March 2025

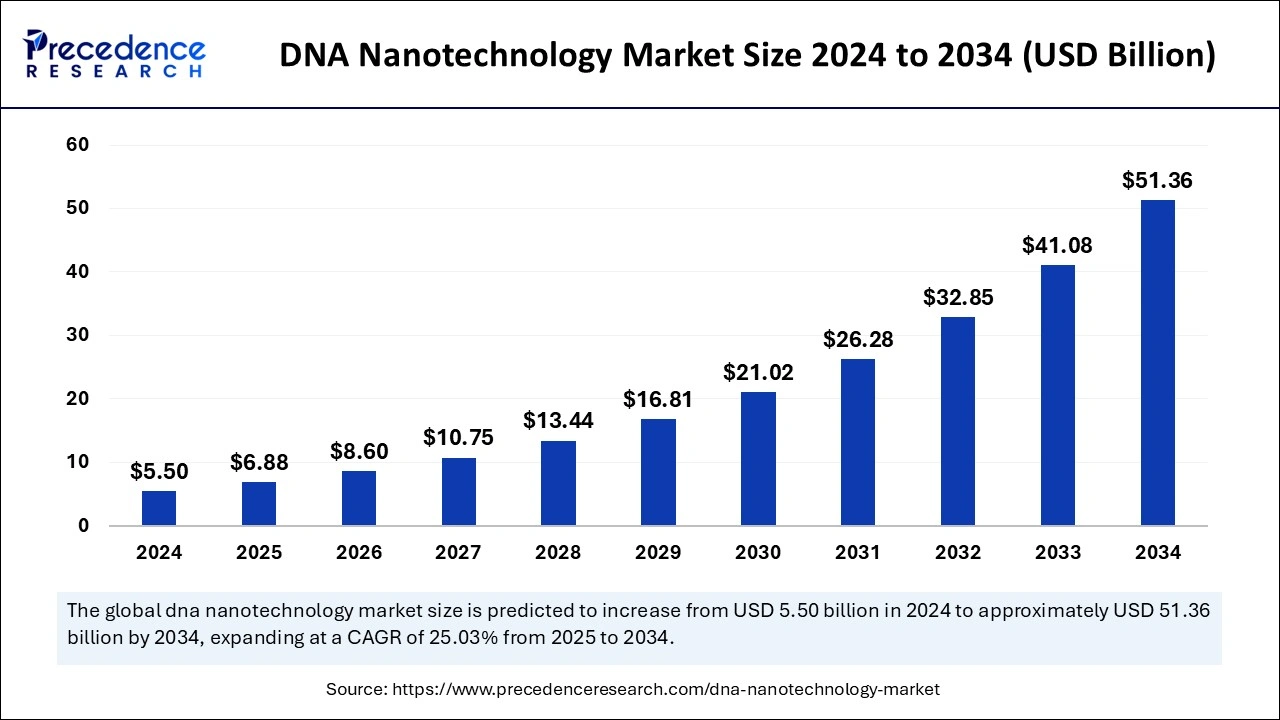

The global DNA nanotechnology market size accounted for USD 6.88 billion in 2025 and is forecasted to hit around USD 51.36 billion by 2034, representing a CAGR of 25.03% from 2025 to 2034. The Asia Pacific market size was estimated at USD 2.15 billion in 2024 and is expanding at a CAGR of 25.16% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global DNA nanotechnology market size was estimated at USD 5.50 billion in 2024 and is predicted to increase from USD 6.88 billion in 2025 to approximately USD 51.36 billion by 2034, expanding at a CAGR of 25.03% from 2025 to 2034. The market growth is attributed to the rising adoption of DNA nanotechnology in drug delivery and diagnostic applications.

DNA nanotechnology market advancement is facilitated by artificial intelligence, as it has the ability to improve design exactness while optimizing synthesis frameworks and running massive data evaluations. Stable Deoxyribonucleic Acid (DNA) structures can be forecasted by machine learning systems that decrease the need for experimental trials, thus accelerating molecular construction. Computer models based on AI help researchers create self-assembling nanostructures that serve as drug carriers, biosensors, and elements for molecular computing. Researchers use AI to evaluate large genomic data collections, which enhances DNA-based diagnostic precision and personal medicine functionality.

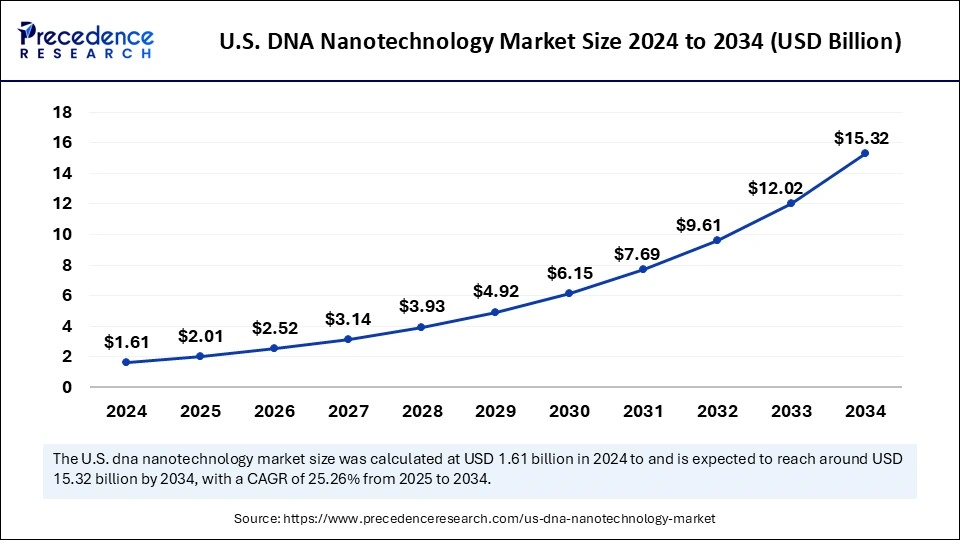

The U.S. DNA nanotechnology market size was exhibited at USD 1.61 billion in 2024 and is projected to be worth around USD 15.32 billion by 2034, growing at a CAGR of 25.26% from 2025 to 2034.

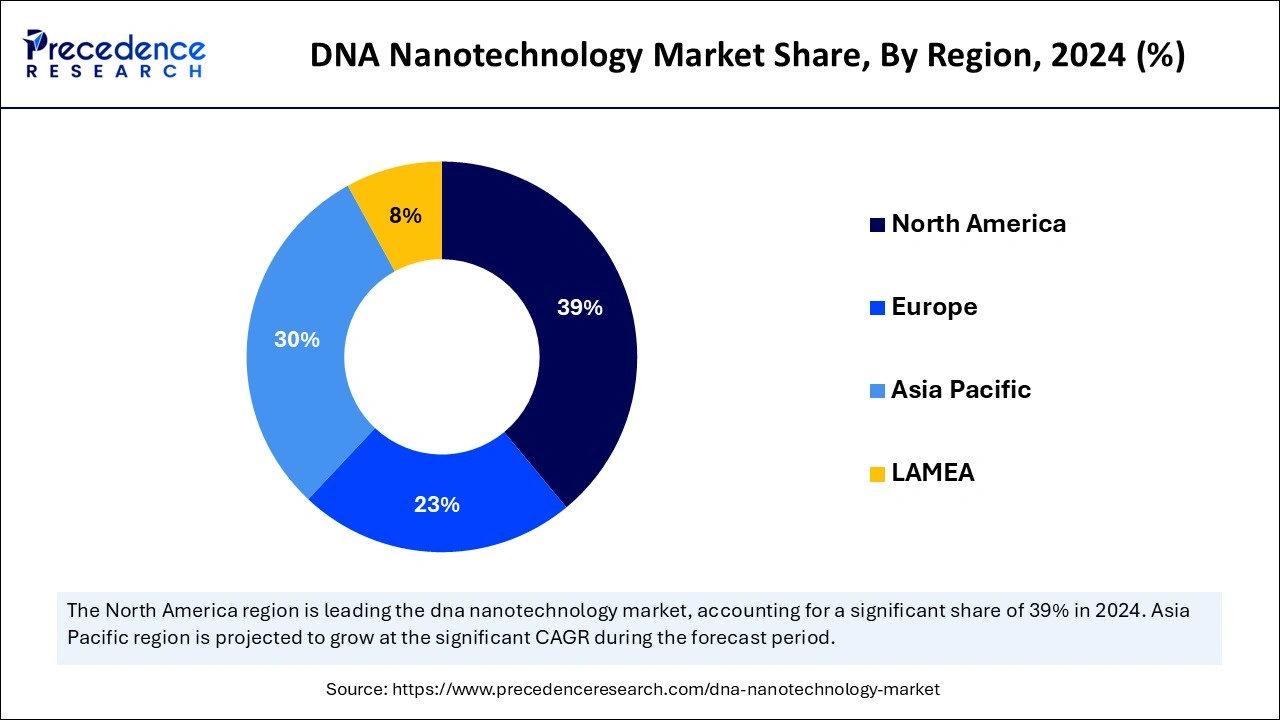

North America accounted for the largest DNA nanotechnology market share in 2024. Nanotechnology research at the forefront maintains its leadership position in the U.S. through substantial federal funding obtained from the NIH and the NSF. Public investments from these organizations enabled DNA nanotechnology to become commercially available for diagnostic purposes, drug delivery systems, and applications in gene therapy fields.

Pharmaceutical firms in North America remain leading developers of the DNA nanotechnology market to advance their research efforts through smart pill development and DNA nanorobot technology. Additionally, its strong regulatory systems, along with solid protection of intellectual property, further boost the market in this region.

Asia Pacific is projected to host the fastest-growing DNA nanotechnology market in the coming years, as China, along with Japan and India, advances biotechnology research while making impressive progress in nanotechnology research. Bio-medical research investments from China have skyrocketed to become one of the largest in the world, while its government aims to lead biotechnology globally by the year 2030. The 2023 Chinese government budgeted billion for biotechnology research while including DNA nanotechnology within its funding scope. The growing healthcare needs of Asian Pacific populations, along with their expanding patient numbers, drive the adoption of advanced delivery systems through DNA nanocarriers.

The continuous growth of the DNA nanotechnology market depends on advances in genomics research, which permits the creation of precise medical treatments and diagnostic instruments. DNA nanotechnology develops nanoscale medical applications through sequential processes of designing devices from DNA molecules, as their unique molecular properties.

Through its All of Us Research Program, the National Institutes of Health (NIH) started in 2023 to obtain health data, including DNA information, from one million participants across the United States. This healthcare initiative provides DNA-based health results to participants to improve customized medical care. The Science Council at WHO issued its report in 2022 advocating for fair genomic expansion, which aims to enhance global health delivery. The document underlines the requirement to distribute genomic tools across all nations in order to obtain their maximum potential in disease recognition and prevention along with treatment delivery.

| Report Coverage | Details |

| Market Size by 2024 | USD 5.50 Billion |

| Market Size in 2025 | USD 6.88 Billion |

| Market Size in 2034 | USD 51.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 25.03% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Increasing demand for targeted drug delivery

Advancements in precision medicine are expected to drive market growth for DNA-based nanocarriers in drug delivery applications. The demand for DNA-based nanocarriers in drug delivery applications has increased in recent progress in precision medicine research. DNA nanoscale structures enable high compatibility between biological systems while providing programmable building capabilities to researchers who develop precision therapeutic options with improved performance and minimized adverse effects. Companies within pharmaceutical research invest in DNA nanotechnology development to make medications stable, enhance delivery control, and improve their ability to reach individual cells.

The DNA nanotechnology market experiences more rapid growth as these systems are being tested through clinical trials for their potential use in cancer therapy and gene treatment. The growing number of chronic diseases, both cancer and genetic disorders, drives the requirement for new delivery devices that advance technological capabilities. Furthermore, the market keeps advancing through precision medicine research, which continues to develop patient-centric approaches for effective treatment creation.

Nanotechnology Use in Drug Delivery and Precision Medicine (2023–2024)

| Category | Statistic / Development |

| Increase in Phase I Advanced Therapy Trials (UK, 2024) | 70% rise, with 27 new or initiated trials vs. 13 in 2023 |

| Global Active Clinical Trials in Cell & Gene Therapies (2022) | 1,221 active trials, including 342 in Phase I/1b |

| Ongoing Phase I Trials in Japan (2024) | Three Phase I trials are currently in progress |

High production costs

High costs associated with DNA nanotechnology development are expected to restrain the DNA nanotechnology market. DNA-based nanostructures need sophisticated fabrication methods together with expert reagents and precise chemical design, which drives up overall prices of production. Small and mid-sized enterprises lack adequate funding to support large-scale manufacturing, which slows down both innovation efforts and commercial opportunities. The expense of obtaining pure DNA sequences and complex self-assembly operations makes production costs rise above market reach limits. Moreover, the lack of inexpensive, scalable methods to produce DNA nanostructures hinders their market adoption within developing nations.

Increasing investments in DNA nanorobotics

Expanding research in DNA-based nanorobotics is projected to create immense opportunities in medical and industrial applications, further fuelling the DNA nanotechnology market. The medical and industrial sectors are gaining substantial opportunities from growing investments directed toward DNA nanorobotics development. The nanoscale devices manufactured through DNA origami methods provide two important features of self-assembly and molecular recognition, so they function well for drug delivery systems and nanoscopic surgical tasks.

Scientists are studying DNA-based molecular machines because they show potential as immune modulators, tissue engineering tools, and intracellular diagnostic instruments. The advancement of artificial intelligence in molecular simulation research stimulates the DNA nanotechnology market by improving both performance and operational capability. Academic-industry partnerships are enabling DNA nanorobot innovation, which will lead to the successful commercialization of these systems. Furthermore, the growing demand for advanced genomic research and DNA nanotechnology, among other technologies, serve critical roles in advancing worldwide health programs.

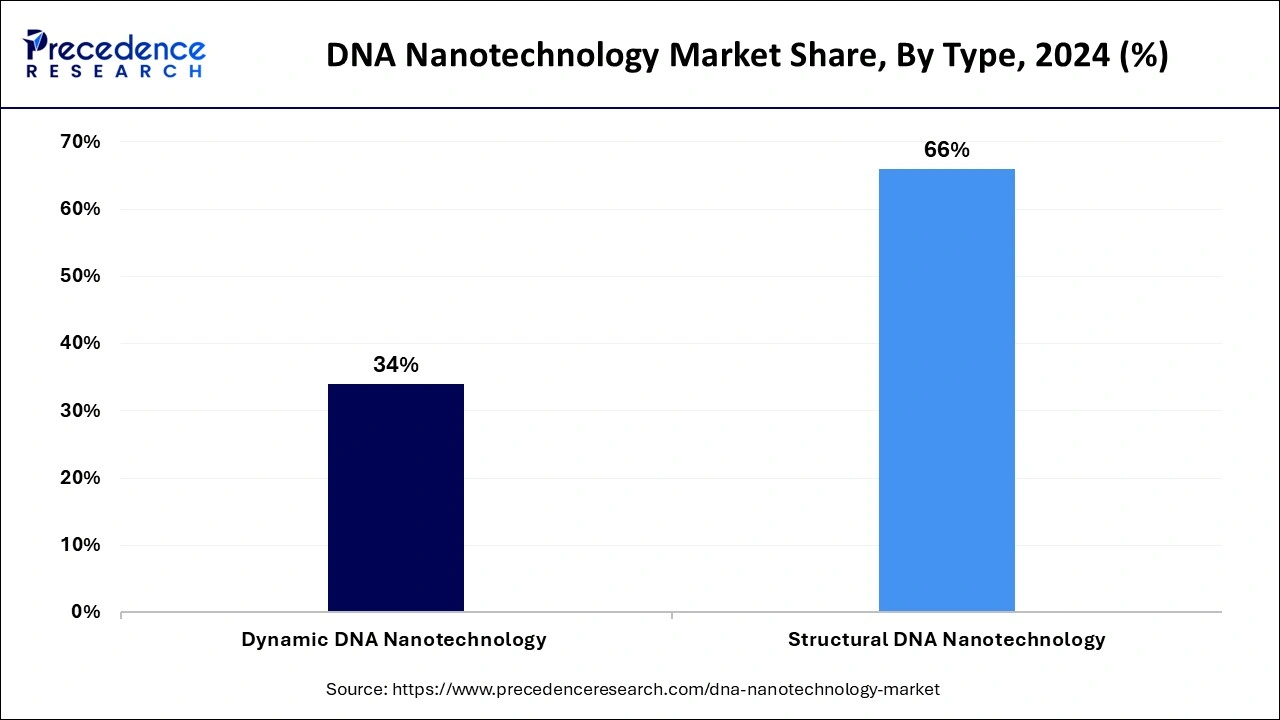

The structural DNA nanotechnology segment held a dominant presence in the DNA nanotechnology market in 2024 due to its drug-delivery solutions and diagnostic applications. DNA nanotechnology, along with related technologies, has obtained recognition from the World Health Organization's Science Council as an essential component for achieving global health objectives. Furthermore, the growing utility of structural DNA nanotechnology demonstrates its ability to transform both medical and industrial applications.

The dynamic DNA nanotechnology segment is expected to grow at the fastest rate over the forecast period of 2024 to 2034. Owing to the nanomechanical devices and strand displacement cascades in the upcoming years. Artificial intelligence-driven molecular simulation advancements speed up DNA nanorobot development and improve their operational efficiency and functionality. Academic institutions join forces with industrial partners to develop DNA nanorobotics through innovation, which results in their commercial release.

The targeted drug delivery segment accounted for a considerable share of the DNA nanotechnology market in 2024. DNA nanocarriers provide advantageous features for drug delivery through their high biocompatibility properties and their programmable assembly functionality with controlled drug release operations. The pharmaceutical industry frequently relies on DNA nanotechnology to enhance drug stability, control release patterns, and achieve intracellular delivery, especially within the contexts of cancer therapy and genetic disorder treatment. Furthermore, the World Health Organization (WHO) identifies nanotechnology-based drug delivery systems as essential tools to manage growing non-communicable diseases, thus accelerating their demand.

The smart pills segment is anticipated to grow with the highest CAGR during the studied years, owing to their expanding role in real-time monitoring and drug delivery. Smart pills use DNA-based nanotechnology for both controlled medicine delivery systems and patient therapy outcome assessments. They are gaining popularity due to increased demand, as well as rising rates of diabetes, gastrointestinal disorders, and neurological diseases that require steady medication administration. Moreover, the development of smart pills has accelerated through both DNA origami achievements and self-assembling nanostructure advancements, as well as expanded research between DNA nanotechnology and sensors.

In 2024, the biotechnology and pharmaceuticals segment led the global DNA nanotechnology market due to the fact that pharmaceutical companies invest heavily in developing advanced therapeutic medicines along with drug delivery platforms. Organizations in the pharmaceutical sector have started using DNA nanotechnology due to the growing necessity for efficient, targeted treatments in oncology and gene therapy and rare genetic disorders. The companies utilize nanocarriers made from DNA to make their drugs more stable while boosting cellular entry and decreasing negative outcomes.

The academic and research institutions segment is projected to expand rapidly in the coming years, owing to their central role in developing innovative techniques in DNA nanotechnology fundamental research. New applications of DNA nanostructures are being investigated by research institutions for molecular computing development, along with the creation of nanorobots and advanced diagnostic methods. Academic researchers develop novel diagnostic tools and therapeutic solutions by progressing DNA-based technologies, as healthcare demands precise medicine techniques and early disease detection.

January 2025 – Aldevron

Chief Scientific Officer for Aldevron – Venkata Indurthi

Announcement - Aldevron, a global leader in DNA, RNA, and protein production, has introduced its latest innovation, Alchemy™ cell-free DNA technology. According to Venkata Indurthi, Chief Scientific Officer at Aldevron, “Alchemy is our exclusive cell-free DNA technology that reduces research-grade linear DNA manufacturing time by over 50%, accelerating mRNA development with cleaner, safer DNA templates.” This technology provides a reliable and efficient foundation for mRNA synthesis, offering higher purity without host cell protein, genomic DNA, or endotoxin.

By Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025