List of Contents

Connected Enterprise Market Size and Forecast 2025 to 2034

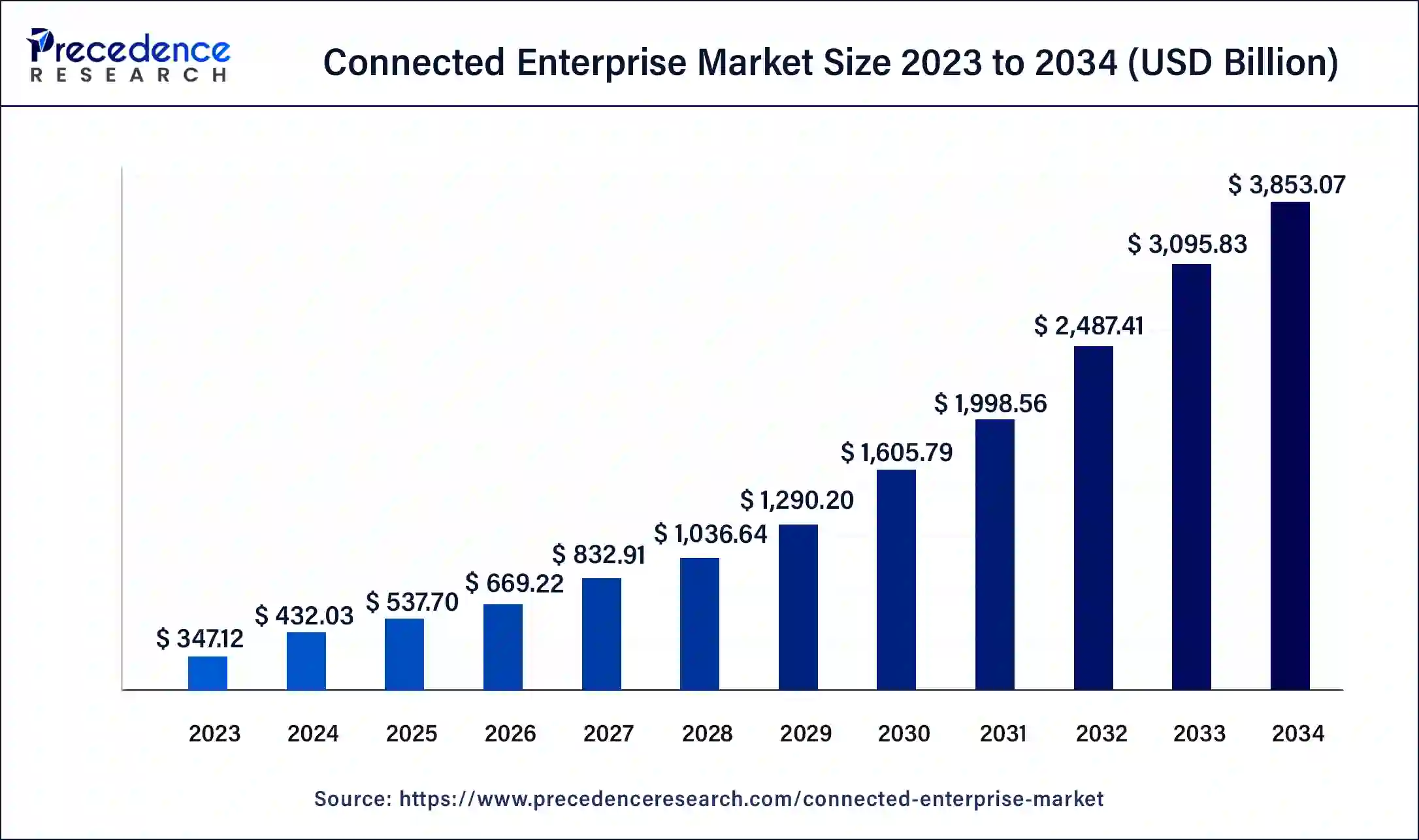

The global connected enterprise market size is projected to be worth around USD 3,853.07 billion by 2034 from USD 432.03 billion in 2024, growing at a CAGR of 24.46% from 2025 to 2034. The connected enterprise market growth is attributed to the growing need for data-driven decision-making.

Connected Enterprise Market Key Takeaways

- The global connected enterprise market was valued at USD 432.03 billion in 2024.

- It is projected to reach USD 3,853.07 billion by 2034.

- The connected enterprise market is expected to grow at a CAGR of 24.46% from 2025 to 2034.

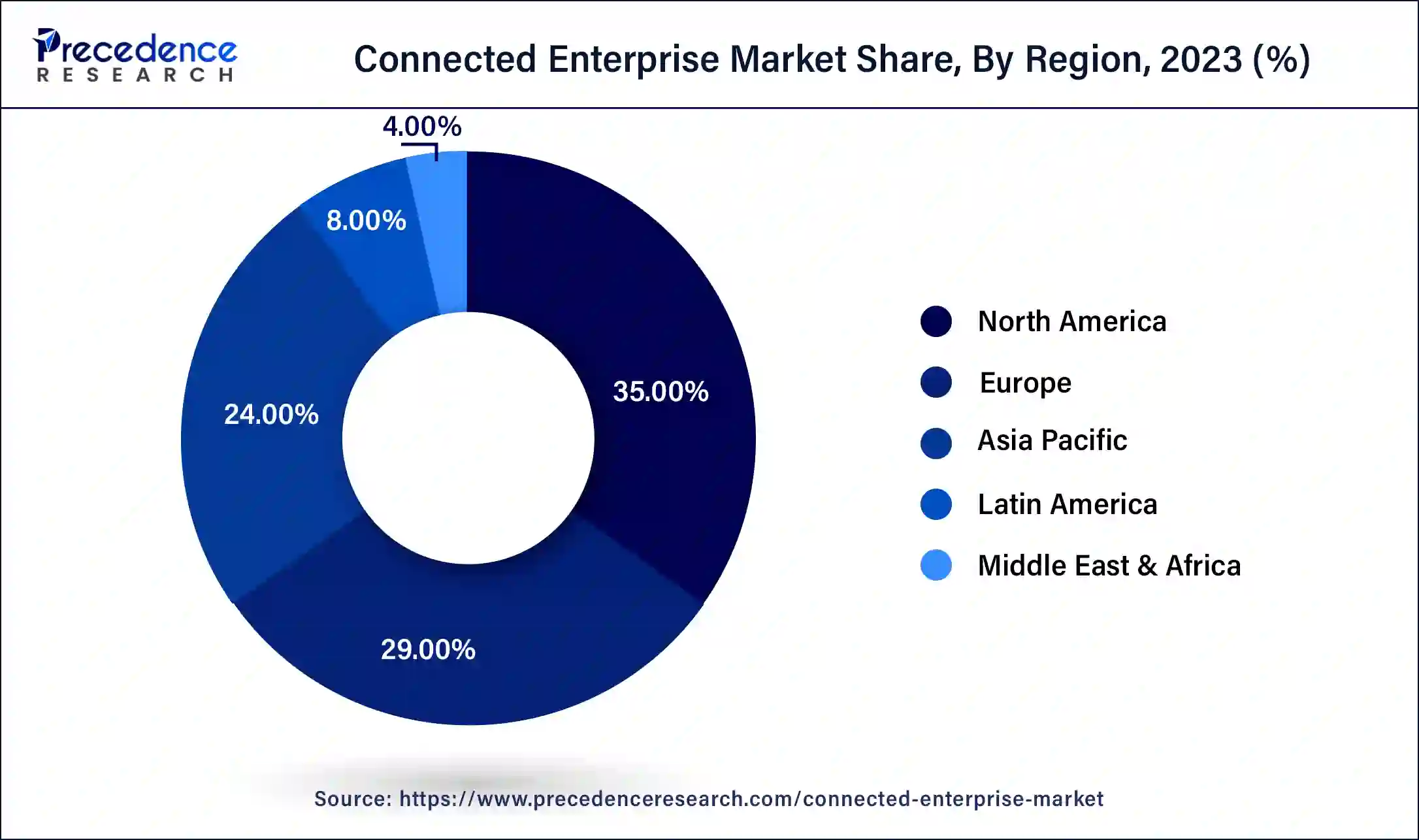

- North America dominated the connected enterprise market with the largest market share of 35% in 2024.

- Middle East & Africa are projected to host the fastest-growing market in the coming years.

- By component, the services segment held a dominant presence in the market in 2024.

- By component, the platform segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By solution, the remote monitoring segment accounted for a considerable share of the market in 2024.

- By solution, the manufacturing execution systems segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By services, in 2024, the managed segment led the global market.

- By services, the professional segment is projected to expand rapidly in the market in the coming years.

- By platform, the connectivity management segment dominated the global market in 2024.

- By platform, the application enablement & development segment is projected to grow at the fastest rate in the market in the future years.

- By application, the manufacturing segment held the largest share of the market in 2024.

- By application, the food & beverages segment is projected to expand significantly in the market in the coming years.

Impact of Artificial Intelligence on the Connected Enterprise Market

The application of artificial intelligence assists organizations in enhancing the operational efficiency of the company, effective resource management, and enhancing customer experiences. They also help in the profitability of the company besides making the organizational entity competitive in the connected enterprise market. The use of AI involves receiving large amounts of data to process them in real time.

Enterprises are able to determine certain trends, probable outcomes, and other characteristics of the market that they operate in and be able to adapt effectively within a short span of time. AI with IoT devices and cloud enhances the company's connectivity in the internal mechanized structure that, in turn, enables smooth interconnectivity of the business functions. Such technological combination leads to the creation of smart products and services that redefine industries and provide new sources of revenue for enterprises.

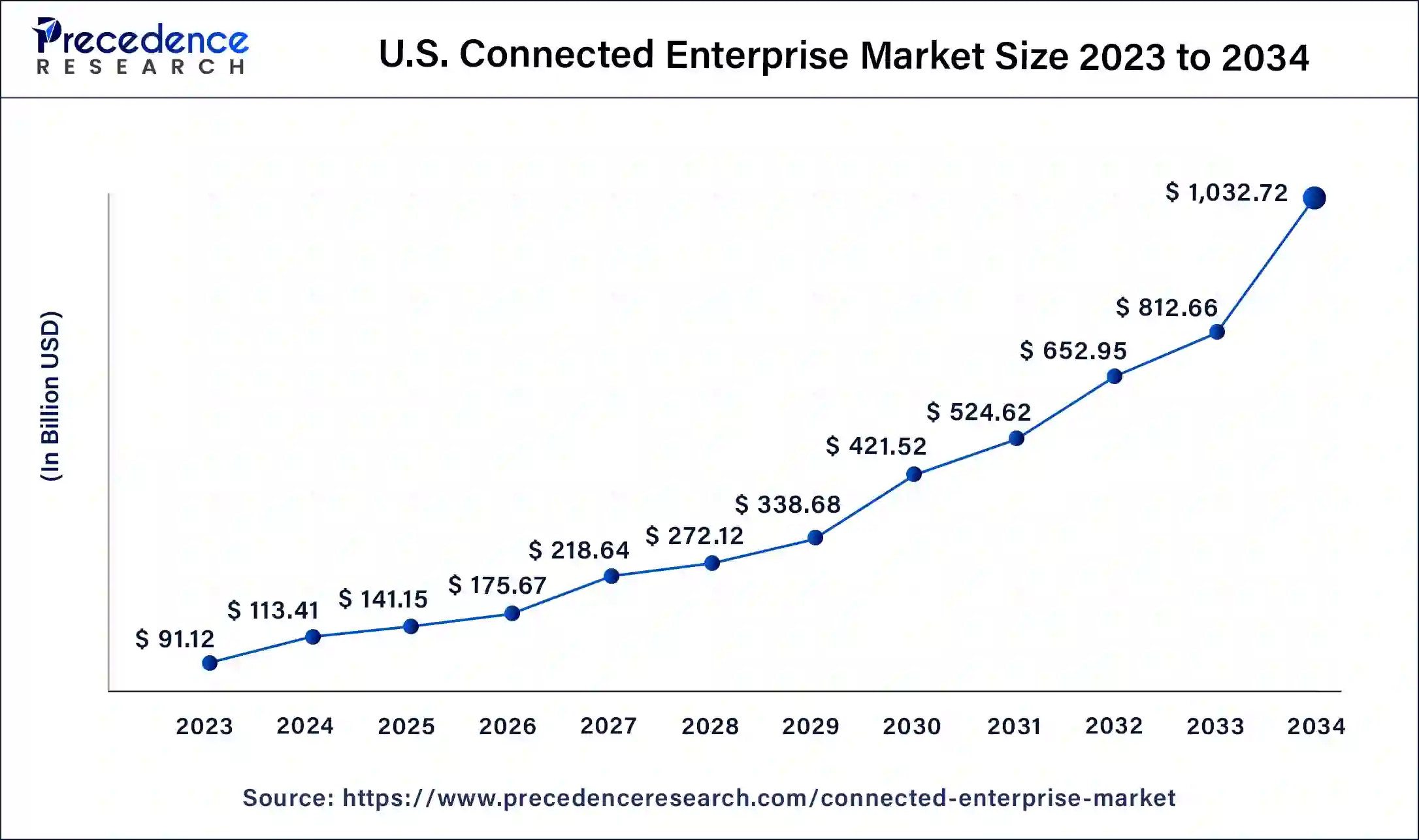

U.S. Connected Enterprise Market Size and Growth 2025 to 2034

The U.S. connected enterprise market size was valued at USD 113.41 billion in 2024 and is predicted to attain around USD 1032.72 billion by 2034, at a CAGR of 24.72% from 2025 to 2034.

North America dominated the connected enterprise market in 2024 due to the technological growth liberalization across commercial segments in the region. Organizations in both the U. S. and Canada continue to deploy connected enterprise solutions to support business operations, customer satisfaction, and information control.

The concentration of this market in North America is attributed to the region's position as an innovation hub that adopted the Internet of Things (IoT) and artificial intelligence (AI) among the first. Their need for stronger security and compliance with regulations was also considered to have greatly contributed to the popularity of connected enterprise solutions across the region.

Middle East & Africa are projected to host the fastest-growing connected enterprise market in the coming years, owing to investments in digital transformation and smart cities. Markets in Middle Eastern countries, such as the United Arab Emirates and Saudi Arabia, are expected to grow rapidly as those regions make smart cities and connectivity a key component in their development.

The oil and gas companies implementing the connected enterprise to improve on the working process and cut unnecessary expenses. Additionally, the fluctuating economy and relatively low rates of advanced ICT adoption mean that the region is an emerging market in the connected enterprises environment where the focus is on the innovation and digitalization of businesses.

Market Overview

Connected enterprise represents the pinnacle of digital transformation, where every facet of a business is seamlessly integrated through digital technology. Leveraging the Internet of Things (IoT), this approach provides invaluable insights and drives operational efficiency across various sectors. Connected enterprise fosters enhanced collaboration and innovation.

The surge in cloud computing adoption across industries, such as healthcare and automotive, further accelerates the connected enterprise market growth as organizations seek to harness its flexibility and scalability. Additionally, there is an increasing push for automation in sectors, including healthcare and banking, coupled with the growing adoption of connected technologies by small and medium-sized enterprises (SMEs).

Connected Enterprise Market Growth Factors

- The rise in cloud computing across industries enhances scalability and flexibility, driving the connected enterprise market.

- Automation in sectors, including healthcare and banking, boosts the need for integrated, efficient business systems.

- Small and medium-sized enterprises increasingly embrace the service of the connected enterprise market.

- Enhanced IoT applications provide valuable insights and operational efficiencies.

- Continuous advancements in digital technologies support more robust and integrated enterprise solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3,853.07 Billion |

| Market Size in 2025 | USD 537.70 Billion |

| Market Size in 2024 | USD 432.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 24.46% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Solution, Services, Platform, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Surging demand for cloud computing solutions

Surging demand for cloud computing solutions is likely to drive expansion in the connected enterprise market. Businesses move their operations to the cloud in the course of operations to balance growth, flexibility, and costs. Cloud platforms enhance the connection of business units so that enterprises can access and share data. It fosters working together, brings improvement in cost concerns of IT structures, and speeds up the provision of new applications and services.

A new generation of hybrid cloud solutions offers the ability to optimize an organization's IT landscapes to leverage both private and public resources. Furthermore, companies have started turning to cloud services in AI and machine learning, as these are solutions designed to give companies essential tools for further growth.

- According to the report from AAG IT Services, cloud infrastructure services have seen substantial growth from the start of 2021 to 2022. Over a 12-month period, revenues reached USD 191 billion. Spending on cloud infrastructure services increased significantly, with a 34% year-over-year (YoY) growth rate, marking the 11th time in 12 quarters that the growth rate has remained in the 34-40% range.

| Quarter | Spending (in Billions USD) | YoY Increase (%) |

| Q1 2022 | 53 | 29 |

| Q2 2022 | 57 | 29 |

| Q3 2022 | 61 | 29 |

Restraint

Hamper from high implementation costs.

High implementation costs are anticipated to hamper the growth of the connected enterprise market. Such costs include the cost of buying computers and other related hardware and software, among others, and the cost of training human resources and technical support, among others. This factor poses a major risk since smaller companies might not be able to afford the investment.

The constant need for updates and maintenance puts a burden on finances. These costs affect the opposite way, with the expected returns from investment decisions causing organizations to adopt these technologies. Moreover, corporations and small businesses are usually funded differently. Hence, this widens the digital gap.

Opportunity

Rising demand for enhanced cybersecurity

Rising demand for enhanced cybersecurity creates immense opportunities for the players competing in the connected enterprise market. Enterprises have started adopting connected technologies, thereby raising their risk profile for cyber threats that require better security solutions. The trend is that those companies that supply sophisticated cybersecurity tools and solutions that address the issue of interfaced systems and data are the ones to reap big.

Security issues hence transform into a competitive requirement that influences enterprises to adopt advanced security solutions that protect their networks and also meet compliance standards. Furthermore, two-thirds of cyber threats are new and more complex, stressing the need for constantly evolving pro-cognitive instruments.

- According to a report by Cobalt Labs, Inc., a leading cybersecurity solutions provider, worldwide cybercrime costs are estimated to reach USD 9.5 trillion in 2024, with a projected growth rate of 15% per year. The report emphasizes the urgent need for enhanced cybersecurity measures, as global cybercrime damage costs are expected to increase to USD 10.5 trillion annually by 2025.

Components insight

The services segment held a dominant presence in the connected enterprise market in 2024 due to the rising adoption of software solutions that facilitate connectivity and efficiency across enterprises. Executives wanted a suite of applications that integrate separate systems and procedures to enable near-real-time data transmission and enhance decision-making. The emergence of IoT and AI stimulated the use of these solutions even more as enterprises attempted to extend connected devices and analytics. Additionally, its ability to meet the client's various needs depending on their type of business and the kind of support that they need in their digital transformation journeys further boosts the segment.

The platform segment is expected to grow at the fastest rate in the connected enterprise market during the forecast period of 2024 to 2034, owing to the growing demand for consolidated environments that support the combination of distinct technologies. Multi-cloud and hybrid solutions seem to be in demand since they allow enterprises to be managed through multiple clouds. Businesses continue to seek platforms that deliver resilient APIs to integrate and extend the related ecosystems. Moreover, the steady increase in data produced by connected devices is expected to fuel the demand for platform solutions.

Solution insights

The remote monitoring segment accounted for a considerable share of the connected enterprise market in 2024 due to the popularity of IoT and smart connected devices in different fields. Organizations use remote monitoring systems to assess the state and productivity of their assets with a view to reducing planned and unplanned downtimes. Remote monitoring of assets also means that valued assets need less frequent check-ups, hence cutting down costs and effective utilization of resources. Furthermore, the utilization of AI and machine learning features within remote monitoring tools is also gaining momentum.

The manufacturing execution systems segment is anticipated to grow with the highest CAGR in the connected enterprise market during the studied years. Manufacturing execution systems (MES) solutions were implemented by manufacturing companies to improve the performance of their production lines, minimize interruptions, and guarantee high-quality products. These systems served as a bridge that connected the lower levels of production from the shop floor up to the enterprise level of the company. Additionally, the increasing trend of smart factories shifted the importance of MES to manufacturing enterprises, which is regarded as essential for manufacturing enterprises' digitalization.

Services Insights

The managed segment led the global connected enterprise market in 2024 due to the rising challenges of technology implementation and demand for best practices in adopting connected solutions. Organizations require outsourcing solutions for consulting, system integration, and training to achieve their objectives of connected enterprises. Furthermore, organizations are coping with the issues related to the implementation of the new technologies and their compatibility with the existing systems. Increased demand for professional services.

The professional segment is projected to expand rapidly in the connected enterprise market in the coming years, owing to the constant need to maintain and update complex infrastructures. Outsourcing of IT functions to specialist providers is a trend that has seen enterprises rightly concentrate on their core operations while being assured of optimized performance and security of their systems. Subscriptions and the increasing use of cloud services also lend themselves to managed services as organizations require solutions that expand as necessary.

Platform insights

The connectivity management segment dominated the global connected enterprise market in 2024. Enterprises targeting connectivity management for achieving smooth, secure, and autonomous data transport throughout their networking. Furthermore, the rise of IoT, 5G networks, and edge computing also responded to the need for enhanced connectivity management to ensure that organizations require high-performance connections geared for digital transformation.

The application enablement & development segment is projected to grow at the fastest rate in the connected enterprise market in the future years, owing to the need for applications that fulfill the specific requirements of various businesses. Businesses continue to spend money on technologies and solutions that provide agility to develop and host applications that facilitate business operations, customer satisfaction, and innovation. Additionally, low code/no code development platforms are used by organizations to build their applications with little coding skills.

Application Insight

The manufacturing segment held the largest share of the connected enterprise market in 2024 due to the growing trend of Industry 4. 0 technologies and the uptrend in operation necessities. Manufacturers aimed to optimize interconnected systems to improve production lines, cut losses, and improve the quality of products. Technological advancements in the industry, including the realization of smart factories where different machines and systems are connected in real-time, have helped this segment. Furthermore, the need for automation, maintenance, and supply chain also influenced manufacturing to develop connected solutions.

Tthe food & beverages segment is projected to expand significantly in the connected enterprise market in the coming years. It is evident that the sector gradually incorporates connected technologies to enhance food safety, traceability, and supply chain performance. Consumers are increasingly demanding transparent and sustainable solutions as well as products, thus the need for connected solutions that improve traceability and minimize waste.

Connected Enterprise Market Companies

- UiPath

- Rockwell Automation, Inc.

- PTC

- MindTree Ltd.

- IBM

- Honeywell International Inc.

- GE Digital

- Cisco Systems

- Bosch GmbH

- Accelerite

Recent Developments

- In April 2024, AVEVA, a global leader in industrial software driving digital transformation and sustainability, has chosen Hannover Messe to unveil CONNECT, the world's fastest-growing industrial intelligence platform. CONNECT provides trusted and actionable insights to decision-makers in diverse sectors. It empowers industrial leaders with a deeper understanding of their business and an intelligent digital twin that unifies insights across their industrial ecosystem.

- In March 2023, Wipro Limited, a leading technology services and consulting company, announced the launch of its ‘5G Def-i' platform. This integrated platform empowers businesses to seamlessly transform their infrastructure, networks, and services. The platform will debut during the MWC Barcelona panel ‘Realizing the Ambitions of the Connected Enterprise.' Many organizations have failed to maximize their return on connectivity investments due to the challenge of bringing 5G services close to the enterprise edge.

Segments Covered in the Report

By Component

- Services

- Solution

- Platform

By Solution

- Customers experience management

- Business analytics

- Remote monitoring

- Manufacturing execution systems (MES)

- Application value management

By Services

- Managed

- Professional

By Platform

- Application enablement & development

- Device management

- Connectivity management

By Application

- BFSI

- Manufacturing

- Retail

- Healthcare

- IT & telecom

- Food & beverage

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client