December 2024

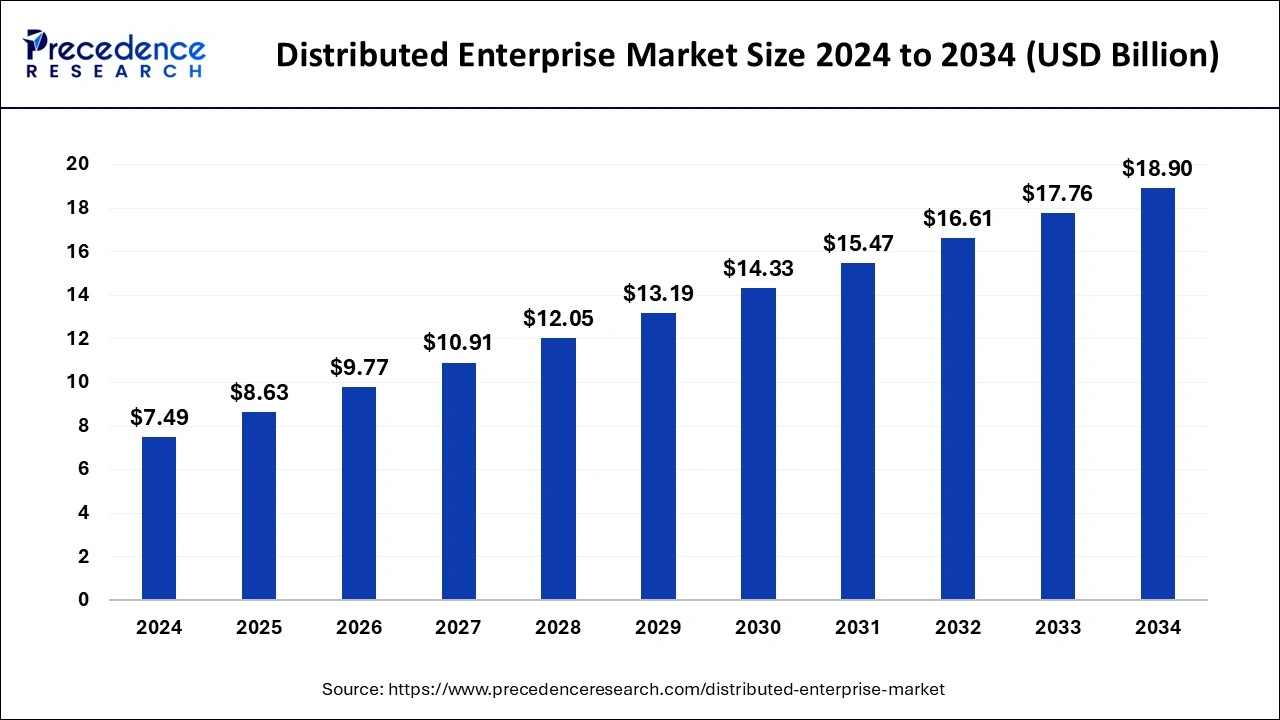

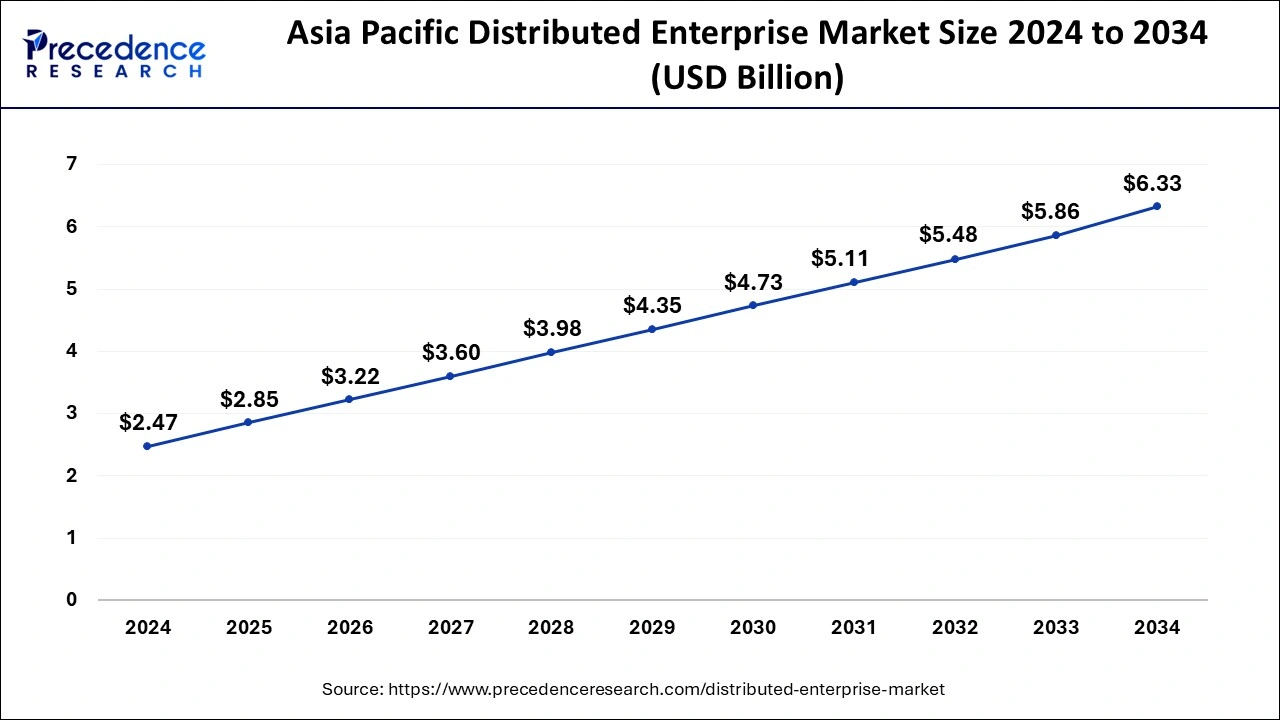

The global distributed enterprise market size is calculated at USD 8.63 billion in 2025 and is forecasted to reach around USD 18.90 billion by 2034, accelerating at a CAGR of 9.70% from 2025 to 2034. The Asia Pacific distributed enterprise market size surpassed USD 2.85 billion in 2025 and is expanding at a CAGR of 9.87% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global distributed enterprise market size was estimated at USD 7.49 billion in 2024 and is predicted to increase from USD 8.63 billion in 2025 to approximately USD 18.90 billion by 2034, expanding at a CAGR of 9.70% from 2025 to 2034.

The Asia Pacific distributed enterprise market size was estimated at USD 2.47 billion in 2024 and is anticipated to reach around USD 6.33 billion by 2034, growing at a CAGR of 9.87% from 2025 to 2034.

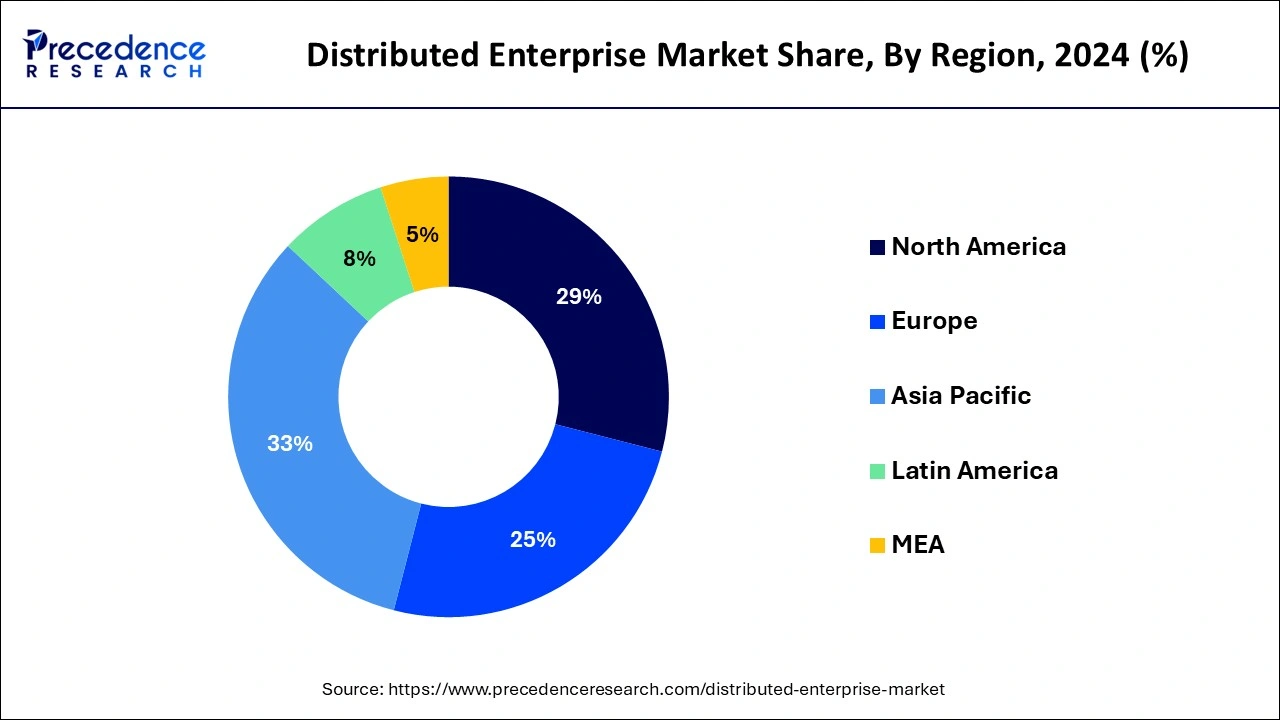

Asia Pacific has emerged as the dominating region of the distributed enterprise market in 2024 while holding 33% of the market share, driven by the widespread adoption of cloud services across many countries in the region. This transition towards cloud-based solutions reflects the increasing reliance on digital infrastructure to support business operations. Moreover, the expansion of manufacturing activity in Asia Pacific underscores the growing demand for high-quality precision equipment, further fueling the growth of the distributed enterprise market. This demand is indicative of the region's evolving industrial landscape and its emphasis on leveraging advanced technologies to enhance productivity and efficiency. The strong presence of the IT sector in Asia Pacific, particularly in countries like China and India, also contributes to the region's market dominance. These countries exhibit significant demand for cutting-edge technology solutions, driving innovation and growth in the distributed enterprise market.

MEA is poised to experience a significant CAGR in the distributed enterprise market. This growth trajectory is attributed to the ongoing development in the telecom sector and the region's strategic efforts to drive new economic development through industrial revitalization. Additionally, there is a notable trend towards the gradual adoption of routers, primarily due to the enhanced functionality of advanced ethernet switches, which can support a wider range of routing protocols. Consequently, enterprises are increasingly inclined towards deploying switches instead of routers, reflecting a shift in preference and technology adoption patterns within the MEA region.

The distributed enterprise market refers to a segment of the business landscape characterized by organizations with multiple locations or branches that operate as part of a cohesive network. In a distributed enterprise model, companies have geographically dispersed offices, remote workers, or branch locations that are interconnected through communication and networking technologies. These distributed enterprises often require robust IT infrastructure, including secure networking solutions, cloud services, and collaboration tools, to facilitate seamless communication, data sharing, and resource access across different locations. As businesses continue to embrace remote work and global expansion strategies, the distributed enterprise market is expected to witness continued growth and innovation to support the evolving needs of modern organizations.

The distributed enterprise market is buoyed by several key drivers including the decentralization of organizational structures, increased adoption of cloud computing and SaaS applications, proliferation of mobile devices and IoT endpoints, and ongoing digital transformation initiatives. These factors reflect the evolving needs of modern businesses operating across multiple locations and remote offices. Organizations seek agile and secure networking solutions to support seamless communication, collaboration, and data exchange among distributed teams and locations. As distributed enterprises rely more on cloud services and embrace digital innovation, the demand for modernized networking technologies and IT infrastructure continues to rise, driving growth in the distributed enterprise market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.70% |

| Market Size in 2025 | USD 8.63 Billion |

| Market Size by 2034 | USD 18.90 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Types, By Deployment Mode, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand of cloud computing

Cloud computing is one of the major driver of the distributed enterprise market, revolutionizing the way organizations manage their IT infrastructure and services. One of the primary factors fueling the adoption of cloud computing in distributed enterprises is its ability to provide scalable and flexible solutions. With cloud services, businesses can rapidly scale their resources up or down based on demand, allowing for optimal performance and cost-efficiency across diverse geographic locations. Furthermore, cloud computing offers unparalleled accessibility, enabling distributed teams to access critical applications and data from anywhere with an internet connection.

This accessibility promotes collaboration and productivity among remote employees and branch offices, enhancing overall operational efficiency. Cost-efficiency is another significant driver of cloud adoption in distributed enterprises. By leveraging cloud services, organizations can eliminate the need for costly upfront investments in physical infrastructure and instead pay for resources on a pay-as-you-go basis. This model reduces capital expenditures while providing access to cutting-edge technology and innovation.

Moreover, cloud computing enhances agility and innovation within distributed enterprises by offering a robust ecosystem of development tools, APIs, and managed services. This enables organizations to accelerate the development and deployment of new applications and services, staying ahead of the competition in today's rapidly evolving digital landscape. Security and compliance are critical considerations for distributed enterprises, and cloud computing providers invest heavily in robust security measures and regulatory compliance certifications. By leveraging cloud-based security solutions, organizations can protect sensitive data and ensure compliance with industry standards and regulations, mitigating cyber security risks across distributed environments. Therefore, cloud computing serves as a cornerstone for distributed enterprises, offering scalability, accessibility, cost-efficiency, agility, and security necessary to thrive in an increasingly interconnected world. As businesses continue to embrace digital transformation initiatives, the adoption of cloud computing is expected to drive innovation and growth in the distributed enterprise market.

Maintaining consistent and reliable connectivity

Maintaining consistent and reliable connectivity across distributed enterprise markets poses a significant restraint. As the distributed nature of these environments means that they often span multiple locations, including remote offices, branch locations, and mobile workforce setups. Ensuring seamless connectivity between these disparate sites requires robust networking infrastructure and technologies that can handle varying bandwidth requirements and network conditions. Also, factors such as network congestion, bandwidth limitations, and latency issues can hinder the delivery of consistent connectivity across distributed environments.

As traffic volumes fluctuate and network demands evolve, organizations must continuously optimize their networks to prevent bottlenecks and ensure smooth data transmission. Additionally, security concerns present another restraint in maintaining connectivity across distributed enterprise markets. With data being transmitted between various endpoints and locations, ensuring data privacy, integrity, and compliance with regulatory requirements becomes paramount. Implementing robust security measures, such as encryption, access controls, and threat detection mechanisms, is crucial to safeguarding sensitive information and mitigating cybersecurity risks.

Moreover, the complexity of managing diverse networking technologies and infrastructure components further complicates efforts to maintain consistent connectivity. From traditional WANs (Wide Area Networks) to SD-WAN (Software-Defined Wide Area Network) solutions and cloud-based networking services, organizations must navigate a myriad of options to architect and manage their network infrastructure effectively.

Growing technological advancements and evolving business needs

The distributed enterprise market presents several promising opportunities driven by technological advancements and evolving business needs. One significant future opportunity lies in the adoption of edge computing solutions within distributed environments. Edge computing brings computation and data storage closer to the source of data generation, reducing latency and enabling real-time processing of critical business data. By leveraging edge computing capabilities, distributed enterprises can enhance the performance of latency-sensitive applications, improve user experiences, and support emerging technologies like IoT (Internet of Things) and AI (Artificial Intelligence) at the network edge.

Furthermore, the increasing convergence of networking and security technologies presents another promising avenue for growth in the distributed enterprise market. With the rise of distributed workforces and cloud-based applications, organizations are prioritizing integrated networking and security solutions that can provide comprehensive protection across distributed environments. This trend is driving the demand for unified security platforms, such as Secure Access Service Edge (SASE), which combine networking and security functionalities into a single, cloud-native architecture. By adopting integrated networking and security solutions, distributed enterprises can streamline operations, reduce complexity, and enhance their overall security posture in an increasingly dynamic threat landscape.

Moreover, the ongoing evolution of SD-WAN (Software-Defined Wide Area Networking) technologies is poised to create new opportunities for innovation and differentiation in the distributed enterprise market. SD-WAN solutions offer organizations greater flexibility, agility, and cost-effectiveness in managing their wide-area networks, enabling centralized network orchestration, dynamic traffic routing, and seamless integration with cloud services. As distributed enterprises seek to optimize their network infrastructures for improved performance, scalability, and resilience, the demand for advanced SD-WAN solutions is expected to grow significantly.

Therefore, the distributed enterprise market is ripe with opportunities for organizations that can effectively leverage edge computing, integrated networking and security solutions, and advanced SD-WAN technologies to address evolving business requirements and stay ahead of the curve in an increasingly interconnected and digital business landscape. By embracing these emerging trends and technologies, distributed enterprises can unlock new levels of efficiency, agility, and innovation to drive business success in the years to come.

The cloud-based infrastructure segment dominated the distributed enterprise market with 30% market share in 2024, accounting for a substantial revenue share. Cloud-based infrastructure offers scalability, cost efficiency, flexibility, global accessibility, security, and disaster recovery capabilities. It enables organizations to innovate, digitally transform, and adapt to changing business needs. Cloud-based solutions also facilitate compliance with regulations and enhance business continuity. As a result, the cloud-based infrastructure segment plays a crucial role in driving growth and empowering distributed enterprises to succeed in a competitive landscape.

The remote workforce segment is projected to witness a rapid CAGR during the forecast period. The remote workforce segment in the distributed enterprise market is primarily driven by the increasing demand for flexible work arrangements, advancements in communication technologies, and the need for business continuity and resilience. The proliferation of remote work has been accelerated by the COVID-19 pandemic, which forced organizations to adopt remote working practices rapidly.

Businesses are recognizing the benefits of remote work, such as improved employee satisfaction, reduced operational costs, and access to a broader talent pool. Additionally, advancements in communication and collaboration tools, cloud-based applications, and virtual private networks (VPNs) have made it easier for employees to work remotely while maintaining productivity and connectivity.

Furthermore, organizations are prioritizing business continuity and resilience by enabling their workforce to operate from anywhere, ensuring operations can continue uninterrupted during emergencies or disruptions. As a result, the remote workforce segment is experiencing significant growth as more companies embrace distributed work environments to adapt to evolving business needs and market dynamics.

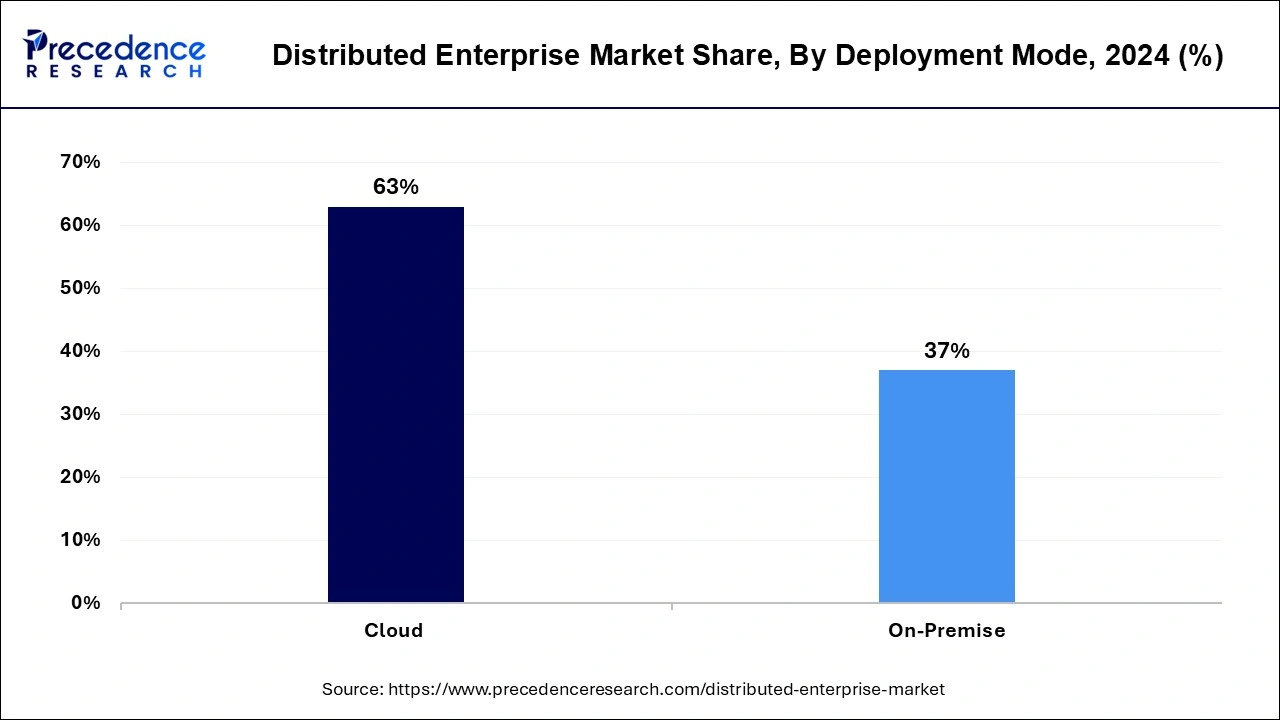

The cloud segment secured the largest market share of 63% in the distributed enterprise market and is anticipated to register the fastest CAGR during the forecast period. This dominance is primarily due to the advantages offered by cloud solutions, such as eliminating firewall restrictions that could impede users' access in on-premise solutions. Cloud-based software as a service (SaaS) solutions also eliminate maintenance and overhead costs, providing a cost-effective and scalable alternative. Cloud object storage services contribute to virtually unlimited storage capacity, overcoming scalability and storage volume limitations associated with locally-placed hardware.

The on-premise segment is projected to experience a significant CAGR of 12.8% over the forecast period. This growth is attributed to the security and privacy benefits provided by on-premise solutions in the field of distributed enterprise. Additionally, on-premise solutions leverage edge analytics, which reduces bandwidth requirements. Integrating these solutions with on-premise deployment ensures higher speed and increased reliability in delivering results. The on-premise deployment model appeals to organizations seeking enhanced control over their data and security measures.

The IT & telecom segment has captured the largest market share of 31% in 2024, driven by the growing availability of data and the continuous development of new technologies. The expanding IT & telecom sector, marked by increased investments and infrastructure expansion, is fueling the demand for distributed enterprise solutions. Companies like COSO IT play a significant role in the telecom sector, providing consulting solutions that enhance efficiency, customer engagement, service delivery, business intelligence, data integration, advanced analytics, predictive analysis, and machine learning-driven automation.

Distributed enterprise vendors leverage advanced technologies, including artificial intelligence and machine learning, to automate tasks and enhance the accuracy of distributed enterprise. The telecom industry benefits from Big Data, optimizing network usage, reducing costs, improving customer satisfaction, and enhancing security by identifying and preventing fraud.

The retail & e-commerce segment is poised to experience the fastest Compound Annual Growth Rate (CAGR) during the forecast period. This industry's increasing reliance on distributed enterprise is crucial for businesses to obtain accurate, up-to-date information about target customers, the market, and competitors. The retail and e-commerce sector, being data-rich, collects extensive customer data. Distributed enterprise aids in optimizing this data to enhance marketing and sales strategies, enabling businesses to make informed decisions and stay competitive in the distributed enterprise market.

By Types

By Deployment Mode

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

May 2024

November 2024

November 2024