December 2024

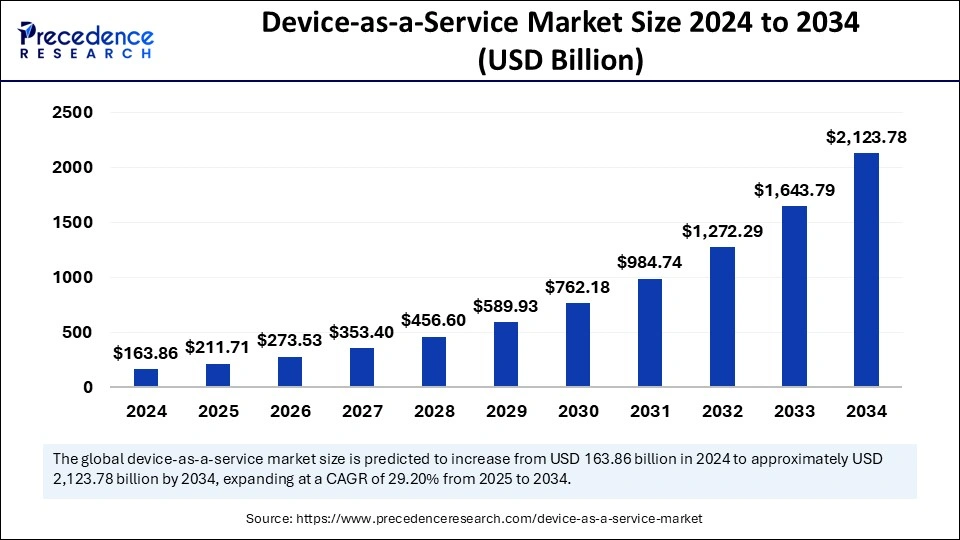

The global device as a service market size is evaluated at USD 211.71 billion in 2025 and is forecasted to hit around USD 2,123.78 billion by 2034, growing at a CAGR of 29.20% from 2025 to 2034. The North America market size was accounted at USD 57.35 billion in 2024 and is expanding at a CAGR of 29.38% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global device as a service market size was estimated at USD 163.86 billion in 2024 and is predicted to increase from USD 211.71 billion in 2025 to approximately USD 2,123.78 billion by 2034, expanding at a CAGR of 29.20% from 2025 to 2034. The market is witnessing rapid growth due to the increasing preference for flexible, subscription-based models. This shift allows for optimized device management, reduced capital expenditure, and enhanced scalability, thereby driving adoption of device-as-a-service (DaaS) across various industries.

Artificial Intelligence and Device-as-a-Service (DaaS) are disrupting industries by altering technology adoption and business models. Advancements in AI, especially generative and reasoning models, are increasing demand for computing power. Organizations like OpenAI and DeepSeek are leading the way by challenging tech giants to increase capital expenditures in order to stay competitive. Meanwhile, investors are challenging organizations using AI to generate financial returns by 2026, which raises issues of longer-term sustainability. As organizations continue to embrace hybrid work, AI-enabled cyber protection through solutions like Microsoft’s Defender for Endpoint will enhance protection around endpoints, so organizations can protect devices and data in an increasingly digital world.

On the other hand, there is continued momentum for DaaS as organizations shift from ownership of IT hardware to subscription modes. For example, organizations like Jio Financial Services are taking advantage of DaaS for organizations to lease devices for their customers. Additionally, DaaS can combine AI in ways that can improve predictive maintenance, optimization of device performance, and help the organization secure devices. In order for an organization to become successful, and DaaS offer new levels of performance, the organization will need to balance risk with profitability while focusing on customer and investor expectations in an evolving market for both AI and DaaS.

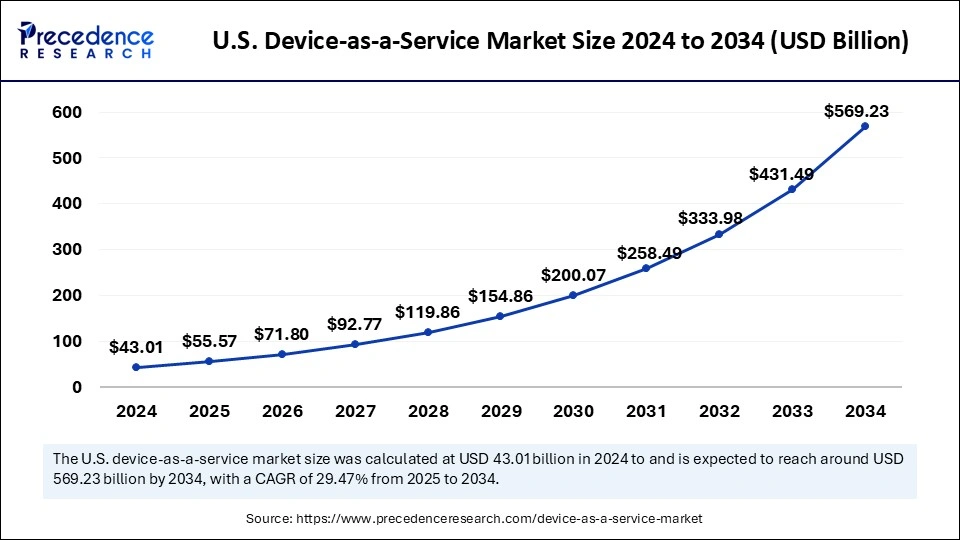

The U.S. device as a service market size was exhibited at USD 43.01 billion in 2024 and is projected to be worth around USD 569.23 billion by 2034, growing at a CAGR of 29.47% from 2025 to 2034.

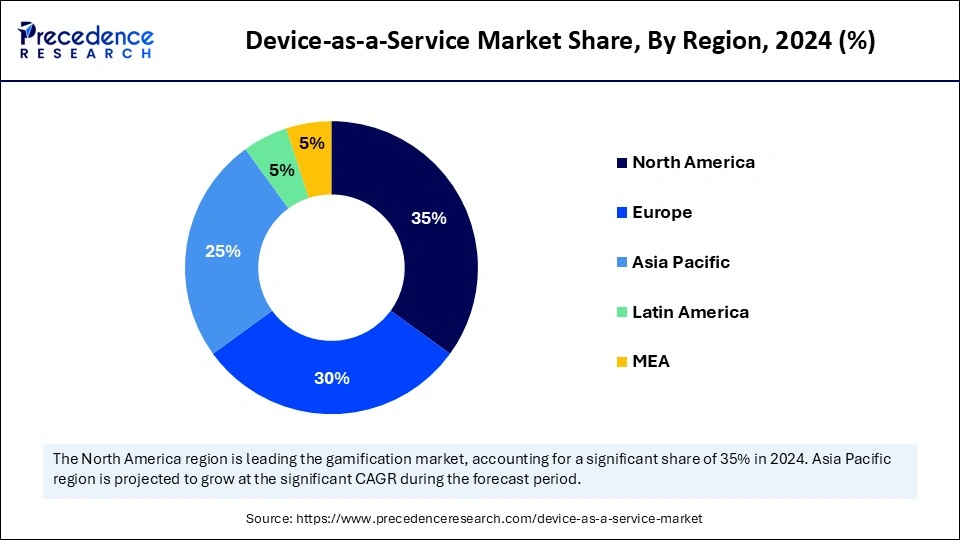

North America’s Stronghold on the Device as a Service Market

North America dominated the market by capturing the largest share in 2024. The regional market growth is driven by its advanced technological infrastructure and heightened adoption of cloud computing. There is an increased demand for flexible, subscription-based IT solutions in the healthcare, education, and financial sectors due to a strong focus on enhancing operational efficiency. In 2024, organizations across the region have leveraged DaaS offerings as a way to streamline device management, reduce security risk, minimize the cost of management, and support hybrid and remote work models. This trend is expected to accelerate, and DaaS will become a mainstay in the IT infrastructure for many organizations seeking to optimize their technology management.

The U.S. is ahead of the curve in the Device-as-a-Service space with strong technology infrastructure and significant capital investments in digital infrastructure. There is a high adoption of DaaS solutions among businesses, especially for hybrid work environments that required flexible, scalable IT services. In 2024, Vista IT Group expanded its DaaS program nationwide, creating a holistic offering designed to help businesses manage all of their devices more productively for the modern workforce. As the demand for secure, affordable, and scalable technology continues to grow, the U.S. remains a leading force in the North American device as a service market.

Asia-Pacific: The Fastest-Growing Region

The device as a service market in Asia Pacific is expected to expand at the highest CAGR in the coming years because of rising digitalization and the increasing number of tech-savvy workforce. Countries such as India, Japan, and Singapore are investing heavily to expand their IT infrastructure. Increasing government initiatives to promote cloud adoption and modernizing enterprises further support market growth. With businesses looking for more scalable, secure, and cost-effective solutions, the DaaS is gaining traction as demand increases for enterprise software and cloud services. The shift toward scalable DaaS solutions helps organizations strengthen operations while reducing capital expenditures.

China is a major contributor to the Asia Pacific device as a service market. This is mainly due to a strong emphasis on establishing technological self-sufficiency and digitalized innovation. While economic headwinds affect Asian countries, government-led initiatives have encouraged a digital shift across many industries, including manufacturing, finance, and healthcare, allowing continued optimism toward DaaS. DaaS adoption through tax benefits and other incentives is increasingly pushing businesses to optimize IT operations. China’s established digital ecosystem and continued investment in enterprise modernization are expected to sustain China’s position in the market into the foreseeable future.

European Device as a Service Market to Grow at a Notable Rate

The market in Europe is evolving as a result of sustainability considerations, digitalization initiatives, and pressure for flexibility in IT. Overall, Europe is seeing consumer interest in DaaS because of the European Commission’s ambitious environmental sustainability goals. DaaS can facilitate device reuse and recycling. Germany is taking the lead in the market owing to its robust manufacturing sector, advanced technology ecosystem, and commitment to digital and environmental innovation. Through a focus on digital supply chains and Industry 4.0, Germany has increased the adoption of DaaS, enabling organizations to continue to increase their competitiveness in an increasingly digitizing environment. The government support for SME digitalization and green IT projects is likely to support regional market growth.

Device-as-a-Service (DaaS) supplies hardware devices on a subscription basis, which includes laptops, desktops, tablets, and phones, along with baseline services such as maintenance, security, and analytics, among possible other value-added provider services. The DaaS model enables organizations to forego a large initial capital obligation that occurs with traditional procurement of a fleet of devices, paying a smaller periodic or recurring fee, and giving organizations full autonomy over how to appropriately identify and manage their IT resources and processes, all while ensuring their employees have access to secure, up-to-date leading-edge technology.

The device as a service market is growing rapidly, driven by a desire to utilize available IT funding wisely for a potentially less expensive, timely, and scalable technology solution and digital transformation. Organizations are using DaaS to realize opportunities with flexibility while balancing internal IT organization software management. The DaaS offerings are on the radar of potentially every significant player in the industry, such as HP, Dell, Lenovo, and Microsoft, along with others, to provide enterprise clients with scaling solutions to their procurement methods. Enterprises are actively transitioning their organizational procurement from a capital expenditure (CAPEX) to an operational expenditure (OPEX), and the needs and widespread availability for consistently predictable, lower-cost, scalable IT procurement continues to gain priority.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,123.78 Billion |

| Market Size in 2025 | USD 211.71 Billion |

| Market Size in 2024 | USD 163.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 29.20% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Device Type, Enterprise Size, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Demand for Subscription-Based IT Services

The increasing demand for subscription-based IT services is a key factor driving the growth of the device as a service market. Organizations are focusing more on scalability, price efficiency, and end-to-end management of the lifecycle of IT assets, which align perfectly with the DaaS model. A new Global Interconnection Index (GXI) report from early 2024 predicts that by 2026, 80% of new spending on enterprise digital infrastructure will be subscription-based.

Companies are moving away from capital expenditure (CAPEX) on hardware to operational expenditure (OPX) for services. The increased demand for computing capability to power AI, the deployment of 5G networks, and edge computing demonstrates the DaaS. DaaS enables businesses to easily scale up or down their device deployments according to requirements. The rapid embrace of subscription-based IT services positions DaaS as a key enabler of today's digital transformation and, thus, a vital growth area in the changing IT services landscape.

Data Security Risks

Data security and privacy concerns are the foremost constraints facing the device as a service market. DaaS services involve leasing devices such as laptops, desktops, and tablets with bundled software and cloud connectivity, which requires organizations to move sensitive data to a third-party service provider. This can lead to data breaches, unauthorized access, and compliance risks, especially from organizations with confidential information, such as finance and healthcare.

For instance, in 2024 major data breach occurred to Snowflake, Inc., a cloud-based data warehousing company. The data breach leaked the personal and financial information of over 100 customers, which included AT&T, Ticketmaster, Santander Bank, and Neiman Marcus. The incident underscored the vulnerability of cloud-based services to hacks and cyber security threats from malware. Thus, if an organization lacks adequate security measures, they may be wary of utilizing DaaS and opt for traditional device ownership instead of service.

Sustainability-Driven Demands

The Device-as-a-Service (DaaS) model provides a major opportunity for businesses to limit their impact on the environment. As sustainability becomes a key priority, businesses are adopting DaaS for e-waste reduction, device life extension, and improved energy efficiency. DaaS encourages the use of devices for extended periods, reducing the need for frequent replacement and e-waste. BBVA, for instance, is working with HP to utilize the DaaS model to reduce the energy consumption of its IT equipment by 32%. DaaS will lead to significant savings in energy consumption over the lifecycle of the devices as BBVA moves to this fleet of devices. This highlights how DaaS can deliver both sustainability and operational objectives, demonstrating DaaS can contribute to meaningful and worthwhile environmental outcomes.

Furthermore, 60% of IT decision-makers are now prioritizing sustainability in their procurement decisions, underscoring the growing demand for eco-friendly technology solutions. For companies that must meet environmental requirements, the DaaS model offers an alternative solution to minimize device purchases and improve sustainability with programs to refurbish devices and recycle packaging. As demand increases for sustainable, more cost-effective IT solutions, more DaaS models will emerge and take shape in, while supporting the tech industry's participation in a more circular economy.

The service segment held the largest share of the device as a service market in 2024. The segment growth is driven by the increasing demand for end-to-end lifecycle services, including deployment, integration, maintenance, repair, and asset recovery. These flexible, tailored, and convenient services allow enterprises to run smoothly while allowing end-user payment flexibility and encourage service providers/resellers to partner with hardware and software suppliers to meet increased demand.

The hardware segment is anticipated to grow at a remarkable CAGR during the forecast period. This is primarily due to the growing number of organizations leveraging managed hardware solutions, which offer organizational flexibility and reduced upfront capital costs. Additionally, the demand for laptops, desktops, smartphones, and tablets across verticals, including healthcare, education, and IT, drives the hardware demand. DaaS providers allow organizations to outsource the procurement and management of hardware so organizations can easily scale their technology infrastructure without worrying about maintenance, repair, and lifecycle management of those devices.

The software segment is projected to grow at a notable rate as organizations increasingly adopt cloud-based software to support device management, security, and analytics. Organizations are not just leveraging their devices but also enjoying the benefits of using software-as-a-service (SaaS) applications in support of their devices to drive operational efficiency. Software enables organizations to maintain security compliance, improve device performance and digital behaviors, as well as effectively track device usage data to streamline the overall lifecycle of workforce devices.

The desktop segment led the device as a service market with the largest share in 2024. Desktop computers are primary in education and enterprise environments due to their reliability and effective pairing with DaaS. Desktops also have a longer lifespan than laptops or tablets, which is important for companies considering DaaS for large deployments. While mobile devices are on the rise, the demand for desktops is rising, especially in areas without the need for mobility.

The smartphone and peripheral segment is expected to expand at the fastest rate over the projection period, as mobile devices play a necessary role in business environments, especially for remote and flexible work-play. Growth in mobile devices is driven by a combinatory effect of mobile-first strategies and 5G capabilities. In looking to move forward, companies want devices that achieve mobility and operational capability, leading to an increase in demand for smartphones.

The large enterprises segment led the device as a service market in 2024. This is mainly due to the increased need for reliable services among large enterprises for users across locations, scalable infrastructure, and IT management functions. For large organizations that employ many individuals and may have complex workflows, DaaS solutions provide cost-effective service, security, and management advantages. While large enterprises may pursue more cost-effective and flexible management of devices, they still represent the largest segment of DaaS adoption.

The small & medium enterprise segment is projected to expand at the highest CAGR during the forecast period. SMEs are becoming aware of the benefits of DaaS adoption, such as lower upfront capital expenditure, simplified IT management, and easily removable subscriptions. The trend of digitalization and the rising adoption of cloud solutions are driving the growth of the segment.

The IT and telecom segment dominated the device as a service market in 2024. This is mainly due to the rise in the usage of remote solutions, secure communications, and continuous innovations in digital technologies. IT service providers and telecom companies heavily use DaaS to supply the latest devices for their teams at lower costs and with more flexibility. This capability allows them to be responsive and competitive in an increasingly complex landscape while effectively providing for the growing global needs of the digital workforce.

The banking, financial services and insurance (BFSI) segment is expected to expand at a significant rate over the projected period. The segment growth can be attributed to the rising need for secure, compliant, and efficient IT infrastructure. Banks and other financial institutions often have large amounts of sensitive data to protect; therefore, financial institutions utilize DaaS to increase security, operate more efficiently, and remain compliant while reducing the complexity of updating their infrastructure and expanding.

By Offering

By Device Type

By Enterprise Size

By End Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

June 2024

January 2025