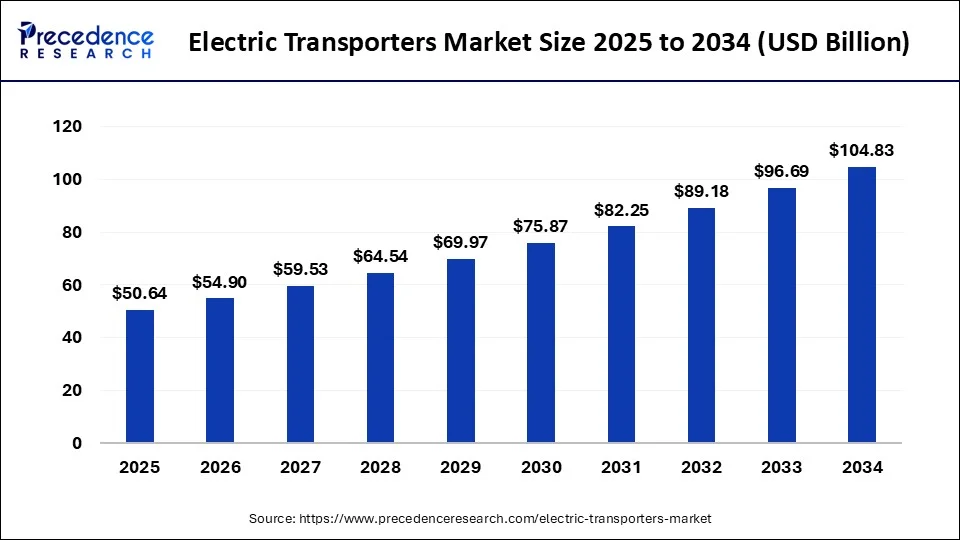

The global electric transporters market size is estimated at USD 46.71 billion in 2024, grew to USD 50.64 billion in 2025 and is predicted to surpass around USD 104.83 billion by 2034, expanding at a CAGR of 8.42% between 2024 and 2034.

The global electric transporters market size accounted for USD 46.71 billion in 2024 and is anticipated to reach around USD 104.83 billion by 2034, growing at a CAGR of 8.42% from 2024 to 2034. Enhancements in battery technology are the key factor driving the electric transporters market. Also, growing support from government policies coupled with reduced costs can fuel market growth shortly.

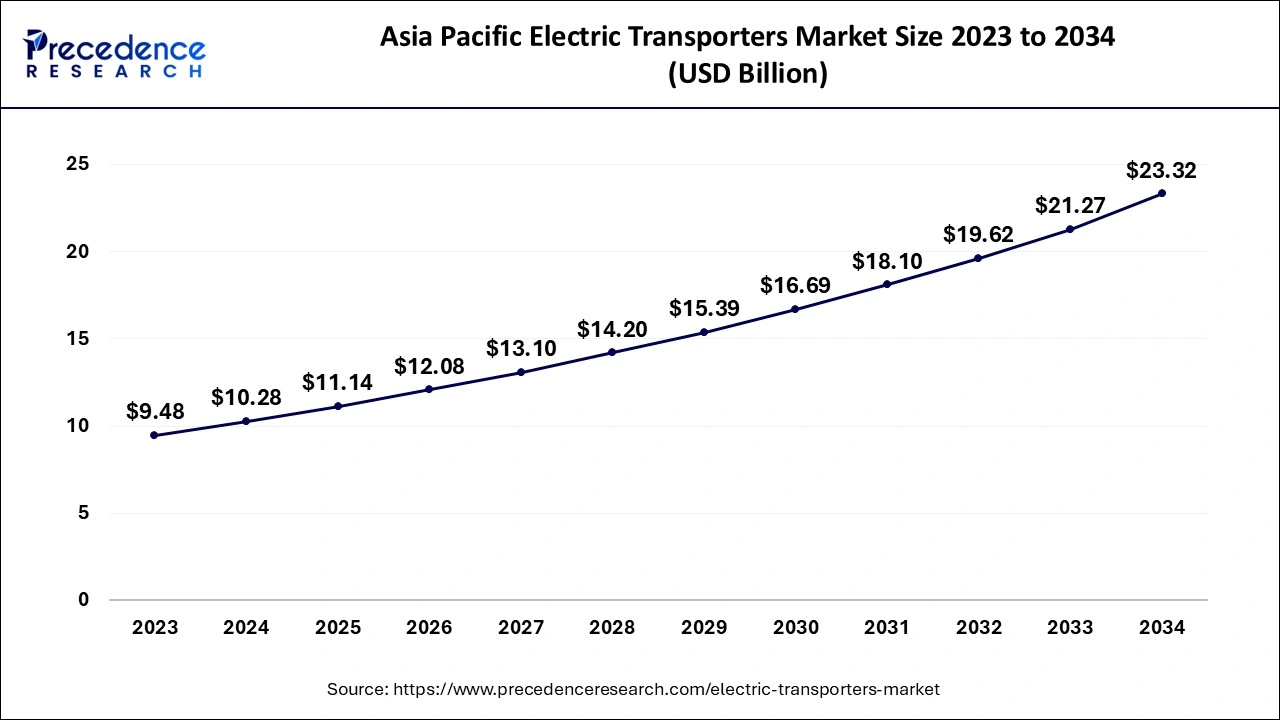

The Asia Pacific electric transporters market size is estimated at USD 10.24 billion in 2024 and is expected to be worth around USD 23.32 billion by 2034, rising at a CAGR of 8.52% from 2024 to 2034.

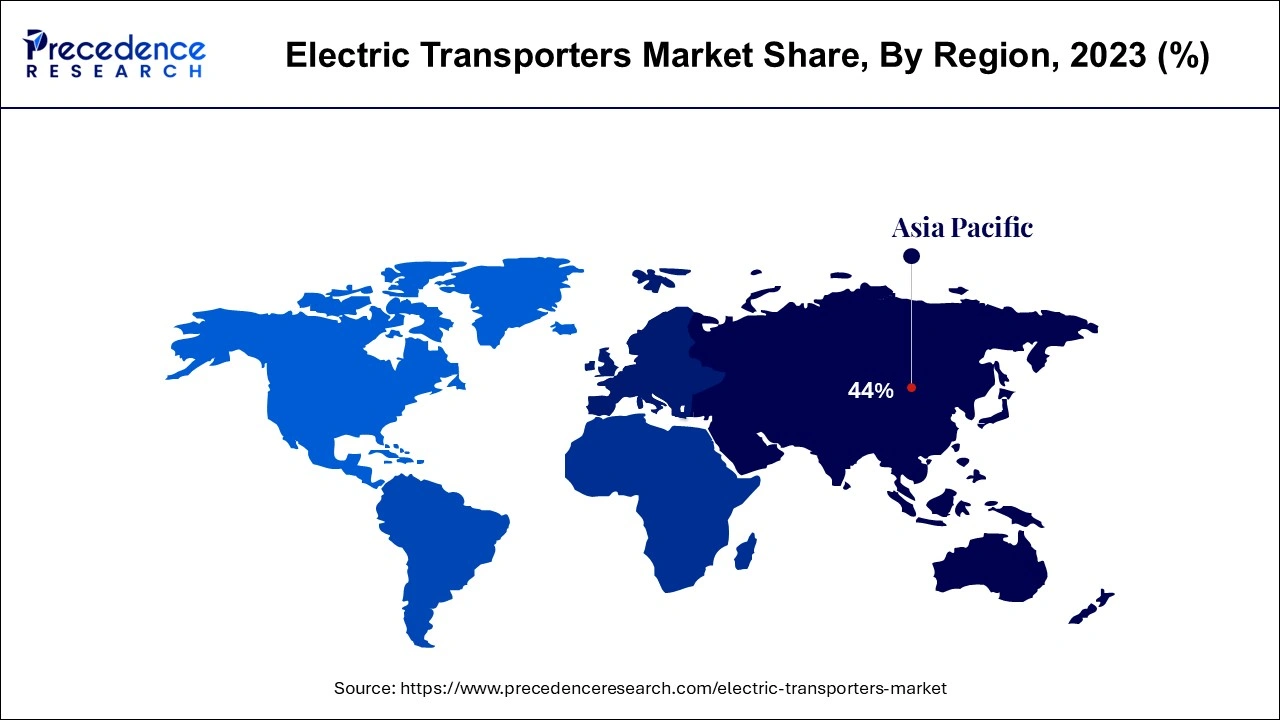

Asia Pacific dominated the electric transporters market in 2023. The dominance of the region can be attributed to the region's increasing focus on sustainable transportation, growing urbanization, and the need to address issues like air pollution and traffic congestion. Furthermore, governments in the region are implementing strict regulations regarding emissions and providing incentives to facilitate cleaner transportation options. China dominates the region due to the increasing adoption of EVs in the country.

North America is expected to show the fastest growth in the electric transporters market over the studied period. The growth of the region can be credited to the increasing awareness about environment preservation among regional consumers coupled with the region’s enhanced electric vehicle industry. Moreover, nations like the U.S. and Canada are experiencing major developments in the market. The U.S. led the regional market due to innovations in battery technology and government incentives for EVs.

Electric transport is used to transport passengers and goods for a short distance to reach the desired location. The purpose behind this multi-purpose vehicle is to offer cheaper vehicle transportation with reduced time. An electric transporter has electric motors placed for its propulsion and uses electrical energy, which is then stored in rechargeable batteries. Also, there are several ongoing government initiatives for green transportation for electric vehicles, along with substantial investment in EV infrastructure.

Top electric cars exports by country in 2023.

| Country | Export in billions of USD |

| Germany | USD 40.1 billion |

| Mainland China | USD 34.1 billion |

| Belgium | USD 18 billion |

| South Korea | USD 14.3 billion |

| Japan | USD 7.7 billion |

| United States | USD 7.26 billion |

| Spain | USD 5.21 billion |

| Czech Republic | USD 4.7 billion |

| United Kingdom | USD 3.7 billion |

| France | USD 3 billion |

The Role of AI in Transforming the Electric Transporters Market

The combination of AI with the electric transporters market is creating an advanced transportation landscape that facilitates charging schedules, assists in battery production, and even customizes the overall driving experience. This collaboration enhances efficiency and lengthens driving range. Furthermore, increasing demand for self-driving cars and the utilization of AI in traffic management enhanced automotive solutions. Government initiatives are also boosting global automotive AI solutions.

| Report Coverage | Details |

| Market Size by 2034 | USD 104.83 Billion |

| Market Size in 2024 | USD 46.71 Billion |

| Market Size in 2025 | USD 50.64 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.42% |

| Largest Market | Largest Market |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle, Battery, Voltage, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rising population in urban areas

The growing population in urban areas has led to mobility hurdles and congestion problems. The electric transporters market provides a key solution for shorter traveling distances along with strong connectivity from transportation hubs to the latest locations. Additionally, they are efficient and compact, which allows people to navigate through narrow pathways, crowded streets, and traffic congestion. Also, the advancement in lithium-ion battery technology has enhanced the range and performance of electric transporters to a greater extent.

Low adoption rate

The electric transporters market can be significantly constrained by low adoption rates due to various factors Such as lack of charging infrastructure, High cost, lack of choice, etc. However, Consumers want electric vehicles to be available readily, but sometimes they witness long waiting periods.

Smart city initiatives

Increasing urbanization and the surge in smart city initiatives are substantially impacting the electric transporters market growth. Urban areas are witnessing pollution, congestion, and an increasing need for enhanced mobility solutions. Electric transporters provide an efficient solution for these urban obstacles. Furthermore, various cities are incorporating electric transport options in their public transit systems, facilitating the utilization of electric buses, scooters, and bikes as alternatives to traditional modes of transport.

The electric scooter segment dominated the electric transporters market in 2023. The dominance of the region can be attributed to the convenience and ease provided by electric scooters in traveling short distances in urban sectors. Electric scooters have rechargeable batteries and control for acceleration and speed on the handlebars. In addition, they are easy to ride through narrow pathways and busy subways, which makes them an efficient transportation option.

The electric skateboard segment is expected to grow at the fastest rate in the electric transporters market over the forecast period. The growth of the segment can be linked to the developments in motor efficiency and battery technology, which has notably enhanced the overall range and performance of these skateboards. Additionally, the rising interest in sustainable living as a lifestyle choice also contributes to their increasing popularity. Also, the impact of social media and a growing trend toward advanced gadgets have propelled their desirability and visibility among the young population.

The Li-Ion segment led the electric transporters market in 2023. The dominance of the segment can be driven by a rising focus on sustainable transport options, and the demand for reliable and efficient battery technologies is increasing. Lithium-ion batteries are known for their longevity and high energy density, which makes them crucial for numerous electric transport vehicles. Moreover, increasing emphasis on decreasing carbon emissions has led to many incentives offered by the government for EV adoption, further driving the demand for Li-Ion batteries.

The NiMH segment is anticipated to grow at the fastest rate in the electric transporters market over the forecast period. The growth of the segment can be linked to the developments in NiMH technology, which have led to advancements in charging times and energy storage capacity. Environmental issues and regulatory pressures are also fuelling the demand for NiMH batteries because they are more eco-friendly and less toxic than other batteries.

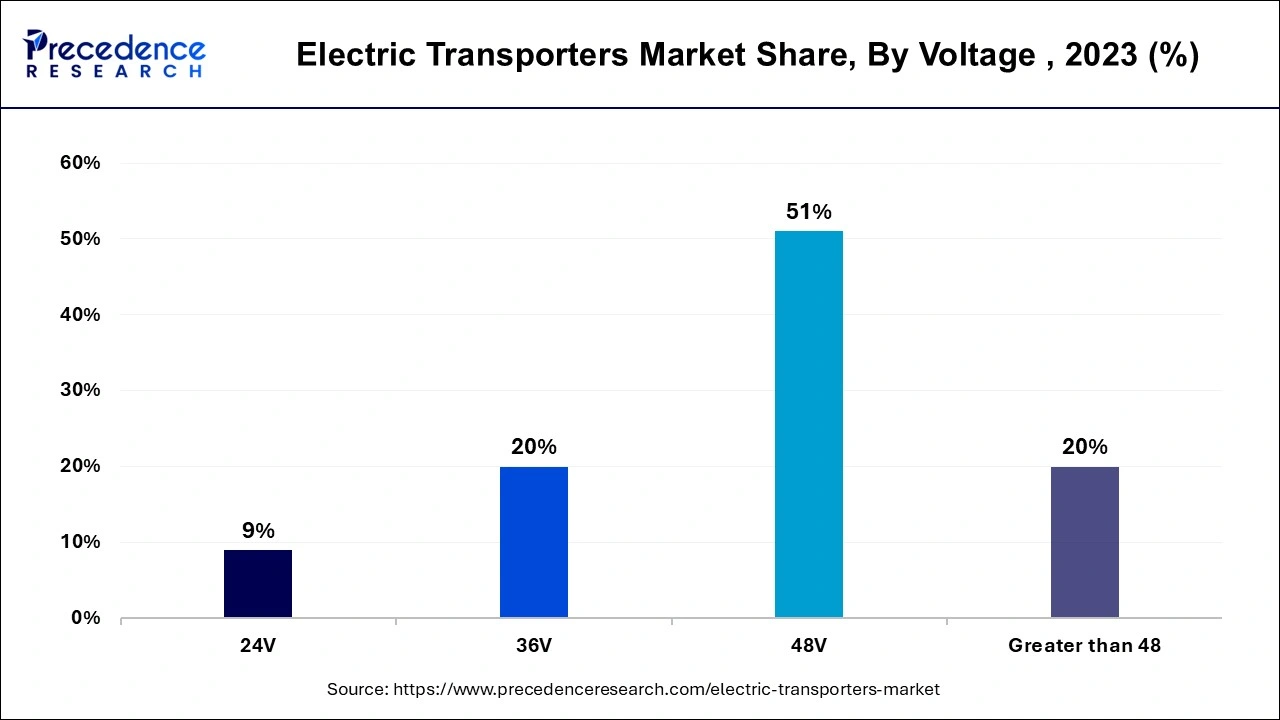

The 48V segment held the largest share of the electric transporters market in 2023. The dominance of the segment is due to the high-voltage batteries and hybridization opportunities provided by this segment. There is an increasing demand from consumers for higher performance output, boosting the need for these batteries. Furthermore, the 48V systems offer enhanced battery life, improved energy efficiency, and high safety features as compared to conventional 12V or 24V systems.

Segments Covered in the Report.

By Vehicle

By Battery

By Voltage

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client