January 2025

DNA Microarray Market (By Type: Complementary DNA Microarrays, Oligonucleotide DNA Microarrays, Others; By Application: Gene Expression Analysis, Genotyping, Others; By End-user: Pharmaceutical and Biotechnology Companies, Diagnostic Centers, Hospitals and Clinics, Academic and Research Institute, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

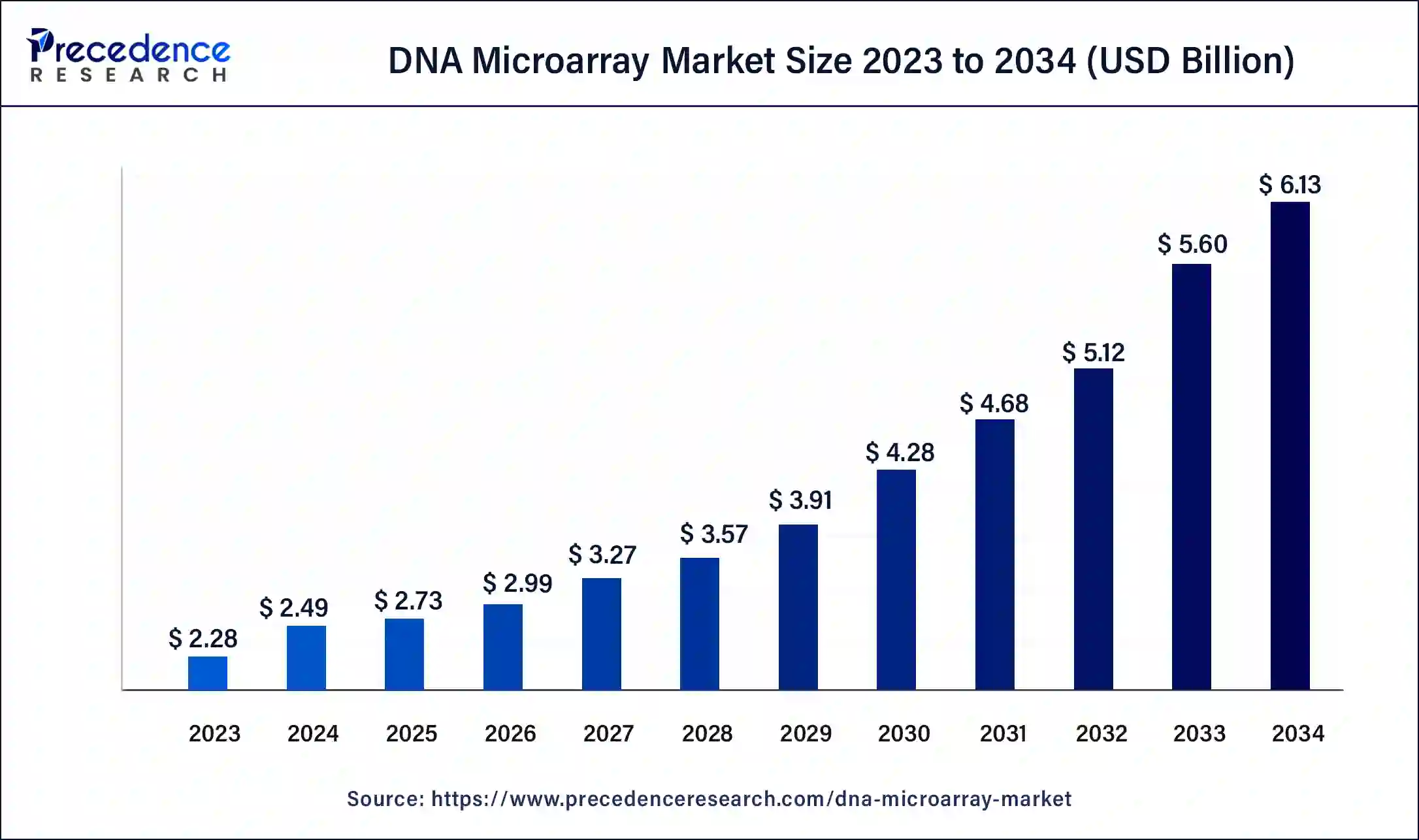

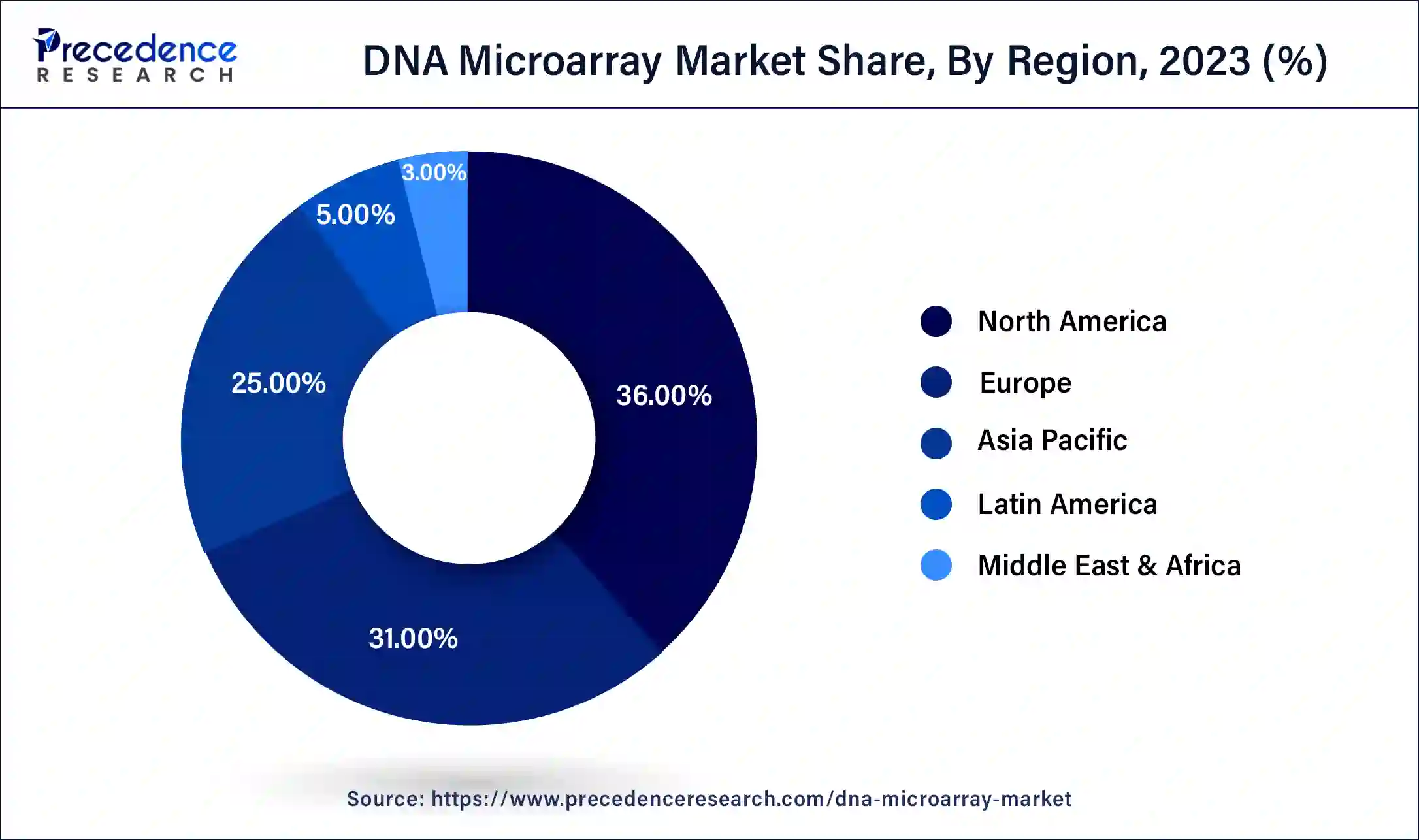

The global DNA microarray market size was USD 2.28 billion in 2023, accounted for USD 2.49 billion in 2024, and is expected to reach around USD 6.13 billion by 2034, expanding at a CAGR of 9.4% from 2024 to 2034. The North America DNA microarray market size reached USD 820 million in 2023.

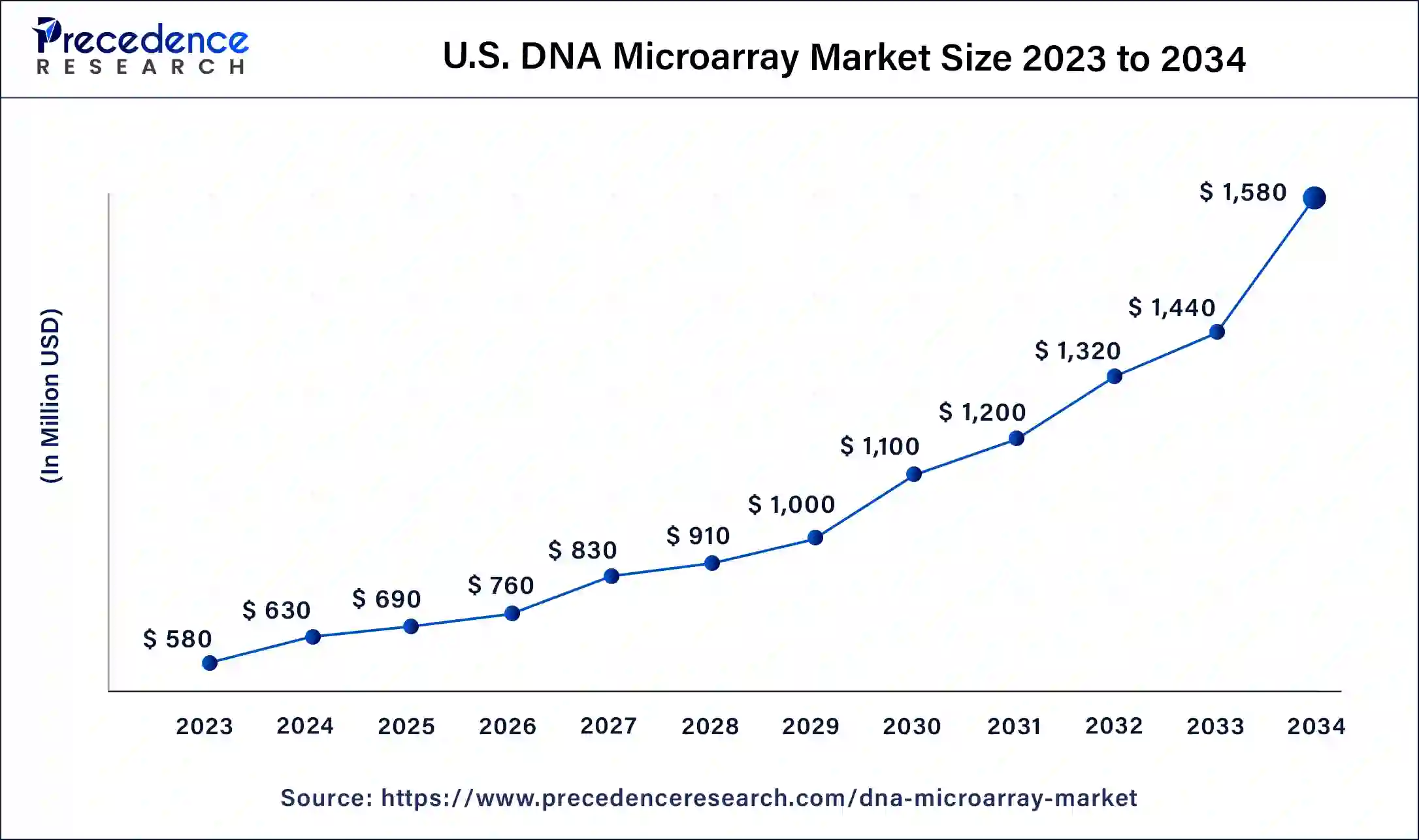

The U.S. DNA microarray market size was estimated at USD 580 million in 2023 and is predicted to be worth around USD 1,580 million by 2034, at a CAGR of 9.6% from 2024 to 2034.

North America has held the largest revenue share of 36% in 2023. In North America, the DNA microarray market exhibits robust growth driven by several trends. The region boasts a strong presence of biotechnology and pharmaceutical companies, fostering innovation and research in genomics. Moreover, government initiatives and funding support genomics research and personalized medicine. Collaborations between academic institutions and industry players drive advancements.

Additionally, the adoption of DNA microarrays in clinical diagnostics and research applications continues to expand. The region's emphasis on precision medicine and its well-established healthcare infrastructure further contribute to the market's growth and technological advancements in DNA microarray applications.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the DNA microarray market is witnessing dynamic trends. Increased government investments in genomics research and healthcare infrastructure are driving market growth. Collaborations with global biotechnology and pharmaceutical companies are fostering innovation and technology adoption.

Furthermore, the increasing incidence of genetic disorders and the rising need for personalized medicine are driving the adoption of DNA microarrays in the Asia-Pacific region. This area is emerging as a focal point for genomics research, with substantial investments and collaborations promoting technology advancements. As a result, the DNA microarray market in Asia-Pacific is projected for sustained growth, presenting substantial opportunities for further expansion and development in the region.

The DNA microarray market is a specialized segment of the biotechnology and genomics industry. It involves the use of microarray technology to simultaneously analyze the expression levels of thousands of genes or genetic variations within a single biological sample. The DNA microarray market caters to researchers, pharmaceutical firms, and clinical laboratories, facilitating the efficient examination of gene expression patterns, detection of disease markers, and streamlined genetic testing. DNA microarrays are indispensable in genomics research, personalized medicine, and diagnostics, enabling the high-throughput analysis of DNA, RNA, and protein interactions at a microscopic level.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 9.4% |

| Market Size in 2023 | USD 2.28 Billion |

| Market Size in 2024 | USD 2.49 Billion |

| Market Size by 2034 | USD 6.13 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Prevalence of genetic disorders and biomarker discovery

The prevalence of genetic disorders significantly surges the market demand for the DNA microarray market. The escalating prevalence of genetic conditions necessitates accurate and early diagnosis, a role in which DNA microarrays excel. They play a crucial part in identifying genetic markers linked to these disorders, enabling timely interventions and personalized treatment approaches. This surging demand for precise genetic testing and diagnostics drives the widespread adoption of microarray technology, establishing it as a pivotal tool in addressing the healthcare challenges posed by genetic disorders, ultimately enhancing patient care and outcomes.

Moreover, Biomarker discovery plays a pivotal role in surging the market demand for the DNA microarray market. DNA microarrays are pivotal in identifying and characterizing biomarkers associated with a diverse array of diseases, including cancer, cardiovascular disorders, and neurological conditions. These biomarkers serve as critical benchmarks for disease diagnosis, prognostication, and treatment response monitoring. Consequently, DNA microarrays stand as indispensable instruments propelling advancements in healthcare and contributing significantly to improved patient outcomes.

Data complexity and quality control concerns

Data complexity poses a significant restraint on the DNA microarray market. The vast volume of data generated by microarray experiments requires advanced bioinformatics tools and expertise for analysis. Handling complex datasets can be time-consuming and resource-intensive, limiting accessibility to a broader range of researchers and healthcare facilities. Moreover, misinterpretation of intricate data can lead to erroneous conclusions, emphasizing the need for skilled professionals. Addressing these challenges is essential to fully harness the potential of DNA microarrays in genomics research and diagnostics. Moreover, quality control concerns present a significant restraint in the DNA microarray market.

Ensuring the accuracy and reliability of microarray data is paramount, requiring meticulous sample handling, hybridization efficiency, and data normalization. Addressing these concerns demands additional resources, time, and expertise, potentially increasing costs. Inconsistent or unreliable data can undermine research and diagnostic outcomes, eroding user confidence in microarray technology. Consequently, organizations may hesitate to adopt or invest in DNA microarrays, hindering market growth and accessibility, particularly for those with limited quality control capabilities.

Integration with other omics technologies and customized microarrays

Integration with other omics technologies significantly boosts the DNA microarray market. Collaborative data analysis and interpretation across genomics, proteomics, and metabolomics enable researchers to attain a more comprehensive understanding of complex biological systems. This synergy provides valuable insights into disease mechanisms, drug discovery, and personalized medicine, driving the demand for microarrays.

The ability to investigate multiple layers of biological information enhances research and diagnostic capabilities, making DNA microarrays indispensable tools for interdisciplinary studies and applications, thereby surging market demand. Moreover, customized microarrays are catalysts for surging market demand in the DNA microarray market. They cater to the specific research needs of diverse industries and research institutions.

By allowing tailored design and manufacturing of microarrays, they empower researchers to conduct highly specialized studies. This flexibility fosters innovation, encourages adoption, and opens niche markets. Researchers, particularly in emerging fields, rely on customized microarrays to explore unique genetic questions, propelling the demand for DNA microarray technology and driving market growth.

According to the type, the oligonucleotide DNA microarrays segment held a 45% revenue share in 2023. Oligonucleotide DNA microarrays, a prominent type in the DNA microarray market, involve short DNA sequences immobilized on a solid substrate for genetic analysis. Trends indicate a shift towards higher-density arrays with improved specificity and sensitivity. This type allows precise examination of gene expression, genetic variations, and mutation detection, making it invaluable in research and diagnostics. Ongoing advancements aim to enhance probe design and synthesis techniques, further boosting the accuracy and versatility of oligonucleotide DNA microarrays in genomics research and personalized medicine.

The complementary DNA microarrays segment is anticipated to expand at a significant CAGR of 10.1% during the projected period. Complementary DNA (cDNA) microarrays, a prominent type within the DNA microarray market, involve the use of cDNA probes to measure gene expression. These microarrays have traditionally been essential tools for studying gene expression patterns.

In recent trends, cDNA microarrays have evolved to offer higher sensitivity, specificity, and multiplexing capabilities, enabling researchers to explore complex biological systems comprehensively. Additionally, advancements in data analysis techniques and integration with other omics technologies have enhanced their utility in genomics research, personalized medicine, and drug discovery, driving their continued relevance and adoption.

Based on the application, the gene expression analysis segment is anticipated to hold the largest market share of 46% in 2023. Gene expression analysis in the DNA microarray market refers to the examination of how genes are activated or deactivated in response to various biological conditions. This application involves measuring the abundance of messenger RNA (mRNA) molecules to understand which genes are actively expressed within a given sample.

A notable trend in gene expression analysis is the integration of microarray data with other omics technologies like proteomics and metabolomics. This integration enhances the understanding of cellular processes by examining gene expression alongside protein and metabolite profiles, providing a more comprehensive view of biological systems.

Furthermore, advancements in single-cell RNA sequencing and data analysis tools have greatly enhanced the precision and accuracy of gene expression studies, enabling researchers to delve deeper into cellular behavior and mechanisms in the DNA microarray market.

On the other hand, the genotyping segment is observed to witness the fastest expansion during the forecast period. Advances in genotyping technologies, such as the development of high-density SNP arrays, have improved the accuracy and efficiency of genotyping. This has contributed to the widespread adoption of genotyping methods in various research and clinical applications. Genotyping has found applications in clinical diagnostics, such as determining an individual's susceptibility to certain diseases, predicting drug responses, and identifying potential genetic markers for hereditary conditions. The clinical relevance of genotyping has contributed to its dominance in certain segments of the DNA microarray market.

The academic & research institutes segment had the highest market share of 37% in 2023. In the DNA microarray market, academic and research institutes represent prominent end users. These institutions utilize microarray technology to conduct cutting-edge genomics research, explore gene expression patterns, and investigate genetic variations.

A notable trend is the increasing collaboration between academic institutions and industry players, fostering innovation and knowledge sharing. Additionally, academic researchers are focusing on multi-omics integration, combining microarray data with proteomics and metabolomics, to gain a comprehensive understanding of biological systems, driving advancements in genomics research within academic and research institutes.

The diagnostic centers segment is anticipated to expand at the fastest rate over the projected period. Diagnostic centers, within the DNA microarray market, are specialized facilities focused on providing advanced genetic testing and diagnostic services. They cater to healthcare professionals and patients, offering insights into genetic factors associated with various diseases and conditions.

A notable trend in diagnostic centers is the increasing demand for comprehensive genetic testing, including ancestry analysis and predisposition assessments. Moreover, these centers are incorporating next-generation sequencing and data interpretation services to offer more detailed and personalized genetic information to individuals, driving the growth of genetic diagnostics.

Segments Covered in the Report

By Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2022