November 2024

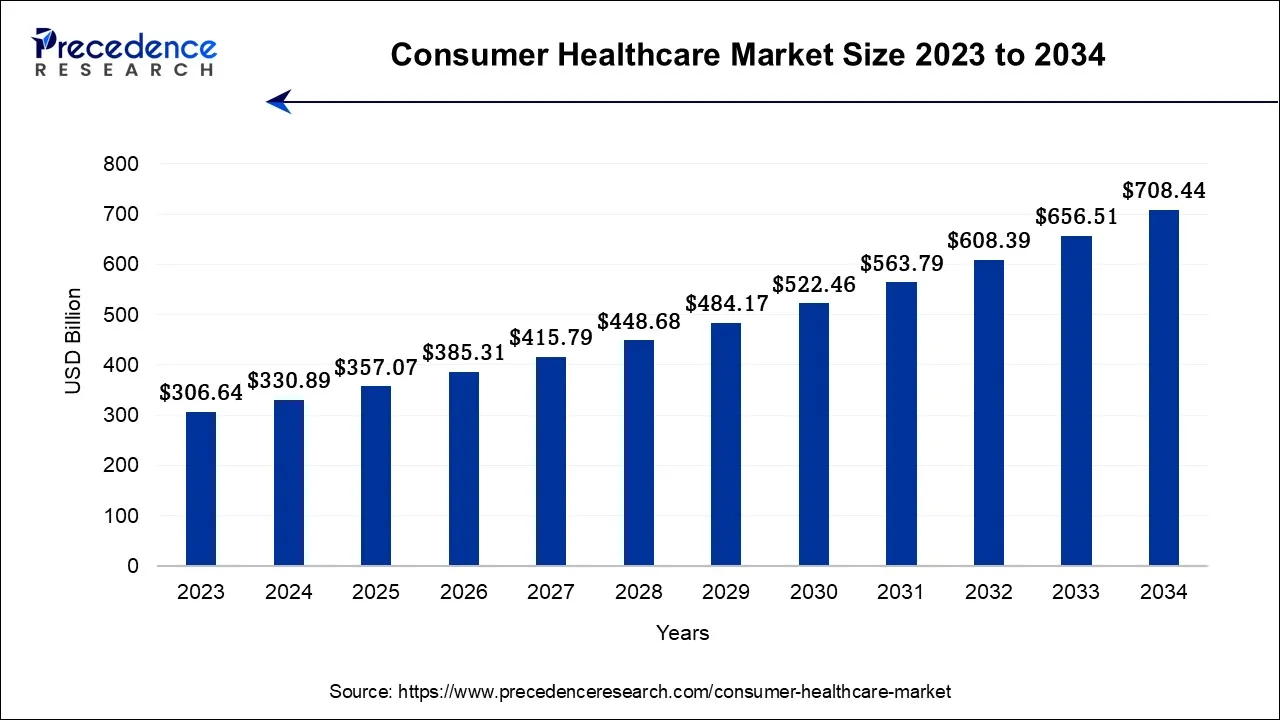

The global consumer healthcare market size accounted for USD 330.89 billion in 2024, grew to USD 357.07 billion in 2025 and is projected to surpass around USD 708.44 billion by 2034, representing a healthy CAGR of 7.91% between 2024 and 2034

The global consumer healthcare market size is calculated at USD 330.89 billion in 2024 and is expected to hit around USD 708.44 billion by 2034, growing at a CAGR of 7.91% from 2024 to 2034.

Consumer healthcare is seen as one of the emerging segments of the healthcare industry. The consumer healthcare market generally offers numerous healthcare services and products where decisions about purchase and usage are taken by the consumers without requiring any specific prescription from the healthcare professional. The major patient base offered to the global consumer healthcare market is the one seeking for pain relief, nutrition and wellness and overall health improvement products in the form of drugs, supplements or powders.

The consumer healthcare market covers the development and distribution of over the counter drugs and vitamins, herbal products, ayurvedic products and multiple health supplements. The consumer healthcare market is expanding due to the innovation in the upcoming new technologies such as tech wearables and wellness and fitness services. The global consumer healthcare market is again supported by the rising awareness about healthcare solutions, early diagnosis of diseases and intervention of multiple healthcare platforms, especially online platforms. The availability of medical content on online platforms and digital channels promotes the growth of the market.

The increasing costs of healthcare services and the rising pressure on healthcare professionals or staff during the emergencies like pandemic has boosted the demand for consumer healthcare solutions from the overall healthcare sector in recent years. Increasing demand for patient-centric treatments and improvements in the healthcare infrastructure will result in the growth of the consumer healthcare market in the forecast period. Moreover, the booming digitization in the healthcare industry is seen as another growth factor in the global consumer healthcare market.

The Covid-19 pandemic majorly contributed to the growth of the consumer healthcare market across the world. The pandemic had a significant impact on the consumption of healthcare services. For instance, the sale of Vitamin C and preventive drugs doubled in 2022. The increase in online channels for the purchase of medicines in healthcare services is observed to be expanding continuously since the pandemic, the element contributes to the growth of the market.

The market has witnessed a major challenge associated with the reach and expansion in underdeveloped areas. However, the rising education and awareness about healthcare systems and services in these areas has started addressing the challenge. The growth of the market is mainly attributed to the rising population across the world and rise in the chronic diseases will highly contribute to the demand for the consumer healthcare market.

| Report Coverage | Details |

| Market Size by 2034 | USD 708.44 Billion |

| Market Size in 2024 | USD 330.89 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.91% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 To 2034 |

| Segments Covered | Product, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rapid adoption of telehealth and telemedicine

To ensure social isolation, many healthcare systems throughout the world have adopted telemedicine since the outbreak of Coronavirus. Since the time of pandemic, patients have started seeking virtual healthcare which is increasing at an unprecedented rate in China, the United States, and Europe. Several digital healthcare platforms are available in European countries to meet this demand. The growing popularity of online platforms for healthcare advice has provided a definite platform for consumer healthcare product distributors for marketing their products according to the patients’ requirement. Many of these distributors are collaborating with healthcare professionals to meet the desired consumer base. This element offers an opportunity for the innovation of consumer healthcare products by driving the growth of the market.

Issues with expansion in underdeveloped areas

The major challenge for the expansion of the consumer healthcare market is caused due to the lack of awareness about underlying health conditions among people. In underdeveloped areas or regions, lack of adequate healthcare infrastructure and weaker economies often create obstacles for the consumer healthcare market players to distribute products and services. Moreover, shortage of digitized solutions and lack of knowledge about online healthcare platforms also limit people from adopting such products. The expansion of the market is also limited in such areas due to skepticism about the consumption of new products. Thus, the factor is observed to hamper the market’s growth.

Booming e-commerce platforms

The availability of consumer healthcare products on online platforms or e-commerce sites is offering massive opportunities for the market. For consumer healthcare organizations, new digital opportunities across every aspect of the value chain, such as increasing e-commerce channels, have set up new routes for reaching new client groups and reinforcing current ones. Multiple supplementary items have seen increased purchasing rates across e-commerce channels as digital medical and health website traffic and online orders have increased dramatically.

Major pharmacy stores have already introduced omnichannel retailing initiatives, integrating their physical and digital sales channels to provide consumers with additional options, the advantages of shopping on these platforms include door-step delivery, a wider product selection, potentially reduced costs due to fewer overheads compared to physical stores, and freedom from pharmacy store pressure. Thus, booming e-commerce businesses are observed to offer opportunities for the consumer healthcare market to grow.

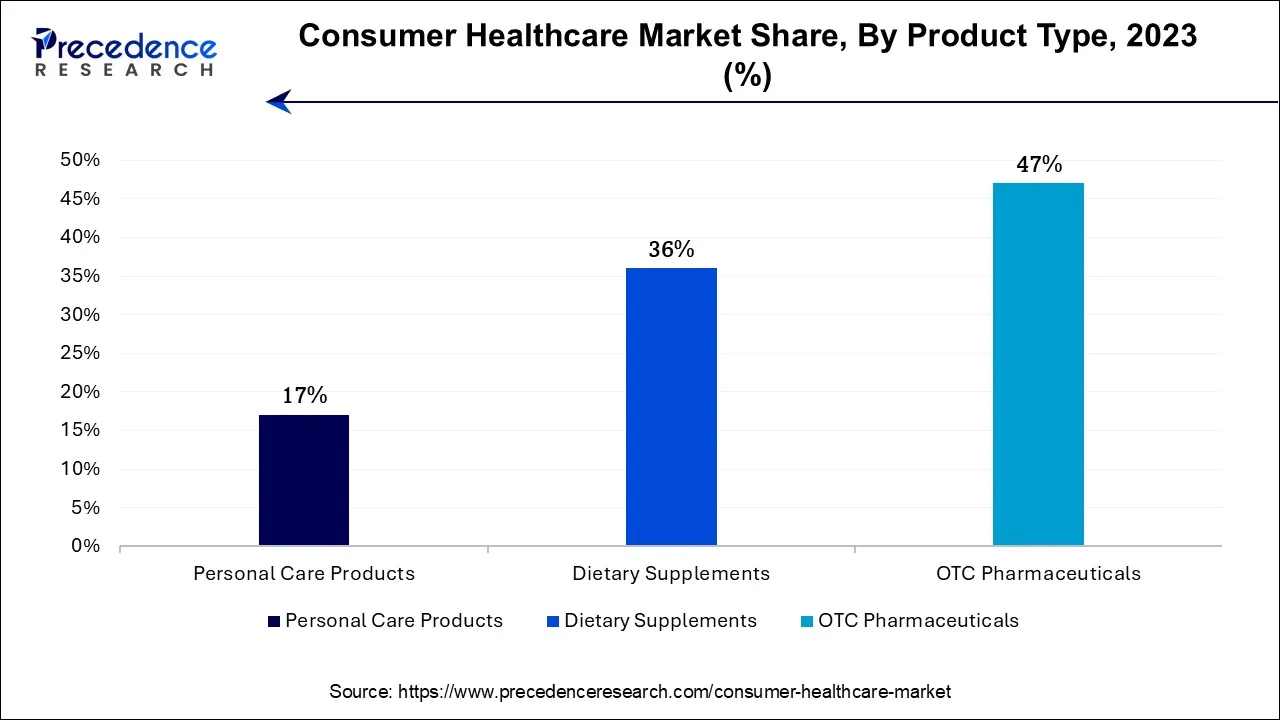

The OTC pharmaceutical segment dominated the market with the highest market share in 2023 the segment is expected to grow at a significant rate during the forecast period. The increasing tendency of self-medication in the population will result in the growth of the segment. OTC refers to over-the-counter medicines or it is also referred to as nonprescription medicines. These medicines are generally taken without prescription, it is completely safe and should be taken according to the guidance of the physicians and the direction written on the label. The increasing use of OTC drugs by the consumer due to easy availability and rising use of self-medication driving the growth of the segment.

The personal care segment is expected to witness a notable rate of growth during the forecast period. The growth of the segment is attributed due to the rising awareness about the personal care and rising beauty standards among consumers. Moreover, the rising number of appearance-conscious consumers across the globe is observed to be a major factor behind the expansion of the segment.

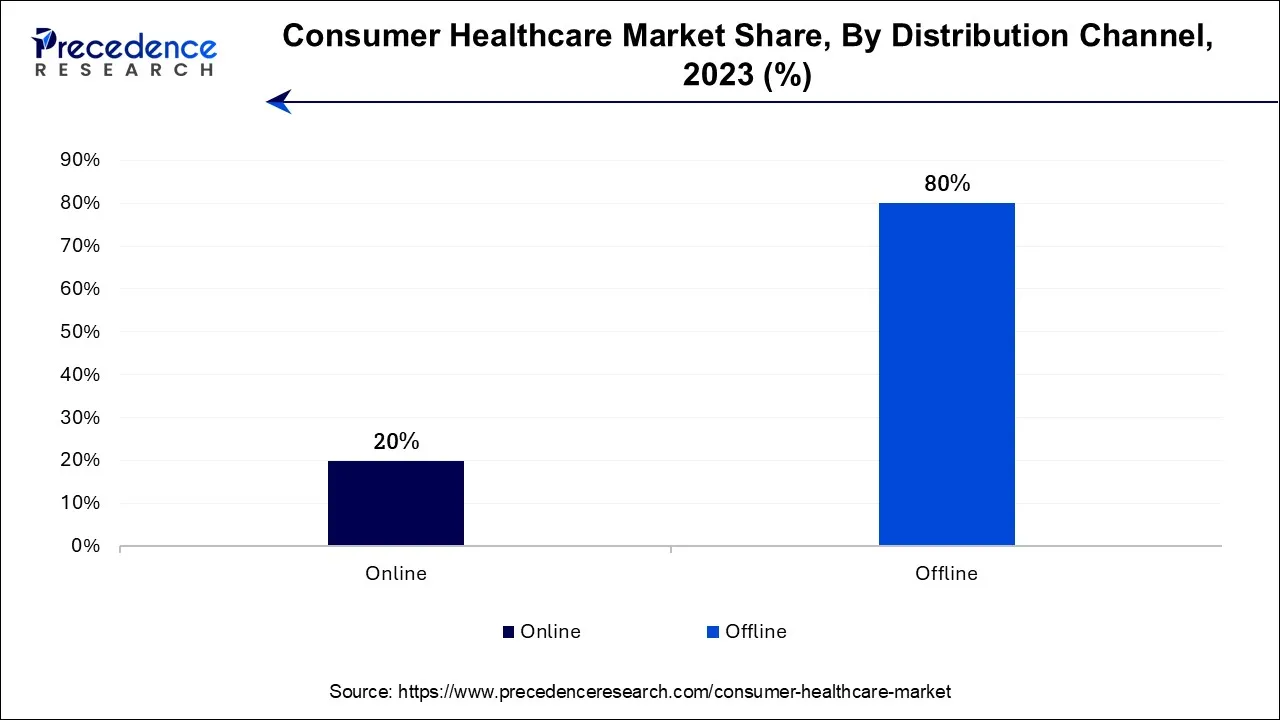

The offline segment dominated the market with the highest revenue size in 2023. The easy availability of healthcare products at pharmacies or stores drives the growth of the segment, the use of the offline healthcare segment as the traditional type in the healthcare industry has supported the segment to expand. Moreover, the offline pharmacies and stores have achieved consumer trust which is happened to be the major factor behind the segment’s dominance.

The online segment is expected to grow at a notable rate during the forecast period. The rising availability of online platforms for pharmaceutical and other healthcare products across the globe, especially in urban areas is driving the growth of the segment. The online platforms offering healthcare products and services aggregate the information about the product, schedule an appointment for telemedicine advice, and delivers products to the consumers. The overall growth of e-commerce industry will present multiple opportunities for the segment’s growth.

North America held the largest share of the market in 2023, the region is expected to sustain its dominance throughout the forecast period. The market’s growth is attribute to the increasing awareness about dietary supplements and nutrition and wellness products in the region. Moreover, multiple healthcare professionals and associated agencies have recognized the importance of consumption of supplementary products, this element supports the market’s expansion in North America.

In addition, the overall presence of strong regulatory framework for the research and developments of consumer healthcare products has supplemented the growth of the market in North America. Manufacturers and distributors of dietary supplements and ingredients in the United States are bind with multiple strict guidelines, this promotes the distribution of reliable products in the country while achieving consumer trust.

The United States-based, consumer healthcare Products Association stated in May 2023, the US Food and Drug Administration has approved the over-the-counter nasal spray, Narcan. The Association applauded the approval by FDA for the product to be available for public without any prescription which was previously available on only prescription basis.

Asia Pacific is expected to grow at a significant rate during the forecast period. The rising population, growing health issues and rising awareness about health among the population promote the growth of the market in the region. Moreover, the presence of multiple potential players to invest in research and development of consumer healthcare products will supplement the growth of the market.

Asia Pacific, especially India is a home to multiple herbal and organic products since the ancient period. The availability of ingredients for herbal healthcare products and the potential for research and development for the same is attracting major investors, local and international in the market.

The booming e-commerce industry in the region promotes the distribution of consumer healthcare products in Asia Pacific, which is observed to act as a major driver for the market’s expansion in the upcoming years. The presence of a geriatric population with multiple health conditions, especially deficiencies has force healthcare professionals to consider consumer healthcare products as a supplementary solution for ageing population. This element contributes to the market’s growth.

Segments Covered in the Report

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

January 2025

September 2024