January 2025

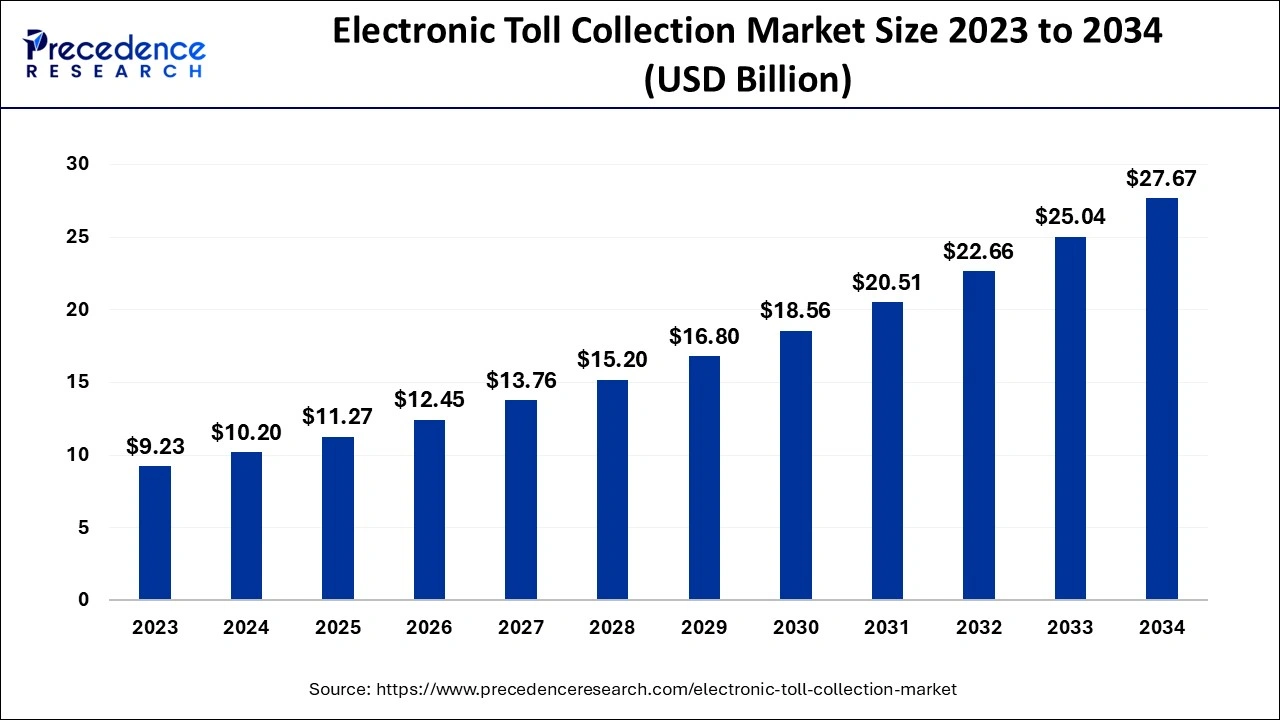

The global electronic toll collection market size accounted for USD 10.20 billion in 2024, grew to USD 11.27 billion in 2025 and is projected to surpass around USD 27.67 billion by 2034, registering a CAGR of 10.50% between 2024 and 2034. The North America electronic toll collection market size is calculated at USD 3.67 billion in 2024 and is expected to grow at a CAGR of 10.64% during the forecast year.

The global electronic toll collection market size is calculated at USD 10.20 billion in 2024 and is predicted to reach around USD 27.67 billion by 2034, expanding at a CAGR of 10.50% from 2024 to 2034. The electronic toll collection market growth is attributed to the increasing activities in highway & road infrastructure upgradation in emerging countries and growing environmental concerns.

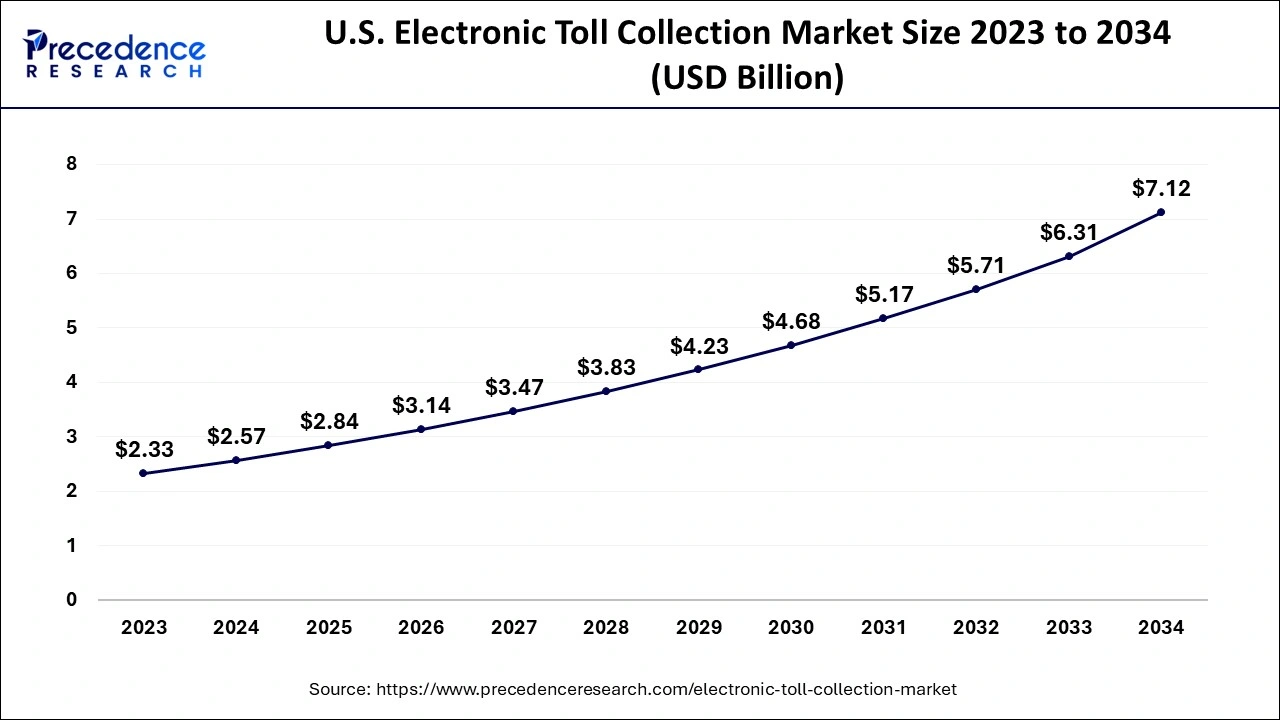

The U.S. electronic toll collection market size is evaluated at USD 2.57 billion in 2024 and is projected to be worth around USD 7.12 billion by 2034, growing at a CAGR of 10.68% from 2024 to 2034.

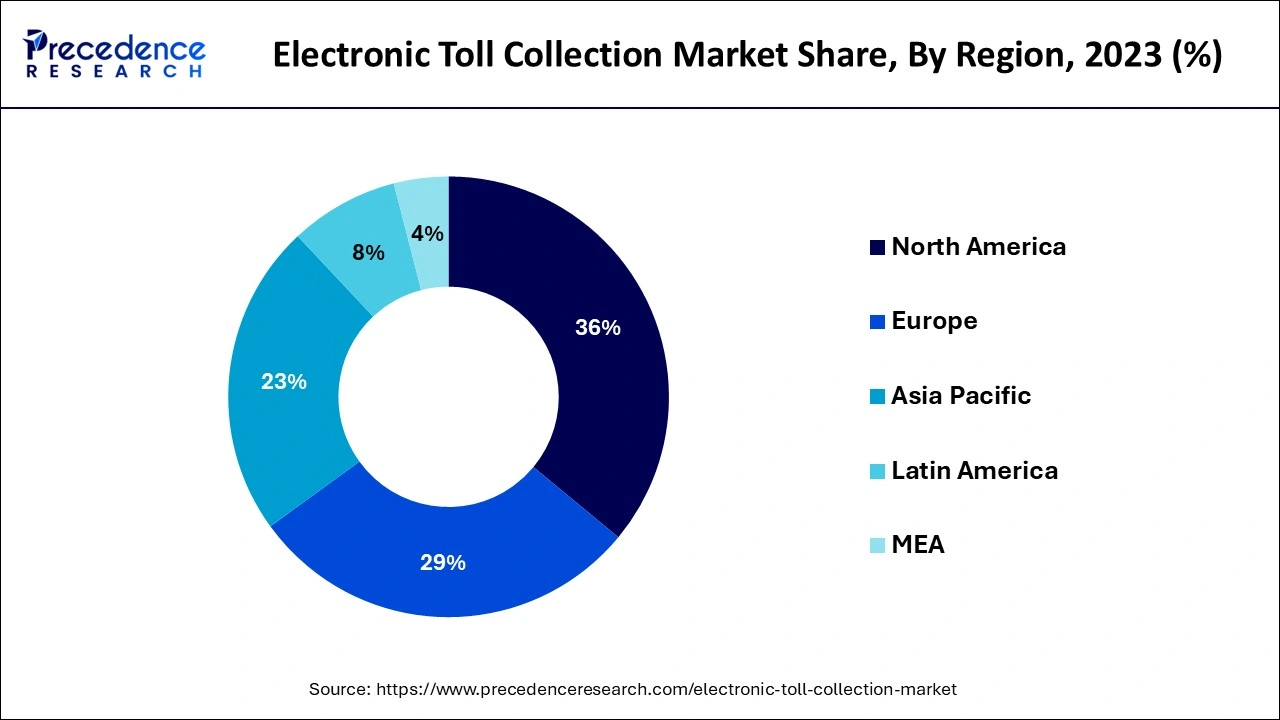

North America dominated the electronic toll collection market in 2023. The market growth in the region is fueled by increasing investment toward modern roadways and early adoption of advanced technology-based ETC. The U.S. and Canada are the major countries in the region. The market in the U.S. is growing rapidly, leading to the rapid implementation of modern technologies in the transportation and road industry. In the U.S., a significant amount was invested in highway networks across urban areas. However, traffic congestion has been far outpaced by population growth and has increased in most urbanized areas.

Asia Pacific is expected to grow at the fastest rate in the electronic toll collection market during the forecast period. The market growth in the region is driven by the Increasing use of automatic tooling devices in urban areas and on the highway. In addition, the top major market players are adopting various business plans of action, such as product developments, acquisitions, business partnerships, and collaborations, further driving the growth of the market. China, India, Japan, and South Korea are the major countries in the region.

The electronic toll collection market deals with the technology used to collect tolls or fees for the use of tunnels, bridges, and highways without requiring drivers to stop and manually swipe a card or cash. Electronic toll collection systems provide a more convenient and efficient method of collecting tolls than traditional toll collection processes like cash payment. With the increasing number of vehicles on the road that can handle high volumes of traffic without causing congestion, there is a need for toll collection systems.

In addition, some tolling providers are emerging all-in-one tolling services that can be used across various toll tunnels, bridges, and roads. These services are capable of reducing the need for multiple toll accounts and tags and improving the tolling process for drivers. The adoption of satellite-based tolling, expansion of mobile payment options, use of blockchain, integration with connected vehicles, and an artificial intelligent-based toll collection system driving the electronic toll collection market growth.

Why is AI changing the Electronic Toll Collection Market?

As the demand for reliable and efficient transportation infrastructure grows, electronic toll collection market products have become an advanced roadway management. Integrating artificial intelligence into these services is transforming the market growth. AI technologies help improve user experiences, reduce costs, and enhance accuracy. AI enhances these processes by machine learning algorithms and employing computer vision to identify license plates and vehicles accurately.

AI helps to manage congestion, optimize roadway usage, and generate revenue more efficiently by adjusting toll rates according to traffic conditions. These advanced factors are expected to revolutionize the growth of the electronic toll collection market in the coming future. AI-generated analytics platforms can manage huge amounts of data generated by ETC systems. AI facilitates seamless toll payments through various digital channels, such as online platforms and mobile applications.

| Report Coverage | Details |

| Market Size by 2034 | USD 27.67 Billion |

| Market Size in 2024 | USD 10.20 Billion |

| Market Size in 2025 | USD 11.27 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 10.50% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Technology, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Rising demand for efficient traffic management

The major factor driving the electronic toll collection market growth is the increasing demand for efficient traffic management solutions in toll collection centers. A well-managed traffic across urban areas is crucial to increasing traffic congestion and urbanization. This automatic toll collection system helps to save time and handle the traffic flow at the toll plaza. In addition, increasing traffic on the highways causes extra congestion at the toll booths, resulting in a loss of fuel and time. The advanced automatic toll collection system uses various technologies such as dedicated short-range communication, RFID tags, and others. This system saves additional costs and waiting time compared to traditional tolling. In addition, this system is used to reduce traffic congestion and seamless passage at toll booths.

Lack of standardization in the implementation of the ETC system

The implementation of the electronic toll collection market has various problems. Several electronic system manufacturers have different standardizations owing to compatibility problems. Various companies produce various standard tools that result in challenges for commuters. Although there is increased growth in electronic toll services, incompatibility issues between manufacturers associated with several technologies restrain the market expansion. The companies leading ETC’s patent rights resulted in a fight in court to save it. Several electronic toll collection technologies have various equipment and systems. For example, readers relate to various computer systems, but the other manufacturer's tool cannot read the RFID tags produced by other manufacturers. If two tags are linked to one vehicle, it may cause interference problems.

Rising investment in the transportation infrastructure

Infrastructure investment includes improvements to the current network and the building of new transport facilities. It is one of the major factors influencing performance in the electronic toll collection market. Developing and developed countries can benefit socially and economically from efficient transportation infrastructure by increasing market productivity and accessibility, ensuring that communities are connected, encouraging labor mobility, and promoting balanced regional economic development. However, only one-third of the evaluated enterprises are included in the supply of infrastructure for electric vehicles or environmental toll schemes.

The automatic vehicle identification system (AVIS) segment held the largest share of the electronic toll collection market in 2023. Based on type insights, the market is segmented into Automatic Vehicle Identification System (AVIS), Automatic Vehicle Classification (AVC), Violation Enforcement System (VES), and others. The segment growth is attributed to the rising popularity of FASTag at the toll collection booth in the market. FASTag is the most convenient and easiest way to collect toll tax without slowing down or stopping the vehicles. In addition, several government authorities in developing countries are taking the initiative to execute an automatic vehicle identification service that is responsible for market expansion. Automatic vehicle identification-based ETC reduces delays and transaction times and increases throughput at the toll plaza. For instance, an automatic vehicle identification system takes around 8 seconds per vehicle to drive in the toll plaza. This type of ETC lane handles around 1,200 vehicles per hour and is further expected to drive the segment growth in the market.

The radio frequency identification (RFID) segment dominated the electronic toll collection market in 2023. Based on technology insights, the market is segmented into cell phone tolling, video analytics, Global Navigation Satellite System (GNSS)/GPS, Dedicated Short-Range Communication (DSRC), Radio Frequency Identification (RFID), and others. Radiofrequency identification distances from a range of around 72 meters, that is 235 feet, and the transponder reads the speed up to 290 km/h.

The cell phone trolling segment is expected to grow rapidly during the forecast period. The segment growth is attributed to the increasing adoption of digital payments across roadways for electronic toll collection. The rising adoption of high-construction projects in becoming prevelant.

The highway segment generated a significant share of the electronic toll collection market in 2023. Based on end-user insights, the market is segmented into urban areas and highways. The segment growth is attributed to the rising investment in highway and road construction projects across the world. In addition, highway vehicles need higher transition at the toll booth. An automatic toll collection system enables vehicles to pay tolls without slowing down and stopping vehicles in toll plazas.

The urban area segment is expected to grow significantly in the electronic toll collection market during the forecast period. The segment growth is attributed to the Increasing smart city investment in urban areas across the globe. In addition, rising global urbanization is further anticipated to enhance the segment growth.

By Type

By Technology

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

February 2025

July 2024