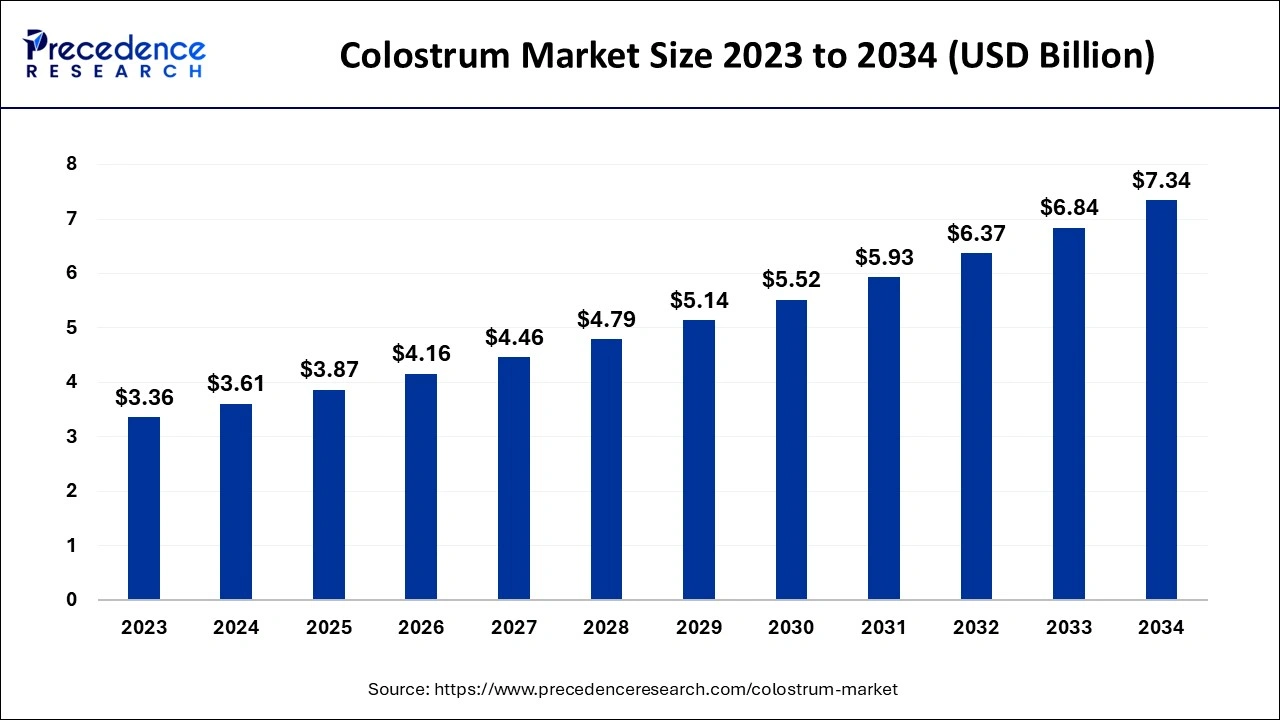

The global colostrum market size is evaluated at USD 3.61 billion in 2024, grew to USD 3.87 billion in 2025 and is projected to reach around USD 7.34 billion by 2034. The market is expanding at a CAGR of 7.36% between 2024 and 2034.The North America colostrum market size is calculated at USD 1.23 billion in 2024 and is expected to grow at a solid CAGR of 7.52% during the forecast year.

The global colostrum market size accounted for USD 3.61 billion in 2024 and is expected to exceed around USD 7.34 billion by 2034, growing at a CAGR of 7.36% from 2024 to 2034. The colostrum market is driven by raising awareness of its immune-boosting qualities, particularly in terms of improving immunity and gut health.

Artificial intelligence improves the production, quality, and use of colostrum, the nutrient-rich initial milk produced by mammals after giving birth, in health and nutrition, revolutionizing its growth and utilization. Using spectrometry and imaging, AI technologies evaluate the nutritional composition of colostrum (such as immunoglobulins and growth factors) to ensure it satisfies commercial and health standards. To minimize waste and preserve freshness, AI technologies also optimize colostrum collection, distribution, and storage. Evaluating enormous volumes of patient data and determining possible advantages and disadvantages expedites clinical trials for colostrum-based treatments.

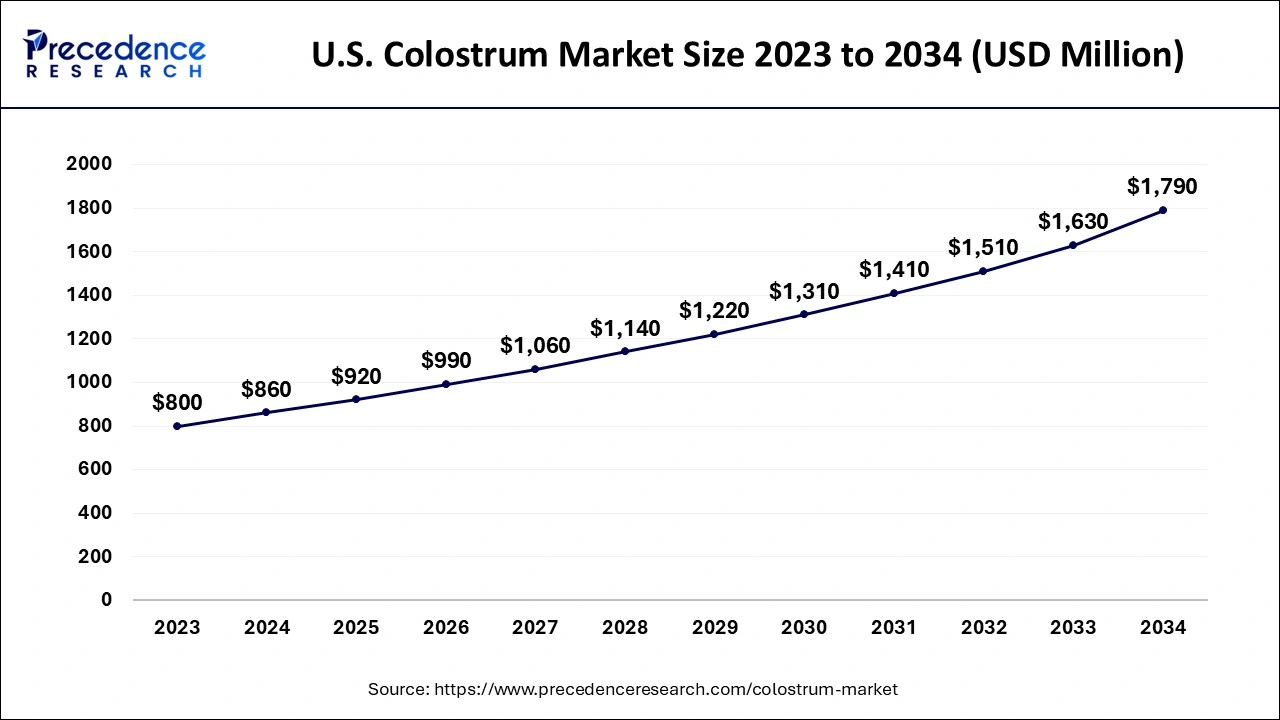

The U.S. colostrum market size is exhibited at USD 860 million in 2024 and is projected to be worth around USD 1,790 million by 2034, growing at a CAGR of 7.60% from 2024 to 2034.

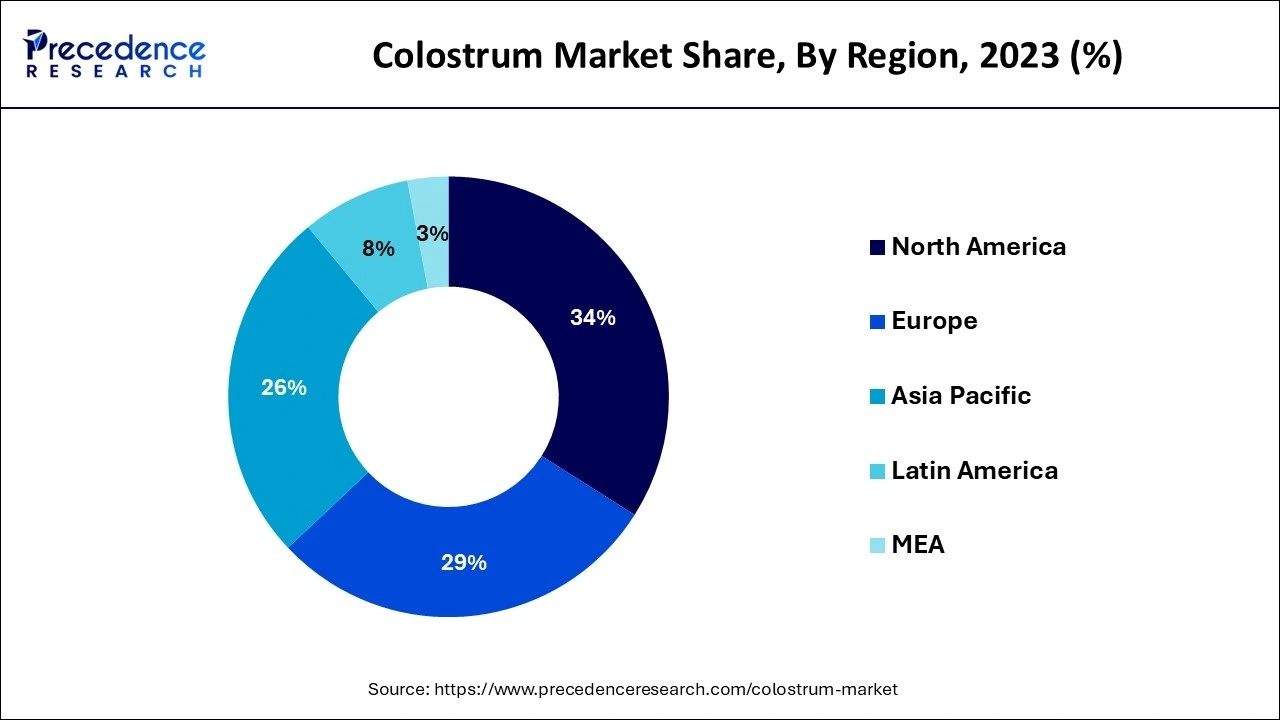

North America dominated the colostrum market in 2023. The advantages of colostrum, including its capacity to boost immunity, promote intestinal health, and promote general wellness, are widely known to the people of North America. North American businesses are investing significantly in research and development to provide cutting-edge colostrum products that satisfy a range of customer preferences, including powders, capsules, and functional beverages. Customers can now more easily access a variety of colostrum products because of the growth of online marketplaces like Amazon, iHerb, and others.

Asia-Pacific is observed to be the fastest growing the colostrum market during the forecast period. Due to urbanization and rising disposable incomes, Asia-Pacific consumers are becoming more health-conscious. As a result, the demand for colostrum-based products, which are high in vital nutrients, antibodies, and growth factors that promote immunity and general well-being, has increased. Fitness activities and club memberships have increased dramatically in Asia-Pacific. Due to its capacity to improve muscle strength, endurance, and recovery, colostrum has become more popular as a nutritional supplement among athletes and fitness enthusiasts.

The immune-boosting qualities of colostrum are well established. It has significant concentrations of growth factors, lactoferrin, and immunoglobulins, all of which support the immune system and guard against infections. The market for colostrum-based supplements is rising as more people become aware of their health advantages, particularly for items that boost the immune system and promote general wellness. It is also frequently employed in veterinary medicine to enhance the health of newborn animals and ensure that they obtain essential antibodies at an early age. Its ongoing importance in the animal healthcare sector is partly attributed to this.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.34 Billion |

| Market Size in 2024 | USD 3.61 Billion |

| Market Size in 2025 | USD 3.87 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.36% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Nature, Source, Form, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing awareness of colostrum’s immune-boosting properties

Bioactive substances such as immunoglobulins, lactoferrin, growth factors, and antimicrobial peptides are abundant in colostrum. These components support gut health, fortify the immune system and ward against infections. Bovine colostrum has been repeatedly shown to improve intestinal barrier function and lower susceptibility to infections, boosting human immunity. Medical professionals and wellness influencers now widely promote Colostrum's immune-boosting qualities. Adoption is accelerated, and recommendations raise consumer awareness from reliable sources. Because milk boosts immunity and aids tissue healing, colostrum is frequently recommended for individuals recuperating from diseases or surgery.

Rising awareness of health benefits

As the world's diets become more natural, less processed, and functional, colostrum is seen as a natural way to improve health. Its use in functional foods, drinks, and dietary supplements has grown due to consumers' demand for preventative rather than reactive medical care. Its use in medications and nutraceuticals is driven by evidence-based claims on its advantages for gut health, immunity, and anti-aging.

Lack of awareness

The unique nutritional and immunological advantages of colostrum, including its high concentrations of growth factors, antibodies, and bioactive chemicals that improve immunity, intestinal health, and general well-being, are not widely known to many consumers. Colostrum has the potential to be very beneficial in developing countries where immune-related disorders and malnutrition are common. However, awareness is hampered by a lack of marketing efforts and low market penetration. It is challenging for interested customers to obtain colostrum-based products because they are not easily accessible or conspicuously exhibited in physical stores or online marketplaces.

Expansion of the infant nutrition market

Immunoglobulins, and other bioactive substances found in colostrum aid in the growth of a newborn's immune system and intestinal health. These advantages are consistent with the growing trend of adding beneficial additives to baby-feeding products. Marketing campaigns can highlight colostrum's capacity to boost immunity, lower inflammation, and improve gut health, which will appeal to consumers' growing desire for functional foods.

Innovations in the processing of colostrum

Innovative processing has made colostrum-based powders, capsules, and drinks suitable for gut health, athletic recovery, and immunological support possible. Better dairy management practices guarantee the ethical harvesting of colostrum without sacrificing the nutrition of newborn calves. Due to advancements, infant formulae can now be fortified with bioactive colostrum components to replicate the nutritional profile of breast milk.

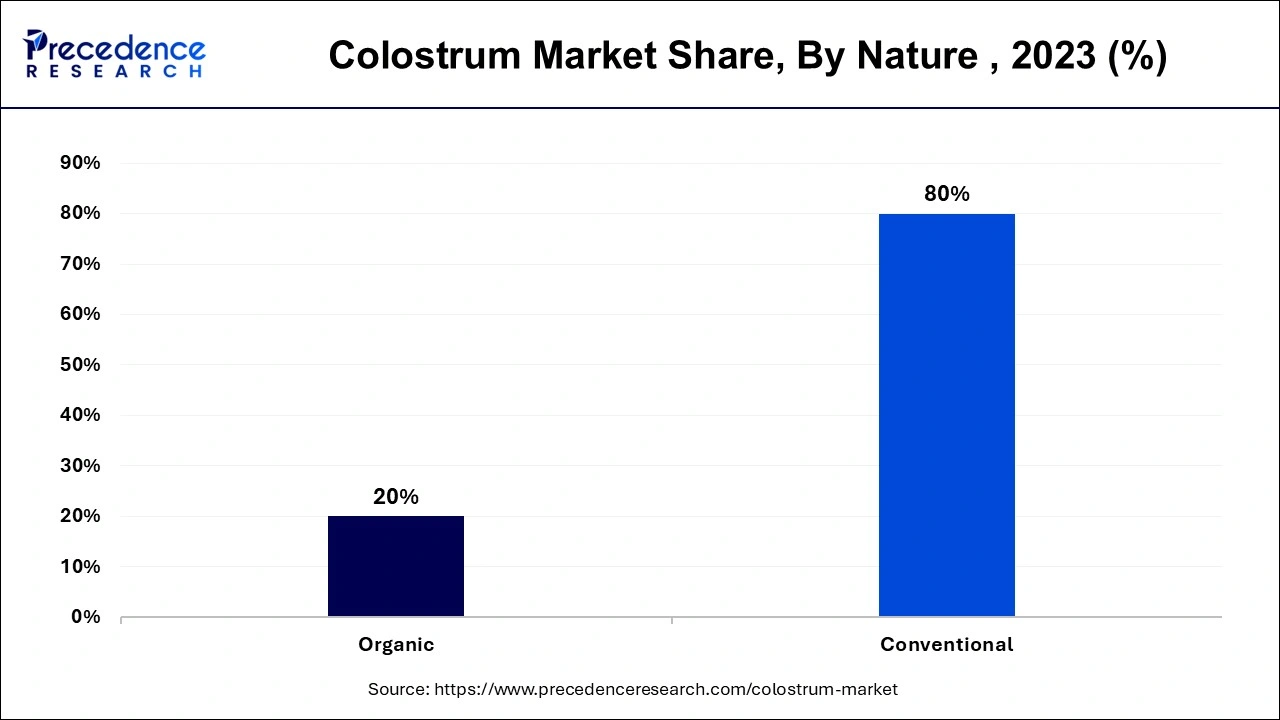

The conventional segment held the largest share in the colostrum market in 2023. Large-scale dairy farming usually incorporates conventional colostrum production, making distribution and procurement easier. Its position in the market has been further reinforced by scientific research and support for the health benefits of traditional colostrum, including increased immunity and improved gut health. The quality and shelf life of colostrum products has been enhanced by advancements in traditional dairy farming, such as better methods for collection and preservation. Conventional colostrum is easier to produce and market and is less expensive than organic colostrum since it is not subject to the exact stringent certification requirements. More manufacturers are operating in this market area due to the lighter regulatory load.

The organic segment is observed to be the fastest growing in the colostrum market during the forecast period. Natural and minimally processed products are becoming increasingly famous among customers who believe they are safer and healthier options. These preferences are supported by organic colostrum, devoid of antibiotics, artificial chemicals, and pesticides. The increasing demand for sustainable techniques is in line with organic farming. Products that support environmental preservation appeal to consumers.

The cow segment held the largest share of the colostrum market in 2023. Bovine colostrum is widely accessible due to the large global breeding of cows for milk production. Its high protein, vitamin, and mineral content adds to its allure in nutrition and health. The market for supplements made from cow colostrum has increased due to growing consumer interest in natural health products and immunity-boosting products. Developed dairy industries have made global trading in colostrum products more accessible, which has increased market share even further.

The goat segment is observed to be the fastest growing in the colostrum market during the forecast period. High concentrations of bioactive substances, such as growth factors, immunoglobulins, and antimicrobial peptides, are found in goat colostrum. Goat colostrum is very sought-after in health and wellness products because these ingredients improve intestinal health and immunity.

The capsules segment held the largest share in the colostrum market in 2023. For contemporary, on-the-go consumers, capsules are incredibly convenient because they are simple to store, transport, and eat. Users can easily incorporate colostrum supplements into their regular routines using this format, which doesn't require any preparation. Some customers may find the distinct taste and smell of raw or powdered colostrum disagreeable. By successfully masking these sensory characteristics, capsules gain broader acceptance. Manufacturers frequently create colostrum capsules to satisfy specialized customer segments seeking focused solutions to address specific health issues, such as immune support or gastrointestinal health.

The chewable tablets segment is observed to be the fastest growing in the colostrum market during the forecast period. Due to their portability and lack of water requirements, chewable tablets are desirable for people who lead busy lives. Since colostrum's benefits for gut health have received much attention, chewable tablets are a desirable daily supplement alternative. Chewable tablets provide an alternative to difficult-to-swallow capsules, meeting the needs of an aging population. Consumer interest has increased due to marketing initiatives emphasizing the advantages of chewable colostrum supplements, especially among younger audiences.

The B2C segment held the largest share in the colostrum market in 2023. Colostrum is becoming increasingly popular in individual households due to growing consumer knowledge of its health-promoting qualities. Colostrum supplements are heavily promoted as ways to boost immunity, support digestive health, and improve athletic performance, all which appeal to health-conscious consumers.

The B2B segment is observed to be the fastest growing in the colostrum market during the forecast period. Colostrum's advantages, including its high content of immunoglobulins, growth factors, and bioactive substances, are becoming more widely recognized by end consumers as they become more health conscious. Because of this, producers are now using colostrum in various functional foods, dietary supplements, and health beverages. Colostrum is frequently used in the animal husbandry industry as a supplement in the business-to-business market to enhance newborn health, immunity, and livestock survival rates. This is especially important for the meat and dairy industries.

By Nature

By Source

By Form

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client