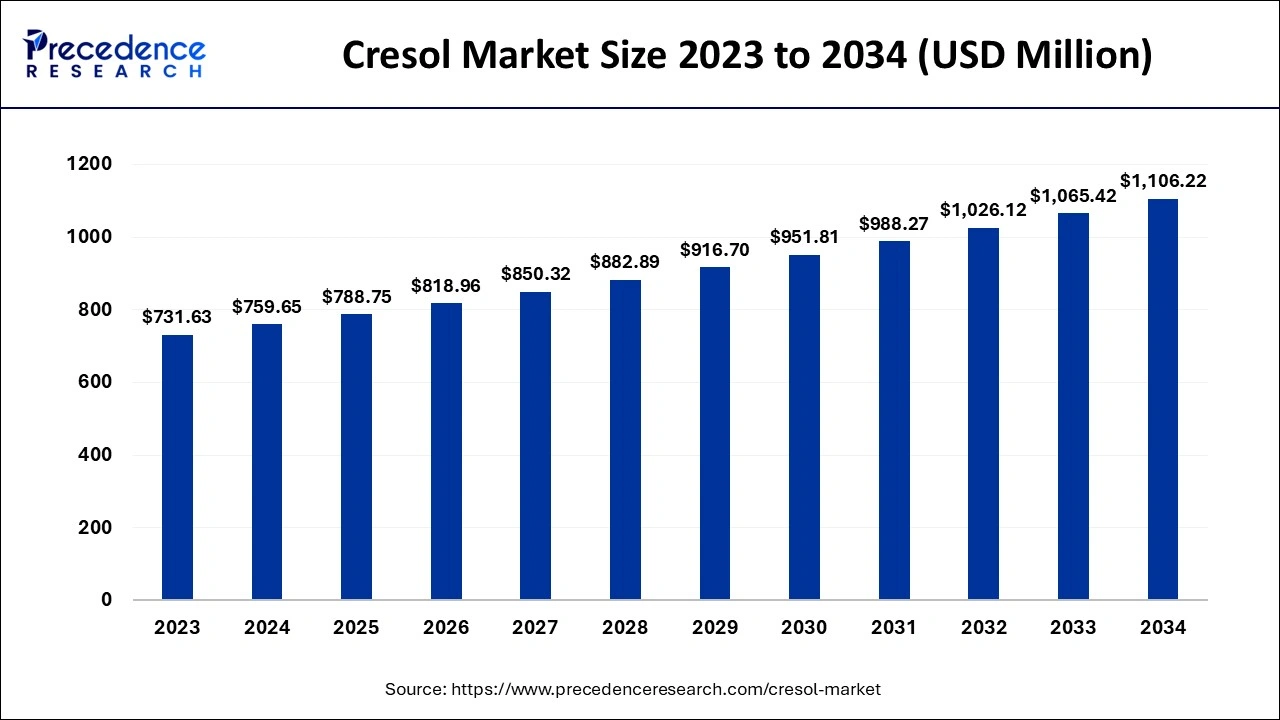

The global cresol market size accounted for USD 759.65 million in 2024, grew to USD 788.75 million in 2025 and is predicted to reach around USD 1,106.22 million by 2034, registering a CAGR of 3.83% between 2024 and 2034. The Asia Pacific cresol market size is evaluated at USD 334.25 million in 2024 and registering a CAGR of 3.94% during the forecast year.

The global cresol market size is calculated at USD 759.65 million in 2024 and is expected to exceed around USD 1,106.22 million by 2034, growing at a CAGR of 3.83% from 2024 to 2034. The growing demand for chemicals in various industries, such as flavors and fragrances, pharmaceuticals, and resins, is the key factor driving the Cresol market growth. Also, the surge in the use of Cresol for producing various chemical products, coupled with the rising use of products in making pesticides, can fuel market growth further.

The Cresol market is experiencing growth fuelled by artificial intelligence which enhances the convenience of the operations of the business also strengthens the customer relationship which enables greater fidelity and engagement as customers can be able to interact in a more personalized manner. Furthermore, AI applications such as process optimization, predictive maintenance, molecular modeling, and virtual screening can transform Cresol production.

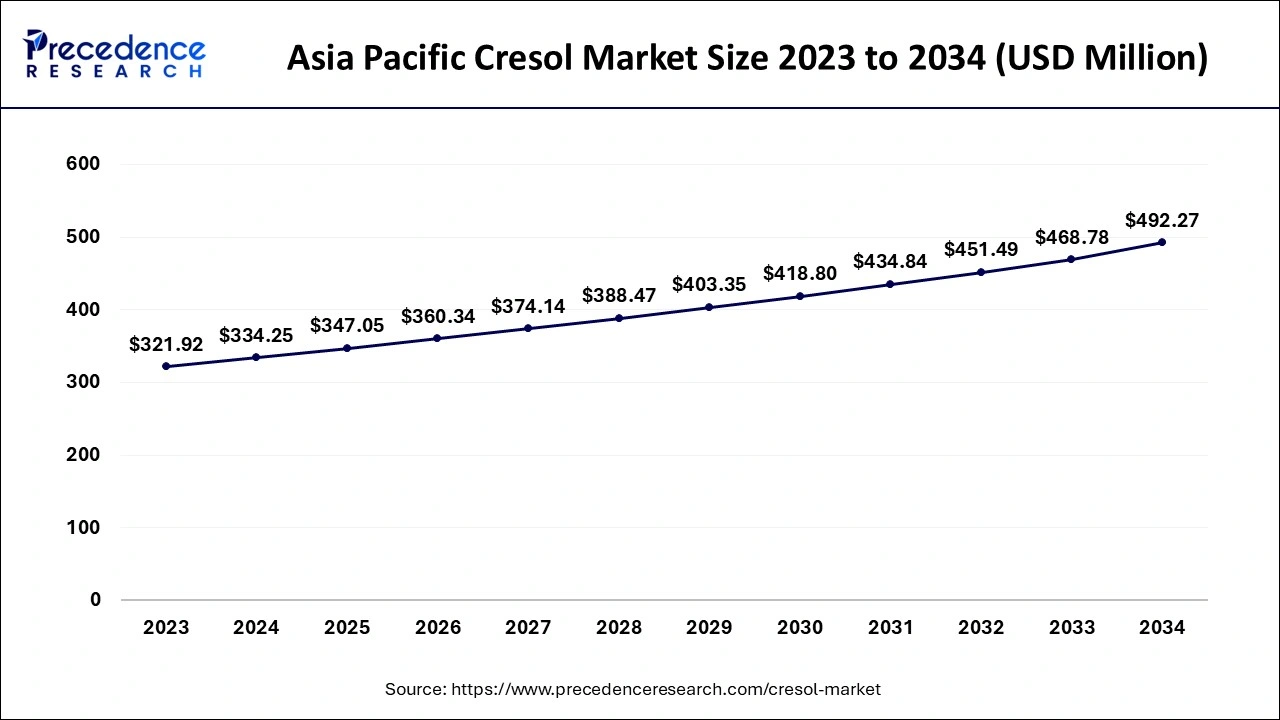

The Asia Pacific cresol market size is exhibited at USD 334.25 million in 2024 and is projected to be worth around USD 492.27 million by 2034, growing at a CAGR of 3.94% from 2024 to 2034.

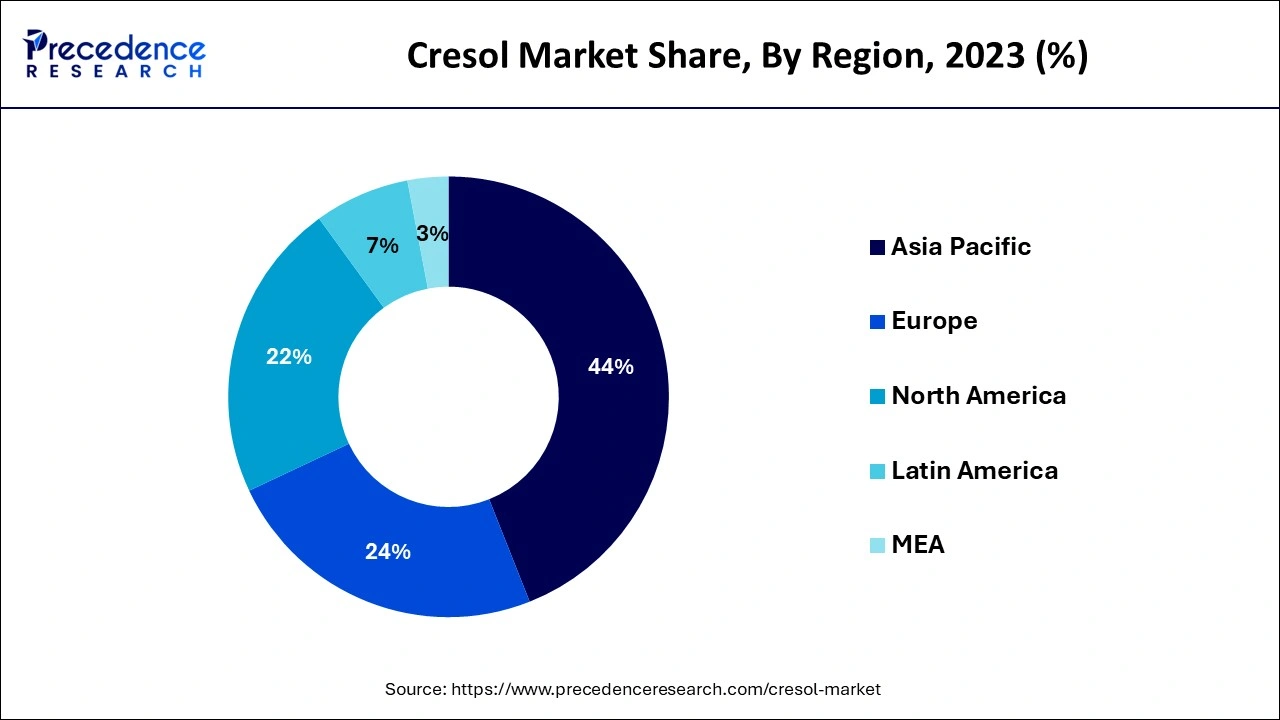

Asia Pacific dominated the global Cresol market in 2023. The dominance of the region can be attributed to the growing requirement for personal care products and the huge consumer population. Also, there is a rising emphasis on infrastructure development in countries such as India and China. Drives the adoption of epoxy resins extracted from Cresol. Furthermore, the agrochemical, pharmaceutical, and automotive sectors are expanding, and they heavily depend on Cresol-based processes.

North America is expected to experience the fastest growth in the Cresol market over the projected period. The growth of the region can be linked to the surge in demand for Cresol in various products, like intermediates, preservatives, and chemical disinfectants. Moreover, the growing production of resins, herbicides, and pesticides with Cresol is estimated to fuel market growth in the region soon. In North America, the U.S. led the market owing to the rising focus on energy efficiency and renewable energy, which has s resulted in a surging need for Cresol-containing insulation materials.

Cresol, known as hydroxytoluene, is a group of organic compounds. Cresol is also called acrylic acid. Cresols occur extensively in nature. The presence of Cresol in water and soil is very low. Most of the emissions are released from vehicle exhaust in populated cities with many gas stations. In addition, Cresol is corrosive and can cause gastrointestinal corrosive injury and cutaneous damage. Cresol is used as a disinfectant, pesticide, antiseptic, and antiparasitic agent in veterinary medicine. Some Cresol polymers can be used as a preservative in pharmaceutical preparations.

Top 5 chemical manufacturers ranking with sales, 2023

| Company | Sales 2023 (USD million) |

| BASF | 76137 |

| Sinopec1 | 72528 |

| Dow | 44622 |

| LG Chem | 42598 |

| LyondellBasell | 41107 |

| Report Coverage | Details |

| Market Size by 2034 | USD 1,106.22 Million |

| Market Size in 2024 | USD 759.65 Million |

| Market Size in 2025 | USD 788.75 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.83% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing demand for high-capacity Cresol

Cresol market vendors are launching large storage capacity products, particularly for applications that require storing huge amounts of data like video surveillance systems, drones, and action cameras. The trend of gathering high-definition video and images by deploying automation technologies across various sectors impacts market growth positively. In addition, innovations in nanotechnology have led to the designing of nano-sized Cresol particles, which provide improved properties and applications in many sectors.

Side effects of Cresol

The Cresol market products may cause serious allergy to the skin. A little exposure can even cause skin rash and itching. Cresols can damage the kidneys and liver. Long-term exposure can cause chronic poisoning, with symptoms such as loss of appetite, swallowing diarrhea, headache, and dizziness. Moreover, Cresol is an essential raw material that is extracted from petroleum feedstocks and coal, so any variation in the prices of this material can substantially influence the overall production cost.

Cresol-based insecticides

These insecticides provide an efficient solution for both residential and agricultural environments to efficiently tackle pest control issues, with notable effectiveness against flies and mosquitoes being killed by this product effectively. Furthermore, Cresol insecticides can become great solutions in pest management strategies. In the pharmaceutical and healthcare sector, Cresol’s antiseptic characteristics have lucrative opportunities for the Cresol market.

Surge in green chemistry

The Cresol market is increasingly adopting green chemistry principles, as there is an escalating opportunity for M-Cresol to be created from renewable resources. The trend towards sustainable chemicals is becoming more popular in different sectors, such as agrochemicals and pharmaceuticals. In addition, players who invest in eco-friendly production processes may attract a new consumer base and improve their competitive edge.

The p-Cresol segment dominated the global Cresol market in 2023. The dominance of the segment can be attributed to the increasing use of p-Cresol in agricultural and pharmaceutical chemicals as a solvent in many chemical processes. It is extensively used as a major player in the creation of herbicides and insecticides, along with the development of antiseptics and disinfectants. The important role of p-Cresol in the agrochemical industry is the rising demand for innovative healthcare products.

The m-Cresol segment is anticipated to show the fastest growth in the Cresol market over the forecast period. The dominance of the segment can be credited to the growing need for meta-Cresol in consumer goods and automotive industries, where it's essential in enhancing material durability. Additionally, the expanding pharmaceutical industry relies largely on m-Cresol to create intermediates and vital drugs.

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client