January 2025

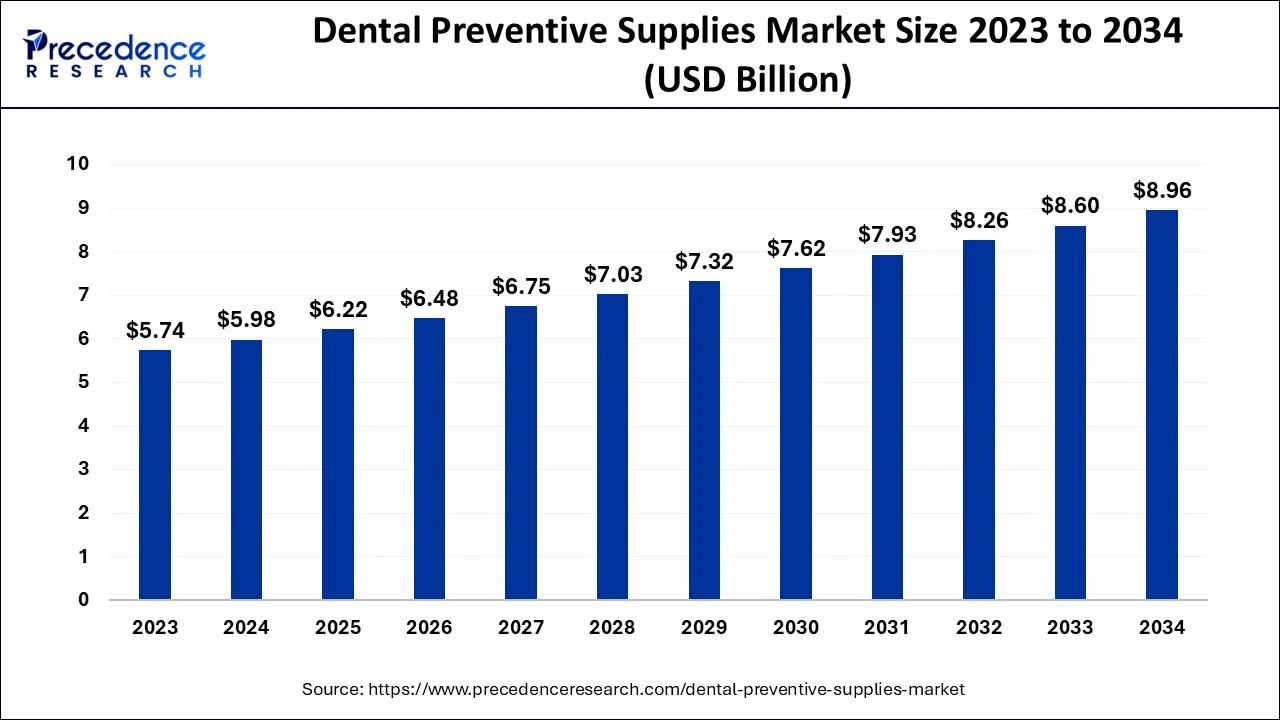

The global dental preventive supplies market size is calculated at USD 5.98 billion in 2024, grew to USD 6.22 billion in 2025 and is anticipated to reach around USD 8.96 billion by 2034. The market is expanding at a CAGR of 4.13% between 2024 and 2034. The North America dental preventive supplies market size is evaluated at USD 2.27 billion in 2024 and is expected to grow at a CAGR of 4.26% during the forecast year.

The global dental preventive supplies market size accounted for USD 5.98 billion in 2024 and is expected to exceed around USD 8.96 billion by 2034, growing at a CAGR of 4.13% from 2024 to 2034. The growth of the global dental preventive supplies market is driven by increased production and supply of effective dental products by leading companies. With the growing prevalence of oral diseases worldwide, the awareness about preventive care is rising, which further drives the market growth.

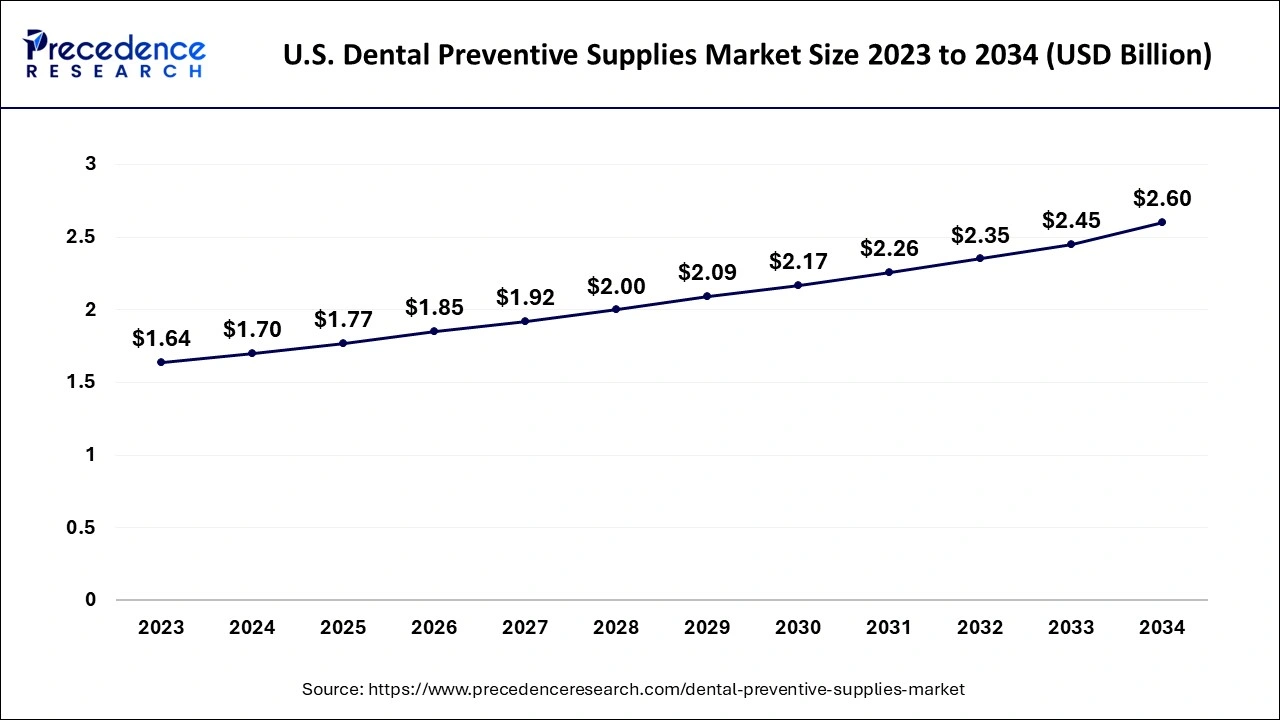

The U.S. dental preventive supplies market size is evaluated at USD 1.70 billion in 2024 and is projected to be worth around USD 2.60 billion by 2034, growing at a CAGR of 4.27% from 2024 to 2034.

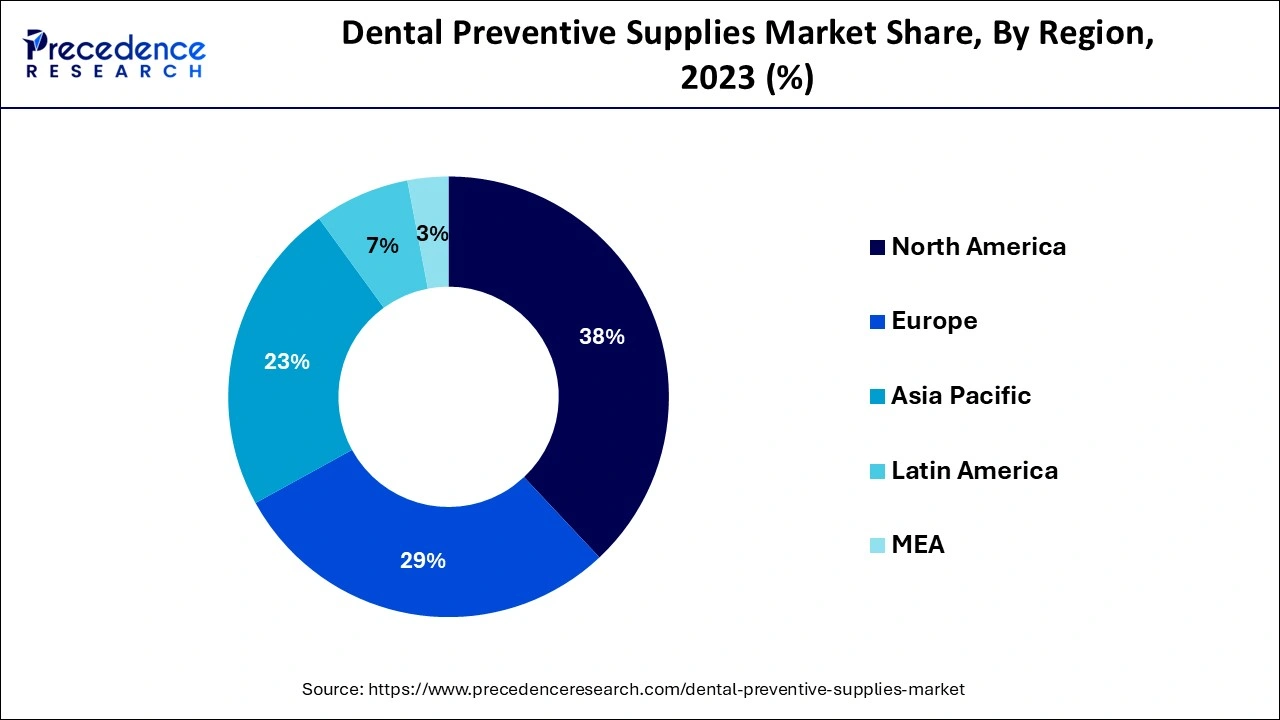

North America led the global dental preventive supplies market in 2023. This is due to an increase in the geriatric population, the availability of skilled medical facilities, clear reimbursement regimes, a large number of key players, and improvements in the existing preventive and reconstructive dental care treatments. Strong emphasis on preventive measures and the rising demand for early diagnosing contributed to regional dominance. Furthermore, due to the better knowledge about oral health’s correlation with general health conditions, patients choose dental examinations and treatments more frequently. The rising healthcare expenditure further bolstered the regional market.

Asia Pacific is expected to be the fastest-growing region in the market throughout the forecast period. Factors such as government support to advance the healthcare system, the increasing geriatric population, and the increasing demand for cosmetic dental surgeries are major factors boosting the market in the region. Medical tourism is also growing in this region because of the availability of affordable treatments, skilled dental professionals, and increasing acceptance of advanced technologies. Furthermore, the increasing occurrence of dental problems and rising government initiatives to promote oral health contribute to regional market growth.

Dental preventive supplies refer to tools and products used to prevent dental diseases such as caries or tooth decay. Some of the everyday items include fluorides, toothpaste, mouthwash, dental sealants, and mouthguards. Dental preventive supplies are used to maintain oral hygiene and prevent dental problems. These supplies help in preventing cavities, gum diseases, and other oral ailments. These products are used by patients as well as dental health care to enhance proper dental care in the home as well as in clinical settings. The increasing geriatric population contributes to market growth. Older people are more prone to oral diseases. Moreover, the rising number of government programs aimed at spreading awareness among the public about oral care, expanding medical tourism in emerging economies, and the availability of advanced dental treatments boost the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.96 Billion |

| Market Size in 2024 | USD 5.98 Billion |

| Market Size in 2025 | USD 6.22 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.13% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rising Incidence of Dental Disorders to Boost the Dental Preventive Supplies Market

The incidence of dental disorders is rapidly growing due to several factors. Tooth decay, gum diseases, cavities, and other oral health problems are rising worldwide. The main reasons contributing to this rise are the high intake of sugar, consumption of tobacco products, and poor dental care. Caries mostly affect children and adolescents after 60 years of age, with root caries being more frequent at this age. Oral diseases are widespread throughout the world due to the changing lifestyles. However, dental preventive supplies will help decrease the possibility of such conditions and improve dental health. With the emergence and higher incidence of dental diseases, the need for products that prevent dental diseases is rising among the public and dental care providers.

High Cost of Dental Procedures

The overall cost associated with dental procedures includes all staff wages, taxes, health insurance, supplies, and many others. It also depends on the nursing team's experience and level of training. Moreover, rising healthcare costs significantly hamper the dental preventive supplies market growth.

Rising healthcare programs fuel the growth of the market. Awareness about the importance of oral hygiene has increased significantly due to educational campaigns by governments, cooperative health institutions, and dentists. The increased awareness about the availability of advanced dental care solutions contributed to the advocacy of early management of dental conditions. People understand the need to use dental products that include toothpaste, mouthwash, and dental floss daily to help maintain oral health, reducing the risk of diseases such as cavities and gingivitis.

The dental fluorides and varnish segment dominated the global dental preventive supplies market in 2023. This is due to the increased demand for fluoride-based products. Fluoride varnish is a resin that protects teeth from tooth cavities and makes the enamel of a tooth stronger. It is often prescribed for kids, babies, older people, and individuals with special healthcare requirements. It is a fast-drying varnish with a sticky property, which forms a sticky coat on the teeth. Fluoride varnish is most effective when used in combination with other products, such as fluoridated toothpaste. Fluoride-containing agents serve to improve the hardness of tooth enamel, reduce bacterial growth, and stimulate the process of demineralization.

The tooth whitening and desensitizers segment is expected to grow rapidly during the forecast period. Tooth desensitizers quickly relieve sensitivity resulting from tooth whitening, heat, and chemical alterations, exposed roots, and toothbrush damage. Toothpaste, mouth rinses, or gums are types of desensitizing agents and work on the principle that one either seals the dentinal tubules or interferes with neural conduction.

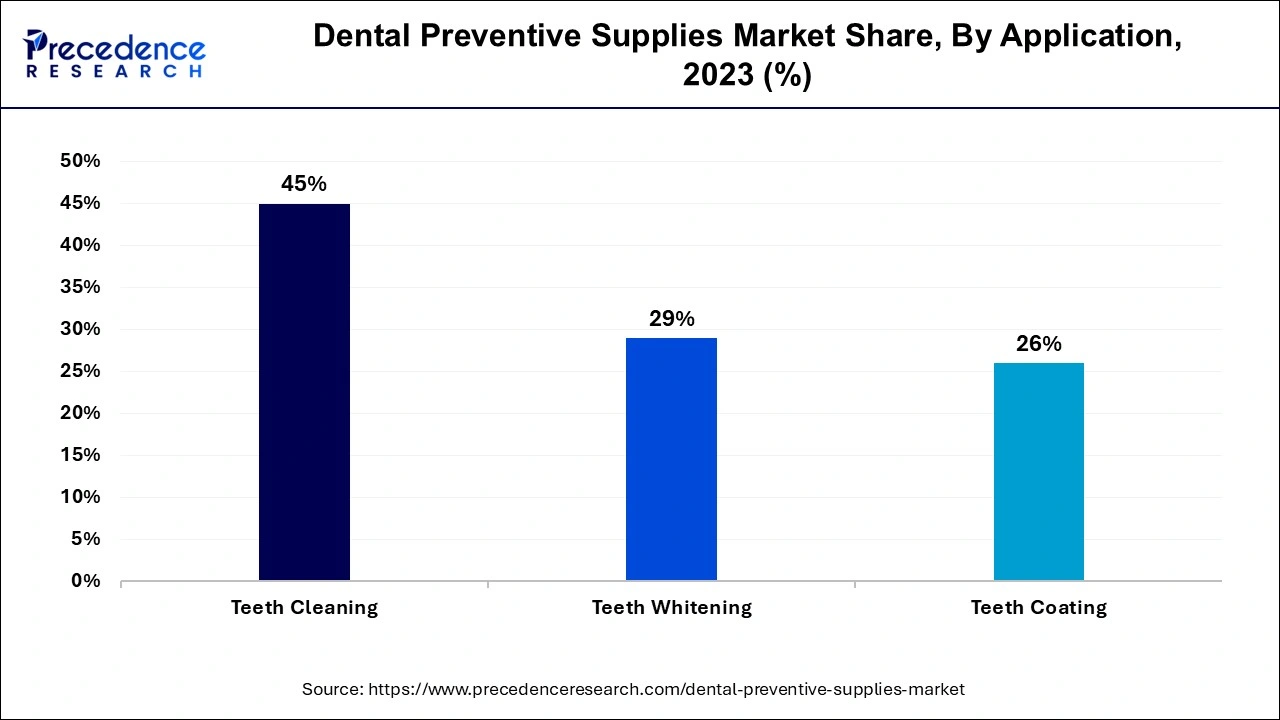

The teeth cleaning segment led the dental preventive supplies market with the largest share in 2023 due to the growing desire for white teeth. Cleansing of the teeth is a dental process through which the dental expert removes the plaque, tartar, and bacteria from teeth to maintain healthy gums and teeth. It is also referred to as topical prophylaxis. Different types of teeth cleaning products are easily available in pharmacies, supermarkets, and online shops, and consumers find it convenient to purchase the necessary products. Furthermore, the rising focus on personal appearance contributed to segmental dominance.

The teeth whitening segment is anticipated to witness significant growth in the market over the studied period, owing to the rising desire for white teeth. Tooth bleaching is the process by which the natural color of a person’s teeth is improved. This is achieved by applying a whitening gel or product to the teeth; at times, a light or laser is used. Chemicals such as hydrogen peroxide or carbamide peroxide are often used in whitening products, resulting in enhanced effectiveness.

The retail pharmacies segment led the global dental preventive supplies market in 2023. This is mainly due to the easy availability of over-the-counter products in these pharmacies. Dental preventive supplies are readily accessible and directly sold to consumers by retail pharmacies for self-care. Additionally, there has been a steady shift in patients' attitudes regarding the importance of spoken and preventive medicine. With the increasing awareness of dental care among the population, the trend of self-care is rising, contributing to segmental expansion.

Segments Covered in the Report

By Product Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023