August 2024

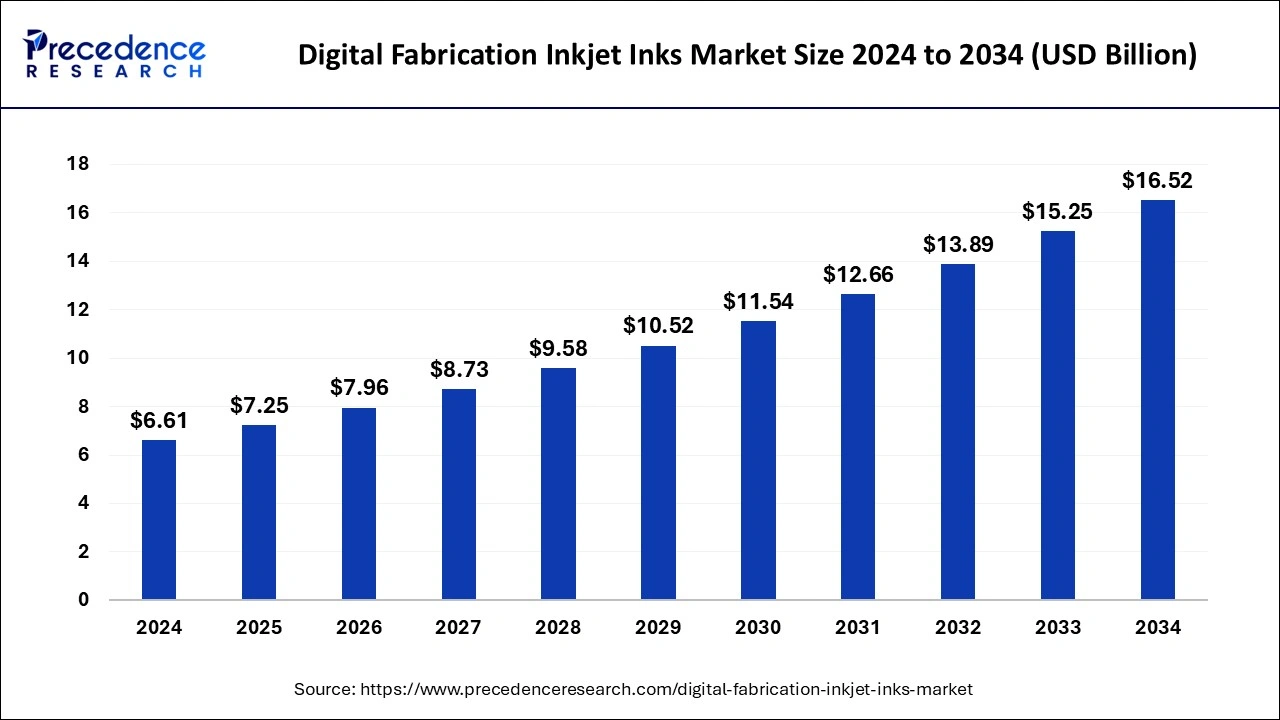

The global digital fabrication inkjet inks market size is calculated at USD 7.25 billion in 2025 and is forecasted to reach around USD 16.52 billion by 2034, accelerating at a CAGR of 9.59% from 2025 to 2034. The North America market size surpassed USD 2.25 billion in 2024 and is expanding at a CAGR of 9.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global digital fabrication inkjet inks market size was calculated at USD 6.61 billion in 2024 and is predicted to increase from USD 7.25 billion in 2025 to approximately USD 16.52 billion by 2034, expanding at a CAGR of 9.59% from 2025 to 2034. The development of innovative 3D printing technologies that are eco-friendly and sustainable is a major goal of prominent industry players. This will promote the usage of inkjet inks in 3D prints, thus driving the market on a larger scale.

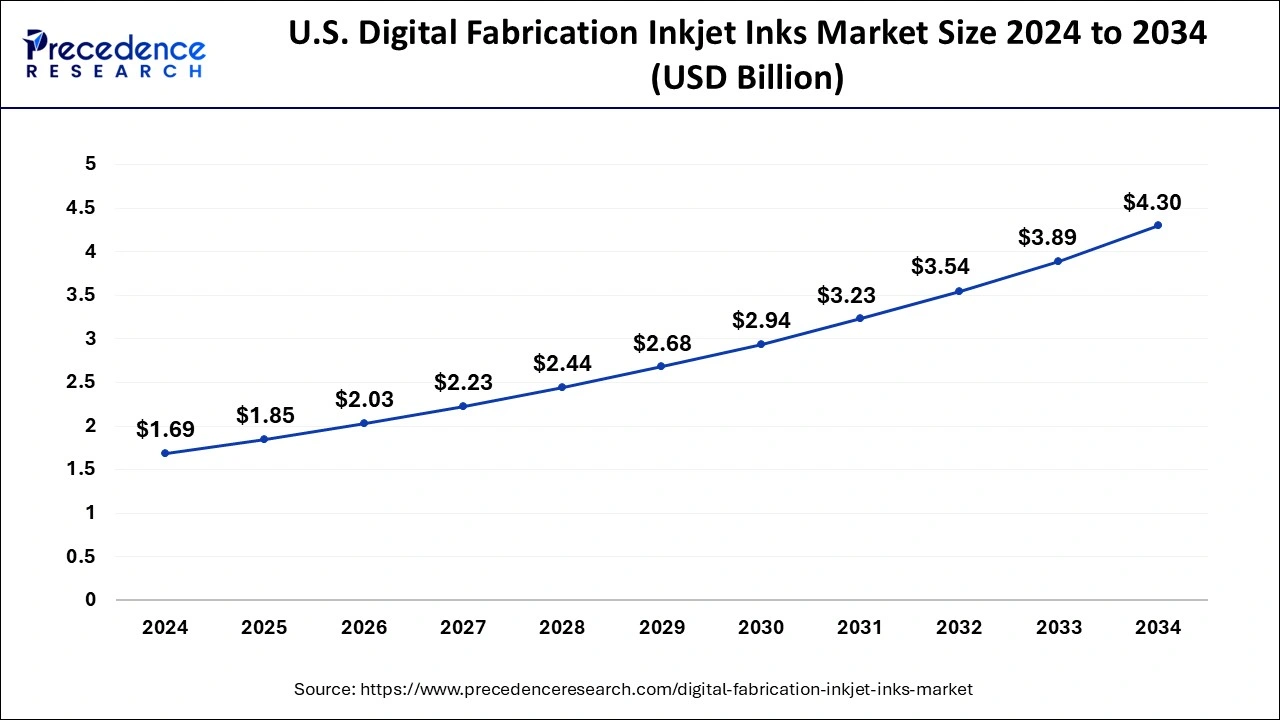

The U.S. digital fabrication inkjet inks market size was exhibited at USD 1.69 billion in 2024 and is projected to be worth around USD 4.30 billion by 2034, growing at a CAGR of 9.79% from 2025 to 2034.

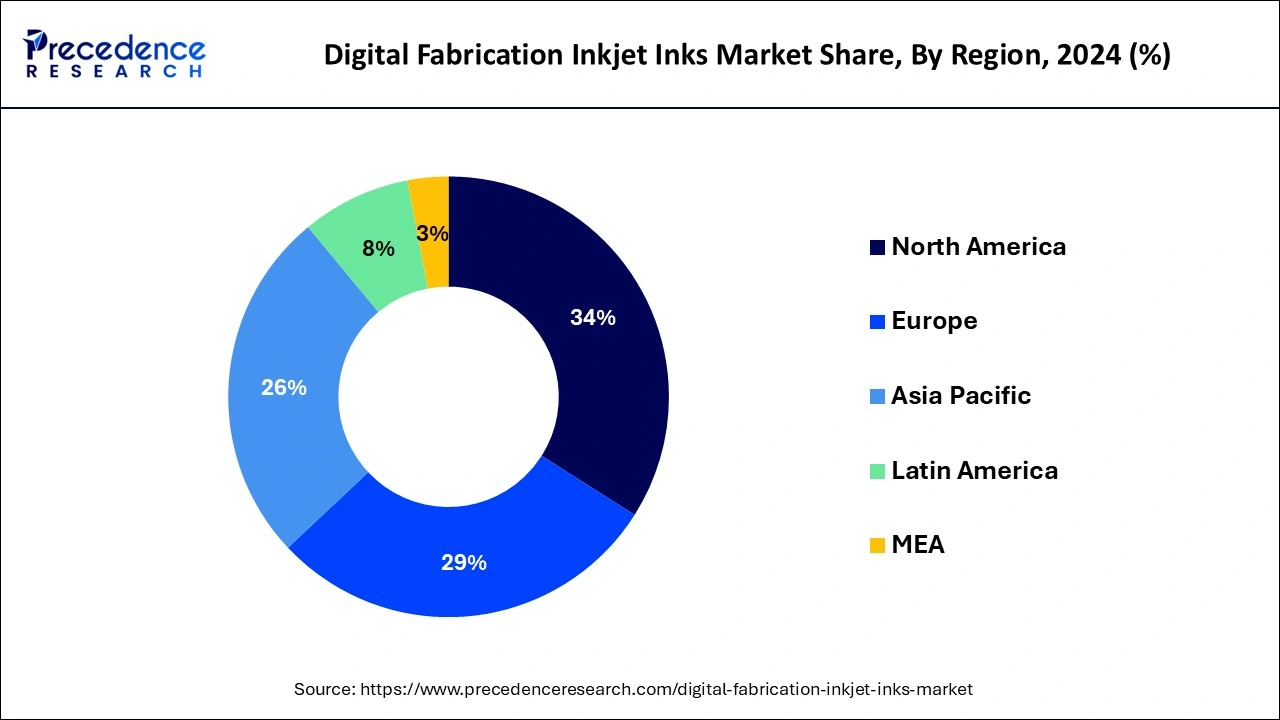

North America held the highest share in the digital fabrication inkjet inks market in 2024 and is poised to show exponential growth during the period of 2025 to 2034. It stands as a powerhouse region characterized by technological hold, market leadership, and robust industry infrastructure. The growth of this region is attributed to the rising interest of major players in expanding their production and challenging limitations regarding it. With a diverse and robust economy, North America is home to thriving industries such as packaging, textiles, automotive, and consumer goods. These industries heavily rely on digital fabrication inkjet inks for various applications, leading to high market demand in the region.

North American consumers increasingly favor customized products, driving the need for flexible and high-quality printing solutions. The digital fabrication inkjet inks market enables businesses to meet these evolving consumer preferences by offering customization options, speed, and superior print quality. The region upholds stringent environmental regulations and prompting the adoption of eco-friendly printing solutions. Digital fabrication inkjet inks that comply with these regulations and offer sustainable alternatives to traditional printing methods.

Asia Pacific is experiencing increased growth and is anticipated to grow exponentially in the upcoming years. Asia Pacific is experiencing robust economic growth, driven by countries such as China, India, Japan, South Korea, and Southeast Asian nations. This economic expansion leads to increased investments in various industries, including textiles, manufacturing, automotive, and consumer goods, driving demand for digital fabrication inkjet inks.

The growing manufacturing sector heavily relies on digital printing technology for customization, prototyping, and packaging, propelling the demand for digital fabrication inkjet inks market in the region. The rapid urbanization taking place in many Asia Pacific countries is driving demand for customized products, particularly in the fashion, home décor, and advertising sectors. Digital printing technology offers the flexibility to produce personalized textiles and promotional materials, catering to the needs of urban consumers.

The digital fabrication inkjet inks market is booming, catering to various industries like textiles, packaging, and signage. These inks are revolutionizing printing by enabling high-quality, customized output on diverse surfaces like paper, fabric, and plastics. Key drivers include the demand for personalized products, rapid prototyping, and the shift towards sustainable printing solutions. Manufacturers are focusing on developing eco-friendly formulations to meet environmental regulations and consumer preferences.

Additionally, advancements in inkjet technology, such as improved durability and color accuracy, are driving market growth. However, competition among key players intensifies as they innovate to meet evolving customer needs. Overall, the digital fabrication inkjet inks market is poised for further expansion as businesses seek efficient, versatile, and sustainable printing solutions.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.59% |

| Market Size in 2025 | USD 7.25 Billion |

| Market Size in 2024 | USD 6.61 Billion |

| Market Size by 2034 | USD 16.52 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for customization

One of the major drivers propelling the digital fabrication inkjet inks market is the increasing demand for customization and personalization across various industries. Consumers today are seeking unique and tailor-made products that reflect their individual preferences, leading to a surge in demand for personalized printing solutions. Digital fabrication inkjet inks offer the flexibility to print custom designs, colors, and patterns on a wide range of materials, including paper, textiles, ceramics, and plastics.

The growing demand for customization extends across diverse sectors, such as textiles, packaging, and consumer goods. In the textile industry, there is a growing trend towards on-demand printing of fabric designs, allowing for smaller production runs and reduced inventory costs. Similarly, in the packaging industry, brands are leveraging digital printing technology to create personalized packaging that stands out on the shelves and enhances brand recognition. Hence, the demand for customization and flexibility is a significant driver fuelling the growth of the digital fabrication inkjet inks market.

Upfront costs

One restraint facing the digital fabrication inkjet inks market is the initial investment required for adopting this technology. While digital printing offers numerous benefits, such as customization, shorter production runs, and reduced waste, the upfront costs associated with purchasing digital fabrication inkjet printers and related equipment can be substantial for businesses, especially small and medium-sized enterprises (SMEs).

These initial costs include not only the purchase of the printer itself but also expenses related to training staff, software integration, and maintenance. Additionally, digital fabrication inkjet inks may be more expensive than traditional printing inks, further adding to the initial investment. Especially for SMEs with limited financial resources, the high upfront costs of transitioning to digital fabrication inkjet printing can act as a barrier to entry, preventing them from fully capitalizing on the benefits of this technology.

Eco-friendly formulations

A major opportunity for digital fabrication inkjet inks is the growing demand for sustainable printing solutions. As concerns about environmental impact and sustainability continue to rise, there's a significant opportunity for inkjet ink manufacturers to develop and market eco-friendly formulations. Hence, the shift towards sustainability presents a significant opportunity for the digital fabrication inkjet inks market to expand its customer base and drive growth in the coming years.

These eco-friendly inks can offer benefits such as reduced emissions, lower energy consumption, and decreased waste compared to traditional printing methods. Additionally, they may be formulated using renewable resources or contain fewer harmful chemicals, making them safer for both the environment and human health. With consumers and businesses increasingly prioritizing sustainability in their purchasing decisions, there's a growing market for products and services that align with these values. By tapping into this trend and offering sustainable digital fabrication inkjet inks, manufacturers can not only meet market demand but also differentiate themselves from competitors and enhance their brand reputation.

The digital fabrication of inkjet inks based on dye segment dominated the digital fabrication inkjet inks market in 2023 owing to their spectrum of application in several industries. The segment is accounted to hold the largest market share and is expected to stay on the top in the foreseeable future. As they are highly resistant to the water molecules present in humid climates, pigment-based inks are appropriate, as the durability of printing is of high importance in many industries.

Dye-based inks are formulated using water-soluble dyes that produce vibrant and vivid colors, making them ideal for applications where color accuracy and image quality are paramount, such as photography and graphic design. One of the main advantages of dye-based printing is its ability to achieve a wide color gamut, resulting in prints with exceptional color saturation and detail. This makes dye-based inks popular among professionals in the fields of advertising, fashion, and fine art who require high-quality prints with rich, lifelike colors.

The digital fabrication based of inkjet inks based on pigment is expected to register rapid growth during the forecast period. Pigment-based inks utilize tiny solid particles suspended in a liquid carrier, providing several advantages over dye-based inks, particularly in terms of durability and longevity. This flexibility makes pigment-based printing suitable for diverse applications, from commercial printing and packaging to home décor and textile printing.

The growth of this segment is expected to be led further by its characteristic of resistance to color fading with long-lasting pigment and durability. Another advantage of pigment-based inks is their versatility across a wide range of substrates, including paper, canvas, textiles, and synthetic materials. Moreover, they are more suitable for external use where the environment is harsh and could easily react with molecules used in the writing process of inkjet inks.

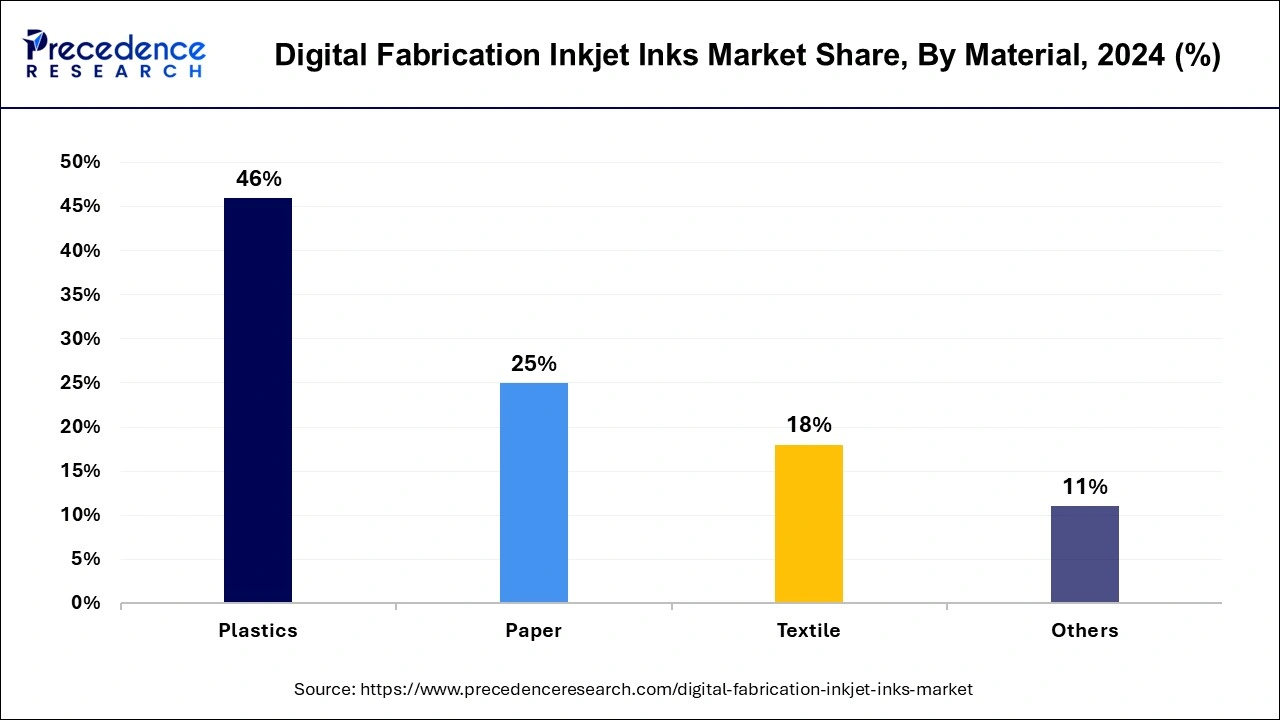

The plastics segment held the largest share of the digital fabrication inkjet inks market in 2024. This growth is fuelled by the increasing demand for customized textiles across various industries, including fashion and home décor. In the packaging industry, plastic materials offer versatility, durability, and cost-effectiveness, making them a preferred choice for packaging solutions.

The plastic material segment stands out as a dominant force within the digital fabrication inkjet inks market. This dominance is fuelled by the widespread use of plastic materials across a multitude of industries, including packaging, signage, automotive, and consumer goods. Digital fabrication inkjet inks play a crucial role in enhancing the visual appeal of plastic packaging by enabling vibrant colors, intricate designs, and high-resolution printing. This is particularly important for brands looking to differentiate their products on store shelves and attract consumers' attention.

The textiles material segment is projected to witness notable growth in the foreseen period. Digital printing on textiles offers designers the ability to create intricate patterns, vibrant colors, and unique designs with unmatched precision and detail. This allows for greater flexibility in garment production, enabling smaller runs, faster turnaround times, and reduced waste compared to traditional printing methods. Moreover, in the home décor sector, digital printing on textiles enables homeowners and interior designers to personalize fabrics for household items. This customization capability allows for the creation of one-of-a-kind home furnishings that reflect individual tastes and styles.

The packaging industry segment has obtained a significant position in the digital fabrication inkjet inks market in 2023. This dominance is attributed to the indispensable role of packaging in various industries such as food and beverage, cosmetics, pharmaceuticals, and consumer goods. The packaging application remains a dominant force within the market, driven by the need for innovative, customizable, and sustainable packaging solutions across diverse industries.

The digital fabrication inkjet inks market plays a crucial role in enhancing the visual appeal and functionality of packaging materials. Brands leverage digital printing technology to create eye-catching designs, vibrant colors, and intricate patterns on packaging substrates such as paperboard, corrugated board, plastics, and flexible films. This allows products to stand out on crowded store shelves and effectively communicate brand identity and messaging to consumers.

The textile industry has been experiencing a rapid spurr in the market growth. The textile industry emerges as a rapidly growing segment within the digital fabrication inkjet inks market, particularly from an application viewpoint. This surge is driven by the increasing demand for customized and on-demand textile printing solutions across various sectors.

Homeowners and interior designers can easily achieve unique and personalized aesthetics for their living spaces, driving demand for digitally printed textiles. Furthermore, the textile segment has experienced substantial growth due to the versatility of digital textile printing. Fabric banners, flags, and promotional textiles offer lightweight, portable, and visually impactful solutions for advertising and branding purposes.

By Type

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

February 2025

February 2025

March 2025