April 2025

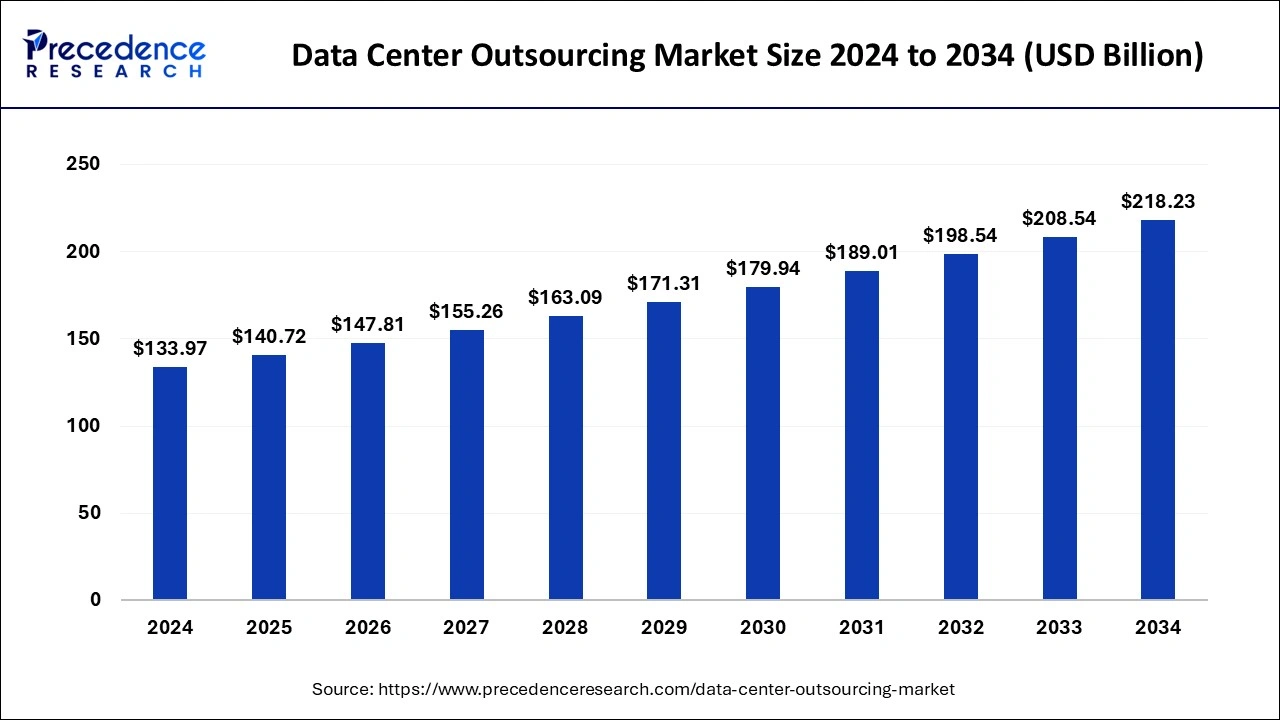

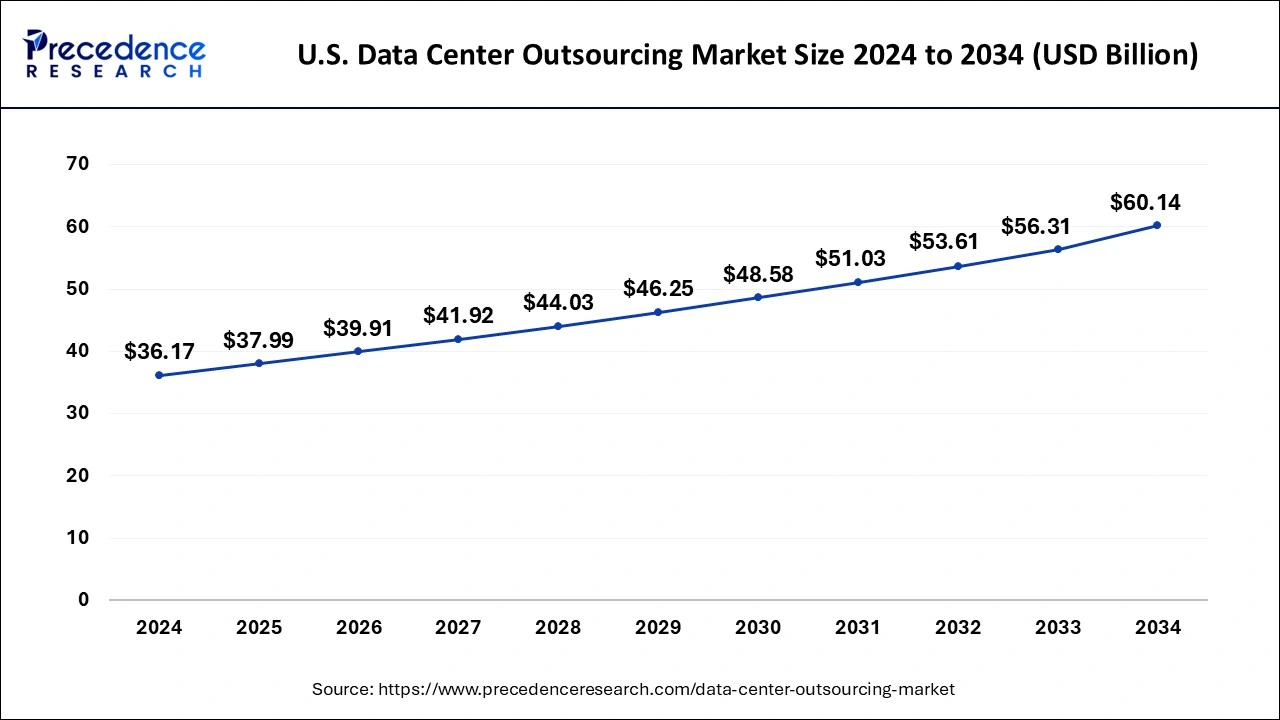

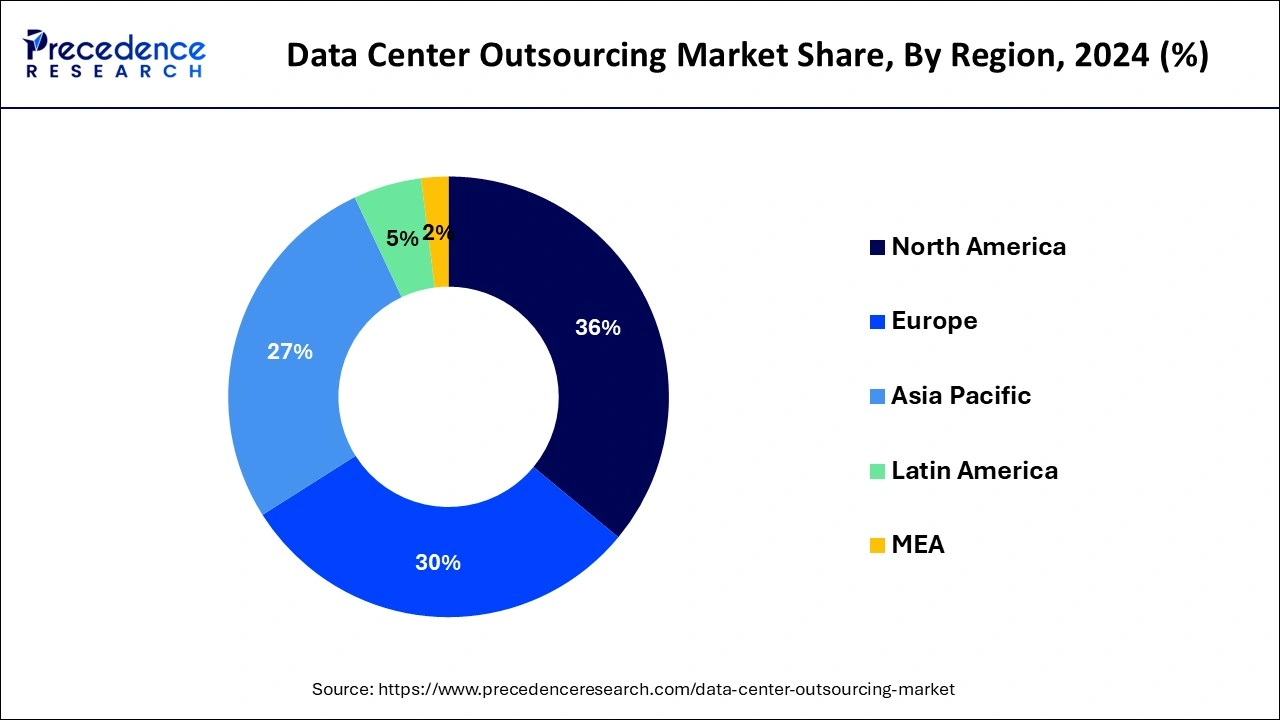

The global data center outsourcing market size is accounted at USD 140.72 billion in 2025 and is forecasted to hit around USD 218.23 billion by 2034, representing a CAGR of 5.00% from 2025 to 2034. The North America market size was estimated at USD 48.23 billion in 2024 and is expanding at a CAGR of 5.14% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global data center outsourcing market size was estimated at USD 133.97 billion in 2024 and is predicted to increase from USD 140.72 billion in 2025 to approximately USD 218.23 billion by 2034, expanding at a CAGR of 5.00% from 2025 to 2034. The increasing need for better IT infrastructure scalability, efficiency, and cost-effectiveness are the significant factors that are driving the market.

The U.S. data center outsourcing market size was exhibited at USD 36.17 billion in 2024 and is projected to be worth around USD 60.14 billion by 2034, growing at a CAGR of 5.22% from 2025 to 2034.

North America dominated the data center outsourcing market globally while holding the highest market share in 2024. North America is considered as a highly developed technological infrastructure, making it conducive for the establishment and operation of data centers. With advanced telecommunications networks and robust internet connectivity, the region provides an ideal environment for outsourcing data center services.

Moreover, the presence of numerous multinational corporations headquartered in North America fuels the demand for data center outsourcing. These companies often seek scalable and cost-effective solutions to manage their expanding data needs while focusing on their core business activities. As a result, they turn to outsourcing providers to handle their data center operations efficiently. Additionally, North America leads in the adoption of cloud computing technologies, which further drives the demand for data center outsourcing services.

Furthermore, the region's regulatory landscape emphasizes data security and compliance, prompting organizations to seek outsourcing partners with expertise in ensuring regulatory adherence. Data center outsourcing providers in North America often offer comprehensive security measures and compliance frameworks to address these requirements effectively. North America benefits from a highly skilled workforce with expertise in managing complex data center environments. This pool of talent enables outsourcing providers to deliver high-quality services and support to their clients.

Asia Pacific emerges as the fastest-growing region in the data center outsourcing market, driven by a combination of factors that underscore the region's dynamic economic landscape and digital transformation initiatives.

One of the primary catalysts for the rapid growth of data center outsourcing in Asia Pacific is the region's expanding digital infrastructure. As countries across Asia Pacific continue to invest heavily in telecommunications networks, internet connectivity, and cloud computing capabilities, the demand for outsourced data center services escalates. This trend is particularly evident in rapidly developing economies such as China, India, and Southeast Asian nations, where businesses are increasingly relying on outsourced data centers to support their digital operations.

Furthermore, the proliferation of mobile devices, internet-enabled services, and e-commerce platforms fuels the exponential growth of data generation in Asia Pacific. This surge in data volume necessitates scalable and secure data center solutions, driving organizations to seek outsourcing partners for their infrastructure needs. government initiatives aimed at promoting digitalization and fostering a conducive business environment play a crucial role in driving the adoption of data center outsourcing services in the region.

Overall, Asia Pacific's status as the fastest-growing region in the data center outsourcing market is influenced by its robust digital infrastructure, escalating data volumes, vibrant tech industry, and supportive government policies, all of which converge to create a thriving ecosystem for outsourced data center services.

The data center outsourcing market refers to the industry that deals with services that involve managing as well as maintaining data center infrastructure of any organization. The growth of this market is attributed to the higher demand of cost effective and scalable IT solutions in the market to reduce the expenses of the capital of the enterprises. The market is poised to grow at the highest CAGR during the foreseeable period, driven by the rising use of cloud computing and ongoing digital transformation.

The rapid increase in the data traffic and the spur in the e-commerce business including banking sector and cloud-based services are the major factors which will present with the promising business development possibilities. Data center outsourcing is the data outsourcing method to manage a day-to- day data activities as a provision of storage and computing resources by employing a third-party provider that have an expertise in deploying and maintaining the data center outsourcing facilities. Such a practises helps enable the enterprises to extensively manage their ICT infrastructure with reliability and security.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.00% |

| Market Size in 2025 | USD 140.72 Billion |

| Market Size in 2024 | USD 133.97 Billion |

| Market Size by 2034 | USD 218.23 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Physical Infrastructure, Organization Size, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Need for scalable and secure data

The data storage strategies play vital role in managing enterprises data activities as it will reflects upon data management efforts and cybersecurity traits of the enterprises. As companies are generating vast amount of data and data must be retrievable, secure and scalable as well. Hence, effective strategies to use data storage are essential for business growth. Security features such as, self-encrypting drives are essential for any kind of data storage strategies.

Scalability of the data is the ability of the data expansion and accommodation without compromise on data integrity and its authencity. As highly scalable data is the cornerstone of the any enterprise’s successful operation, it is essential to allow an enterprise to handle rising flux of vast data efficiently and with ease. Organization requires robust system and infrastructure to manage vast amount of scalable data to avoid the data hamper during operations. Hence, organisation must use the perfect data structures to manage the vast amount of unstructured data.

Privacy concern

Amidst rising technological advancements, security and privacy are the major concerns for existing business models. The headline and news flooded with major data breaches are underscores the importance of security and privacy measures in the data centers. The companies engaged with outsourcing it is essential to confirm the safeguard methods as, data leaks happening globally poses a challenge to keep the data secure.

The path to secure outsourcing has many challenges as government as well as corporate groups are vulnerable to the prominent security risks and a data breach by the hacker's groups globally. As outsourcing has invaded boundaries of the industry and becoming large scale practises for many industries, data security would be the topmost priority that must be fulfilled by outsourcing members.

Adoption of AI and ML

One of the major future opportunities and emerging trend in the data center outsourcing industry is integration of Artificial industry and machine learning in the data centers. Advanced technologies such as AI and ML aids in a data integrity by improving efficiency, by automating routine tasks and improving predictive maintenance. By harnessing the power of AI and ML data center outsourcing providers can meet the ever-evolving market trends that caters an enterprise in rapidly rising digital ecosystem.

The hardware segment represented as a dominant segment in the data center outsourcing market, driven by their need for specialized infrastructure to support product development, testing, and deployment. For hardware manufacturers, maintaining in-house data centers can be prohibitively expensive and resource intensive. Outsourcing data center operations allows them to streamline costs, optimize resource utilization, and access state-of-the-art infrastructure without the burden of ownership and management.

Furthermore, hardware manufacturers often require highly secure and reliable environments to safeguard their intellectual property, sensitive data, and proprietary technologies. Outsourced data centers offer robust security measures, compliance frameworks, and disaster recovery capabilities to meet these stringent requirements.

The data center facilities segment held a significant market share and dominated the market globally. Data center facilities encompass a wide range of services, including colocation, managed hosting, and cloud infrastructure, catering to the diverse needs of businesses seeking to outsource their IT infrastructure requirements. These facilities invest heavily in state-of-the-art infrastructure, including redundant power systems, cooling mechanisms, and security measures, to ensure uninterrupted operations and optimal performance for their clients.

The data center facilities specialize in providing tailored solutions to meet the unique requirements of different industries and use cases. Additionally, the rise of digital transformation initiatives and the proliferation of data-intensive technologies drive the demand for outsourced data center services, further solidifying the position of data center facilities as a dominated segment in the market. Overall, data center facilities play a pivotal role in enabling businesses to leverage advanced infrastructure, mitigate risks, and focus on core competencies helping in establishing them as a cornerstone of the data center outsourcing market.

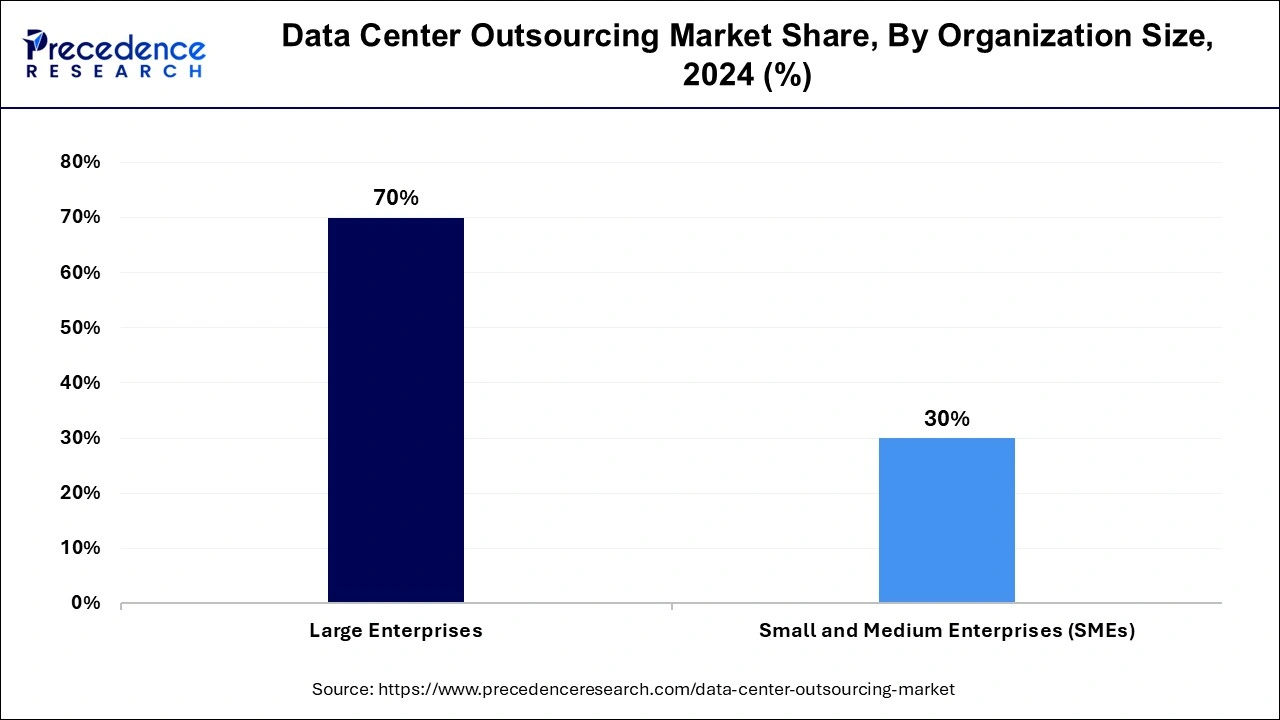

The large enterprises segment dominated the data center outsourcing market in 2024. These enterprises, characterized by their expansive operations and diverse IT requirements, often face challenges in managing their data center environments efficiently. As their digital footprint grows, maintaining in-house data centers becomes increasingly complex and resource-intensive, prompting many large organizations to turn to outsourcing providers for specialized expertise and scalable solutions.

Large enterprises prioritize reliability, security, and performance in their data center operations, making them prime candidates for outsourcing partnerships. Outsourcing allows them to leverage the advanced infrastructure and stringent security measures offered by specialized data center providers.

Outsourced data center services enable them to adapt quickly to changing business requirements, scale their infrastructure on-demand, and access cutting-edge technologies without significant upfront investments. Overall, large enterprises dominate the data center outsourcing market by virtue of their scale, complexity, and strategic moves, driving substantial growth and innovation in the industry.

The IT and telecom segment dominated the data center outsourcing market in 2024, showcasing a profound reliance on outsourced data center services to support their critical operations and infrastructure needs. Within the IT and telecom sector, companies operate in highly competitive environments where technological innovation and operational efficiency are paramount. As a result, these organizations prioritize scalable and secure data center solutions. Data center outsourcing enables IT and telecom companies to focus on their core competencies, such as software development, network management, and customer service. By partnering with outsourcing vendors, they gain access to advanced infrastructure, redundant systems, and 24/7 support.

By Component

By Physical Infrastructure

By Organization Size

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

March 2025

January 2025