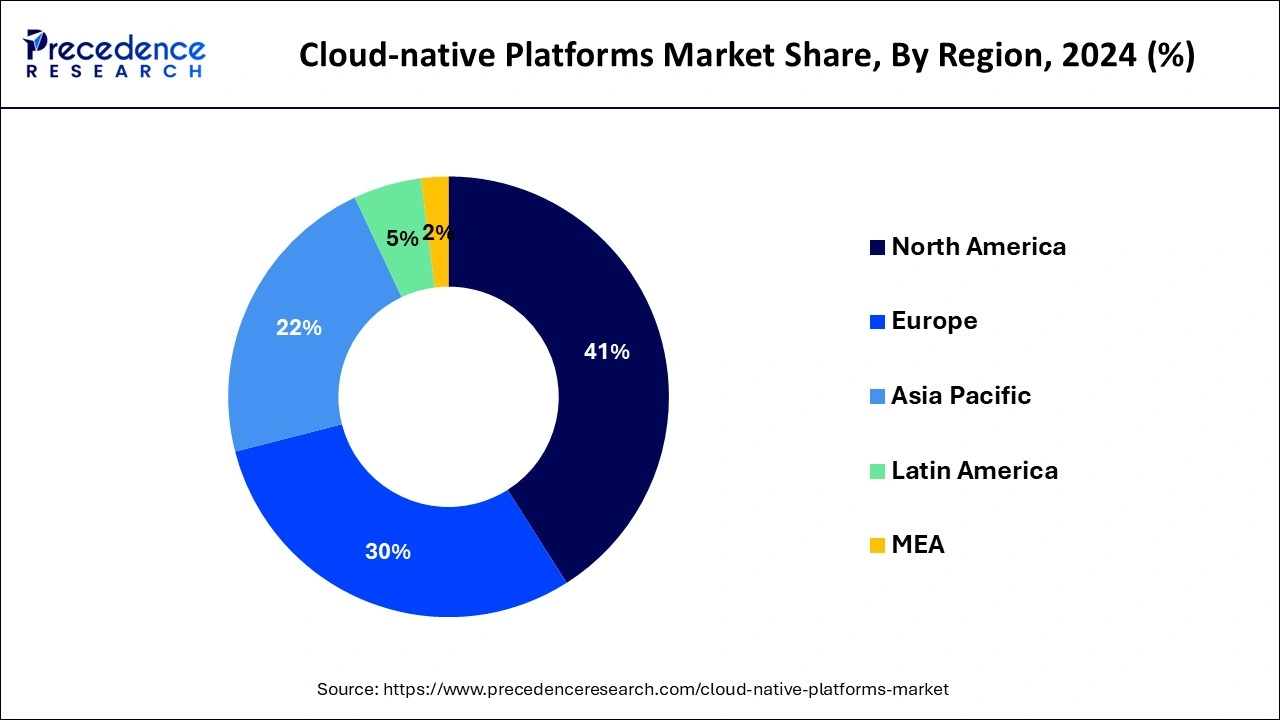

The North America market emerged as the dominating region in 2024, holding the largest share of 41% in the cloud-native platforms market. The region's robust revenue growth can be attributed to the rapid adoption of advanced technologies like artificial intelligence (AI), Internet of Things (IoT), and machine learning (ML) across various industries. The integration of AI and ML technologies has empowered companies in effectively deploying and managing cloud platforms. Evolving market dynamics have led end-use industries to swiftly embrace cloud platforms, further fueling revenue growth in the region.

Key players in the North American cloud-native platforms market are strategically focused on reducing operational and downtime costs while enhancing the flexibility and efficiency of cloud platforms, contributing to overall revenue expansion. Within North America, Canada stood out with the largest revenue share, benefiting from a wealth of skilled professionals. Additionally, significant investments by end-use companies in upskilling their workforce have accelerated adoption, further bolstering market revenue growth in the country.

The Asia Pacific cloud-native platforms market is observed to witness the fastest growth rate during the forecast period, driven by a growing demand for advanced cloud solutions in medium and large-scale industries. The region's market revenue growth is further propelled by an increasing awareness of the various benefits offered by cloud-native platforms. Unlike monolithic architecture in cloud-native applications, all solutions are designed to operate seamlessly in the cloud, resulting in reduced costs for backup, maintenance, development, and resource utilization. The compatibility with cloud-native infrastructure, along with the use of open-source systems and tools like serverless systems with a pay-per-use model, contributes to significant cost reductions.

Within the Asia Pacific region, Japan emerged as a key contributor with the largest revenue share. This can be attributed to substantial investments in improving product services. Additionally, the rising consumer awareness of the advantages associated with cloud-native platforms, such as enhanced productivity, infrastructure flexibility, rapid scalability, and lower operational costs, significantly contributes to cloud-native platforms market’s revenue growth in Japan.

The cloud-native platforms market refers to the ecosystem of technologies and solutions designed to support the development, deployment, and management of applications built using cloud-native principles. Cloud-native applications are developed using microservices architecture, containerization, and orchestration tools, allowing for scalability, flexibility, and efficient resource utilization in cloud environments. Cloud-native platforms provide a set of integrated tools and services, including container orchestration platforms (e.g., Kubernetes), container runtimes (e.g., Docker), continuous integration/continuous deployment (CI/CD) pipelines, service meshes, and observability tools.

The cloud-native platforms market offers services for organizations to build, deploy, and operate applications seamlessly in dynamic and distributed cloud environments. The market encompasses a variety of vendors offering cloud-native solutions, addressing the growing demand for agile, scalable, and resilient application development and delivery methodologies. The global cloud-native platform market is witnessing robust growth as organizations embrace cloud-native architectures. These solutions, known for their agility, scalability, and cost-efficiency, are gaining traction.

The shift towards cloud-native platforms requires the establishment of new roles and a product-oriented operating model. Additionally, the market is experiencing expansion due to the rising popularity of low-code and no-code technologies, which simplify and streamline application development, making it more accessible and efficient. This trend reflects the increasing importance of cloud-native approaches in the evolving landscape of IT infrastructure and application development.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 26.77% |

| Market Size in 2025 | USD 7.45 Billion |

| Market Size by 2034 | USD 62.72 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component Type, By Deployment Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing adoption of cloud-based services and increasing automation in industrial processes

The growing adoption of cloud-based services is a primary catalyst propelling the cloud-native platforms market’s growth. Developers are increasingly leveraging cloud platforms due to the immediate access they offer to a diverse array of cloud resources and services. This surge in utilization significantly contributes to the expanding market share of cloud-native software. Enterprises benefit from enhanced agility as these platforms address security requirements, ensuring the secure storage of cloud data and facilitating seamless access.

The integration of cloud-native solutions aligns with the dynamic needs of businesses, fostering innovation and efficiency in application development and deployment. This trend underscores the pivotal role of cloud-native platforms in driving technological advancements and meeting the evolving demands of modern enterprises.

Additionally, the market for cloud-native software is expected to experience substantial growth driven by the increasing automation in industrial processes. Automation plays a crucial role in shaping the market landscape, particularly as there is a growing demand for cloud-based security solutions and services.

The global transformation brought about by digitalization has further contributed to the surge in demand for cloud-native software. The development of Internet of Things (IoT) applications and the rapid pace of technological innovation are creating global opportunities for the cloud-native platforms market. As industries embrace automation and leverage cloud-native solutions, the market is poised for significant expansion, meeting the evolving needs of businesses in an increasingly digital and connected environment.

Concerns over data security

The growth of the cloud-native software market may face restraints due to concerns over data security. Regulatory and compliance policy requirements are expected to be significant factors limiting growth during the projected period. The increasing frequency of cyberattacks, such as Meltdown, account or service hijacking, and cloud malware injection attacks, poses significant threats leading to business disruptions and financial losses. These challenges, related to security and compliance, could act as impediments to the overall expansion of the global market for cloud-native software. Addressing these issues and enhancing security measures will be crucial for sustained growth in the market.

Growing demand for soundproof transportation

An exciting opportunity in the cloud-native platform market is the sustained growth of micro services architecture. Micro services, a software development approach, involve breaking down applications into smaller, independent components. This approach facilitates easier development, scaling, and maintenance of applications. Organizations are increasingly realizing the advantages of micro services, such as enhanced flexibility and rapid development. This trend creates a significant opportunity for cloud-native platform providers to offer tailored solutions that cater specifically to applications built on micro services architecture. Capitalizing on the demand for platforms that support micro services development can be a strategic move for providers looking to align their offerings with the evolving preferences of organizations adopting cloud-native technologies.

Future opportunities in the cloud-native platform market are expected to revolve around continued evolution and integration of edge computing with cloud-native platforms. As edge computing gains prominence for processing data closer to the source, cloud-native solutions that seamlessly integrate with edge environments will be in high demand. The increasing adoption of serverless computing represents another future opportunity. Serverless architectures allow developers to focus solely on writing code without managing the underlying infrastructure.

Cloud-native platforms that effectively support and optimize serverless computing models are likely to experience substantial growth. Additionally, the ongoing advancements in artificial intelligence (AI) and machine learning (ML) will open new frontiers for cloud-native platforms. Integrating AI/ML capabilities directly into these platforms can enhance automation, analytics, and decision-making processes. Moreover, addressing environmental sustainability concerns by offering eco-friendly cloud-native solutions will be a future opportunity. Green cloud computing initiatives and energy-efficient practices within cloud-native platforms will likely become critical considerations for businesses aiming to align with sustainable practices.

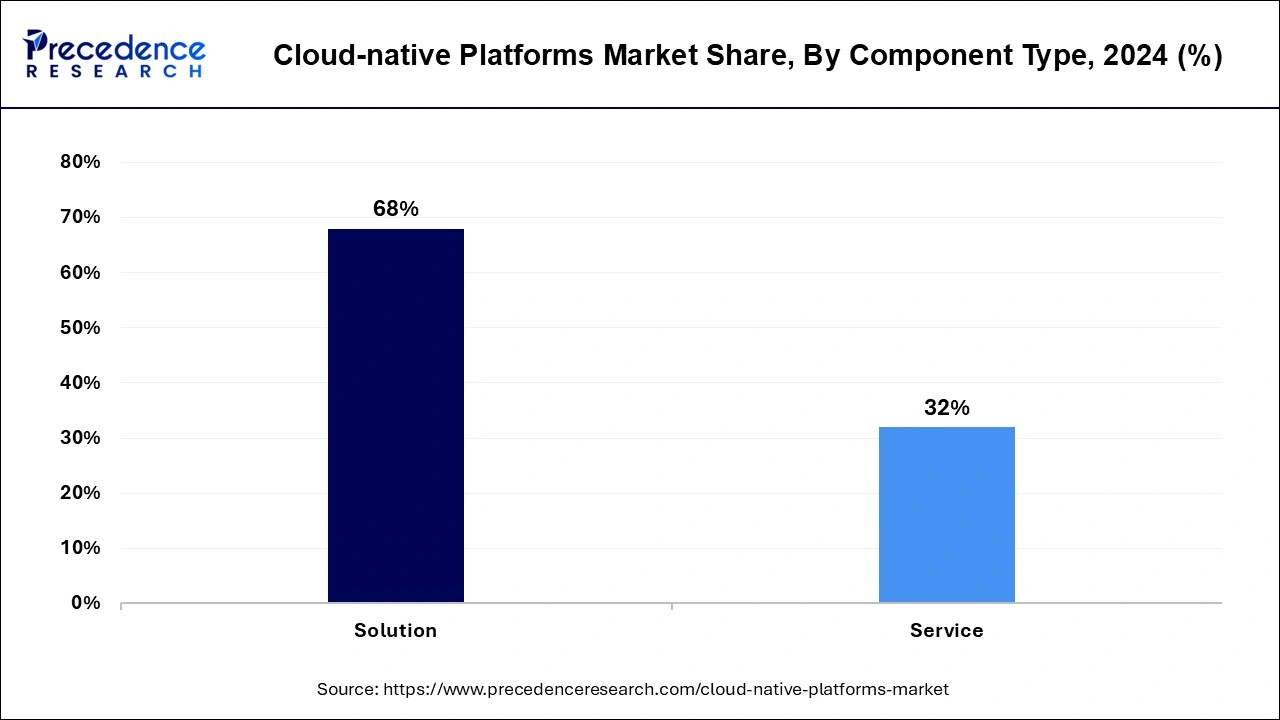

The solution segment held the largest share of 68% in 2024. Cloud-native platforms offer a range of solutions for streamlining and modernizing application development processes. These platforms facilitate the creation and deployment of applications in the form of small, autonomous, and scalable microservices.

Containers play a pivotal role in cloud-native platforms, providing a means to package and deploy applications as self-contained units. This approach enhances the efficiency and flexibility of application development, contributing to the prominence of the solution segment in the market.

The hybrid cloud segment dominated the cloud-native platforms market with 43% of the market share, propelled by the increasing demand for scalable and cost-effective computing solutions. Businesses are adopting the hybrid cloud model to address challenges that are hard to tackle with traditional IT infrastructure. This approach not only enhances agility and efficiency but also bridges the gap between IT and business needs. The hybrid cloud enables enterprises to scale applications and infrastructure as required, ensuring high-speed performance and availability.

Moreover, it offers economies of scale and safeguards sensitive information. The availability of secure, scalable, and cost-effective resources opens up diverse operational possibilities for organizations, contributing to the growing demand for hybrid cloud. Market players like IBM are strategically investing in platform-centric, hybrid cloud, and AI strategies, further driving the segment's revenue growth across regions. Additionally, businesses' investments in employee upskilling and innovative offerings play a significant role in boosting the segment's revenue.

The IT & telecom segment dominated the market with 31% of market share in 2024 with the increasing adoption of Fifth generation (5G) technology serving as a significant driver for revenue growth. The telecom industry has witnessed the integration of cloud-native and container-based Third-Generation Partnership Project (3GPP) 5G Core functions with the widespread adoption of 5G. Operators and vendors in the telecom sector are increasingly embracing cloud-native technologies due to their manifold advantages.

This adoption is influencing various aspects, including application design, development processes, infrastructure, orchestration, and more. Cloud-native platforms, particularly for telecom applications relying on microservices, containers, and state-optimized design, are witnessing increased demand, contributing to faster software upgrades and releases.

Key factors driving revenue growth in this industry include cost savings, rapid deployment, enhanced consumer engagement, and the growing trend of DevOps 2.0. DevOps 2.0 emphasizes adaptive feature delivery, broader engagement with non-technical teams, and cross-functional methods to ensure continuous iteration of software in alignment with marketing and sales campaigns. Additionally, DevOps 2.0 elevates security as a fundamental component throughout the development cycle, fostering a mindset where everyone is responsible for security, leading to more frictionless and valuable contributions from security professionals.

By Component Type

By Deployment Type

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

July 2024

July 2024

January 2025