April 2025

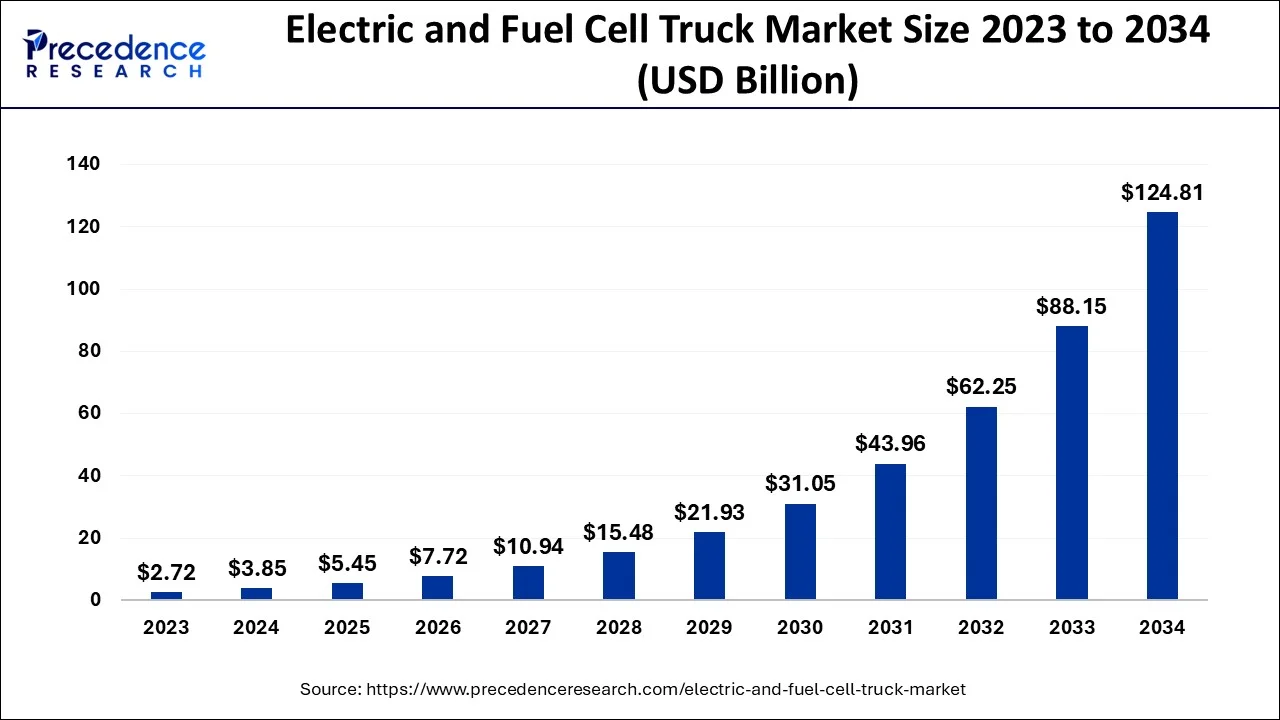

The global electric and fuel cell truck market size accounted for USD 3.85 billion in 2024, grew to USD 5.45 billion in 2025 and is predicted to surpass around USD 124.81 billion by 2034, representing a healthy CAGR of 41.60% between 2024 and 2034.

The global electric and fuel cell truck market size is estimated at USD 3.85 billion in 2024 and is anticipated to reach around USD 124.81 billion by 2034, expanding at a CAGR of 41.60% from 2024 to 2034.

AI is highly beneficial to electric and fuel cell trucks. Incorporating AI algorithms in batteries makes it possible to track battery health and performance in real-time, further reducing downtime and increasing energy efficiency. AI has the ability to predict problems before they become worse. Moreover, it plays a crucial role in developing autonomous driving technologies for trucks. AI also analyzes road conditions, traffic patterns, and weather conditions and suggests the best possible routes. Deploying AI into EV fleet management systems leads to improved operational efficiency and lower operational costs.

Electric and fuel cell electric vehicles are the best developed alternatives for combustion-based automobiles. Electric and fuel cell trucks are the newly developed innovative technology which are electronics-based trucks and installed embedded systems, fuel cells, battery, capacitor to give power to the battery. In the trucks fuel cells are present which is used to produce electric power by utilizing oxygen from the air and the hydrogen.

Majorly electric and fuel cell vehicles are free from emission of carbondioxide which only involves emission of water and heat. Hydrogen is a natural gas storing and transporting also can cause pollution. Vehicles such as internal combustion vehicles, hydrogen vehicles can also create the pollution which stores the hydrogen. Increased growth of the electric and fuel cell market which majorly involves electric power for running the vehicles.

Major components in the electric and fuel cell truck include fuel cells, battery, capacitor. Due to less emission of carbondioxide gas and improved ecosystem giving rise to clean and green city with improved air quality and less pollution. Majorly fuel cells are developed with three parts such as cathode, anode, electrolyte by producing electricity and storing the power and transmitting. In fuel cell hydrogen is stored which produces electrochemical energy to drive the vehicle.

Impact of covid-19 affected the market growth rate of electric and fuel cell market due to wide spread of corona virus across various regions declined the market growth. Due to norms and regulations imposed by the governments lock down in various regions led to shut down of the doors of many industries which halted the production and manufacturing in automobile industry.

Increased government initiative for developing the electric and fuel cells truck considering the environment by zero emission of carbon and contributing for producing and manufacturing the electric and fuel cell trucks with increased demands from the consumer extended the market due to less carbon emission which helps the environment to be green and clean with developed infrastructures for refuelling the gas. Increased demand for electric and fuel trucks due fuel efficiency and low emissions and increased prices of the petrol and diesel. Which helps to boost the market to larger extent during the forecast period. Increased investments and awareness about new developed features in automobile industry have contributed for the growth of electric and fuel cells market.

Impact of covid-19 on the electric and fuel cell truck market declined the growth of the market revenue share due to decreased demands from the consumer and shutdown of the automotive industries led to shortening of manufacturing electric vehicles and others. Post pandemic situation raised the demands for thriving the market growth of electric and fuel cell truck increased demands from the consumer with improved focus on ecosystem with clean and green economy and increased rates of the fuel increased market rate of electric an fuel cell truck. The key market players involved in launching new trucks with new various features and increased research and development in electric and fuel cell trucks have expanded the market size value during the forecast period.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.85 Billion |

| Market Size by 2034 | USD 124.81 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 41.60% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Power Rating, Vehicles, and Geography |

Increased fuel efficiency - Increased fuel consumption by electric and fuel cell truck compare to the convenient vehicles. Increased electric and fuel cell trucks with increased fuel in demand from the market drives the market to grow at a larger extent. Increased range of the electric and fuel cell trucks has boosted the market to grow high.

Increased Encouragement - Encouraging automotive industry to develop manufacture and produce electric and fuel-efficient vehicles increased investment in automobile industry to improve the electrification system in the vehicles. Increased government initiative and encouragement to develop more electric and fuel cell trucks with less emission of carbondioxide and to improve the global ecosystem which helps to drive the market. The key market players involved in producing the new improved electric fuel cell truck with new developed innovations have shown a rise in themarket with increased benefits with low emission of carbondioxide gas and less air pollution contributing to increase the market revenue share.

Increased costing - Improved development in electric and fuel cell trucks with various new technology developed and innovations led to increased costing of the trucks which may act as to hinder the market growth and decline the market rate necessary to maintain the balance and outcome of the product. Increased cost of the fuel cell. A fuel cell is made up of bipolar plates, stacks, gas diffusion layers, membrane, catalyst. Usually platinum is utilized in catalyst during manufacturing of the fuel cells. Whereas the platinum is the most expensive metal used.

Availability of number of options to the electric and fuel cell truck also with increased demand and high rates the market can be turned towards the availability of the options in the market. Which may led to decline the market growth.

The proton exchange membrane fuel cell segment dominated the global market with the largest share in 2023. The segment is driven by the increased preference for proton exchange membrane fuel cell (MEMFC) due to its high efficiency in converting hydrogen into electricity. Its low operating temperatures, quick start-up time, high power density, and scalability are major factors boost the demand for PEMFC. Moreover, PEMFC produce water vapor as a byproduct, reducing carbon emissions. The rising demand for sustainable transportation and high-performance electric vehicles bolstered the segment.

On the other hand, the phosphoric acid fuel cell segment is expected to expand rapidly in the coming years due to its excellent durability and high performance. These cells have the ability to operate in various environmental conditions. Moreover, they can operate at higher temperatures, making them suitable for heavy-duty trucks.

The 100 – 200 kW segment dominated the electric and fuel cell truck market in 2023. This is primarily due to its scalability, optimal power, and heavy-duty applications. 100 to 200 kW power range provides the necessary power, making it suitable for medium and heavy-duty trucks. This power range provides sufficient power and maintains energy efficiency without consuming excessive amounts of electricity.

Passenger vehicle to hold the largest position, bus with the second highest position, followed by light commercial vehicles and trucks. Increase preference to the electric fuel cell trucks with new research and development in the technology have expanded the market to grow.

Asia Pacific dominated the electric and fuel cell truck market with the largest share in 2023. This is mainly due to rise in development of charging infrastructure and increased government support for developing electric and fuel cell vehicles. China held the maximum share of the market, as it is the largest producer of EV batteries. There is a strong focus on zero emission targets, encouraging consumers and businesses to adopt electric vehicles for transportation. Moreover, governments of various countries are providing incentives and subsidies to encourage the adoption of electric vehicles, including electric trucks.

North America is anticipated to witness the fastest growth in the market throughout the studied period. The regional market growth is mainly attributed to the stringent environmental regulations. Moreover, governments in countries like the U.S. and Canada are implementing protocols to reduce carbon emissions. This encourages the adoption of EVs. Moreover, advancements in battery technology led to the development of improved batteries, making electric trucks suitable for long-haul transportation.

By Type

By Power Rating

By Vehicles

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

September 2024