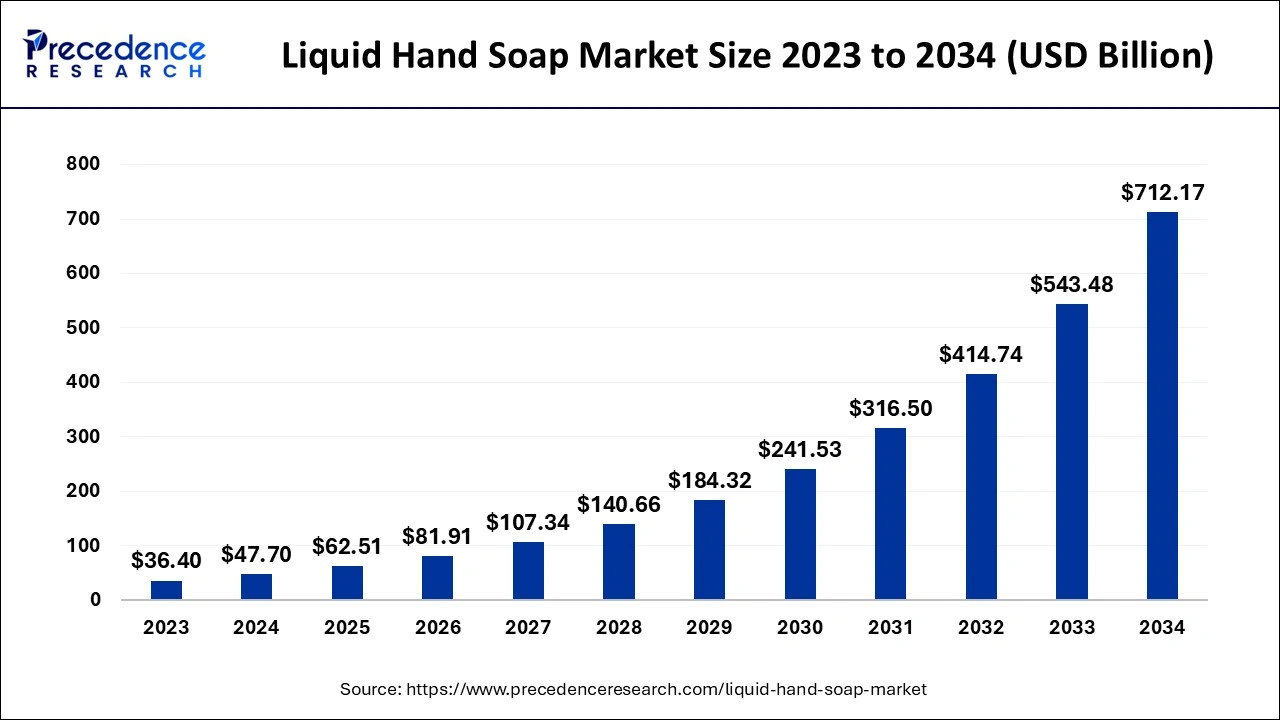

The global liquid hand soap market size accounted for USD 47.70 billion in 2024, grew to USD 62.51 billion in 2025 and is expected to be worth around USD 712.17 billion by 2034, registering a CAGR of 31.04% between 2024 and 2034. The Asia Pacific liquid hand soap market size is evaluated at USD 19.08 billion in 2024 and is expected to grow at a CAGR of 31.19% during the forecast year.

The global liquid hand soap market size is calculated at USD 47.70 billion in 2024 and is predicted to reach around USD 712.17 billion by 2034, expanding at a CAGR of 31.04% from 2024 to 2034. Due to awareness, the need for convenience, innovations in products, attractive environmentally friendly packaging, and growing health awareness the liquid hand soap market is growing.

The specious change in liquid hand soap market is the addition of artificial intelligence (AI). Production parameters can be adjusted through the machine by the systems; thus, the output quality can be checked by the machines themselves. They can adjust the amount of medicine to add, the temperature, and the ratio at which the mixture is done to produce a product with the right quality. The dispensers are also receiving upgrades by integrating AI into the mix through features like usage tracking in real-time, maintenance prediction, and user profiling. Machine learning and other advancements in technology have enabled the use of sensory-enabled automated systems to reduce operational costs.

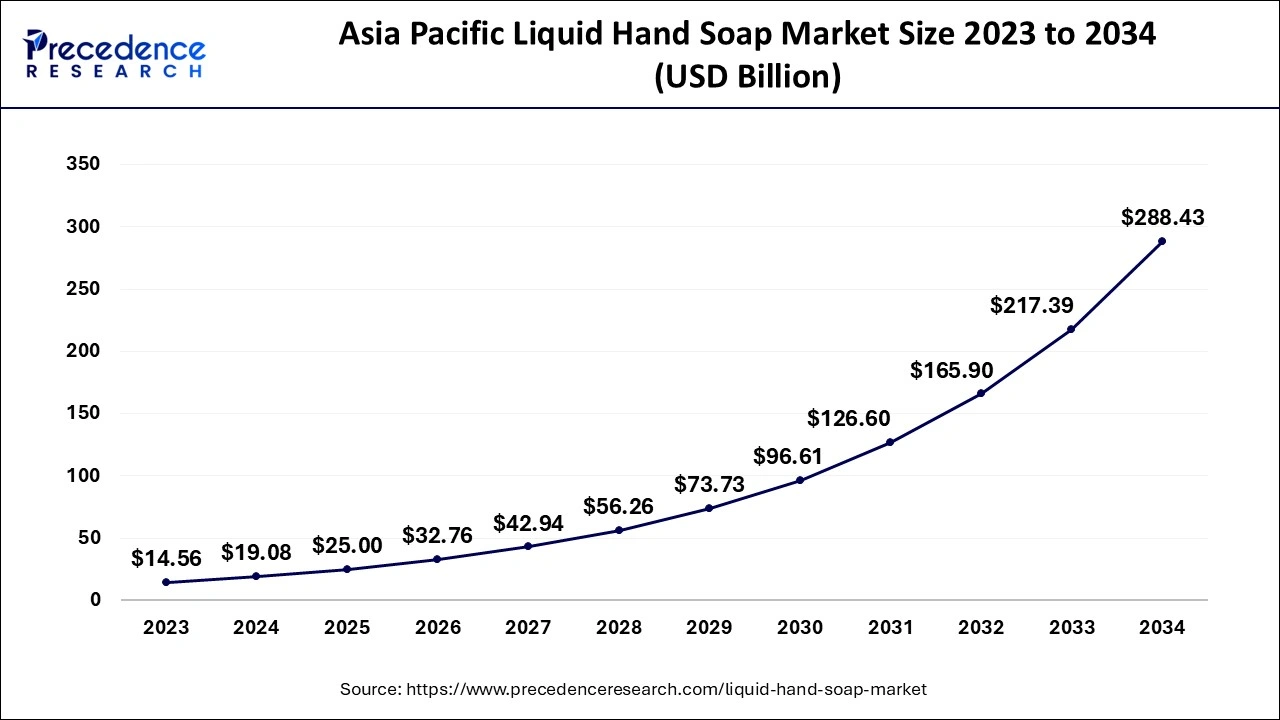

The Asia Pacific liquid hand soap market size is exhibited at USD 19.08 billion in 2024 and is projected to be worth around USD 288.43 billion by 2034, growing at a CAGR of 31.19% from 2024 to 2034.

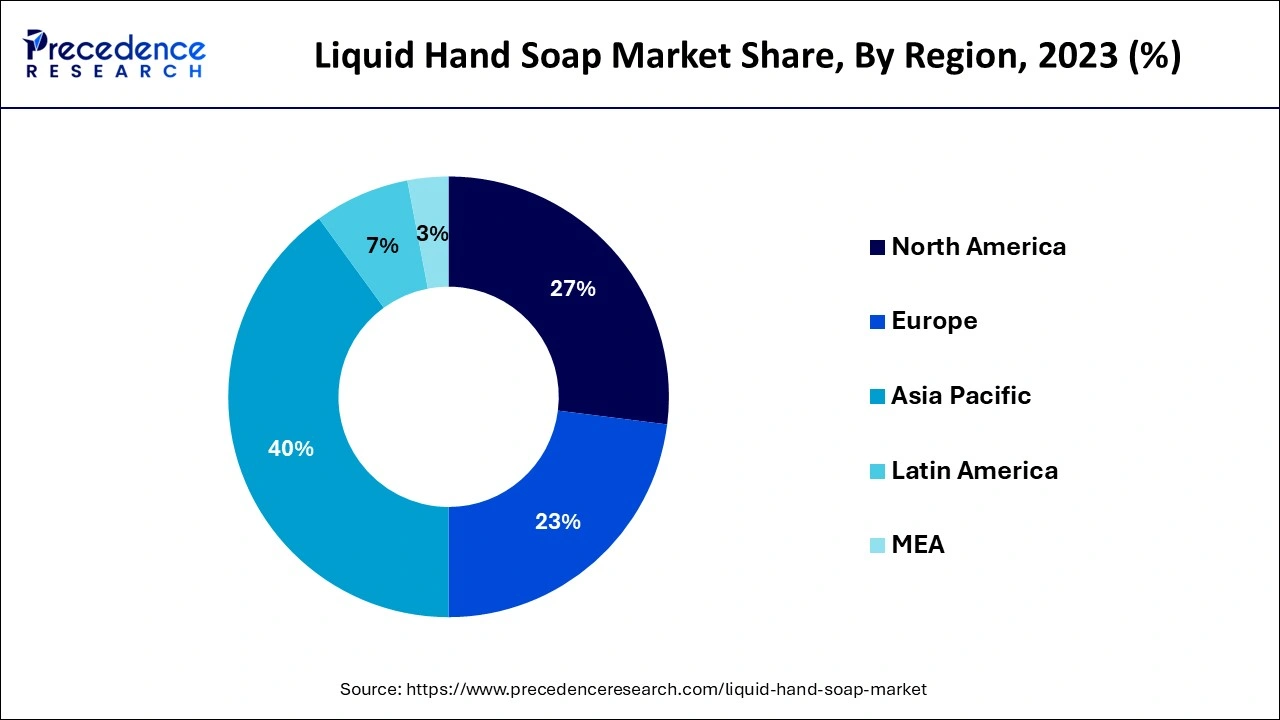

Asia Pacific accounted for the largest share of the liquid hand soap market in 2023. Due to the increasing disposable income in the region, consumers can afford personal care and hygiene products such as liquid hand soaps. An increase in the level of health consciousness and hygiene awareness has been witnessed by the growth of the urban population. In highly crowded countries, hotels and resorts are booming, and there is enhanced concern for cleanliness. Also, the gradual improvement of the income standards of households has led to the overall growth of the market of products of better quality.

North America is anticipated to witness the fastest growth in the liquid hand soap market during the forecasted years. The new product developments, such as the moisturizing and antibacterial properties of the products, are helpful to consumers as they look for hygiene products that they can use as multi-purpose items. Besides, the retail availability in North America and its availability in supermarkets, pharmacies, and on the Internet has contributed to the convenience and, thus, the growth of the market. With the positive government policies present in the certification of organic products and incorporation of eco-labels, the manufacturers of organic products have seen the incorporation of organic materials in products as a great opportunity to market their products greatly.

Liquid hand soap is specially formed to clean and wash the hands. Liquid hand Soap is the most used and preferred detergent product type. Liquid soaps come in many forms and can include many substances, they can have numerous characteristics. Also, it’s characterized by a substance that forms hand sanitizer that is antimicrobial. The children’s liquid hand soap can also be prepared using non-hazardous chemicals. It is usually packed in pump bottles to ensure that the user is using it without contact with other surfaces.

The growing concern that consumers have towards avoiding bacterial infection is boosting the use of liquid hand soap. Liquid soap is used to wash hands with the aim of avoiding bacterial infection. Bridging health complications through liquid hand soaps in hospitals, diagnosable centers, and general health facilities boosted the demand for liquid hand soap market. Hand washing liquid may be antibacterial and features an active agent that eliminates or inactivates bacteria on the hands.

| Report Coverage | Details |

| Market Size by 2034 | USD 712.17 Billion |

| Market Size in 2024 | USD 47.70 Billion |

| Market Size in 2025 | USD 62.51 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 31.04% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Packaging Type, Nature, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Rising awareness of sanitation

Washing hands with soap and water helps reduce the transmission of many illness-causing germs and enhances health. Hand soaps are increasingly being consumed because of the increasing appreciation of the importance of washing hands due to the COVID-19 pandemic. The people around the world are developing an increasing awareness concerning hygiene and cleanliness.

Liquid soap can also efficiently remove germs on the hands as well as other items of daily use, such as cutleries, tiles, floors, and clothes, by preventing microbial attacks. The government bodies of various countries are getting involved in ensuring general public hygiene maintenance practices like hygiene maintenance.

Market competition and increasing prices

Sales of superior or more luxurious items may be impacted by consumers’ sensitivity to hand soap product costs in cases of a downturn in the economy due to the price of the hand soap product. While the market is oriented toward eco-friendly and sustainable products, there are potential challenges connected with the costs and availability of eco-friendly components and packaging materials.

Increased awareness of natural and organic products

Global awareness of organic products is, as shown, the key factor that has boosted the liquid hand soap market. Some of the natural products floated in the market are basil and neem-based products because of their antibacterial values. The gentle natural healing and anti-fungal formulary applied in medicated liquid washes and natural liquid soaps based on plants has recently come to much interest.

Business firms are striving to make products out of bio-surfactants that are harmless to aquatic life in case the soap is washed away. There is a growing demand for medicated liquid hand soaps. Paraben-free natural/botanical essences of medicinal liquid soaps top the list. Increasingly, consumers are selecting natural, medicated liquid hand soaps because of their anti-fungal and healing properties.

The bottle segment accounted for the largest share of the liquid hand soap market in 2023. These bottles possess physical attributes such as strength and lightweight, which enhance the overall experience for the end users. Intermediaries such as commercial end-users like hotels and hospitals prefer buying water in large bottle quantities. The peculiar application of liquid hand soap in variable packaging sizes, including hand dispensers, will further the market growth. These bottles are polyethylene terephthalate (PET) or high-density polyethylene (HDPE) by default. These materials are selected mainly to protect the soap from factors such as bacterial contamination. They also have the added advantage of a large capacity for holding, and as such, bottles form one of the most widely used packaging systems both in the business and at home.

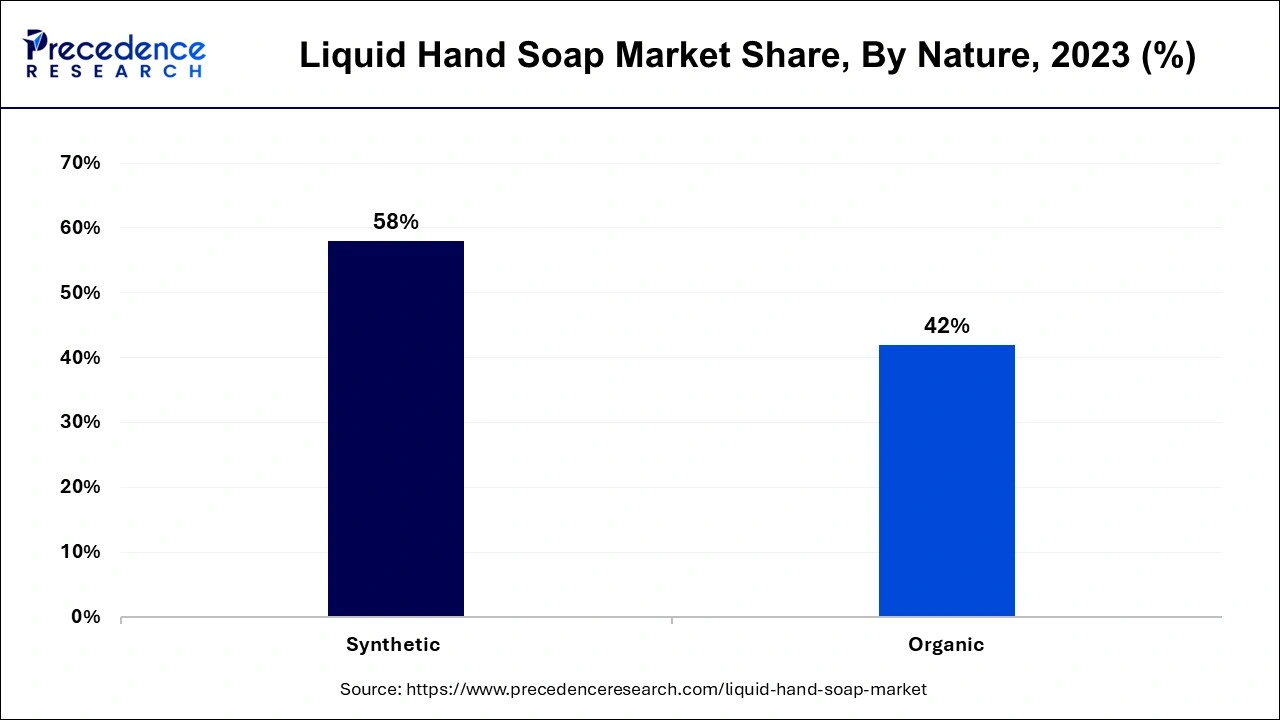

The synthetic segment noted the largest share in the liquid hand soap market in 2023. synthetic liquid soaps are characterized by simple composition, which is usually enough to provide simple cleaning without using additional components and innovative technologies, due to which such soaps can be produced and bought comparatively cheaply. Sulfated soap occupies the largest market segment in the liquid soap market due to the abundance of cheap liquid fragrance soaps. Washing and sanitizing are of growing importance to consumers.

The organic segment is projected to witness the fastest growth in the liquid hand soap market during the forecast period. Organic liquid soaps are considered safer than conventional ones as they are made from natural ingredients, and they do not contain such synthetic chemicals, additives, and artificial fragrances. This change in consumer choice behavior is exerting pressure on the manufacturers to launch more organic products. These are generally degradable green products, and their packs are also materials friendly to nature, aligning with the values of consumers who prioritize sustainability.

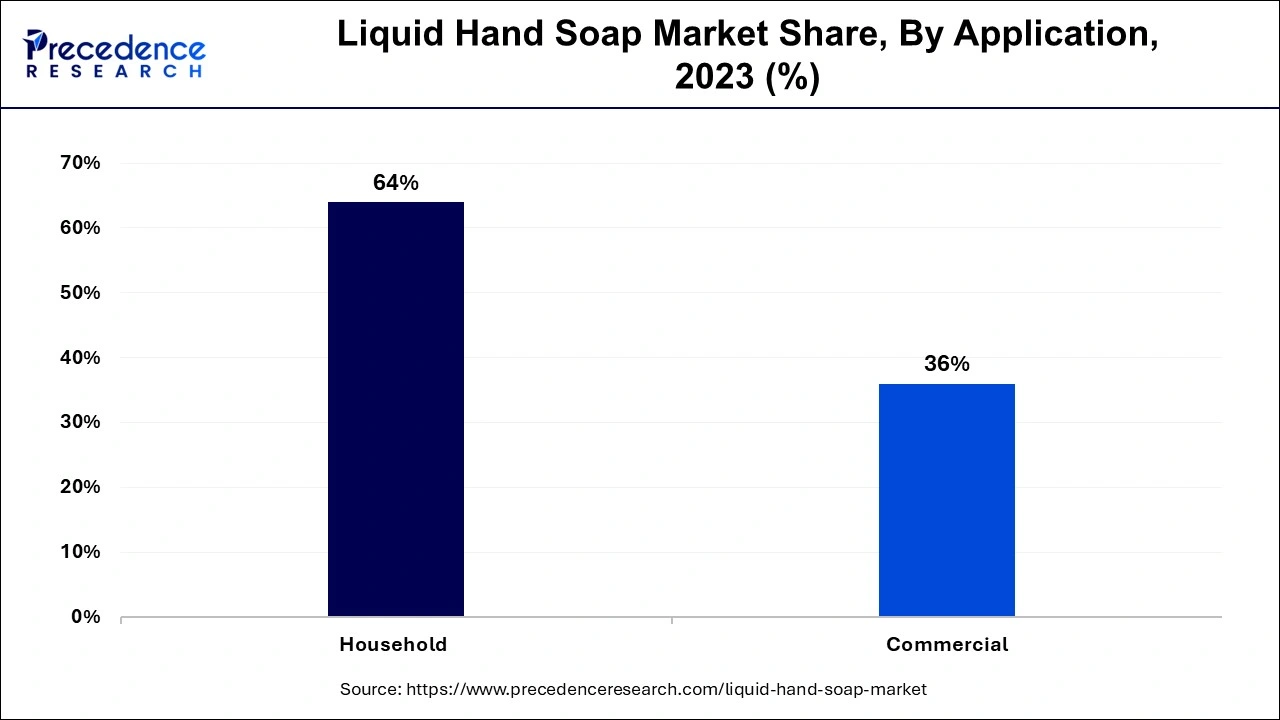

The household segment recorded the highest share of the liquid hand soap market in 2023. The growth observed in the household segment is, to a large extent, due to the changing attitude of the population in terms of convenience and cleanliness. Liquid soap is much more convenient than bar soap due to the fact that it is easier to use and easy to mess with. The household segment is predicted to hold the largest share due to increased utilization of the product, especially in washing hands and baths.

The commercial segment is projected to witness the fastest growth in the liquid hand soap market during the forecast period. Hospitality, retail, health care, and food industries have shifted to higher hygiene standards to ensure they provide a clean environment for everyone. Due to the emphasis placed on hygiene and cleanliness during the present and the recent past in light of the COVID-19 pandemic and similar other diseases, the overall awareness about purity and sterilization has gained value and has become important to protect customers and business people. Further, the use of liquid soap, due to its versatility and flexibility, together with the improved formulations that can meet the needs of various customers, also strengthens the need for this product in commercial places.

The supermarket/hypermarket segment contributed the largest share of the liquid hand soap market in 2023. This facility is frequently visited by customers in supermarkets and hypermarkets due to the availability of many choices in a single place, as well as exaggerated discounts on bulk and seasonal products. The facilities, together with diverse brands and the availability of generous offers on bulk purchases and during the holiday seasons, make the products easily sell at these stores. On the other hand, due to their nearness to the residences, many people in developing countries rely on such goods from the convenience stores.

The online segment is projected to witness the fastest growth in the liquid hand soap market during the forecast period. This growth has been accelerated by the existence of e-commerce platforms. Home delivery services are among the benefits of e-commerce websites since they enable consumers to buy from their comfort spaces. Promoting discount sales and coupons are common among e-commerce outlets as they convince consumers to buy from the firm. In addition, the increase in the use of artificial intelligence to improve the utility of shopping applications for users has equally contributed to the development of the purchasing system.

By Packaging Type

By Nature

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client