January 2025

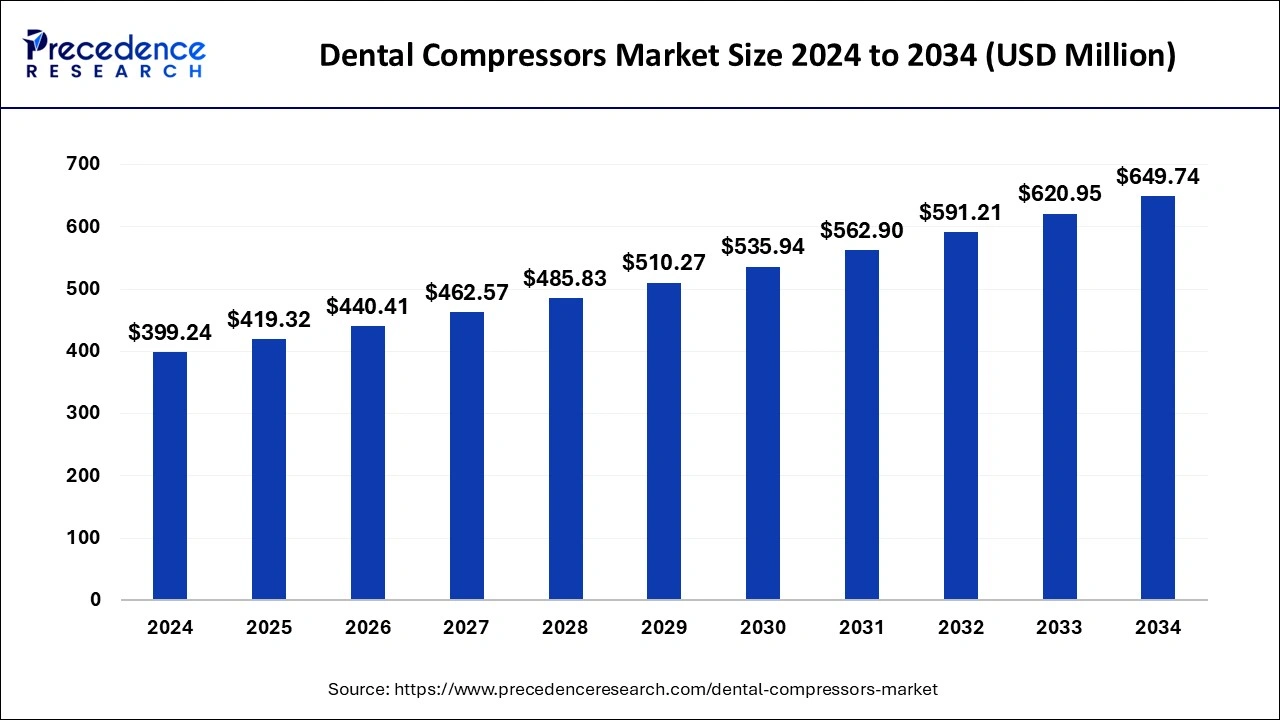

The global dental compressors market size is calculated at USD 419.32 million in 2025 and is forecasted to reach around USD 649.74 million by 2034, accelerating at a CAGR of 4.99% from 2025 to 2034. The North America dental compressors market size surpassed USD 143.73 million in 2024 and is expanding at a CAGR of 5.14% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental compressors market size was estimated at USD 399.24 million in 2024 and is predicted to increase from USD 419.32 million in 2025 to approximately USD 649.74 million by 2034, expanding at a CAGR of 4.99% from 2025 to 2034. The dental compressors market is driven by the global increase in the frequency of dental problems.

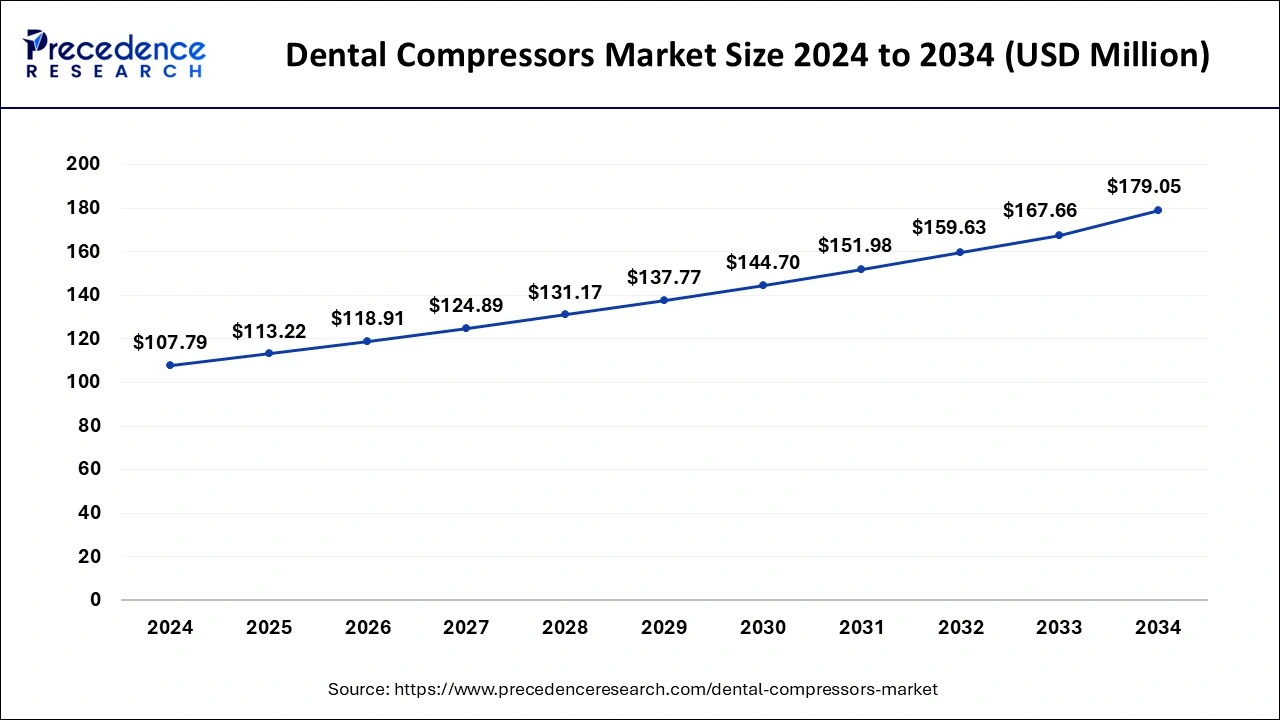

The U.S. dental compressors market size surpassed USD 107.79 million in 2024 and is expected to be worth around USD 179.05 million by 2034 at a CAGR of 5.21% from 2025 to 2034.

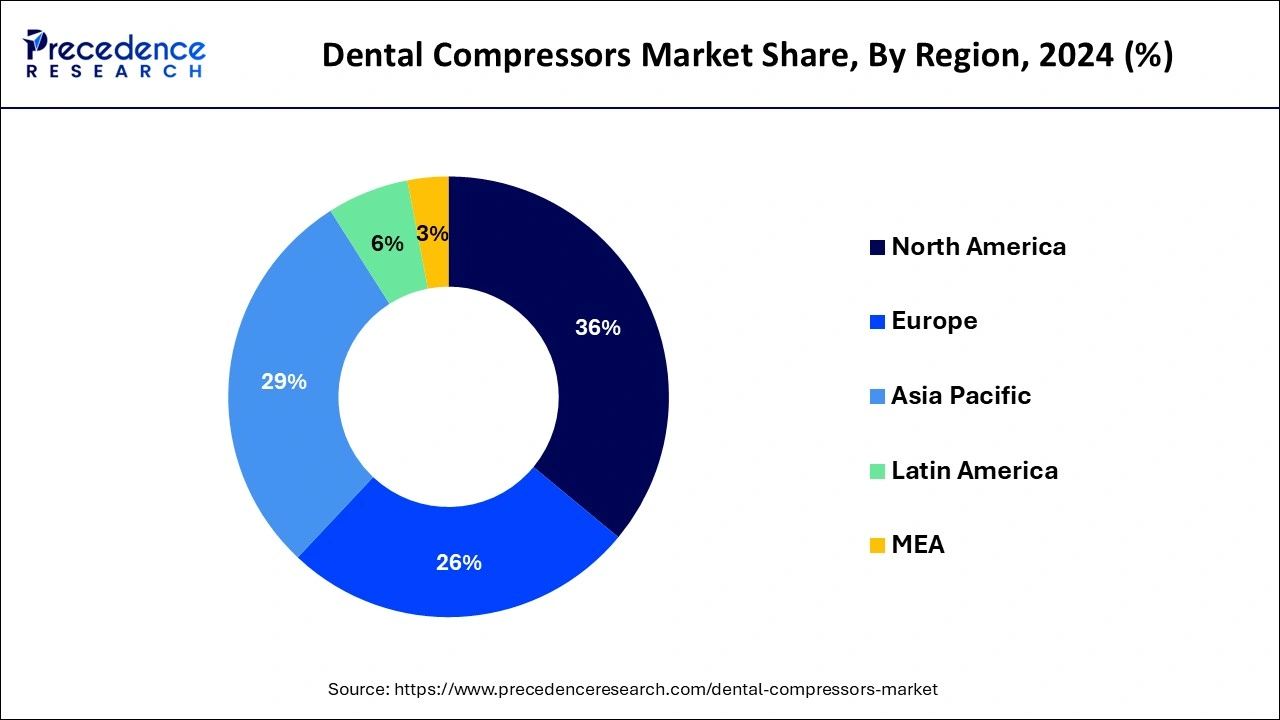

North America had the largest market share in 2024 in the dental compressors market and is observed to sustain throughout the predicted timeframe. Every year, many dental procedures are performed in the area, ranging from simple checkups to intricate surgery. The need for dental compressors is driven by the aging population's increased awareness of dental health and its ongoing need for dental treatments. In North America, people's understanding of dental health's significance has steadily grown. Compressors are among the equipment and dental facilities that are receiving more substantial investments due to the societal trend towards prioritizing dental care.

Asia-Pacific is observed to be the fastest growing dental compressors market during the forecast period. In response to the increasing need for qualified dental practitioners in this area, dental education and training programs are being expanded. The establishment of dental clinics and practices rises with the number of dental schools, colleges, and training facilities. The market is growing because these new facilities need dental compressors to run necessary dental equipment.

Many countries in Asia Pacific are investing heavily in healthcare infrastructure development to meet the growing demand for dental services. This includes the construction of new dental clinics, hospitals, and specialty dental centers equipped with modern dental equipment and technology, including dental compressors.

An apparatus that raises ambient air pressure so that it is appropriate for use in dental operations is called a dental compressor. Since contamination can harm the equipment and the patient's health, these compressors are usually oil-free to guarantee the purity of the compressed air. Dental equipment requires a steady and dependable supply of compressed air, which dental compressors offer.

Any disruption to the air supply can cause dental procedures to be delayed, which will cause the patient and the dentist to be inconvenienced. A well-functioning dental compressor enhances dental practices' production and efficiency by reducing downtime and ensuring seamless equipment operation. This eliminates the need for equipment breakdowns to interfere with dentists' ability to provide high-quality care.

An estimated 2.5 billion people worldwide suffer from untreated dental caries, making it the most prevalent ailment worldwide. One billion people worldwide are thought to be afflicted with severe gum disease, which is a critical factor in complete tooth loss.

Dental Compressors Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 4.99% |

| Market Size in 2025 | USD 419.32 Million |

| Market Size by 2034 | USD 649.74 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Technology, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Technological breakthroughs

Significant technological breakthroughs have led to the development of more advanced dental instruments and equipment in dentistry. Dental practitioners strongly value modern dental compressors because of their sophisticated characteristics, which include energy economy, oil-free operation, and noise reduction. These developments raise the dental care standard and increase dental offices' general effectiveness.

Modern dental compressors are equipped with smart control and monitoring features, such as touchscreen interfaces, digital displays, and remote monitoring capabilities. Dentists and dental staff can easily monitor compressor performance, adjust settings, and troubleshoot issues in real-time using intuitive control panels or smartphone applications.

Presence of co-operative government policies

Dental compressors are required by law to adhere to strict quality and safety requirements. Clear criteria for the manufacture, installation, and operation of dental compressors are established through cooperative policies between government authorities and industry stakeholders. Following these rules guarantees dental equipment's dependability and security, boosting consumer confidence and promoting market expansion.

High initial investment

The cost of purchasing and installing dental compressors can be significant for dental practices, particularly for smaller clinics or newly established practices. The initial investment required for high-quality compressors, along with installation and maintenance costs, may deter some dental practitioners from upgrading or investing in new compressor systems. In some regions, reimbursement policies may not cover the full cost of dental compressor purchases or upgrades. This limitation can pose a financial barrier for dental practices, especially in areas with limited access to dental insurance or government healthcare funding. As a result, some dental clinics may opt for lower-cost alternatives or delay investments in compressor technology.

Increased focus on infection control

Infection control procedures aim to stop diseases from spreading amongst dental personnel, patients, and the surrounding area. Dental compressors with cutting-edge filtration systems may efficiently eliminate impurities, moisture, and microbes from compressed air, lowering the possibility of cross-contamination during treatments. Dental practices may experience long-term cost benefits when they make the initial financial investment in high-quality dental compressors. Reliable compressors with effective filtering systems need less maintenance and are less likely to break down, which lowers downtime and related expenses. Additionally, practices can save money on additional patient care and liability costs by reducing infections and complications.

The dental oil-free compressors segment dominated the dental compressors market in 2024. The chances of oil contamination in the compressed air stream is removed with oil-free compressors. Since air quality directly affects patient health, dental practices must maintain a clean and sterile atmosphere. It reduces the possibility of oil seeping into dental instruments, shielding patients from potential injury and preserving a clean working environment. In addition, it usually requires less maintenance than its competitors, which are lubricated with oil.

Dental professionals can save time and money by not having to make oil changes, filter replacements, and other maintenance procedures linked with oil-based systems. Small to medium-sized dental practices trying to reduce downtime and streamline operations will find this feature especially intriguing.

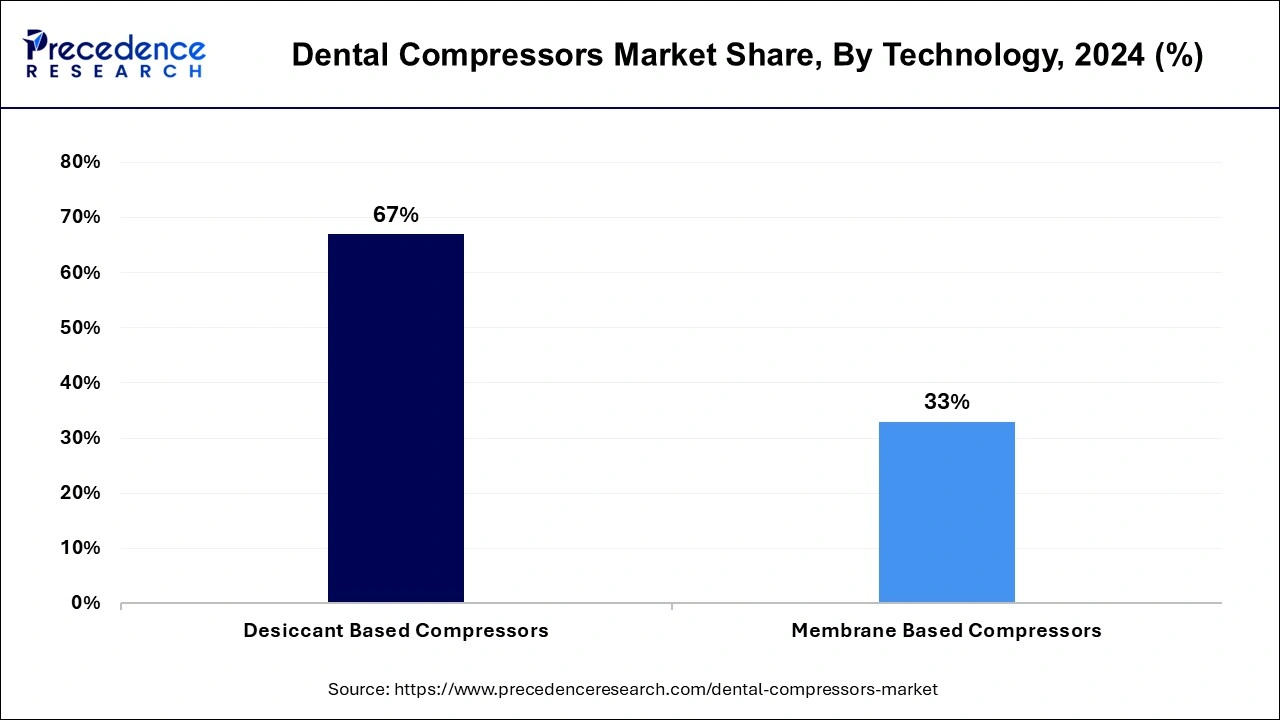

The desiccant based compressors segment dominated the dental compressors market in 2024. Compressors based on desiccant perform exceptionally well at controlling moisture, which is crucial in dentistry applications where dry, oil-free air is necessary. Moisture can encourage the growth of microorganisms and damage dental supplies and equipment. Systems based on desiccant efficiently extract moisture from compressed air, guaranteeing a dry and hygienic supply for dental operations. Noise levels are critical in dentistry settings because they affect patient comfort and the ability of practitioners to concentrate.

Because desiccant-based compressors operate more quietly than conventional oil-lubricated compressors, they are a popular option for dental offices where preserving a serene and comfortable atmosphere is essential.

The membrane-based compressors segment is anticipated to grow in the dental compressors market during the forecast period. In the dentistry field, keeping the atmosphere sanitary is crucial. They provide a hygienic alternative because membrane-based compressors don't need lubricants, which could contaminate the compressed air. They are, therefore, a good fit for dental applications where infection prevention and hygiene are essential. Dental clinics seek equipment that meets or surpasses increasingly strict regulatory criteria in the healthcare sector. Membrane-based compressors are a solution that fits in with the changing regulatory landscape because of their hygienic design and regulatory compliance.

The hand pieces segment dominated the dental compressors market in 2024. As dental professionals are changing demands and preferences, manufacturers in the dental compressor market have expanded the range of products they provide. This includes introducing different handpiece types suited to procedures and applications, including electric, air-driven, low-speed, and high-speed variants. By offering a complete range of handpiece alternatives, manufacturers can efficiently grab a greater market share and meet the different expectations of dental practitioners worldwide.

The chair valves segment is anticipated to expand in the dental compressors market during the forecast period. The demand for dental procedures has steadily risen due to the development of oral health issues and tooth difficulties worldwide. Consequently, hospitals and dental clinics are expanding and modernizing equipment, such as dental compressors. Chair valves are in high demand because they are essential to efficiently operating dental chairs during various dental operations. During dental treatments, modern dental chairs are made with the comfort and safety of the patient in mind.

Chair valves are essential for regulating the movement and posture of the dental chair and guaranteeing the best possible comfort for the patient. The demand for dependable and effective chair valves is anticipated to increase as dental clinics emphasize improving patient experience and safety.

By Type

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023