January 2025

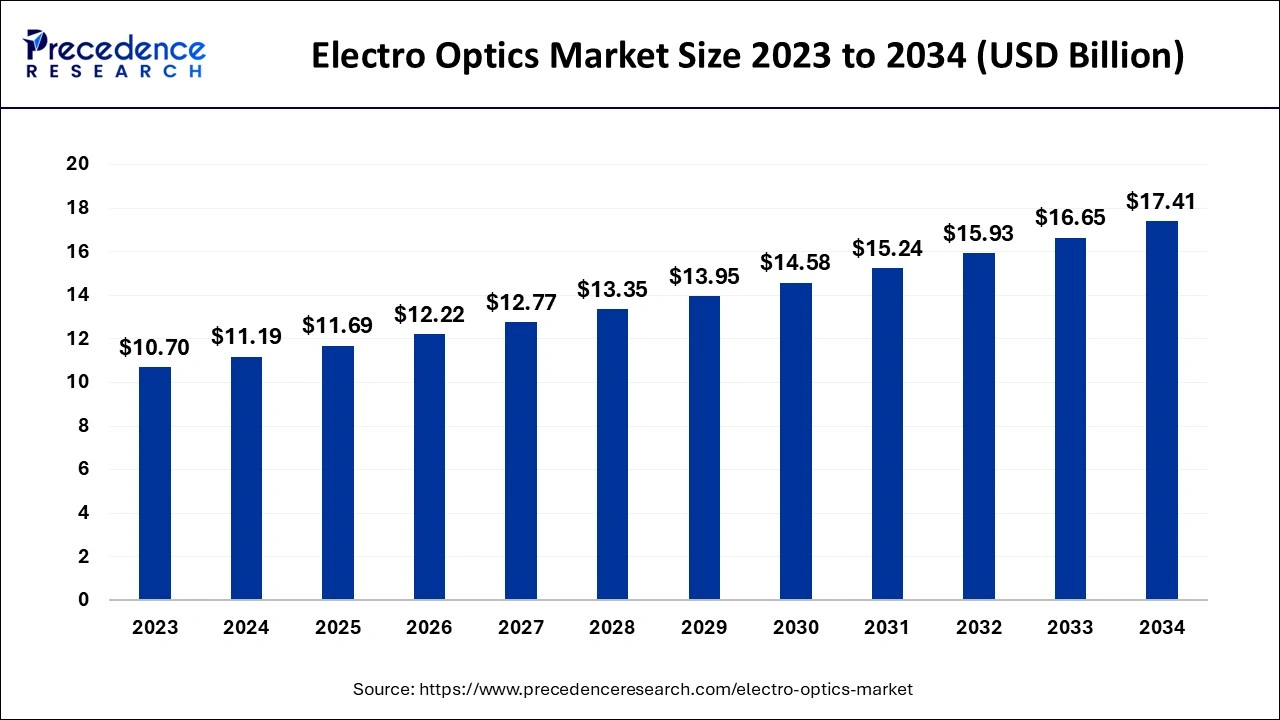

The global electro optics market size accounted for USD 11.19 billion in 2024, grew to USD 11.69 billion in 2025 and is projected to surpass around USD 17.41 billion by 2034, representing a CAGR of 4.52% between 2024 and 2034.

The global electro optics market size is calculated at USD 11.19 billion in 2024 and is anticipated to reach around USD 17.41 billion by 2034, expanding at a CAGR of 4.52% from 2024 to 2034. The rising adoption of the electro optics market is observed as they help scientists to understand the behavior and properties of light which improves data security and processing speeds.

The integration of artificial intelligence in the electro optics market is shaping the defense sector with electro-optics providing an advanced landscape in operations that enhance border security. The al-based solutions offer border surveillance by incorporating advanced feature cameras, radar feeds, sensors, and many more. These advanced technologies help in detecting border intrusions, target classification and enhance the accuracy of fence operations. Along with this AI helps with Unmanned aerial vehicles, lethal autonomous weapon systems (LAWS), data management, autonomous armored vehicles, and robotics.

The electro optics market comprises electrical engineering and manufacturing of optics and beam delivery equipment. The application of electro-optics is commonly noticed in complicated types of equipment such as lasers, LEDs, and waveguides. In a true sense, the electro-optics effect is concerned with the generation, control of propagation, and detection of electromagnetic waves. Optics means the science of light. Therefore, electro-optics is referenced as the science of electric light. Electro-optics allow scientists to have a better understanding of the behavior and properties of light and how light interacts with different matter. Detailed knowledge about electro-optics helps inventors investigate new technologies and explore new ways to increase productivity and functionality through science within the manufacturing industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.41 Billion |

| Market Size in 2024 | USD 11.19 Billion |

| Market Size in 2025 | USD 11.69 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Miniaturization trends

The miniaturization of the electro optics market products improves the performance, portability, and energy efficiency of devices. Technology enthusiasts and inventors seek smaller, more efficient solutions. With miniature electro-optics, the assemblies are smaller in size while maintaining or improving the device’s functionality and performance. In modern technology, enabling the creation of smaller, lighter, and more powerful electro-optics devices is driving miniaturization.

High cost and vulnerability

Despite the application of electro-optics in various sectors, the major drawback of it is the expense due to the high cost of manufacturing, implementation, and maintenance of electro-optics. This issue is gradually being resolved with better production methods. Another limiting factor is its vulnerability which is interfered with by environmental factors such as extreme weather and physical damage. This constraint is expected to be settled by the incorporation of robust housing to protect the sensor in an electro-optical camera against adverse conditions.

Micro-electro-mechanical systems

The electro-optics system technology is advancing its development into micro optics electro mechanical systems which is also known as micro-electro-mechanical systems (MEMS). Optical MEMS are the next generation of integrated systems. This provides the most advanced electro-optics sensors and mechanical and electrical systems that manipulate optical signals at the molecular level. MOEMS is an optical device used in telecommunication, sensing, and mobile systems such as v-grooves, gratings, shutters, scanners, filters, micromirrors, switches, alignment aids, lens arrays, and hermetic wafer-scale optical packaging. MEMS offers great accuracy for military users and provides a higher mission rate even at extremely hostile theatres.

The air-based segment contributed the highest share of the electro optics market in 2023 due to its high-performance intelligence, reconnaissance, and surveillance capability comprised of electro-optics and infrared systems. The imaging sensors used through EO/IR systems bands provide spherical situational awareness, long-range precision, and protection from infrared-guided missiles, that too without emitting detectable energy.

The land-based segment is expected to grow at the fastest CAGR in the electro optics market during the forecast period. The electro-optics systems offer a product range that includes state-of-the-art, operationally proven gyro, accelerometers, and EO/IR payloads. These products have high performance and an excellent cost/performance ratio. The common application of electric optics in land-based is used for supporting armored fighting vehicles of various types, tracked and wheeled artillery, rockets and missile launchers. The electro-optical surveillance system is crucial for tracking down deep-space objects. Deep space orbits consist of more than 2,500 objects such as geostationary communication satellite which varies in altitude from 10,000 to 45,000 kilometres from Earth.

The defense segment contributed the highest share of the electro optics market in 2023. The dominance of this segment is observed as electro-optics systems have the potential to better assist the defense manufacturers with independent surveillance and telemetric guidance which help to monitor threats, protect significant assets, and track enemy contacts. The electro-optic systems are in-build in a defense vehicle. So that these defense vehicles can see even in clouds, and fog and can operate by guidance or by an independent surveillance system.

The aerospace segment is anticipated to grow with the highest CAGR in the electro optics market from 2024 to 2034. The growth of this segment is observed due to the integration of transformation the electro-optics has brought to the aerospace industry. These advancements have improved aircraft performance and offered new opportunities in space exploration, including navigation and flight control which aids with GPS, space telescope where instruments such as Hubble space telescope us used to capture extraordinary images of the universe, remote sensing technology, and laser. One of the greatest impacts electro-optics have made on aerospace applications is in satellite imagery.

North America dominated the global electro optics market in 2023 due to the advanced defense system in the United States and leading manufacturers of electro-optics in Canada. The THAAD is an advanced missile defense system made by U.S. defense and aerospace manufacturers Lockheed Martin Corp. Another is the Patriot system which has 4 major operational functions- communication, commands and control, radar surveillance, and missile guidance.

Asia Pacific is anticipated to grow at the fastest CAGR in the electro optics market during the forecast period. The expansion of this region is experienced due to the investment and presence of key players in the region’s market. In Asia Pacific, China holds the dominant position and India is expected to emerge in the coming future. The companies of this region are focusing on investment in the defense sector and increasing the adoption of modern technology for safety purposes.

In November 2024, Bezhalel (Butzi) Machlis, President and CEO of Elbit Systems said, “We are proud to support our European customer with advanced and versatile defense solutions that enhance operational effectiveness and adaptability. These contracts reflect the global trust in our innovative systems, such as the PULS and Hermes 900, which are designed to meet a broad range of mission requirements. Through our comprehensive portfolio, we remain committed to providing our customers with reliable, technologically advanced tools that address today’s complex defense challenges.”

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2023

October 2024

January 2025