January 2025

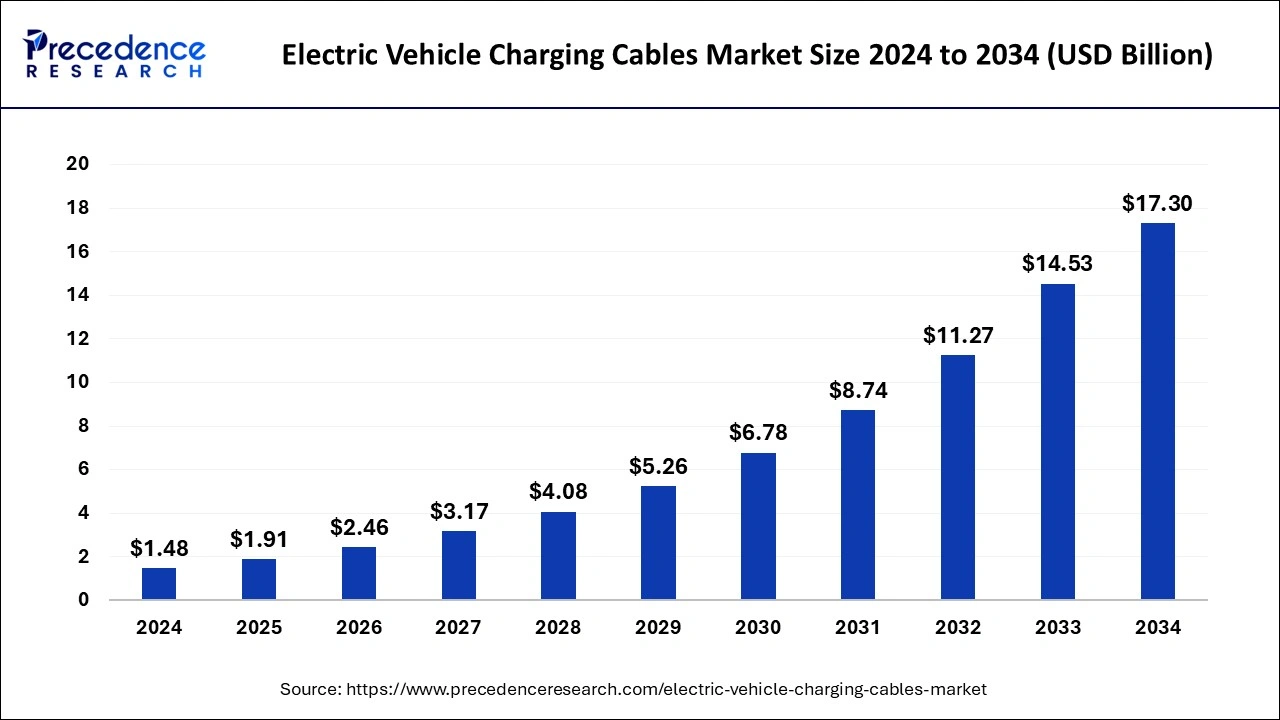

The global electric vehicle (EV) charging cables market size is calculated at USD 1.91 billion in 2025 and is forecasted to reach around USD 17.30 billion by 2034, accelerating at a CAGR of 27.87% from 2025 to 2034. The Asia Pacific electric vehicle (EV) charging cables market size surpassed USD 1.15 billion in 2025 and is expanding at a CAGR of 27.95% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electric vehicle (EV) charging cables market size was accounted for USD 1.48 billion in 2024, and is expected to reach around USD 17.30 billion by 2034, expanding at a CAGR of 27.87% from 2025 to 2034. The market growth is driven by the rising adoption of electric vehicles, advancements in charging technologies, and supportive government policies promoting clean energy solutions.

Artificial intelligence (AI) and machine learning (ML) algorithms positively impact the electric vehicle charging ecosystem by transforming charging solutions. AI and ML technologies are responsible for delivering a seamless user experience. They adapt the charging process by analyzing the probabilistic distribution of charging requests and balancing load to provide a shorter waiting time for electric vehicle owners. These smart systems also include real-time monitoring of the charging stations, where any developing fault or maintenance problem can be detected and solved before it becomes a threat. Additionally, AI algorithms are applied to develop ideal charging cables, considering the user's mannerisms, climate conditions, and energy consumption.

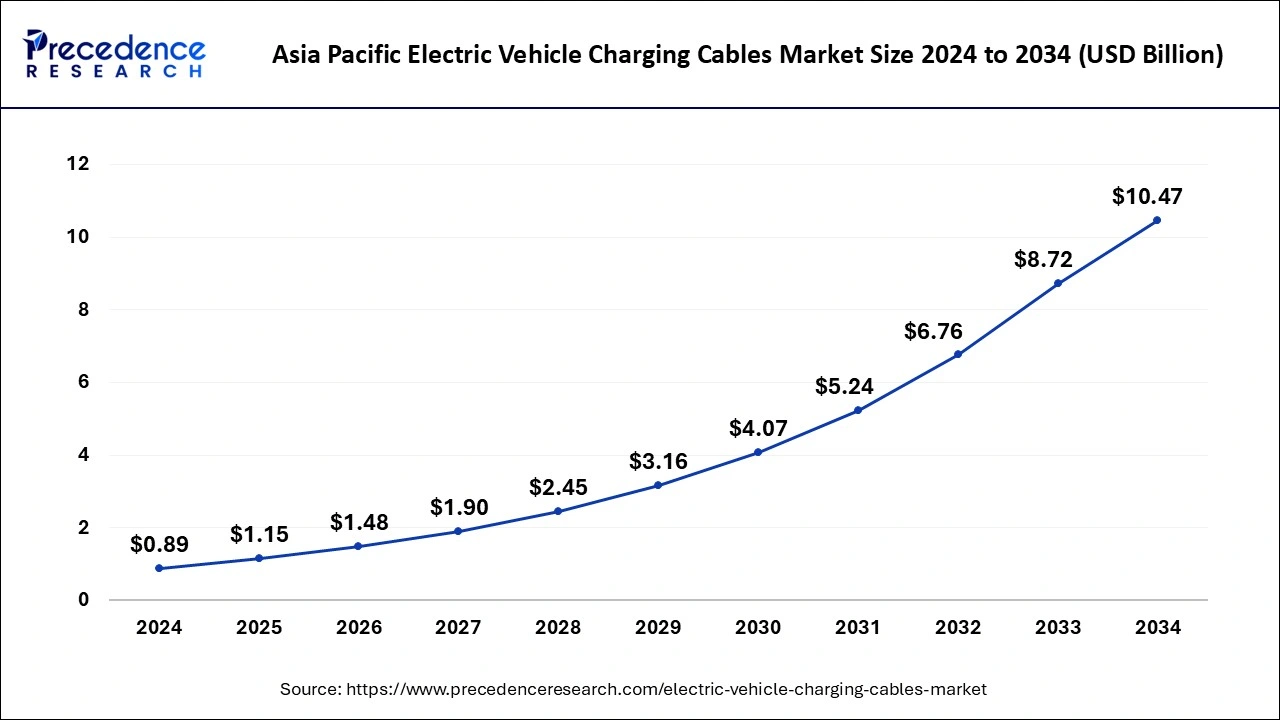

The Asia Pacific electric vehicle (EV) charging cables market size was estimated at USD 0.89 billion in 2024 and is predicted to be worth around USD 10.47 billion by 2034, at a CAGR of 27.95% from 2025 to 2034.

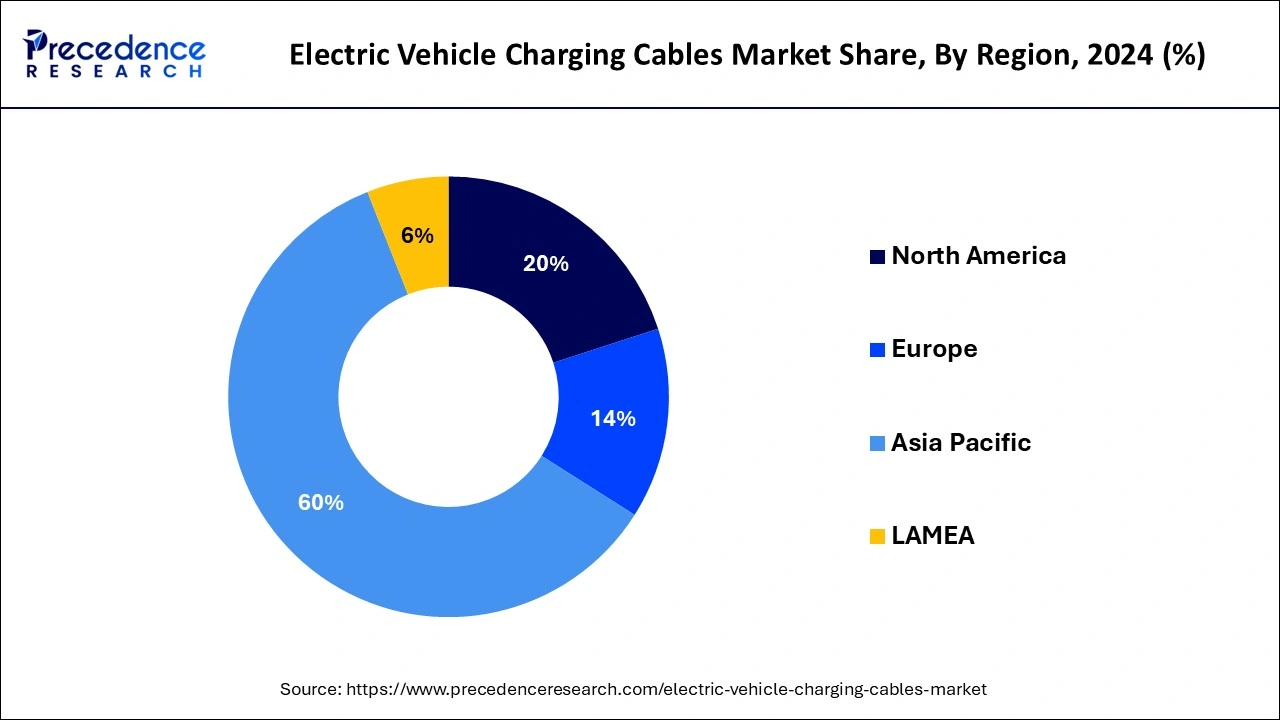

In 2024, Asia Pacific led the market and accounted for 60% of total revenue. China, South Korea, and Japan are principally responsible for this region's growth. The greatest market for electric car charging cables is China. The governments of China and Japan have developed different policies and efforts to encourage key market participants to produce Electric Vehicle Charging Infrastructure in their home countries because they anticipated the growing potential of the worldwide market for EV supply equipment. The region's high density of Electric Vehicle Charging Stations is anticipated to boost regional market expansion throughout the projection period.

The COVID-19 outbreak, however, has a particularly negative impact on South Korea and China, which gives the situation an interesting twist for the auto industry. Since CATL, LG Chem, and Samsung HDI are the main Chinese and South Korean providers of EV batteries, their supply may be limited, and finding them from alternate sources would be extremely difficult. Manufacturers in Europe are undoubtedly really concerned about this as they strive to meet their own emissions objectives. In a prolonged situation, EV demand may be impacted further by the need for EV charging lines due to decreased government subsidies, declining oil costs, and the economic effects of the pandemic.

From 2025 to 2034, North America is expected to experience a CAGR of 32.5%, which will be preceded by Europe and Asia Pacific. This is due to manufacturers' increased focus on creating electric cars with excellent performance, greater efficiency, and quicker speeds. The presence of significant EV supply equipment manufacturers in the area and the expanding installation of sophisticated charging infrastructure are projected to propel the regional market.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.91 Billion |

| Market Size by 2034 | USD 17.30 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 27.87% |

| Largest Maret | Asia PAcific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Shape, Power Supply, Charging Level, Application, Length, Mode, and Diameter |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for quick speed charging

Rise in demand for vehicle electrification across the globe

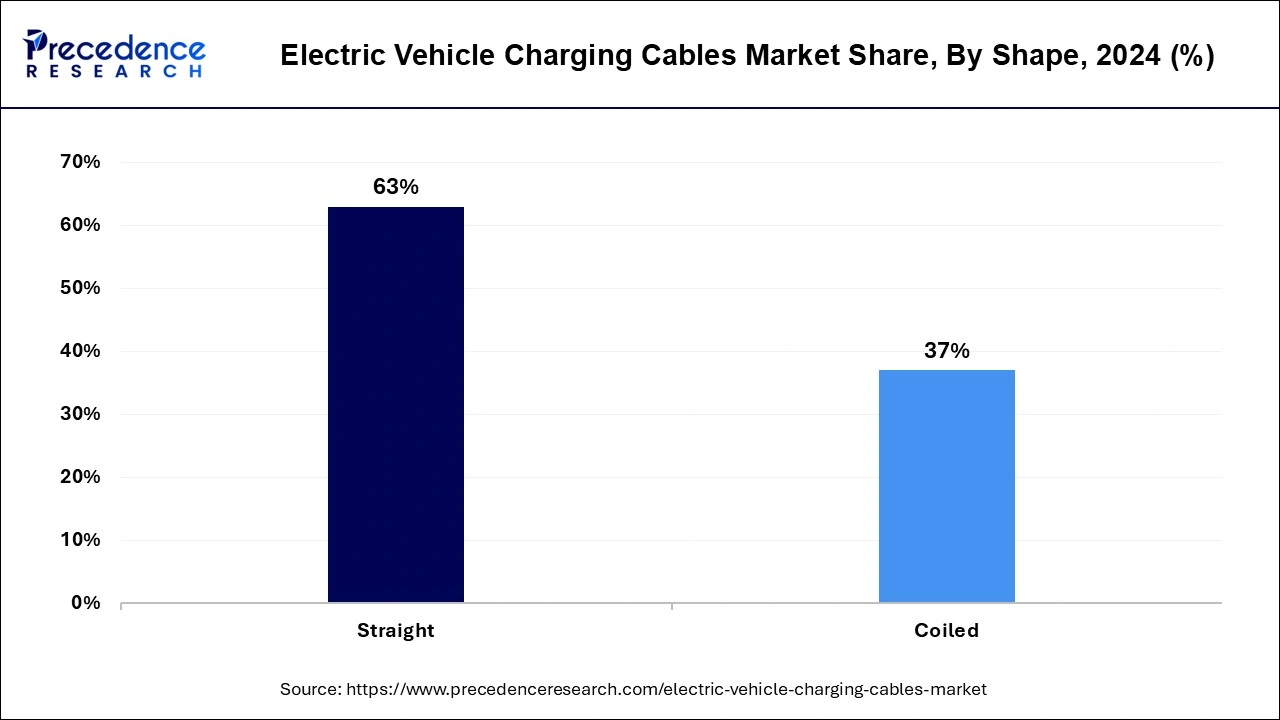

Straight wires are typically employed when several stations are close together. Though less sturdy, these cables are less expensive than coiled cables. Increasing thickness of the cable affects the current carrying capability of these cables. Since Type 1 (J1772) connections are found on the majority of charging stations, straight cables are frequently utilised while charging electric vehicles. The single-phase capacity of this kind of EV cable is 7.4 kW. Nissan, Toyota, Mitsubishi, Volvo, BMW, Audi, and Mercedes Benz are among the automakers who utilise a Type 1 EV direct charging connection. To make EV cables easier to handle, their diameter must be tiny, yet doing so exposes them to overheating. Therefore, a liquid-cooling system is installed on these wires. The US and Japan both employ Type 1 AC charging cords that adhere to SAE J1772/IEC 62196-2 specifications. An efficient cable design takes into account a number of important factors. A connection, an insulating substance, and an electrical conductor are a few examples.

During the projected period, straight cables are anticipated to have the greatest market in Asia Pacific. The majority of the nations in this area have cost-sensitive economies. Straight cables might cost up to 30% less than coiled cables, according to specialists in the field. Because they are less costly and easier to handle than coiled cables, straight cables are chosen. Apart from being inexpensive, straight cables are lightweight, simple to store, and straightforward to use. Additionally, the bulk of the region's public EV chargers feature straight-shaped wires.

With a share of 76%, the AC category led the market in 2024. Depending on the car and the criteria of the charging infrastructure, alternate charging provides a 120 V with a 22-kW charging speed. Around the world, household and semi-commercial stations mostly use AC power supplies. This kind of power supply power outlet is inexpensive to install and provides a meagre power output. Additionally, wall-mounted chargers for electric vehicles are favoured over floor-mounted chargers since they reduce the expense of subterranean electrification.

Additionally, domestic stations are ideally suited for wall-mounted chargers. Due to many developments in public stations, the DC category is predicted to have the greatest CAGR of 28.5% from 2024 to 2033. DC fast chargers quickly transfer energy, giving users of electric vehicles a lot of freedom. Additionally, it is projected that during the forecast period, rising demand for speedier in less time would fuel the segment's growth.

The market has been divided into level 1, level 2, and level 3 charge levels. As they are increasingly employed in residential and semi-commercial applications, including individual houses, condominiums, apartments, hotels, parking lots, and retail facilities, the level 2 category led the market in 2023 with a 49% share.

From 2025 to 2034, the level 3 segment category is predicted to have the greatest CAGR, at a rate of 28%. A Level 3 system has CHAdeMO technology, which recharges using 480V. A level 3 charger can recharge an electric car battery that has been completely depleted by 80% in far less than 15 minutes. The main driver of the segment's growth is the high-power charging ability that can be accomplished in less than 30 minutes. The category is expected to see growth throughout the forecast period as a result of the rising demand for fast charging station in nations like China, South Korea, and Japan as well as the quick improvement of high-power electric car charging infrastructure.

By Shape

By Power Supply

By Charging Level

By Application

By Length

By Mode

By Diameter

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

September 2024