November 2024

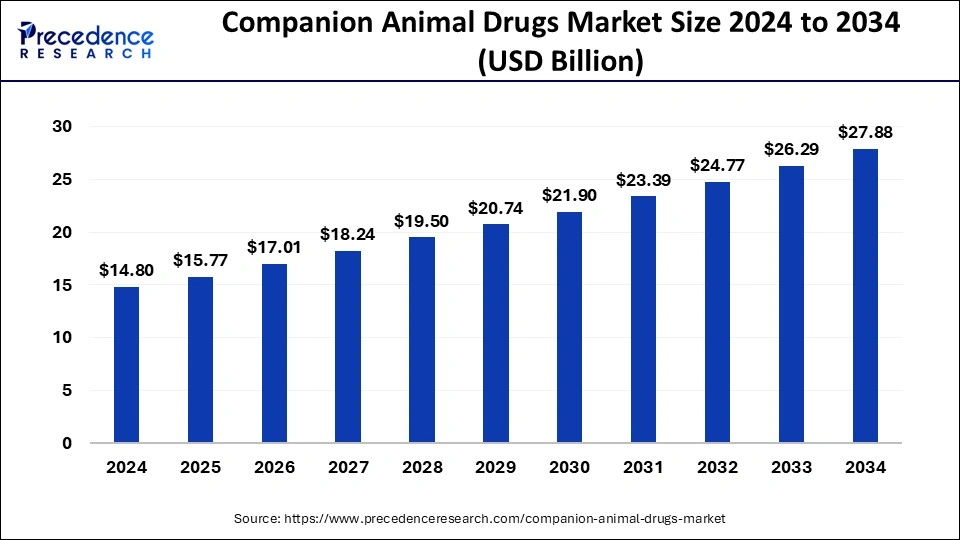

The global companion animal drugs market size accounted for USD 15.77 billion in 2025 and is forecasted to hit around USD 27.88 billion by 2034, representing a CAGR of 6.50% from 2025 to 2034. The North America market size was estimated at USD 5.77 billion in 2024 and is expanding at a CAGR of 6.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global companion animal drugs market size accounted for USD 14.80 billion in 2024 and is predicted to increase from USD 15.77 billion in 2025 to approximately USD 27.88 billion by 2034, expanding at a CAGR of 6.50% from 2025 to 2034. The companion animal drugs market is driven by the increasing rate of pet adoption.

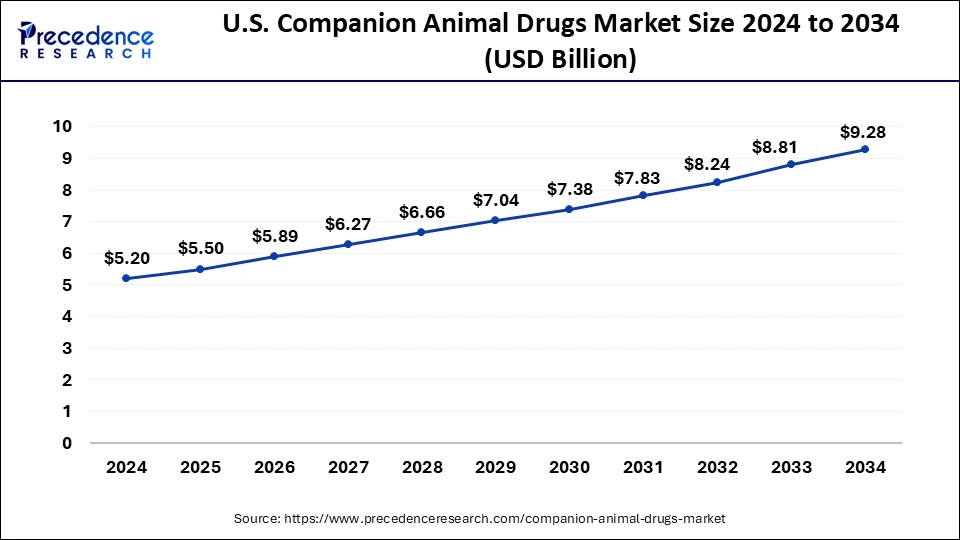

The U.S. companion animal drugs market size was exhibited at USD 5.20 billion in 2024 and is projected to be worth around USD 9.28 billion by 2034, growing at a CAGR of 6.00%.

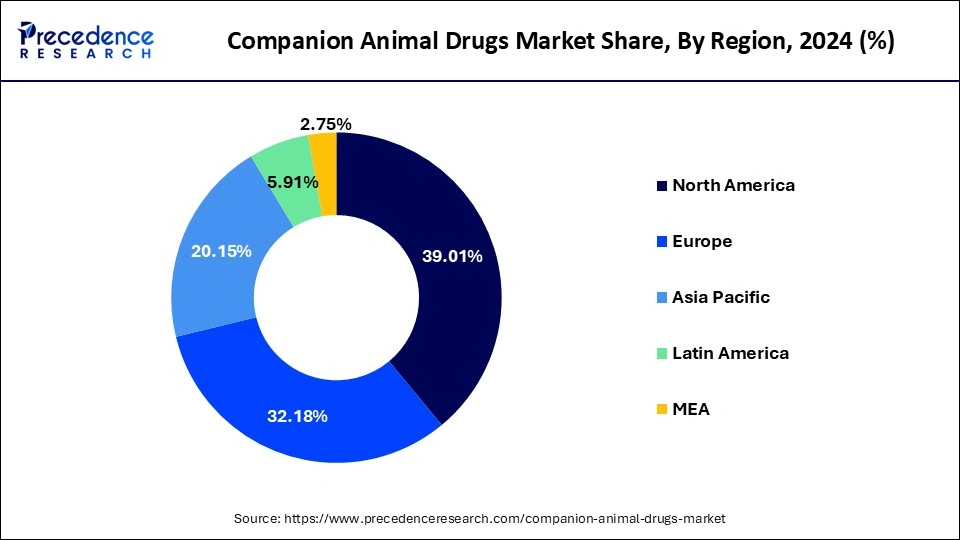

North America has the largest market share of 39.01% in 2024 in the companion animal drugs market throughout the predicted timeframe. Pet owners in North America are becoming more conscious of the value of preventive healthcare and the part that drugs play in maintaining the long-term health of their animals. Online resources, pet-focused media, and veterinary practitioners frequently serve as fuel sources for this understanding, which shifts consumer behavior in favor of preventative healthcare practices. It boasts a sophisticated infrastructure for veterinary treatment, along with cutting-edge veterinary hospitals, clinics, and specialty pharmacies. This infrastructure makes companion animal medications more accessible and promotes routine visits for treatments and preventative care.

Asia-Pacific is expected to witness the fastest rate of expansion in the companion animal drugs market during the forecast period. In the past, people frequently maintained pets as working animals or for valued purposes. However, attitudes toward pets have changed significantly in society; many are now seen as essential members of the family. The demand for companion animal medications has increased due to this shift in spending on pet healthcare, including preventive measures and treating various illnesses. The development of novel medicines especially suited to the requirements of companion animals is becoming the focus of pharmaceutical companies' attention. Large sums of money are being spent on research and development projects as the emphasis on strengthening treatment options and improving pet health outcomes grows. As a result, new pharmaceutical formulations and therapies have been introduced, propelling regional market expansion.

The companion animal drugs market revolves around the production and distribution of medications designed especially for pets, such as cats, birds, dogs, and other domesticated animals kept primarily for companionship instead of for commercial objectives. Companion animal drug development has progressed in tandem with advances in human medicine, enabling pets to obtain therapies and prescriptions that can enhance their well-being, increase their longevity, and efficiently treat medical issues.

Preventative measures for parasite control, vaccination against infectious diseases, and protection against potentially fatal heartworm disease are just a few of the many medications used for companion animals. Pets may have age-related ailments such as organ malfunction, arthritis, or cognitive decline as they age. Drugs for companion animals can help with these problems and offer respite, enhancing geriatric dogs' comfort and quality of life.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.50% |

| Market Size in 2025 | USD 15.77 Billion |

| Market Size by 2034 | USD 27.88 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Animal Type, Route of Administration, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing awareness about animal healthcare

This enhanced consciousness results from various causes, such as a better comprehension of the value of pets in homes and the desire to give them the best care possible. To protect the health of their animal companions, pet owners are spending more on preventive healthcare procedures, including immunizations, parasite management, and routine checkups. The need for companion animal medications has also been fueled by developments in veterinary care and pharmaceuticals, which have expanded the spectrum of treatment choices available for various illnesses and disorders in companion animals.

Rising prevalence of parasitic diseases

Pets frequently contract parasitic illnesses such as intestinal worms, heartworms, fleas, and ticks, which can cause several health problems if left untreated. The danger of parasite illnesses rises along with the global pet ownership trend, particularly in metropolitan areas. The need for parasiticides, medications made expressly to prevent and treat parasitic diseases in companion animals, has increased due to this development. Pharmaceutical companies are investing in new and improved parasiticides to tackle developing difficulties, including resistance to current therapies. As a result, the market for companion animal medications is growing to fulfill this demand.

High cost associated with companion animal drugs

This high-cost results from several variables: production costs, regulatory compliance, and research and development expenses. The costs of veterinary services, marketing, and distribution also go into the total cost. Because of this, pet owners might find it expensive to buy and keep up with their companion animals' medical needs, which could reduce demand and create obstacles to receiving essential care.

Rapidly increasing demand for companion animal products

A growing pet population, increased pet ownership rates, rising disposable incomes, and a trend toward the humanization of pets, the idea that pets should be treated like members of the family and get the same care and attention as people, are some of the causes contributing to this demand rise.

The increasing number of individuals choosing to own pets has led to an increase in the need for veterinary care and drugs to maintain the health and welfare of these creatures. A wide range of goods are included in companion animal drugs, such as medications, vaccinations, nutraceuticals, and equipment made especially for dogs.

Growing trend of adopting pet animals

Veterinarian care and medication are becoming more and more necessary as more people bring pets into their homes to maintain these creatures' health and welfare. The market for companion animal medications, such as those for common illnesses, chronic disorders, and preventative care, has expanded due to this trend. In response to this need, pharmaceutical companies are creating novel medications suited to the requirements of companion animals like dogs, cats, and other pets. Such a growing trend of adopting animals is observed to offer lucrative opportunities for the companion animal drugs market.

Furthermore, the growing humanization of pets has increased the demand for cutting-edge medical cures and treatments that were previously only available to humans. This covers both behavioral pharmaceuticals to treat anxiety and other behavioral problems in pets, as well as prescription meds for ailments like cancer, diabetes, and arthritis.

The medicated feed additives segment dominated the companion animal drugs market in 2024. Animal husbandry has always made extensive use of medicated feed additives. They are a practical way to give medication to multiple animals at once because they are often given to companion animals through their food or drink. The extensive use of medicated feed additives by veterinarians and pet owners can be attributed in part to their ease of administration. Before being licensed for use in companion animals, several medicated feed additives are subjected to stringent testing and regulatory inspection to guarantee their safety and effectiveness.

The vaccines segment is observed to be the fastest growing in the companion animal drugs market. There has been a discernible change in pet owners' perspectives on preventive medical treatment for their animals. A greater focus is being placed on preventive strategies to keep pets healthy and free from sickness, as opposed to reactive illness treatment. Vaccination is essential as a preventive measure since it shields animals from various infectious illnesses. More and more pet owners are realizing the value of vaccinations in preserving their animals' health and lifespan. Veterinarians are an important resource when it comes to informing pet owners about the advantages of vaccinations and the suggested vaccination schedules for various species and breeds.

Global Companion Animal Drugs Market Revenue, By Product, 2022-2034 (USD Million)

| Product | 2022 | 2023 | 2024 |

| Drugs | 7,600.6 | 8,014.4 | 8,515.1 |

| Vaccines | 3,801.5 | 4,053.5 | 4,354.2 |

| Medicated Feed Additives | 1,698.3 | 1,805.5 | 1,933.6 |

The dogs segment dominated the companion animal drugs market in 2024. The way people view and care for their pets, especially dogs, has changed significantly over time. Many consider Dogs part of the family, and their owners are becoming increasingly committed to their health and welfare. Due to the humanization trend, high-quality medications and medical supplies for dogs are in high demand. Novel drugs and treatment approaches created especially for dogs have been made possible by developments in veterinary research and pharmaceutical development. Novel drug formulations, targeted therapy, and customized medical techniques are some of these breakthroughs that improve the safety and effectiveness of treatments for patients with dogs.

The horses segment is the fastest growing in the companion animal drugs market during the forecast period. Horses are adaptable for companionship, racing, show jumping, dressage, recreational riding, and therapy. Due to the distinct healthcare requirements of these industries, various medications are created and recommended for equines. The need for companion animal medications catered to the unique needs of equestrian athletes and companions is growing along with the popularity of these activities.

Veterinarians can better identify and treat a broader range of equine illnesses and disorders because of developments in veterinary medicine and technology. In the equestrian industry, this increased capacity has led to a rise in the prescription and usage of companion animal medications.

Global Companion Animal Drugs Market Revenue, By Animal Type, 2022-2034 (USD Million)

| Animal Type | 2022 | 2023 | 2024 |

| Dogs | 5,380.0 | 5,708.3 | 6,114.3 |

| Cats |

4,447.0 | 4,711.9 | 5,029.5 |

| Horses |

2,173.9 | 2,299.6 | 2,448.8 |

| Others | 1,099.6 | 1,153.6 | 1,210.4 |

The topical segment dominated the companion animal drugs market in 2024. Especially for pets who find it challenging to administer pills, topical treatments are frequently simpler to provide than oral ones. Pet owners no longer must battle to get their pets to consume tablets or drinks because topical medicines may be applied directly to the problematic area. Numerous topical drugs quickly relieve common ailments like pain, irritation, and itching. For discomfort-stricken pets, this rapid commencement of action is advantageous because it enables instant symptom relief.

It focuses on certain bodily parts, like ears or skin. By delivering active substances precisely to the site of infection or inflammation, this tailored method maximizes efficacy and minimizes systemic side effects.

Global Companion Animal Drugs Market Revenue, By Route of Administration, 2022-2034 (USD Million)

| Route of Administration | 2022 | 2023 | 2024 |

| Oral |

3,253.3 | 3,466.2 | 3,720.9 |

| Injectable |

5,737.4 | 6,054.4 | 6,437.2 |

| Topical |

2,333.4 | 2,479.9 | 2,655.7 |

| Others | 1,776.4 | 1,872.9 | 1,989.1 |

The veterinary hospitals segment dominated the companion animal drugs market in 2024. Advanced medical facilities and equipment in veterinary hospitals allow for precise diagnosis and efficient care of companion animals. Veterinary clinics are equipped to offer complete healthcare services, from surgical equipment and lab facilities to diagnostic imaging tools like X-ray and ultrasound devices. It customizes therapy regimens based on the unique requirements of every companion animal. Considering each pet's age, breed, medical history, and current health conditions, this individualized approach guarantees they receive the best care possible.

The veterinary clinics segment is the fastest growing in the companion animal drugs market during the forecast period. In veterinary medicine, preventive care is becoming increasingly important to detect and treat health concerns early on before they worsen. Veterinary clinics play a critical role in encouraging preventative care through regular wellness examinations, immunizations, parasite control, and nutritional guidance. Companion animal medications are essential to these efforts at preventative care because they encourage veterinarian clinics to embrace and use them. The willingness of pet owners to make financial investments for the health and welfare of their animal friends is growing. The rising cost of veterinarian services, including regular checkups, vaccinations, diagnostic testing, and prescription drugs, indicates this trend.

Global Companion Animal Drugs Market Revenue, By Distribution Channel, 2022-2034 (USD Million)

| Distribution Channel | 2022 | 2023 | 2024 |

| Veterinary Hospitals |

4,858.8 | 5,117.2 | 5,431.1 |

| Veterinary Clinics |

3,784.8 | 4,008.9 | 4,277.9 |

| Pharmacy and Drug Stores |

2,526.1 | 2,686.6 | 2,878.4 |

| E-commerce | 1,930.9 | 2,060.7 | 2,215.5 |

By Product

By Animal Type

By Route of Administration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

June 2024

March 2025

December 2024