December 2024

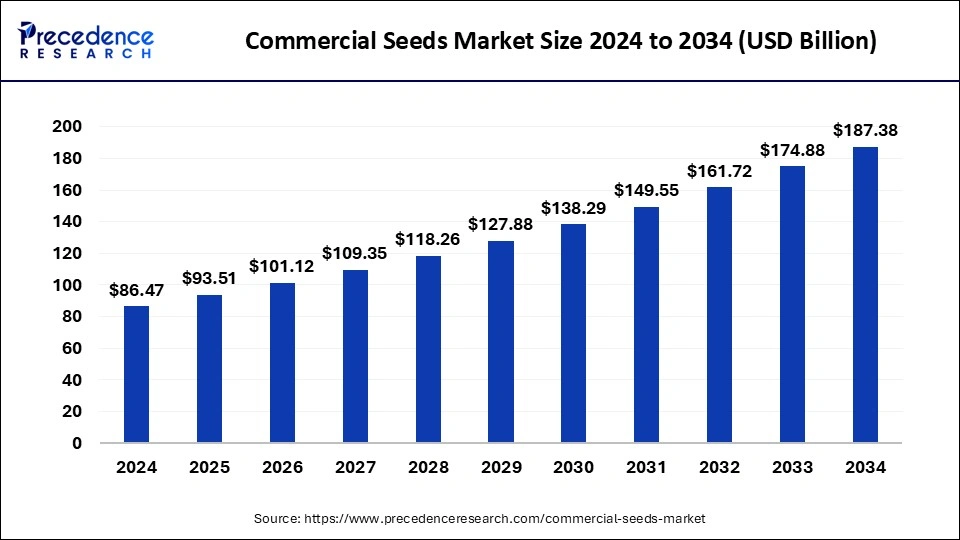

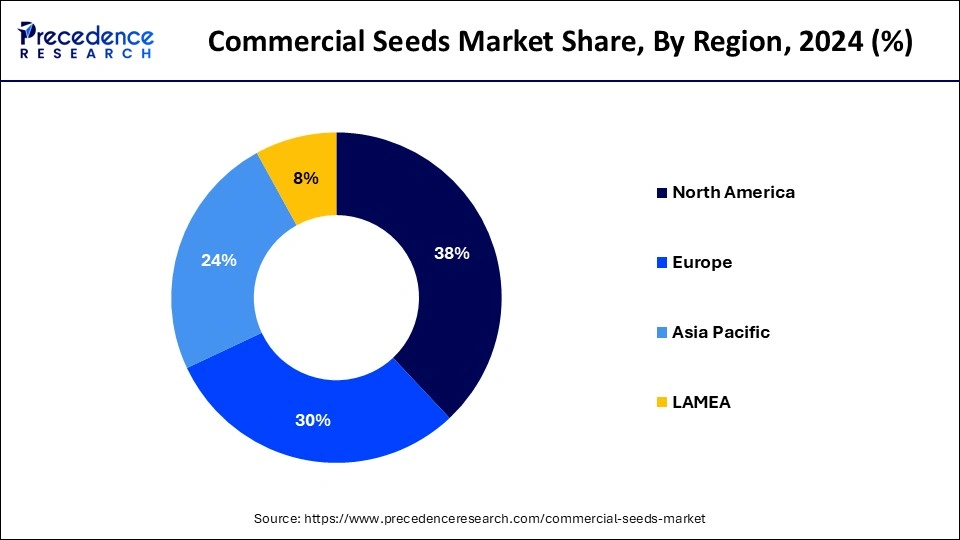

The global commercial seeds market size is calculated at USD 93.51 billion in 2025 and is forecasted to reach around USD 187.38 billion by 2034, accelerating at a CAGR of 8.04% from 2025 to 2034. The North America commercial seeds market size surpassed USD 32.86 billion in 2024 and is expanding at a CAGR of 8.09% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global commercial seeds market size was estimated at USD 86.47 billion in 2024 and is predicted to increase from USD 93.51 billion in 2025 to approximately USD 187.38 billion by 2034, expanding at a CAGR of 8.04% from 2025 to 2034. The ability of commercial seeds to maximize crop yield whilst decreasing arable land is the significant factor driving the commercial seeds market growth.

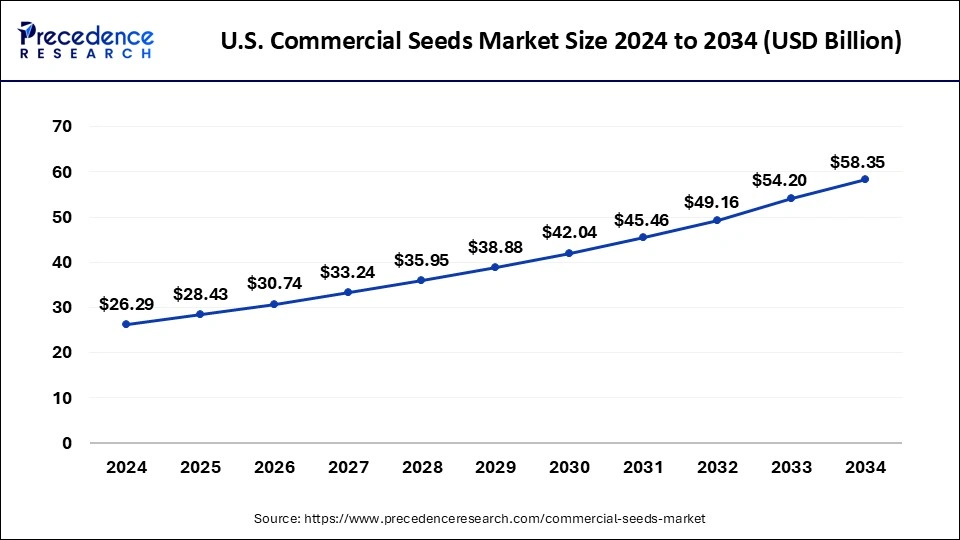

The U.S. commercial seeds market size was valued at USD 26.29 billion in 2024 and is expected to be worth around USD 58.35 billion by 2034 with a CAGR of 8.30% from 2025 to 2034.

North America dominated the commercial seeds market in 2024. The regional market growth is expected to be fueled by extensive R&D, favorable government policies, and the cost-effectiveness of commercial seeds. Precision farming has enabled the collection of more detailed data and increased farmers' awareness and usage of these seeds. Also, North America has a highly developed agricultural sector, with the United States and Canada possessing extensive arable land and advanced farming practices. This substantial agricultural base drives a significant demand for commercial seeds to support crop production.

Asia Pacific is projected to grow at the fastest rate in the commercial seeds market over the forecast period. Asia Pacific has a rich history of agriculture, with many countries relying heavily on farming as a crucial part of their economies. Continuous advancements in agricultural practices, including the adoption of high-yield and hybrid seeds, have bolstered the region's growth. The region is home to more than half of the world’s population, driving a high demand for food. This demand necessitates improved agricultural outputs, which are achieved through the use of commercial seeds designed for higher yields and better resistance to pests and diseases. Many governments in the region actively support the agricultural sector through subsidies, research and development initiatives, and favorable policies. This support encourages farmers to adopt advanced agricultural inputs like commercial seeds.

Latin America is expected to witness notable growth in the commercial seeds market in the upcoming years. The agriculture sector is a vital part of the region's economy, encompassing diverse farming practices and structures, including farmers in Brazil and those in Argentina. Latin America is a key player in global agricultural trade, with Brazil, Argentina, and Chile being the largest exporters of soybeans and corn.

Commercial seeds are vital to contemporary agriculture and horticulture, and they serve as the cornerstone for crop production globally. These seeds are specifically developed, produced, and marketed by seed companies for diverse agricultural, horticultural, and industrial purposes. They are essential for cultivating food crops such as rice, potatoes, onions, broccoli, corn, wheat, soybeans, cauliflower, and various other fruits, vegetables, and grains.

Technological advancements and supportive government policies are key drivers of growth in the commercial seeds market. The leading commercial seed companies worldwide are concentrating their research on enhancing agricultural productivity while managing limited resources. Major countries like the United States, Brazil, Argentina, Canada, and India are at the forefront of adopting genetically modified (GM) agricultural practices.

| Report Coverage | Details |

| Market Size by 2034 | USD 187.38 Billion |

| Market Size in 2025 | USD 93.51 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.04% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Genetically Modified Seed Products, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Population growth around the world

The demand for commercial seeds is rising alongside the global population, driving the commercial seeds market growth. Higher disposable incomes are expected to lead to increased resource use and boost the demand for commercial seeds. This, in turn, will enhance crop yields compared to traditional farm seeds. Advances in molecular biology have made it simpler and more cost-effective to map plant genetic codes, likely increasing the production of commercial seeds.

Commercial seeds are crucial for achieving food security by boosting agricultural output. Economic growth typically follows population growth. As incomes increase, people consume a more diverse and higher-quality diet, requiring a broader variety of crops produced from commercial seeds.

Managing intellectual property rights

In the commercial seeds market, managing intellectual property rights related to seed technologies, patents, and licensing agreements introduces additional complexity. Negotiating these rights and navigating legal frameworks can create challenges and disputes that significantly impact market dynamics. Overcoming these issues requires coordinated efforts from industry players, policymakers, and regulatory bodies.

Key strategies for addressing these challenges include collaborative research, regulatory harmonization, sustainable agricultural practices, and consumer education. These approaches are essential for developing a robust commercial seeds market.

Advancements in biotechnology

Biotechnology allows the creation of seeds tailored for specific farming methods by enabling precision agriculture. These seeds are designed to thrive in conditions, which makes them attractive to modern farmers who prioritize efficiency and sustainability. Biotech seeds incorporate genetic traits that offer built-in resistance to pests and diseases. This largely impacts the dynamics of the commercial seeds market.

With the increasing global trade and transportation, there is a higher risk of new pests emerging. Biotechnology offers a proactive solution by reducing the reliance on chemical pesticides, thereby safeguarding crop yields. Given the growing emphasis on sustainability from both consumers and regulators, biotech seeds have become crucial in minimizing the environmental impact of agriculture. As a result, this has contributed to the growth of the commercial seeds market.

The maize (corn) segment dominated the commercial seeds market in 2024. The demand for corn is expected to increase, especially for animal feed, as meat consumption rises in emerging countries. Moreover, the extensive use of corn in producing starch and sweeteners is predicted to drive the growth of this segment during the forecast period. Corn seeds remain highly popular among various types of crops.

The soybean segment is predicted to grow at a significant rate in the commercial seeds market over the forecast period. The high protein content and extensive oil extraction from soybeans are expected to drive their demand. Soybeans are widely used for animal feed, as a direct food source, and as a raw material in various industrial food products. The significant oil extraction and high protein content of soybeans are predicted to drive their demand.

The maize segment dominated the commercial seeds market in 2024. The expansion of land dedicated to GM crops and the growing acceptance of GM crop yields in various regions are expected to boost market growth. These seeds are modified in laboratories to possess special characteristics, such as resistance to pests and diseases. They are designed to enhance crop growth and strength by making them valuable for modern agriculture. The increasing acceptance of GM produce, and the introduction of seeds with beneficial traits are anticipated to drive strong growth in the genetically modified crop seeds segment during the forecast period.

The cotton segment is anticipated to grow at the fastest rate in the commercial seeds market during the forecast period. The increased yield of cotton, potential cost savings in cultivation, and reduced insecticide use contribute to this segment's growth. The U.S., China, and India are the leading adopters of GM cotton seeds. Their ability to address issues such as pest resistance, herbicide tolerance, and improved yield has made GM cotton highly desirable for farmers aiming to optimize crop production and reduce risks.

By Product

By Genetically Modified Seed Products

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

August 2024

November 2023