Commodity Plastics Market Size and Forecast 2025 to 2034

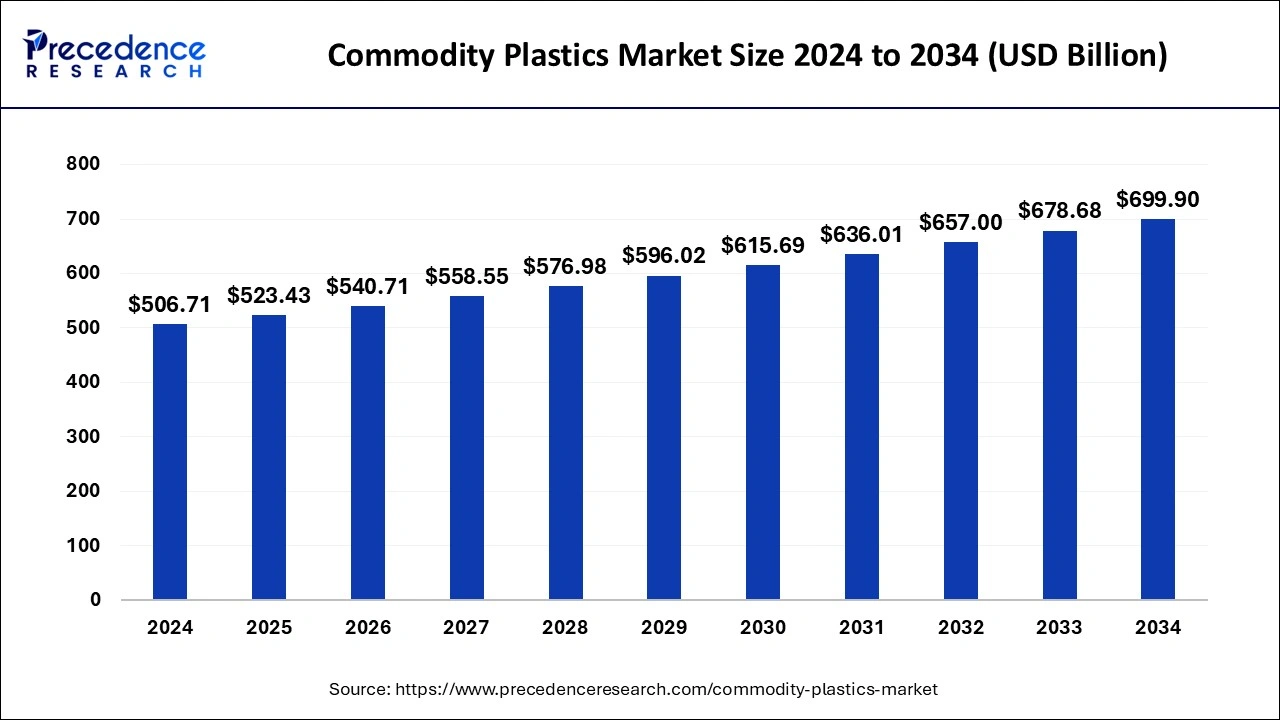

The global commodity plastics market size was estimated at USD 506.71 billion in 2024 and is predicted to increase from USD 523.43 billion in 2025 to approximately USD 699.90 billion by 2034, expanding at a CAGR of 3.28% from 2025 to 2034. The increasing penetration in the end-use industry of packaging, medical & pharmaceutical, and consumer durable goods is expected to be the major driver of the global commodity plastics market over the forecast period.

Commodity Plastics Market Key Takeaways

- The global commodity plastics Market market was valued at USD 506.71 billion in 2024.

- It is projected to reach USD 699.90 billion by 2034.

- The market is expected to grow at a CAGR of 3.28% from 2025 to 2034.

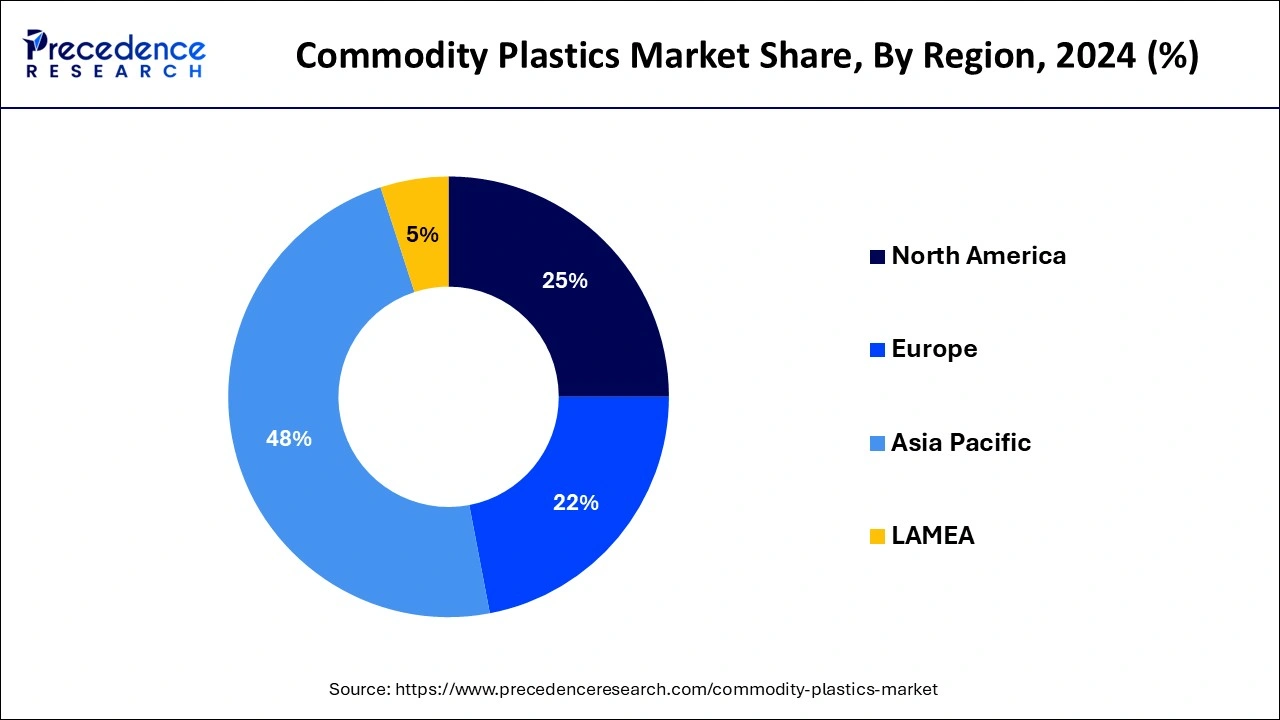

- Asia Pacific dominated the global market with the largest market share of 48% in 2024.

- North America is expected to witness the fastest growth during the projected period.

- By product, the polyethylene segment has accounted more than 37% of market share in 2024.

- By product, the poly methyl methacrylate (PMMA) segment is projected to experience the fastest growth during the forecast period.

- By end use, the packaging segment has held the largest market share of 41% in 2024.

- By end use, the medical & pharmaceutical segment is anticipated to experience the fastest growth shortly.

Asia PacificCommodity Plastics Market Size and Growth 2025 to 2034

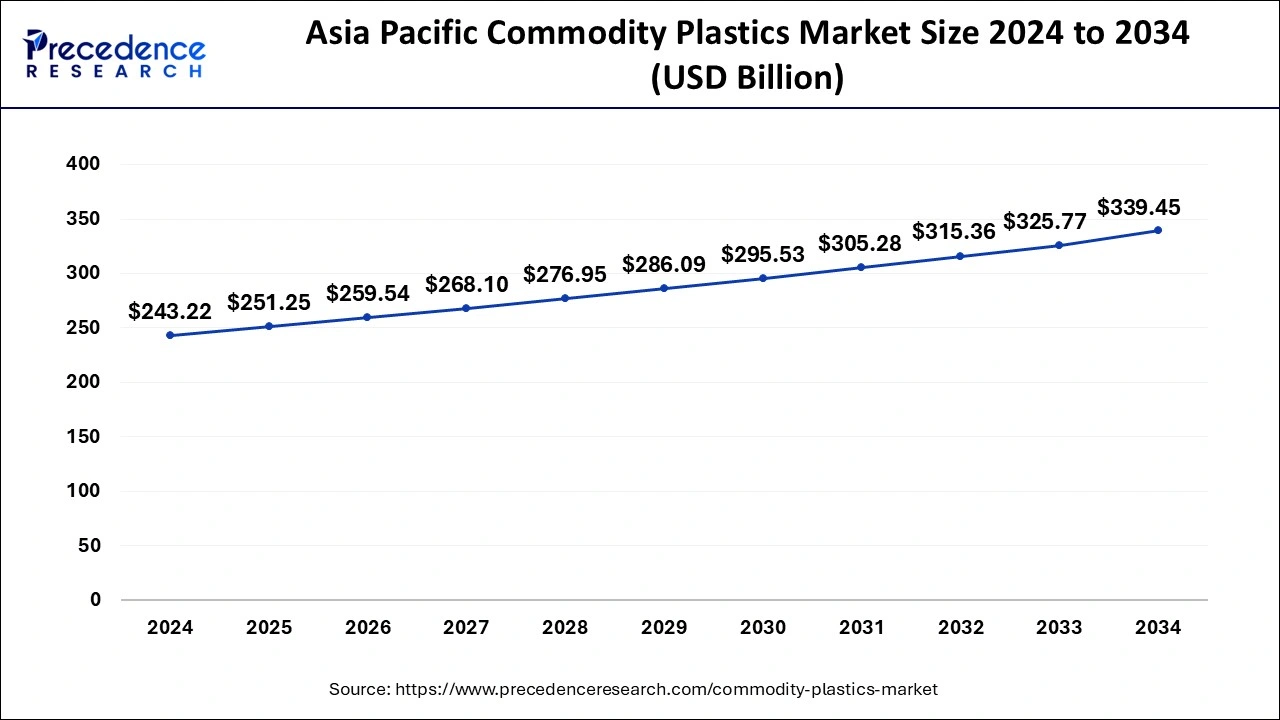

The Asia Pacific commodity plastics market size reached USD 243.22 billion in 2024 and is expected to be worth around USD 339.45 billion by 2034 with a CAGR of 3.39% from 2025 to 2034.

Asia Pacific dominated the global commodity plastics market in 2024. The surge in demand for commodity plastics, particularly from the packaging and medical & pharmaceutical sectors in countries such as China, India, and Japan, is projected to propel market growth in the region. Moreover, the economic and healthcare advancements witnessed in Asia Pacific nations, alongside increased investments in the construction sector, are anticipated to further boost the demand for commodity plastics in the region during the forecast period.

- In April 2024, LyondellBasell revealed the inauguration of a plastics recycling joint venture in Zhaoqing, Guangdong Province, Southern China, in collaboration with Genox Recycling. Employing mechanical recycling technology, the plant will recycle plastic waste and generate new polymers, expanding the LyondellBasell CirculenRecover product range. Operating under the name Guangdong Genox LyondellBasell New Material Co., Ltd., the JV signifies a strategic partnership.

- In October 2023, Coca-Cola India launched Coca-Cola in 100% recycled PET (rPET) bottles produced by SLMG Beverages Ltd. and Moon Beverages Ltd. This initiative contributes to the evolving landscape of the commodity plastics market by promoting the use of recycled materials in beverage packaging. Coca-Cola demonstrates its commitment to sustainability by utilizing rPET, aligning with global efforts to reduce plastic waste and minimize environmental impact in the packaging industry.

North America is expected to witness the fastest growth during the projected period of the commodity plastics market. This growth will be propelled by a rising focus on advanced packaging materials and the increasing demand for renewable packaging materials. The plastics industry in the United States, ranking as the third-largest manufacturing sector and employing around 1.4 million individuals, underscores the region's robust contribution to this market. The emphasis on the development of advanced packaging materials and the rising demand for renewable packaging materials further reinforce the positive trajectory of revenue growth in this region.

Market Overview

Commodity plastics are versatile materials widely employed in everyday items due to their moisture resistance, weight, durability, and affordability. They find a wide range of uses in various applications, including household products, clothing, packaging, and more. While they may lack high mechanical strength, they offer ease of recycling and molding into different shapes, which makes them ideal for packaging solutions.

With properties like low density, transparency, and toughness, commodity plastics cater to diverse consumer needs across multiple industries. The commodity plastics market is propelled by the growing demand for packaging materials and consumer goods, with rising disposable incomes.

Commodity Plastics Market Growth Factors

- The rising use of plastic across various industries, like photography, packaging, etc., can fuel the demand for the commodity plastics market.

- A rise in customers' disposable income is one key factor driving the market's growth.

- Growing production of lightweight electric vehicles in the automotive industry, along with rising metal prices, can boost the commodity plastics market growth.

- Increasing industrialization coupled with growth in the healthcare industry can contribute to market expansion shortly.

- Developing economies are likely to create opportunities during the forecast period due to the involvement of key players in the commodity plastics market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 3.28% |

| Global Market Size in 2025 | USD 523.43 Billion |

| Global Market Size by 2034 | USD 699.90 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing infrastructure development

Commodity plastics like PVC, polyethylene, and polypropylene play vital roles in infrastructure projects, providing durability, corrosion resistance, and cost-effectiveness for manufacturing pipes, cables, and structural components. As global investments in transportation, energy, and water systems surge, driven by both public and private sectors, the demand for these plastics rises. This upward trajectory is anticipated to continue as urbanization intensifies and emerging economies prioritize infrastructure enhancements, which can foster further growth in the commodity plastics market.

- In March 2024. ICIS, a global source of commodity intelligence, announced, together with Plastics Recyclers Europe, Petcore Europe, UNESDA, and NMWE, the launch of the State of Play 2024 study, offering a detailed examination of the PET market in Europe in 2022. The study, conducted in collaboration with industry leaders and organizations, provides valuable data, trends, and future scenarios for the PET market, including insights into challenges and opportunities within the supply chain.

Restraint

Environmental concerns

The growing concerns over environmental sustainability and the responsible disposal of plastic waste pose significant obstacles to the expansion of the commodity plastics market. Rising public awareness regarding the detrimental ecological impacts of plastics, along with stringent regulatory measures aimed at curbing excessive plastic consumption, can serve as a key restraint to the market's revenue growth. The presence of primary microplastics, which manifest in millimetric or sub-millimetric sizes, further creates environmental concerns. These microplastics infiltrate various household products, including facial cleansers, toothpaste, and exfoliating lotions, by contributing to environmental pollution and ecological damage.

Opportunities

Rising disposable income

The increasing disposable income among consumers, coupled with a heightened demand for consumer goods, serves as a driving force behind the market's growth. The packaging industry's requirements and the rising production of lightweight electric vehicles contribute to the expansion of the commodity plastics market. The packaging sector's increasing reliance on plastics propels the demand for commodity plastics by augmenting market revenue. Polyethylene, polyvinyl chloride, and polypropylene stand out as prominent materials used in manufacturing commodity plastics. Among these, polyethylene terephthalate finds extensive application in crafting soft drink bottles, shampoo and conditioner containers, liquid hand soap dispensers, food storage containers, and various other products. This type of plastic is deemed safe for food and beverage usage due to its capacity to shield the contents from oxygen exposure by preserving their quality and freshness.

The growing versatility of commodity plastics

The expansion and modernization of healthcare facilities worldwide fuel demand for medical equipment, devices, and packaging materials crafted from commodity plastics. These materials offer crucial properties such as sterility, durability, and flexibility, meeting the stringent requirements of laboratories, hospitals, clinics, and pharmaceutical industries. Commodity plastics contribute significantly to the production of single-use medical supplies, protective gear, and diagnostic tools, addressing the escalating demand for increased hygiene and safety standards in healthcare environments.

- In April 2023, S&P Global Commodity Insights, the provider of information, analysis, and benchmark prices for the commodities and energy markets, announced the launch of. India's first price assessment for recycled polyethylene terephthalate flakes This is expected to bring greater transparency to pricing, especially with recycled plastic.

Product Insight

The polyethylene segment dominated the commodity plastics market in 2024. The rising utilization of polyethylene (PE) across consumer durable goods, packaging solutions, and the medical and pharmaceutical sectors is anticipated to propel the growth of this segment in the foreseeable future. Additionally, the incorporation of PE in the manufacturing of advanced polymer variants like high-density polyethylene (HDPE), polyethylene terephthalate (PET), and extended polyethylene (EPE) for high-performance applications is poised to further stimulate product demand in the upcoming years.

- In May 2023, Platts, part of S&P Global Commodity Insights, the leading independent provider of information, analysis, data, and benchmark prices for commodities, energy, and energy transition markets, announced the launch of first-of-kind daily price assessments of European recycled polystyrene (R-PS) plastic, commonly found in household items such as coat hangers, light switches, and electrical coverings.

In the commodity plastics market, the poly methyl methacrylate (PMMA) segment is projected to experience the fastest growth during the forecast period, primarily driven by its expanding applications in the automotive & transportation and building & construction sectors. PMMA finds a wide range of use in these industries due to its notable attributes, such as toughness, enhanced impact resistance, and superior environmental stability, which surpass those of other plastic materials.

End-use Insight

The packaging segment dominated the commodity plastics market in 2024. This segment's revenue growth is mainly fueled by rising demand for packaged food and beverages, coupled with the increasing popularity of flexible packaging solutions. Plastics play an important role in food packaging due to their lightweight nature, high recyclability, cost-effectiveness, durability, and versatility in shaping attractive packaging designs.

The medical & pharmaceutical segment is anticipated to experience the fastest growth shortly due to the rising demand for medical devices in the commodity plastics market. Commodity plastics are becoming increasingly favored in this sector because of their advantageous attributes, such as improved optical clarity, biocompatibility, and cost-effectiveness. Various types of plastics, including polystyrene and polyethylene, are combined to attain specific properties required for medical device production.

- In April 2024, PM Plastics owners launched a new business, Polymer Medical Inc., in New York to supply the healthcare and bioscience markets with disposables and devices, following decades of experience founding and operating medical plastic manufacturers.

Commodity Plastics Market Companies

- Exxon Mobil Corporation (U.S.)

- Chevron Phillips Chemical Company, LLC (U.S.)

- BASF SE (Germany)

- Dow (U.S.)

- DuPont (U.S.)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Borealis AG (Austria)

- Braskem (Brazil)

- Eni S.p.A (Italy)

- Formosa Plastics Corporation (Taiwan)

- Sumitomo Chemical Co., Ltd. (Japan)

- Hanwha Group (South Korea)

- INEOS (Switzerland)

Recent Developments

- In November 2023, Fresh Del Monte Produce Inc. collaborated with Arena Packaging to introduce Reusable Plastic Containers (RPCs) tailored for banana packaging. This collaboration addresses the growing demand for sustainable packaging solutions in the commodity plastics market, offering an alternative to single-use plastic packaging for fresh produce.

- In February 2023, Ecolab and TotalEnergies collaborated to introduce a new plastic packaging solution derived from recycled materials. This joint venture responds to the growing demand for sustainable packaging options within the commodity plastics market. Incorporating recycled materials into their packaging production, Ecolab and TotalEnergies support the circular economy objectives of the European Union (EU) while addressing environmental concerns associated with heavy-use plastic packaging

- In September 2022, Rebound, a subsidiary of International Holding Company, celebrated the launch of Rebound Plastic Exchange (RPX), a global B2B digital trading platform for recycled plastics. This is a turning point for the industry as the world's plastics market is forecast to reach $45.6 billion by 2025.

Segments Covered in the Report

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Poly Methyl Methacrylate (PMMA)

By End-use

- Building & Construction

- Packaging

- Electrical & Electronics

- Automotive & Transportation

- Medical & Pharmaceutical

- Textile

- Consumer Durable Goods

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting