October 2024

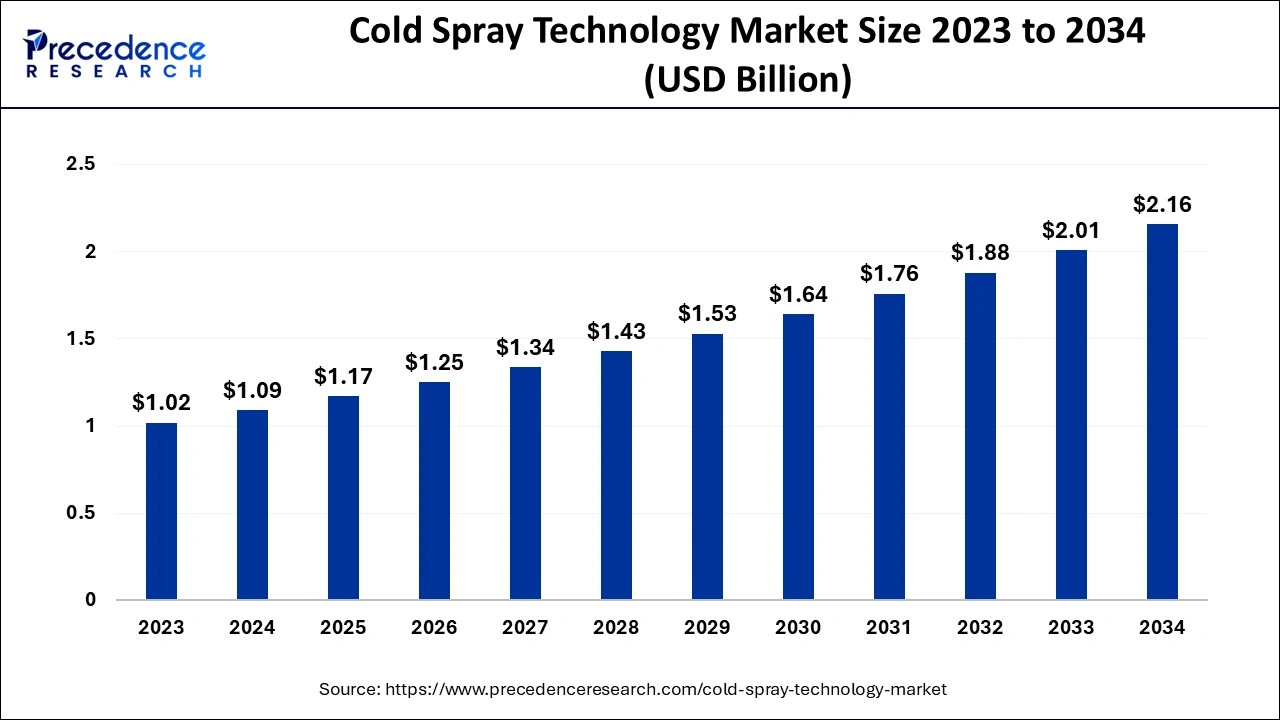

The global cold spray technology market size accounted for USD 1.09 billion in 2024, grew to USD 1.17 billion in 2025 and is expected to be worth around USD 2.16 billion by 2034, registering a CAGR of 7.06% between 2024 and 2034. The North America cold spray technology market size is evaluated at USD 460 million in 2024 and is expected to grow at a CAGR of 7.16% during the forecast year.

The global cold spray technology market size is calculated at USD 1.09 billion in 2024 and is predicted to reach around USD 2.16 billion by 2034, expanding at a CAGR of 7.06% from 2024 to 2034. Increasing demand for cold spray technology from the aerospace industry is the key factor driving the cold spray technology market growth. Also, expanding the electrical industry in emerging economies coupled with materials innovation is expected to fuel market growth soon.

The implementation of AI technology has significantly transformed the dimensions of the cold spray technology market by offering better enhancements in terms of precision, scalability, and operations, helping improve the range of predictive analysis and enabling businesses to showcase their market trends. Furthermore, AI analytics tools can extract the required data from the vast data sets, which helps to employ data-based operations. As AI technologies progress, they directly help the market grow at a remarkable rate.

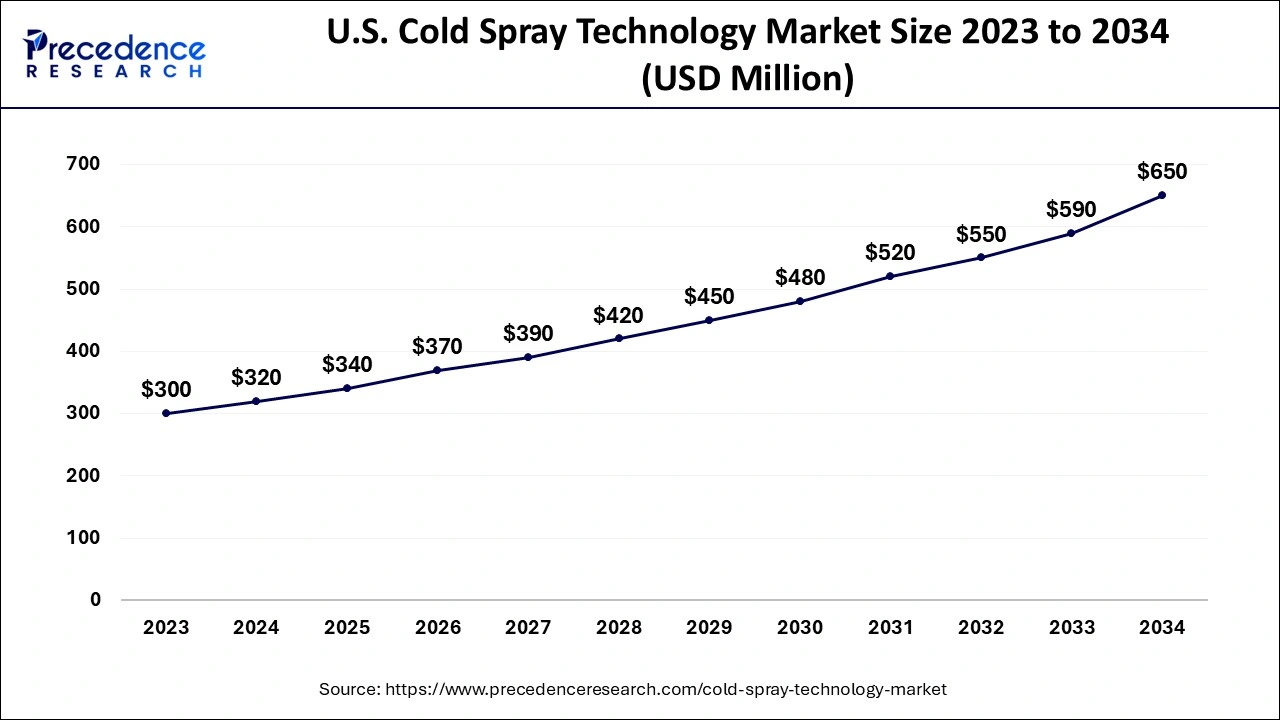

The U.S. cold spray technology market size is exhibited at USD 320 million in 2024 and is projected to be worth around USD 650 million by 2034, growing at a CAGR of 7.28% from 2024 to 2034.

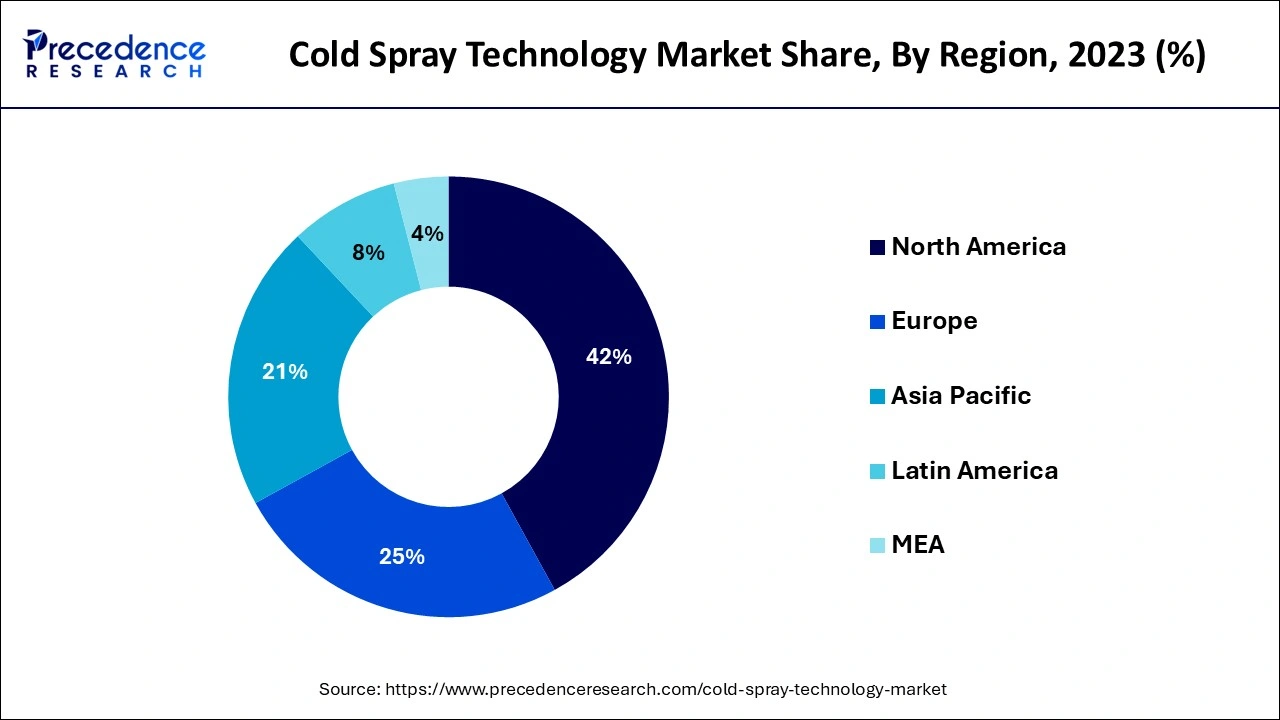

North America dominated the global cold spray technology market in 2023. The dominance of the segment can be attributed to the increasing demand for products produced using cold spray technology from the automotive and transportation industries in the region. The region is also experiencing substantial growth due to the abundance of commodities in its nation. Moreover, growing investments in R&D activities for designing autonomous cars in countries like the U.S. and Canada are expanding market growth in the region.

Asia Pacific will witness the fastest growth in the cold spray technology market during the forecast period. The growth of the region can be credited to the increasing demand for cold spray technology from the aerospace industry in developing countries such as India and China. Furthermore, in India, the adoption of cold spray technology is escalating, especially in the utility sector, because of its potential benefits. The region also has a flourishing automotive sector that will contribute to the market growth during the forecast period.

The cold spray technology market is the industry for innovative techniques of cold spray, which utilize compressed gas to propel metal particles onto the material at high speed. The coating is used to restore structural and corrosive elements which cannot be eliminated with welding. Cold spray coating technology is preferred over the thermal spray method as it reduces porosity, increases hardness, enhances adhesion strength, and retains feedstock powder properties.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.16 Billion |

| Market Size in 2024 | USD 1.09 Billion |

| Market Size in 2025 | USD 1.17 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.06% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Service, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Better performance and durability

The cold spray technology market provides exceptional longevity and wear resistance properties, which makes it highly preferred for applications in industries like automotive and aerospace. The coating done by this technique can bear extreme conditions, such as abrasion, stress, and harsh climatic changes. In addition, this higher strength ensures that the material remains reliable and functional over a longer duration of time, even in challenging operational situations.

Technical complexity of the system

The requirement for specialized knowledge and training, along with the technical complexities of the system, can be the major obstacle hindering the adoption of the cold spray technology market. The technical person must need extensive training to learn and understand the whole operation, which can be difficult in areas with limited access to technical resources.

Surge in the renewable energy sector

There is an increasing demand for renewable energy sources, which directly raises the requirement for reliable and robust materials that can bear the environmental stresses related to these applications. Furthermore, the cold spray technology market can enhance the longevity and overall performance of components, including solar panel supports and wind turbine blades, by offering better resistance to corrosion, wear, and environmental degradation.

The aluminum segment dominated the cold spray technology market in 2023. The dominance of the segment can be attributed to the extensive features of this metal, such as great ductility, low density, better resistance to corrosion, and good electrical conductivity. This alloy coating can be used to repair industrial parts for cost-saving purposes. Additionally, the surface of aluminum powder gets rapidly oxidized, and hence, it is hard to make high-density deposits while mimicking the effect of the oxide layer.

The titanium segment is expected to grow at the fastest rate in the cold spray technology market over the forecast period. The growth of the segment can be linked to the titanium's good biocompatibility, high strength, and better corrosion resistance properties. Titanium is also widely used in chemical, medical, petroleum, sports equipment, and aviation sectors. The technique of cold sparring can create oxygen-sensitive compounds such as titanium without leading to chemical degradation of the powder.

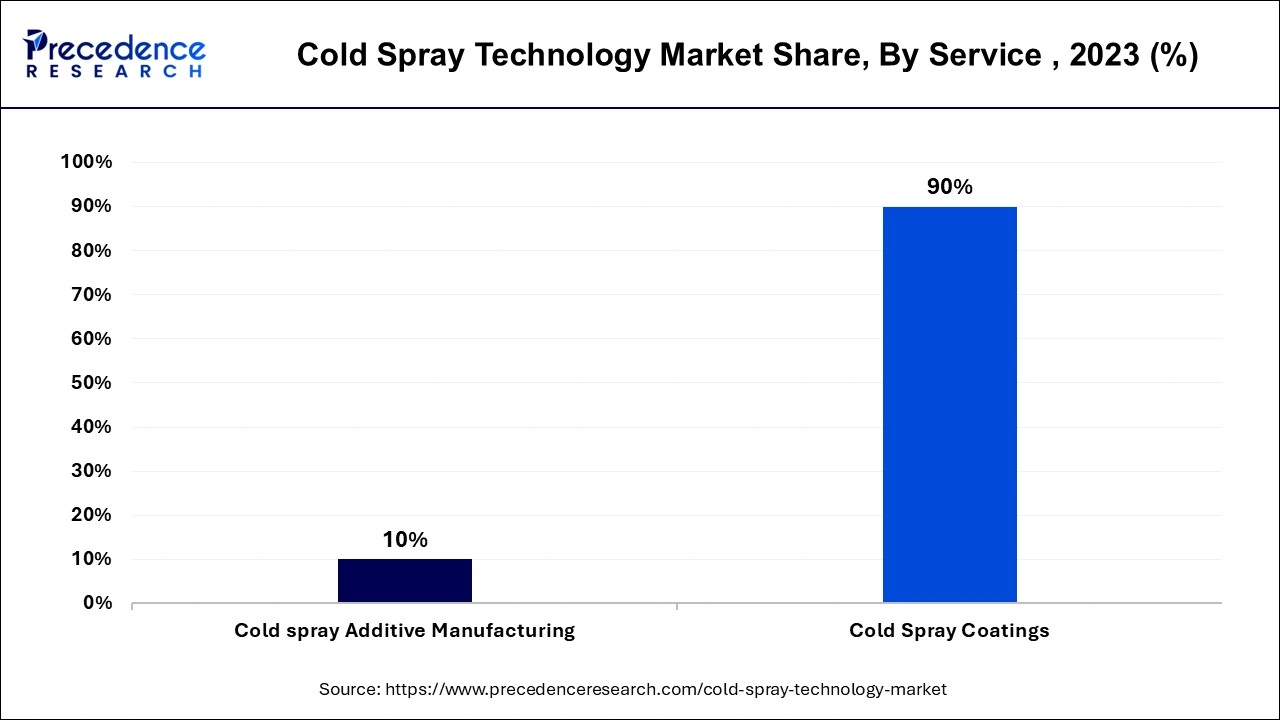

The cold spray coatings segment accounted for the majority share of the cold spray technology market in 2023. The dominance of the segment is due to cold spray coatings preventing oxidation, chemical reactions, and residual stresses of the material. Also, the cold spraying coating technique is being increasingly adopted because of their capability to offer protective layers which enhances the longevity and maintenance of the existing materials.

The cold spray additive manufacturing (CSAM) segment is anticipated to grow at the fastest rate in the cold spray technology market over the projected period. The growth of the segment can be driven by increasing demand for sustainable solutions and developments in the latest technologies. However, the current developments in CSAM technology are highly focused on electric motors utilized in the automotive sector to decrease the emission of carbon dioxide from automobiles.

The aerospace segment held the largest share of the global cold spray technology market. The dominance of the segment can be linked to the increasing application scope of this technology because of its advantages, such as protection from wear and corrosion, reduction in harmful gas emissions, and electrical resistance. Furthermore, a good impact on the market is expected to come from the surge in the civil aviation sector, especially in countries like China and India, due to their increasing disposable income.

The electrical & electronics segment is estimated to grow rapidly in the cold spray technology market during the forecast period. The dominance of the segment is due to the increasing use of spray technology in the many components like refrigeration units, electrical contacts, transformers, electric motors & electric generators, &semiconductors displays, and circuit boards, etc., which necessitates good electrical, oxidation, and corrosion resistance to function in harsh environments.

By Material

By Service

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

December 2024

February 2025