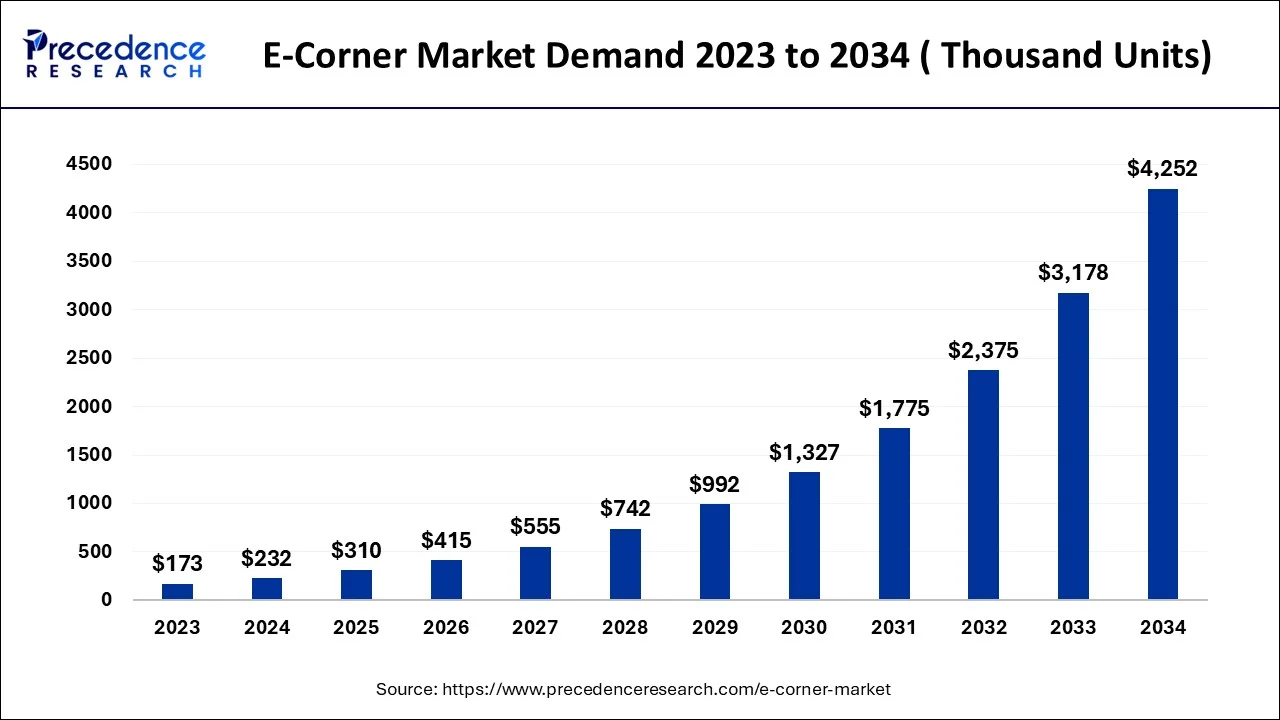

The global e-corner market demand accounted for 232 thousand units in 2024, grew to 310 thousand units in 2025 and is projected to surpass around 4,252 thousand units by 2034, representing a CAGR of 33.76% between 2024 and 2034.

The global e-corner market demand is calculated at 232 thousand units in 2024 and is predicted to reach around 4,252 thousand units by 2034, expanding at a CAGR of 33.76% from 2024 to 2034.

The e-corner market is revolutionizing the car movement, especially bringing major changes to the automotive industry in design, production, maintenance, and driving. Until now, automobiles were limited to forward and backward, life, and right directional movement. However, with the e-corner system, the core technology of future mobility provides more options. It allows various movements, such as crab driving that moves life or right or 360°rotation on the spot. Such complex movements are possible with the help of next-generation technology that integrates driving, braking, steering, and suspension systems within each wheel of the vehicle. The e-corner system is suitable for mobility, such as shuttles to and from the city center, robot taxis, logistics vehicles, and commuting vehicles.

The integration of artificial intelligence in wheel motor technology or the e-corner market is achieved due to the continuous advancement of material science, electronic information technology, and artificial intelligence. In-wheel motor technology has moved to a broader development space. With the lighter material and smarter control system, these factors push the application of hub motors in the field of robotics to an advanced level.

In the future, more development in the area of robotics will be witnessed, which will play a vital role in the e-corner market. Artificial intelligence in the automotive industry is beneficial for streamlining operations and improving vehicle performance. With the help of big data, IoT, AI, and ML, the industry is transforming in terms of vehicle design, manufacturing, and driving.

| Report Coverage | Details |

| Market Demand by 2034 | 4,252 Thousand Units |

| Market Demand in 2024 | 232 Thousand Units |

| Market Demand in 2025 | 310 Thousand Units |

| Market Growth Rate from 2024 to 2034 | CAGR of 33.76% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle, Motor Configuration, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Technological advancements and EV adoption

The e-corner market is experiencing significant growth due to rapid advancement in technologies such as AI and Internet of Things (IoT) , along with the increasing adoption of electric vehicles with e-corner systems is fueling the market growth. Key players in the market have made a heavy investment in R&D to develop advanced driver-assistance systems and autonomous vehicles which are independent of precise localization provided by the e-corner system. E-corner systems are not suitable for gasoline vehicles; they are exclusively designed for electric vehicles that do not have axles to transfer their power from an internal combustion engine.

High cost

The e-corner market is more complex and expensive to manufacture and maintain, in addition to the overall cost of the vehicle. Along with that, there is a potential for maintenance issues. the mechanical components increase the maintenance and repair costs. As there are limited manufacturers and engineers of this new advancement, the complexity of manufacturing and providing the right diagnosis in case of repair would be difficult. Fixing the vehicle from any servicing engineer might lead to more tangled complications resulting in greater bills.

Mandatory implementations

Currently, the e-corner market is in the stage of implementing novel functions, and future technology development is required. With the coming age, advancement is expected to witness the evolving e-corner system, which will require changes in the automotive manufacturing process, infrastructure, and even regulatory framework to understand its potential fully.

The light commercial vehicle segment contributed the highest share of the e-corner market in 2023. The dominance of the light commercial vehicle segment is due to the availability of manufactured vehicles in various sizes depending on the vehicle specification. Small, larger, and ultra-small vehicles are used in robotics. Additionally, it has great scalability. For instance, large logistics transport PBVs (platforms beyond vehicles) are equipped with plenty of e-corner systems as required. Depending on the size and weight of the vehicle, many e-corner systems are installed as needed.

The passenger car segment is projected to grow at a significant CAGR in the e-corner market during the forecast period. The expansion of the segment is observed due to the new approach to cars. The passenger car in-build with e-corner systems has sophisticated sensors, sensor fusion in electric control units (ECU), and software development for safety control. The driving features such as carb-walk are ideal for parallel parking in tight spaced, diagonal driving provides a 45-degree angle turn to avoid obstacles or vehicles on the road, and pivot turn is perfect for drivers who choose any point for the central axis to rotate the car, and lastly, zero turns allow the driver to take a 360-degree idle turn.

The quad-motor segment captured the biggest share of the e-corner market in 2023. Quad motor comprises where four wheels deliver instant power and independently adjusting torque at each wheel for precise traction control in all scenarios. With a quad-motor, the vehicle can turn on the spot. For instance, the electric G-Class from Mercedes. It offers advantages in terms of control and comfort when driving.

The tri-motor segment is expected to grow at a solid CAGR in the e-corner market during the forecast period. The expansion of this market is noticed as it could carry heavy, bulky loads and operate out of small landing strips. This makes it an ideal automotive motor for logistics and industrial use. Ford has been using tr-motors for a long time in aeroplanes to carry passengers rather than airmail.

Asia Pacific dominated the global e-corner market in 2023, owing to the increasing demand for electric vehicles with in-build e-corner modules equipped in luxury vehicles such as Yangwang U8 & U9 developed on BYD’s e4 platform. China provides relatively low-cost electric vehicles from manufacturers such as BYD, SAIC, BAIC, and Geely. Along with that, it is the world’s biggest producer and exporter of batteries and battery components. Technological patents and wireless charging are the main technologies used by Chinese automakers.

North America is anticipated to grow at the fastest CAGR in the e-corner market during the forecast period. The expansion of this region is witnessed due to the rising demand for SUVs and pickup trucks with quad-motor configurations, such as the Tesla CyberTracker for off-road capability and the GMC Hummer EV. The existing demand for EVs is already popular in the U.S., but nowadays, electric SUVs are gaining traction as they are more fuel-efficient and produce zero emissions. SUVs are well-suited for autonomous driving, as they are typically larger and heavier than passenger cars. Popular SUVs seen in the United States are the Toyota RAV4, Honda CR-V, Ford Explorer, Hyundai Tuscon, and Subaru Cross Trek.

By Vehicle

By Motor Configuration

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client