February 2025

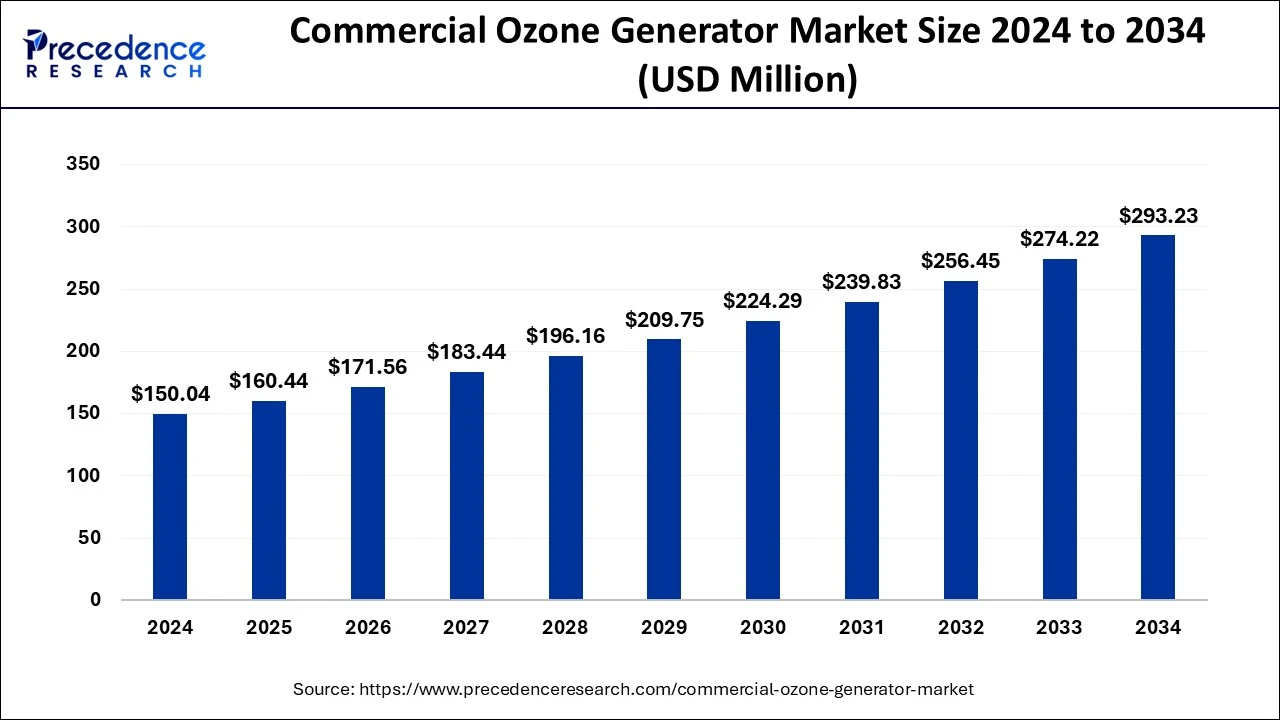

The global commercial ozone generator market size was calculated at USD 150.04 million in 2024, grew to USD 160.44 million in 2025 and is projected to reach around USD 293.23 million by 2034. The market is expanding at a CAGR of 6.93% between 2025 and 2034.

The global commercial ozone generator market size was worth around USD 150.04 million in 2024 and is expected to hit around USD 293.23 million by 2034, growing at a CAGR of 6.93% from 2025 to 2034. Increasing investments towards up-gradation of wastewater treatment facilities is the key factor driving the commercial ozone generator market growth. Also, growing awareness of indoor air quality concerns, along with Ongoing technological advancements, is anticipated to fuel market growth soon.

Artificial intelligence is playing a crucial role in the commercial ozone generator market. AI-powered technologies facilitate more accurate control and monitoring of whole generation processes, stimulating effectiveness and efficiency in real-time. Furthermore, the Integration of AI with automated systems can improve its reliability, and operational efficiency and decrease human error, enabling accurate and continuous, ozone treatment with no manual intervention.

An ozone generator is a device created to generate ozone gas, which can be used in many industrial applications such as pharmaceuticals, textiles, food, water treatment, and the medical sectors. Ozone is a compound having f three oxygen atoms. This gas can eliminate bacteria, viruses, odors, and other contaminants in water and air. Careful handling is important for proper adherence to safety guidelines because high ozone concentrations can lead to risks to pets and humans, too.

2024 top 5 countries with the best water quality in the world

| Country | EPI Drinking Water Score 2024 |

| United States | 100 |

| Italy | 100 |

| Singapore | 99.8 |

| Canada | 99.1 |

| Germany | 98.1 |

| Report Coverage | Details |

| Market Size by 2034 | USD 293.23 Million |

| Market Size in 2025 | USD 160.44 Million |

| Market Size in 2024 | USD 150.04 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.93% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Surge in greenhouse gas emission

The increase in air pollution due to the rise in global population has resulted in limited resources. Also, high amounts of greenhouse gas (GHG) emissions are depleting the ozone layer, leading to a surge in various health problems. This increases the demand for the commercial ozone generator market across the globe. In addition, increasing investments in expanding and upgrading wastewater treatment facilities coupled with the massive growth in the industrial sector are likely to boost market growth over the forecast period.

Short ozone half-life

The short ozone half-life creates a substantial challenge for the commercial ozone generator market. Ozone gas has a short lifespan, especially under ambient conditions. This feature restrained the feasibility of storing and transporting ozone over long distances. However, the short half-life of ozone requires keen planning and coordination to stimulate its effectiveness. These hurdles can impact decision-makers who seek more alternatives with high stability.

Rising use of ozone technology over chlorine for water disinfection

Though chlorination is the conventional method for water disinfection, it poses major environmental and health risks. It is now widely accepted that chlorinated water can possess water-borne pathogens, many of which can cause human diseases as they are not regulated properly. Furthermore, the increasing awareness of the benefit of ozone over chlorine along with the strict regulations from environmental agencies such as the EPA monitoring, is anticipated to fuel the commercial ozone generator market growth in the upcoming years.

The corona discharge segment dominated the global commercial ozone generator market in 2023. The segment's dominance can be attributed to its high ozone production with less energy consumption and the increasing adoption of technology that monitors large volumes of water and air while managing constant ozone output. Additionally, increasing the utilization of eco-friendly disinfectants in line with the current technological advancements can propel segment growth in the market soon.

The cold plasma segment is expected to grow at the fastest rate in the commercial ozone generator market over the forecast period. The growth of the segment can be linked to the superior disinfection abilities and eco-friendly profile of cold plasma. These innovative methods provide benefits like improved efficiency, minimized harmful byproducts, and decreased energy consumption. Moreover, the segment is also experiencing higher adoption due to increasing prioritization for sustainable solutions from the market players.

The laboratory & medical equipment segment led the global commercial ozone generator market. The dominance of the segment can be credited to the increasing demand for a strong oxidizing agent capable of killing viruses, bacteria, and other contaminants more impactfully than conventional disinfectants like chlorine, which increases product adoption in water treatment plants. Furthermore, increasing regulations on the quality of water, especially in corporate water treatment, will propel the adoption of ozone generators to achieve compliance standards.

The water treatment segment is anticipated to show the fastest rate during the projected period. The growth of the segment can be driven by the growing utilization of ozone generators for water treatment because of their sustainable nature and higher disinfection capabilities. In addition, municipalities and several industries are using ozone technology to meet strict standards of water quality and address environmental concerns, which can impact segment growth positively over the forecast period.

North America dominated the global commercial ozone generator market in 2023. The region's dominance can be attributed to its increasing emphasis on wastewater treatment and the growing requirement for air treatment systems to tackle concerns including mold elimination, smoke odor removal, and pungent odors. Moreover, in the region, the U.S. led the market owing to the growing demand for eco-friendly solutions with less harmful products that align smoothly with green initiatives.

Asia Pacific is expected to grow at the fastest rate in the commercial ozone generator market during the studied period. The growth of the region can be linked to the growing industrialization and rising air and water pollution concerns in developing nations such as India and China. Furthermore, increasing awareness of the advantages of ozone over conventional disinfection methods bolsters the market expansion in the region soon. With the launch of advanced water treatment plants in past years, the need for ozone technology for the purification of water has risen.

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024

October 2024

November 2024