April 2025

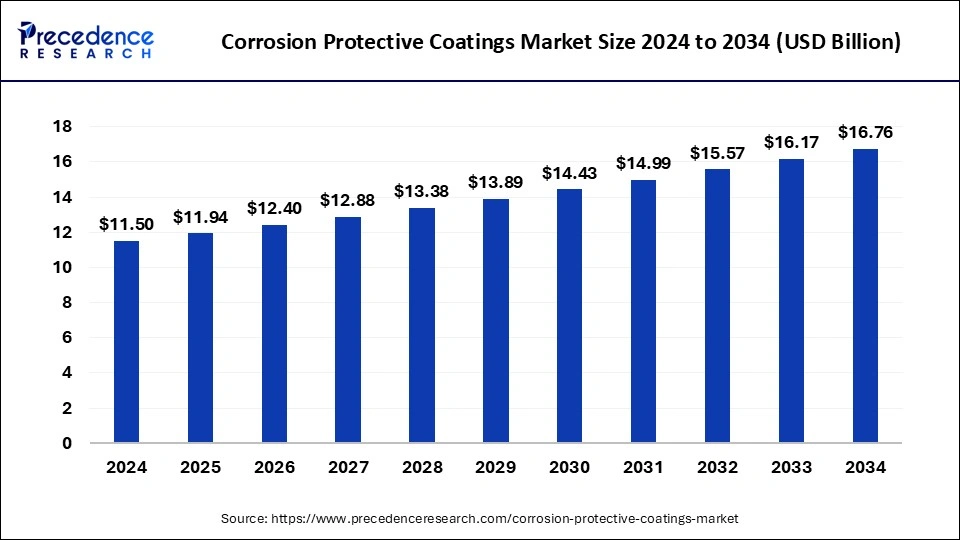

The global corrosion protective coatings market size is calculated at USD 11.94 billion in 2025 and is forecasted to reach around USD 16.76 billion by 2034, accelerating at a CAGR of 3.84% from 2025 to 2034. The Asia Pacific corrosion protective coatings market size surpassed USD 6.21 billion in 2025 and is expanding at a CAGR of 3.94% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global corrosion protective coatings market size was estimated at USD 11.50 billion in 2024 and is predicted to increase from USD 11.94 billion in 2025 to approximately USD 16.76 billion by 2034, expanding at a CAGR of 3.84% from 2025 to 2034. The rising application of corrosion protective coatings in oil & gas and marine industries across the world is driving the growth of the corrosion protective coatings market.

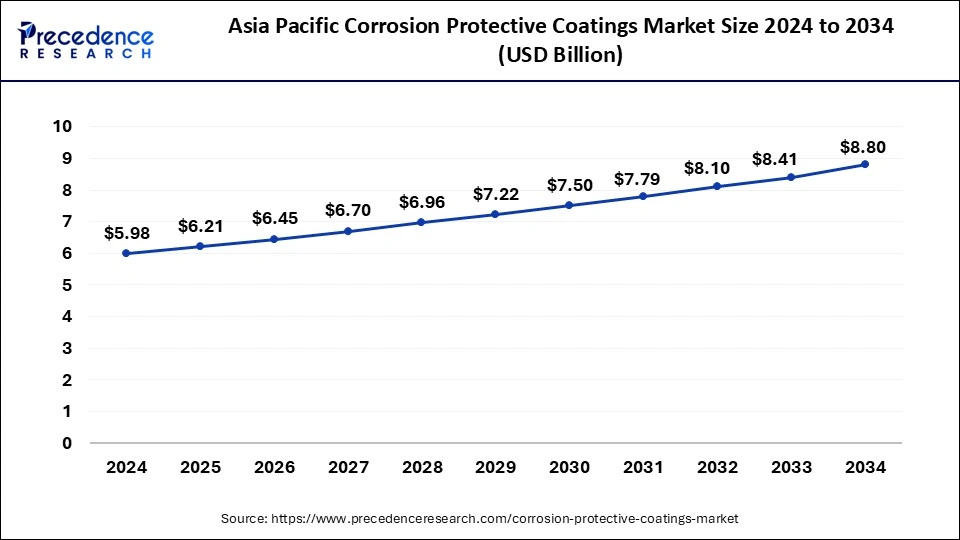

The Asia Pacific corrosion protective coatings market size reached USD 5.98 billion in 2024 and is expected to be worth around USD 8.80 billion by 2034, at a CAGR of 3.94% from 2025 to 2034.

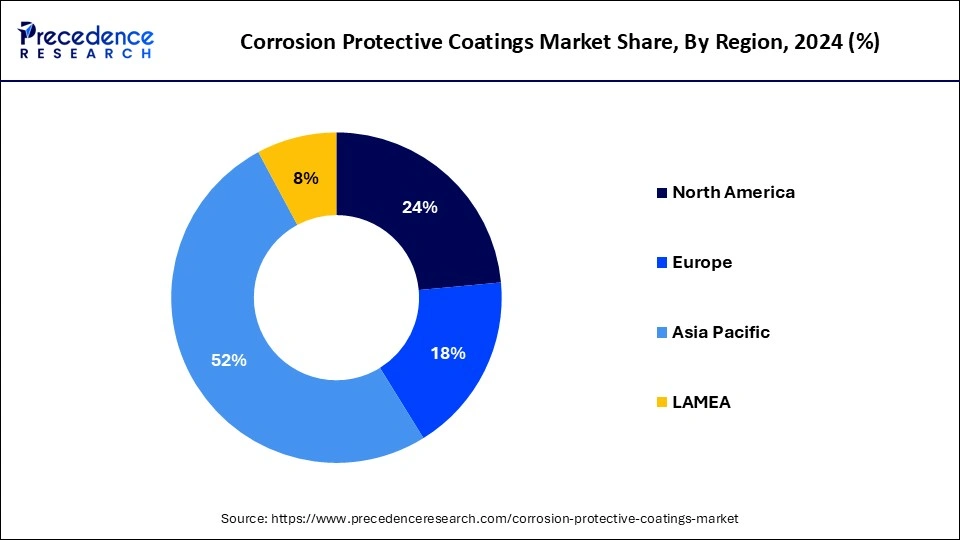

Asia Pacific holds the largest market share in 2024 and is expected to maintain its dominance throughout the forecast period. The growth of this region is mainly driven by the rising government initiatives in countries such as India, South Korea, China, Japan, and some others for developing the chemical industry. Also, growing advancements in the oil & gas and electronics industries in countries such as China, India, Indonesia, Japan, Singapore, and some others have driven the market growth. Moreover, the presence of market players such as Nippon Paint, Kansai Paint, Toa Paint, Avian Brands, and some others have driven the growth of the corrosion protective coatings market.

North America is expected to be the fastest-growing region during the forecast period. The growth of this region is mainly driven by the scientific advancements in the aerospace sector in countries such as the U.S., Canada, and others. Also, the growing interest from the public and private sectors for development & research related to coating industries has boosted the market growth. The market growth is also driven by the rising construction of roads and bridges, along with the presence of a well-established automotive industry in this region. Moreover, the presence of coating companies such as Axalta Coating Systems, PPG Industries, Sherwin Williams, Benjamin Moore, and others drives market growth.

The corrosion protective coatings market is one of the most important industries of the chemical sector. This industry deals in developing coatings that possess anti-corrosive properties for use in several end-user industries, including automotive, marine, oil and gas, aerospace, power generation, and others. There are several technologies involved in manufacturing corrosion protective coatings, which mainly include organic coatings, inorganic coatings, and metallic coatings. These coatings also consist of several applications, such as spray coating, brush/roller coating, dip coating, powder coating, electroplating, and others. This industry is expected to grow exponentially with the growth in the chemical industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.76 Billion |

| Market Size in 2025 | USD 11.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.84% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Coating Technology, Surface Type, Application, Environment and Exposure Conditions, End-Use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising trend of electric vehicles (EVs)

The automotive industry has developed drastically with the advancements in modern technologies. Currently, the adoption of electric vehicles (EVs) is an ongoing trend that is shaping the automotive sector positively. The demand for EVs has increased rapidly in recent times due to rising awareness regarding environmental problems along with increasing prices of fossil fuels. Also, automotive manufacturers have started manufacturing EVs that are affordable and come with superior features. Moreover, the governments of several countries are allowing tax exemptions for adopting EVs along with launching initiatives to strengthen the EV infrastructures. Thus, with the growing demand for EVs, the demand for corrosion protective coating increases due to several applications in charging infrastructure, cooling systems, battery enclosures and connections, electrical contacts and connectors, and others. This, in turn, drives the growth of the corrosion protective coatings market.

Less affordability and strict compliance

The prices of raw materials such as pigments, additives, zinc oxide, resin, solvents, and some others have increased in recent times. Also, the workforce engaged in coatings industries lacks high skills, and their wage rates are also growing gradually. Thus, with the rise in wage rates and raw material prices, the coating companies have to increase the prices of the end products to earn maximum profits. This, in turn, restrains the market growth. Moreover, there are several government policies that forbid the use of volatile organic compounds (VOCs), which are important for the coating industry and are expected to restrain the growth of the corrosion protective coatings market during the forecast period.

Innovations in coatings

The coating industry has been growing rapidly with the development of science and technology in recent times. Recently, scientists have developed smart coatings that find applications in several industries. Smart coatings are integrated with nanomaterials that provide added functions such as stimuli response or environment sensing. Thus, rising innovations in smart coatings are expected to create ample growth opportunities for market players in the future.

The organic coatings segment held the largest market share in 2024 and is expected to continue its dominance during the forecast period. The main types of organic coating include epoxy-based coatings, polyurethane-based coatings, acrylic-based coatings, alkyd-based coatings, and others. Epoxy-based coatings are mainly used as strong adhesives in the automotive industry. Polyurethane-based coatings are used in several industries, including marine, oil-based, furniture, and some others. Acrylic-based coatings are fast-drying coats that are mainly used for architectural and decorative purposes. Alkyd-based coatings are used in interior trim, cabinets, doors, and other regularly used objects that require smooth durability. Thus, the growth of the organic coatings segment is expected to drive the growth of the overall corrosion protective coatings market.

The inorganic coatings segment is estimated to be the fastest-growing segment during the forecast period. The main types of inorganic coatings include zinc-rich coatings, aluminium-rich coatings, phosphate coatings, silicate coatings, and others. Zinc-rich coatings are mainly used on steel surfaces for protection against corrosion. Aluminum-rich coatings are widely used in naval operations as they provide chemical protection against sulfur oxides (SO2, SO3) and hydrogen sulfide (H2S). Phosphate coatings are mainly used in military equipment, cars, washing machines, toys, refrigerators, and some others, as they provide protection against corrosion. Silicate coatings are found to be applicable to plastering during the construction of buildings as they are highly durable and require less maintenance. Thus, growing developments in inorganic coatings are likely to boost the growth of the corrosion protective coatings market.

The metal substrates segment dominated the market in 2024 and is expected to continue its dominance during the forecast period. The growth of this segment is generally driven by the rising use of metal substrates in aerospace industries to improve corrosion and heat resistance in aerospace components. Also, growing advancements in the electroplating process are also expected to drive market growth. Moreover, the growing adoption of metal substrates in automotive and oil & gas industries is further expected to boost the growth of the corrosion protective coatings market.

The concrete substrates segment is expected to grow with the highest CAGR during the forecast period. The growth of this segment is generally driven by the rising number of construction activities across the world. Also, the growing demand for concrete substrates due to properties such as high tensile strength and fast drying is driving the growth of the corrosion protective coatings market.

The spray coatings segment dominated the market in 2024. The growth of this segment is driven by the growing demand for spray coatings in the automotive and healthcare industries. Also, the rising use of gas turbines in helicopter engines, ships, tanks, and railway locomotives has increased the demand for spray coatings, thereby driving the market growth. Moreover, spray coating provides high temperature and corrosion resistance properties to protect engine components in automobiles, which are likely to drive the growth of the corrosion protective coatings market.

The powder coatings segment is estimated to grow with the highest CAGR during the forecast period. The growth of this segment is generally driven by the rising demand for eco-friendly coatings across the world. Also, the growth of the market can be attributed to the growing use of powder coatings in electronic appliances such as washing machines, freeze liners, air conditioners, and others. Moreover, rising applications of powder coating in electric vehicles for battery protection are driving the growth of the corrosion protective coatings market.

The atmospheric conditions segment held the largest market share during the forecast period. The growth of this segment is mainly driven by the growing impacts of natural calamities such as excessive rain, heavy wind, and UV radiation. Also, growing developments in the production of coatings that can withstand harsh environmental conditions are driving the growth of the corrosive protective coatings market.

The high-temperature applications segment is expected to be the fastest-growing segment during the forecast period. The growth of this segment is generally driven by the rise in the number of power generation and oil & gas industries. Also, the coating companies are manufacturing high-grade thermal resistance coatings that can withstand extreme heat, which has driven the growth of the corrosive protective coatings market.

The oil & gas segment dominated the market in 2024. The growth of this segment is generally driven by the growing number of oil & gas exploration centers across the world. Also, corrosion protective coatings provide temperature resistance, abrasion resistance, chemical resistance, and some others for protection of machinery used in oil & gas industries, thereby driving the market growth.

The infrastructure segment is expected to be the fastest-growing segment in the corrosion protective coatings market. The growing number of buildings across the world is driving the market growth. Also, corrosive protective coatings act as a barrier between corrosive elements and metal substrates that help in increasing the service life of infrastructures, thereby driving the growth of the corrosive protective coatings market.

By Coating Technology

By Surface Type

By Application

By Environment and Exposure Conditions

By End-Use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

January 2025