January 2025

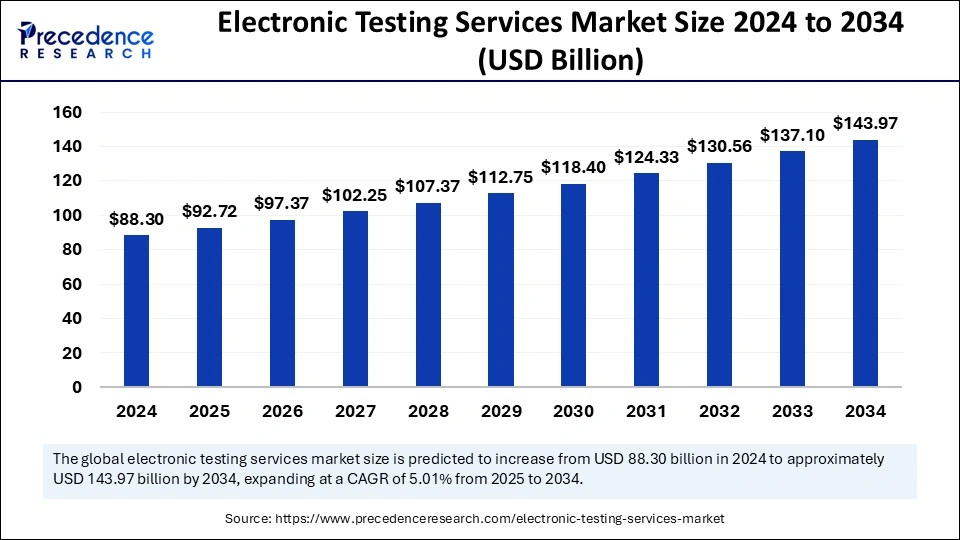

The global electronic testing services market size is calculated at USD 92.72 billion in 2025 and is forecasted to reach around USD 143.97 billion by 2034, accelerating at a CAGR of 5.01% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electronic testing services market size accounted for USD 88.30 billion in 2024 and is predicted to increase from USD 92.72 billion in 2025 to approximately USD 143.97 billion by 2034, expanding at a CAGR of 5.01% from 2025 to 2034. The market is rapidly expanding due to the adoption of IoT devices and growing smart technology trends in nearly every sector, further augmenting the market's reach on a large scale.

The integration of artificial intelligence (AI) with electronic testing services is set to create a huge leap in the global testing industry. Integration of generative AI with electronic testing services can create realistic and various test datasets, which further allow labs to simulate uncontrolled conditions in electronic systems to detect their potential hazards and how to avoid them by placing other components or systems into them. Offering virtual testing services positively affects product reliability. Generative AI can create circumstances virtually to streamline testing workflow and help minimize the need for physical prototypes, in turn, speed up the development. It also helps to adapt to testing by adjusting test conditions as per recent data and enhances precision while warning about potential failure.

The electronic testing services market is revolutionizing because they play a critical role in finding the integrity of electrical systems in different conditions, like power generation, data centers, and manufacturing. Various benefits have been noticed by the incorporation of electronic testing services, such as minimizing downtime and increased working efficiency, enhanced longevity of the equipment, and compliance assurance with safety regulations. To detect potential faults, testing services like transformers and circuit breakers are key components that are an essential part of critical infrastructure applications. A consistent power supply is essential in commercial establishments and healthcare sectors, highlighting the need for electrical testing services.

Additionally, many countries are striving for greener solutions for leading sectors to combat global warming and shifting to more efficient use of energy, popularly known as green energy. Such advancement needs power testing services, further expanding the market's reach. The electronic testing market is substantially growing in emerging economies like India and China owing to their developmental phases in every sector, which requires robust systems for testing services to minimize chances of failure.

| Report Coverage | Details |

| Market Size by 2034 | USD 143.97 Billion |

| Market Size in 2025 | USD 92.72 Billion |

| Market Size in 2024 | USD 88.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.01% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Enhanced safety standards in electrical systems.

A key driving factor for the electronic testing services market is the increasing demand for safety standards and compliance with stringent regulations regarding electrical systems to avoid catastrophic events. In the private and public domain, the construction of electrical infrastructure should adhere to regulatory compliance, which is internationally accepted.

Rapidly growing complex nature of testing

The major restraining factor for the electronic testing services market is the rapidly growing complexity of testing services owing to the evolving nature of the electronics sector. Precise and detailed engineering is required for electronic components having high power levels, high transient movements, and extensive thermal loads. Moreover, addressing parasitic effects along with resistant factors like electromagnetic interference in high-frequency devices requires a certain level of complexity in the testing methodology. To achieve this exceptionally accurate level of testing, substantial investment is required.

Growing adoption of smart grid infrastructure

The major opportunity that the electronic testing services market holds is the growing adoption of smart grid infrastructure equipped with highly advanced technologies, creating a lucrative option to expand the market globally. To achieve better management, supervision, and proper distribution of electricity, the physical networks are combined with highly advanced communication technologies and increase their working efficiency with smart grid infrastructure.

It is crucial to place smart grids carefully into already existing electrical grids. Also, devices like sensors, smart meters, and automated systems need to be perfectly implemented to ensure proper functionality and security. Geographically, the U.S. is the frontrunner in adopting smart grid technology along with several developing and developed economies, like the European Union and the Asia Pacific. As the U.S. is extensively investing in establishing smart grid technology, testing services are also necessary to reduce the risk of failure and support operational efficiency.

The motors and generator testing segment accounted for the largest electronic testing services market share in 2024. The motors and generators are essential components of the various industries for energy conversion. Energy conversion can be done by transforming electrical power into different forms, like direct current and alternating current. Most probably, alternating current is used frequently for many operations where electricity is required.

Motors and generators are used to adjust the frequency, voltage, or phase of electrical impulses. Hence, the segment is expanding due to its extensive applications in various fields like power supply, energy distribution, manufacturing, and transportation. Additionally, routine testing plays a critical role in power-intensive industries for equipment efficiency, identifying faults, extending lifespan, and reducing downtime in operations. For example, power generation plants majorly depend on periodic generator testing methods to ensure the stability of the grid and fulfill energy demands.

The transformer testing segment is expected to show considerable growth over the forecast period. The segment is expanding due to factors like safety, reliability, and compliance playing a critical role in transformer testing as it is an essential and major part of the electronic system. Proper transformer testing helps ensure the insulation of transformers and windings and whether it can withstand adverse conditions to prevent accidents. Also, regular testing of transformers to validate their performance and life cycle is one of the leading reasons for the transformer testing segment’s growth.

The data centers segment accounted for the largest electronic testing services market share in 2024. The segment is expanding due to the role of data centers being critical for various sectors like telecommunication, cloud storage, and digital computing. Data centers are critical infrastructures that have high power requirements as they are prone to system failures more often while performing operations.

Electrical testing is necessary for such systems to deal with voltage stability, energy efficiency, and backup systems. Global leaders like Amazon Web Services and Microsoft Azure are substantially investing in data center expansion, thus, in turn, positively affecting the demand for highly advanced testing services, propelling the segment's growth further on a global scale.

The transmission and distribution stations segment is anticipated to witness significant growth in the studied period. A transmission and distribution system plays a crucial role in any electronic system as it controls, transforms, and regulates electrical power to safely reach towards destination. Electronic testing services are crucial to detecting the kind of hurdles in such systems for seamless operation.

Asia Pacific accounted for the largest electronic testing services market share in 2024. The region is experiencing robust growth due to factors like digital transformation at a rapid pace and technological advancements such as the industrial Internet of Things, 5G, Industry 4.0, and others. Electronic testing services are becoming more compact, user-friendly, handy, and precise with the integration of these technologies driving the market further in the region.

Trends in India

The electronic testing services market in India is expanding rapidly due to mandatory regulations set by authorities for product safety along with compliance with imported electrical equipment. Industries like manufacturing, automotive, energy, and others are majorly dependent on electronic testing services, as electricity is a crucial part of these sectors. The increasing adoption of electric vehicles in the country is also a key driver of the market, as it requires supportive electronic testing services to ensure the safety and optimal efficiency of Electric Vehicles.

North America is expected to witness the fastest growth in the electronic testing services market during the foreseeable period in the market. The growth of this region is attributed to various reasons, like continuous innovation in the semiconductor industry and thermal management solutions and the growing adoption of solar, wind, and storage systems, which need thorough testing services to keep them working efficiently and to ensure grid stability. Due to the increasing adoption of EVs, the need for testing battery management systems is also expanding. In addition to this, strategic partnerships between leading players in the market boost the region's hold on a global level.

Trends in the U.S.

Country-wise, the U.S. holds a substantial market share in 2024 for the electronics testing services market for reasons like the strong presence of electrical and electronics businesses they hold within the area and the expansion of diverse end-use industries. Leading manufacturers are investing heavily in robust infrastructure that supports electronic testing services to meet the growing demand from end users and to fulfill stringent regulatory requirements holding onto safety and performance. Moreover, U.S. governments are relentlessly working on the aging infrastructure to reconstruct and modernize it, further boosting the demand for electronic testing services in the U.S.

Europe registered a notable growth in the global electronic testing services market. The region is notably expanding due to driving factors like a surge in domestic EV production by leading European nations and the growing adoption of electric and hybrid vehicles for environmental safety compliance, which necessitates electronic testing services. Additionally, leading players are developing innovative devices for efficient and precise electronic testing services, boosting the region's growth.

By Service Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

January 2025