February 2025

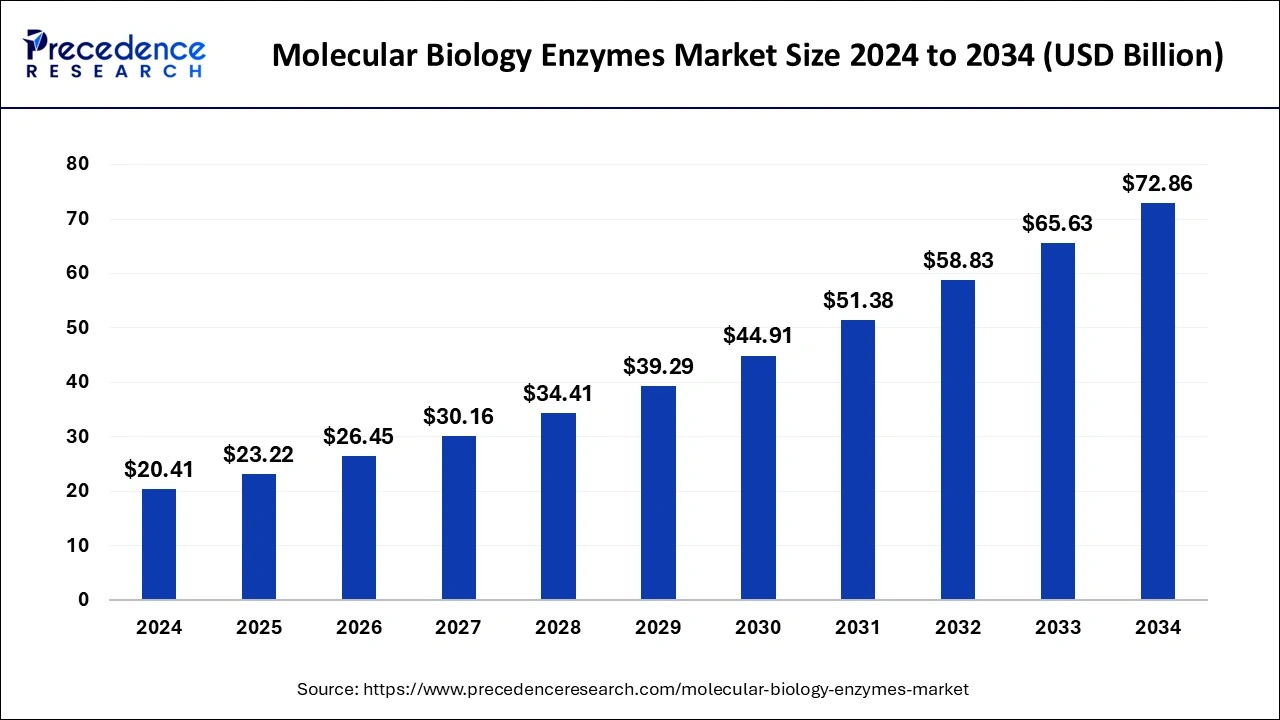

The global molecular biology enzymes market size is evaluated at USD 23.22 billion in 2025 and is forecasted to hit around USD 72.86 billion by 2034, growing at a CAGR of 13.57% from 2025 to 2034. The North America market size was accounted at USD 10.00 billion in 2024 and is expanding at a CAGR of 13.60% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global molecular biology enzymes market size accounted for USD 20.41 billion in 2024 and is predicted to increase from USD 23.22 billion in 2025 to approximately USD 72.86 billion by 2034, expanding at a CAGR of 13.57% from 2025 to 2034.

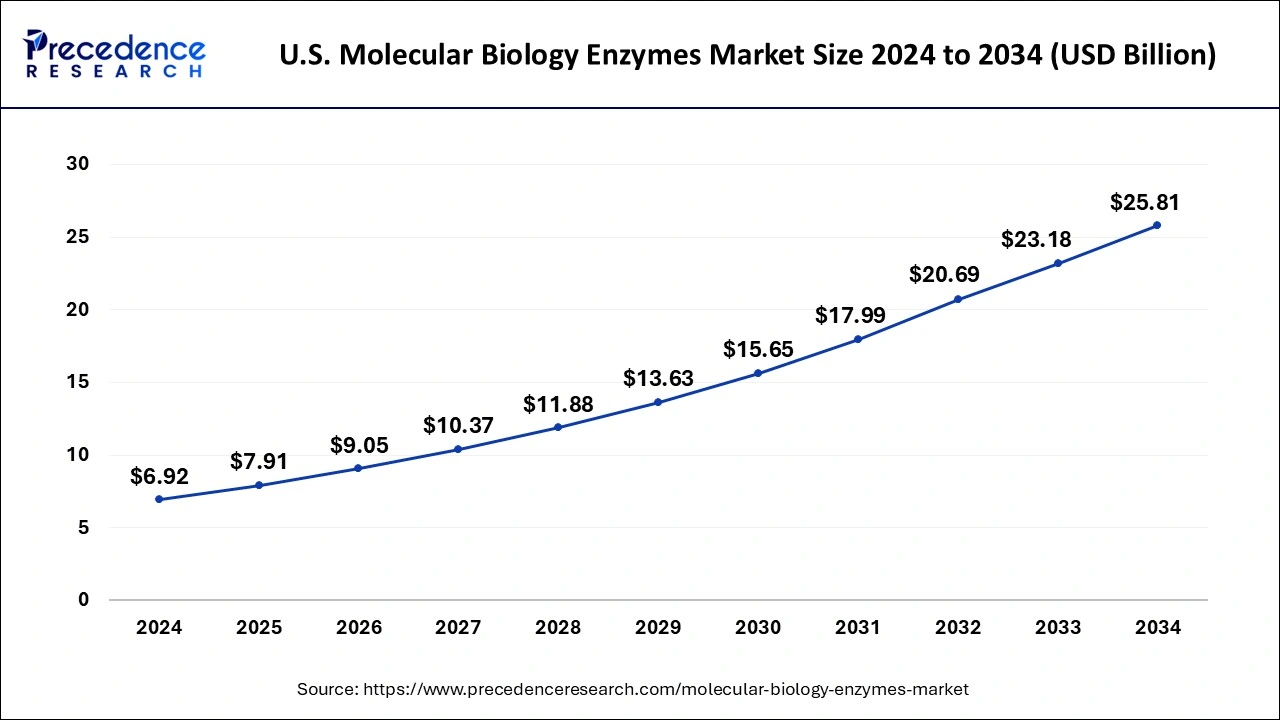

The U.S. molecular biology enzymes market size was exhibited at USD 6.92 billion in 2024 and is projected to be worth around USD 25.81 billion by 2034, growing at a CAGR of 14.07% from 2025 to 2034.

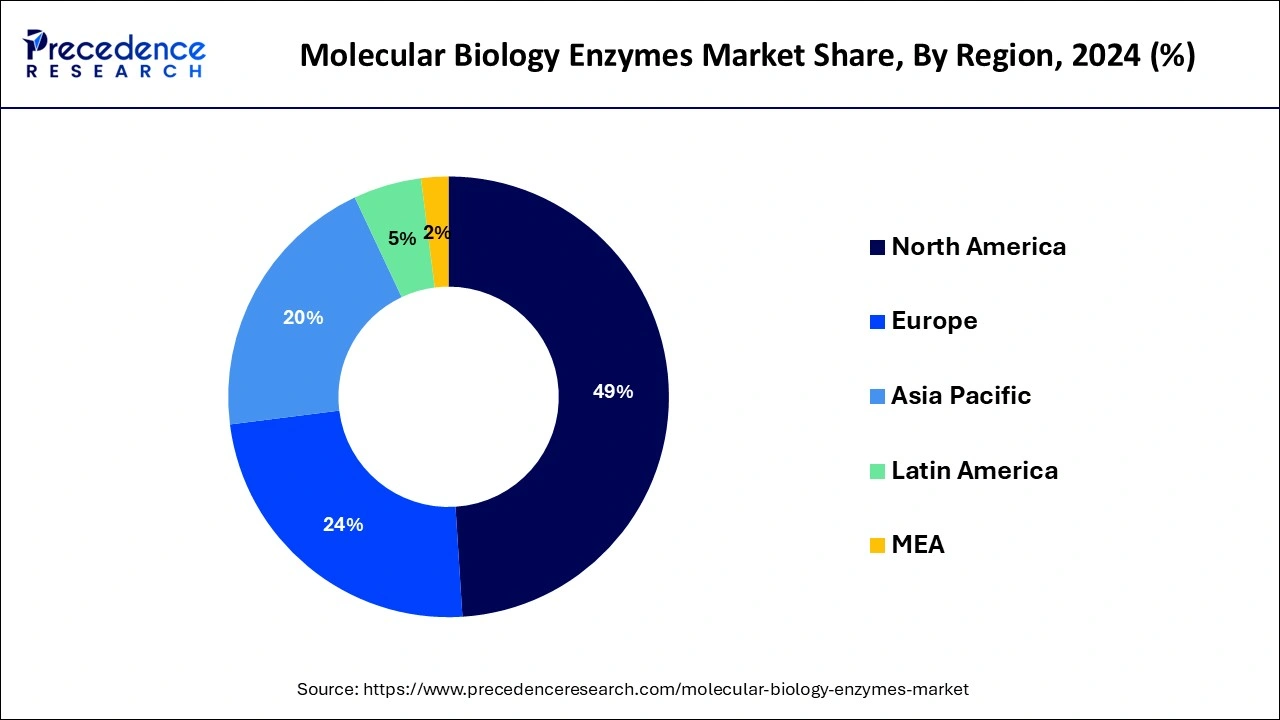

North America has held the largest revenue share of 49% in 2024. North America commands a significant share of the molecular biology enzymes market due to a robust infrastructure supporting advanced research and development in biotechnology and healthcare. The region houses prominent pharmaceutical and biotech companies, fostering innovation and enzyme adoption.

Additionally, a high prevalence of chronic diseases and a strong emphasis on personalized medicine contribute to increased demand for molecular biology enzymes. Well-established regulatory frameworks and substantial investments in life sciences research further consolidate North America's leading position in this dynamic market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific holds a significant growth in the molecular biology enzymes market due to the increasing investment in life sciences research, expanding biotechnology sector, and rising prevalence of genetic disorders. The region's pharmaceutical and biotech industries drive demand for enzymes in drug development and bioprocessing applications.

Additionally, the growing population, coupled with advancements in healthcare infrastructure, fuels the adoption of molecular biology techniques in diagnostics and personalized medicine, contributing to the prominent market share held by Asia-Pacific.

Molecular biology enzymes are specialized proteins essential for managing and controlling DNA, RNA, and protein activities within cells. They play vital roles in fundamental cellular processes like DNA replication, transcription, and translation. One notable enzyme, DNA polymerase, is responsible for crafting new DNA strands during replication, ensuring the precise transfer of genetic information. Another key player, RNA polymerase, transcribes DNA into RNA, a crucial step in gene expression.

Additionally, restriction enzymes are pivotal tools in molecular biology, cutting DNA at specific recognition sites and enabling the manipulation of genetic material. Ligases, on the other hand, facilitate the joining of DNA fragments by catalyzing the formation of phosphodiester bonds. Enzymes like helicases and topoisomerases are crucial for unwinding and manipulating the structure of DNA during processes like replication and repair. Overall, molecular biology enzymes are indispensable in understanding and manipulating genetic information, forming the foundation for advances in biotechnology, genetic engineering, and medical research.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.57% |

| Market Size in 2025 | USD 23.22 Billion |

| Market Size by 2034 | USD 72.86 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Growing biotechnology sector and diagnostic advancements

The expanding field of biotechnology, covering areas like medicine, agriculture, and industry, is a key driver for the molecular biology enzymes market. Enzymes, essential in genetic engineering and the development of biopharmaceuticals, see heightened demand as biotech applications diversify and grow. Simultaneously, diagnostic advancements, especially in molecular diagnostics, contribute significantly to the surge in demand for molecular biology enzymes.

These enzymes serve as critical components in the precise analysis of genetic material, supporting diagnostic tests that detect and characterize various diseases. The relentless pursuit of more accurate and efficient diagnostic tools amplifies the reliance on molecular biology enzymes, positioning them as indispensable in the rapidly evolving fields of biotechnology and diagnostics.

Stability and storage challenges

Stability and storage challenges present significant restraints to the growth of the molecular biology enzymes market. Many enzymes exhibit sensitivity to environmental conditions, requiring specific storage conditions to maintain their efficacy. The need for stringent temperature controls and other specialized storage conditions can increase operational complexity and costs, particularly for end-users in research laboratories and industrial settings.

Moreover, these challenges may result in the degradation of enzyme activity over time, impacting the reliability of experimental outcomes and hindering the scalability of certain applications. Researchers and industry professionals often face the dilemma of balancing the demand for consistent enzyme performance with the logistical challenges of maintaining ideal storage conditions. As a consequence, the market faces limitations in reaching its full potential as stability and storage challenges constrain the seamless integration and broader adoption of molecular biology enzymes in various scientific and industrial processes.

Bioprocessing and industrial applications

Bioprocessing and industrial applications represent a significant growth avenue for the molecular biology enzymes market. Enzymes play a pivotal role in bioprocessing, offering sustainable solutions for various industrial applications. Their ability to catalyze specific reactions efficiently is harnessed in processes such as biofuel production, food and beverage processing, and pharmaceutical manufacturing, driving demand. The shift towards green chemistry and sustainable practices further accentuates the opportunities for enzyme utilization in eco-friendly industrial processes.

In particular, enzymes contribute to the optimization of production processes, reducing energy consumption and waste generation. Their versatility in breaking down complex substrates enhances the efficiency of bioprocessing, making those valuable tools in industries embracing bio-based alternatives. As industries increasingly prioritize environmentally conscious practices, the demand for molecular biology enzymes in bioprocessing and industrial applications is expected to grow, presenting opportunities for innovation and market expansion.

In 2024, the kits segment had the highest market share based on the product. In the molecular biology enzymes market, the kits segment refers to comprehensive sets of pre-packaged reagents and enzymes designed for specific molecular biology applications. These kits streamline experimental processes, offering convenience and efficiency. A notable trend in this segment includes the development of all-in-one kits for applications like DNA/RNA extraction, PCR, and cloning. Such kits, often tailored for specific research needs, reduce laboratory workflow complexities, minimize errors, and cater to the increasing demand for user-friendly solutions in molecular biology research and diagnostics.

The enzyme segment is anticipated to expand at a significant CAGR of 15.9% during the projected period. In the molecular biology enzymes market, enzyme segments encompass a diverse range, including DNA polymerases, RNA polymerases, ligases, and restriction enzymes. DNA polymerases, crucial for DNA replication, exhibit a trend towards engineered variants with enhanced fidelity and performance.

RNA polymerases, vital for gene expression, see advancements in their utility in transcriptomics. Ligases and restriction enzymes continue to evolve with increased specificity. As the demand for precise molecular tools grows, the market anticipates further innovations and customization in enzyme products tailored to specific applications, driving segment expansion and technological refinement.

According to the application, the PCR segment held a 26% revenue share in 2024. Polymerase Chain Reaction (PCR) is a pivotal application segment in the molecular biology enzymes market. PCR involves enzymatic amplification of DNA, enabling researchers to replicate and analyze specific DNA segments. A notable trend in this segment is the increasing demand for high-fidelity DNA polymerases, enhancing the accuracy of DNA amplification.

Additionally, there is a growing preference for hot-start PCR enzymes, reducing non-specific amplification and improving reaction specificity. The PCR segment continues to evolve with innovations that enhance efficiency, sensitivity, and reliability in DNA amplification processes, catering to diverse research and diagnostic applications.

The synthetic biology segment is anticipated to expand fastest over the projected period. In the molecular biology enzymes market, the synthetic biology segment involves the application of enzymes in designing and constructing artificial biological systems. This includes the synthesis of novel DNA sequences, genetic circuits, and engineered organisms for various purposes. A notable trend in this segment is the increasing integration of molecular biology enzymes in creating customized biological components, contributing to advancements in fields such as biofuel production, pharmaceuticals, and sustainable materials. As synthetic biology continues to evolve, the demand for specialized enzymes tailored for these innovative applications is expected to rise.

In 2024, the research institutes segment had the highest market share of 78% based on the end-user. The research institutes segment in the molecular biology enzymes market encompasses academic and research institutions utilizing enzymes for diverse molecular biology applications. As a key end-user, research institutes contribute to advancements in genetic research, drug discovery, and biotechnology.

Current trends in this segment include a growing focus on precision medicine, CRISPR-based technologies, and collaborative research initiatives, driving the demand for specialized enzymes. The continuous expansion of academic and research collaborations further propels the utilization of molecular biology enzymes in cutting-edge scientific investigations within research institutes.

The hospitals segment is anticipated to expand fastest over the projected period. In the molecular biology enzymes market, the hospitals segment refers to healthcare institutions utilizing enzymes for diagnostic applications, genetic testing, and personalized medicine. The trend in hospitals involves an increasing reliance on molecular biology enzymes for precise genetic profiling, disease diagnosis, and therapeutic monitoring. As hospitals strive to enhance patient care through advanced molecular diagnostics, the demand for these enzymes is driven by their crucial role in supporting accurate and personalized medical interventions within the healthcare setting.

By Product

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024

January 2025

February 2025