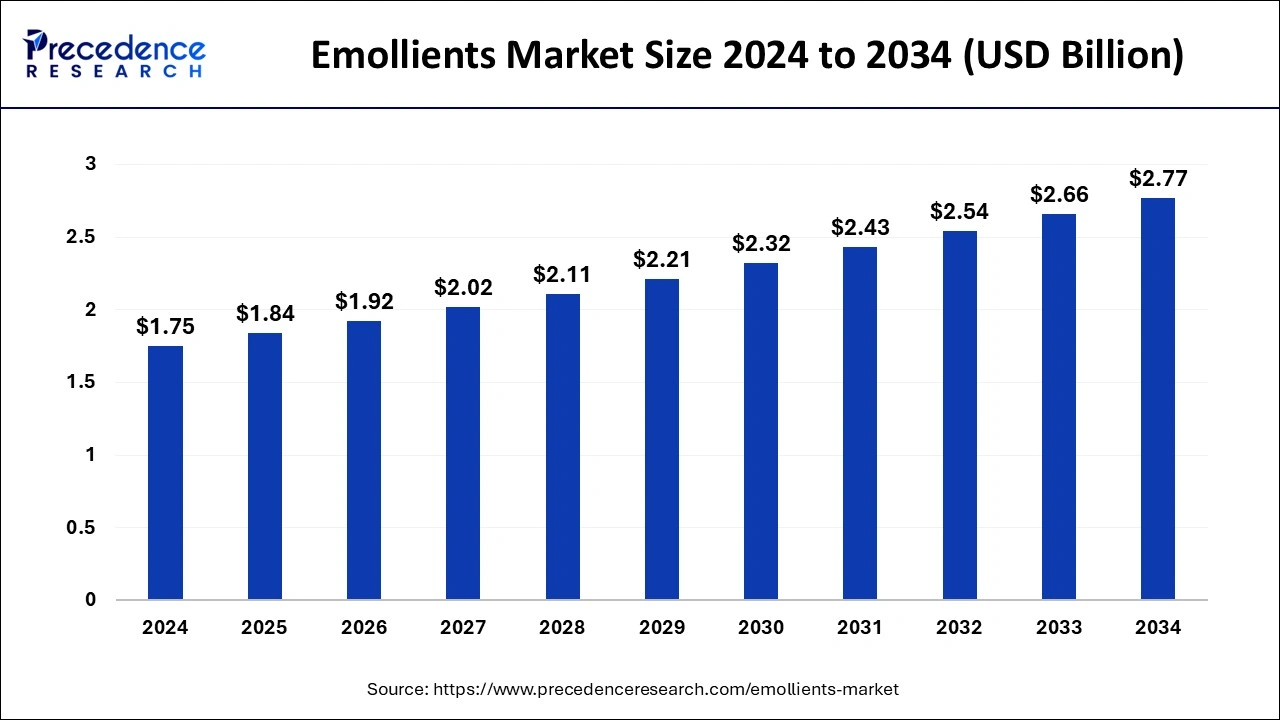

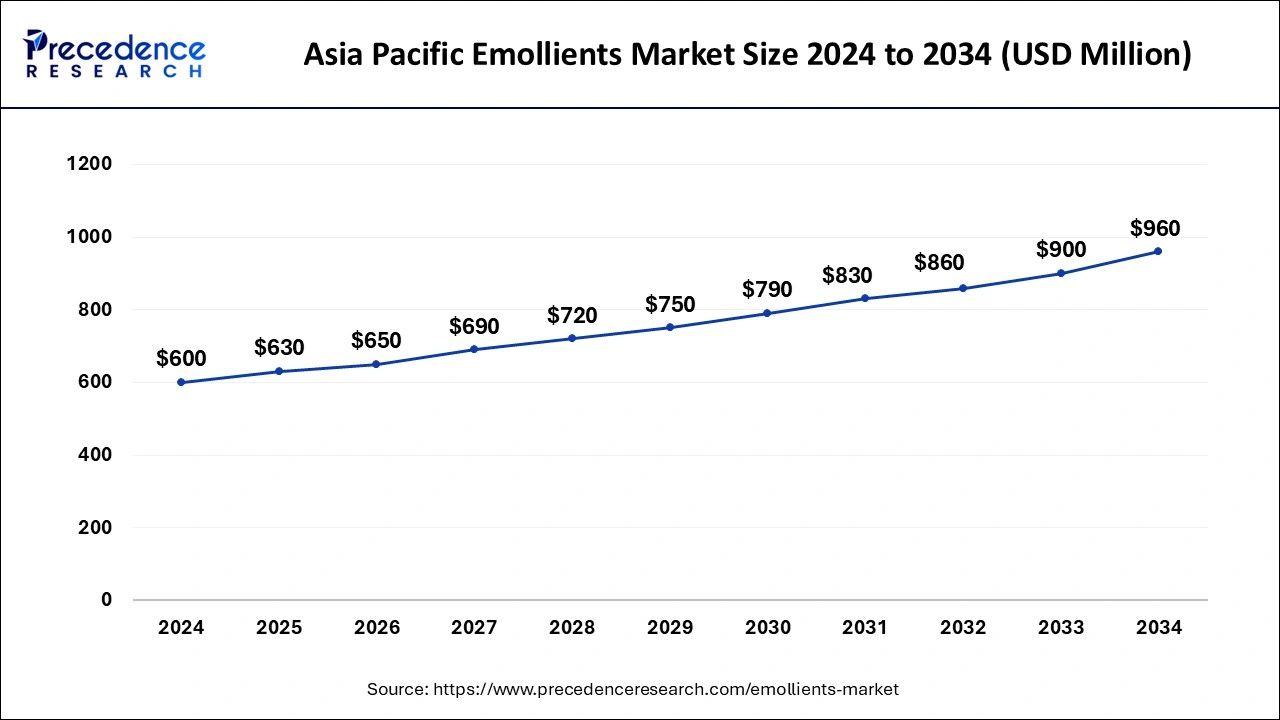

The global emollients market size is evaluated at USD 1.84 billion in 2025 and is forecasted to hit around USD 2.77 billion by 2034, growing at a CAGR of 4.70% from 2025 to 2034. The Asia Pacific market size was accounted at USD 600 million in 2024 and is expanding at a CAGR of 4.81% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global emollients market size accounted for USD 1.75 billion in 2024 and is predicted to increase from USD 1.84 billion in 2025 to approximately USD 2.77 billion by 2034, expanding at a CAGR of 4.70% from 2025 to 2034. The market is anticipated to be driven by globally increasing demand for cosmetic, beauty care, and personal care products.

The Asia-Pacific emollients market size was exhibited at USD 600 million in 2024 and is projected to be worth around USD 960 million by 2034, growing at a CAGR of 4.81% from 2025 to 2034.

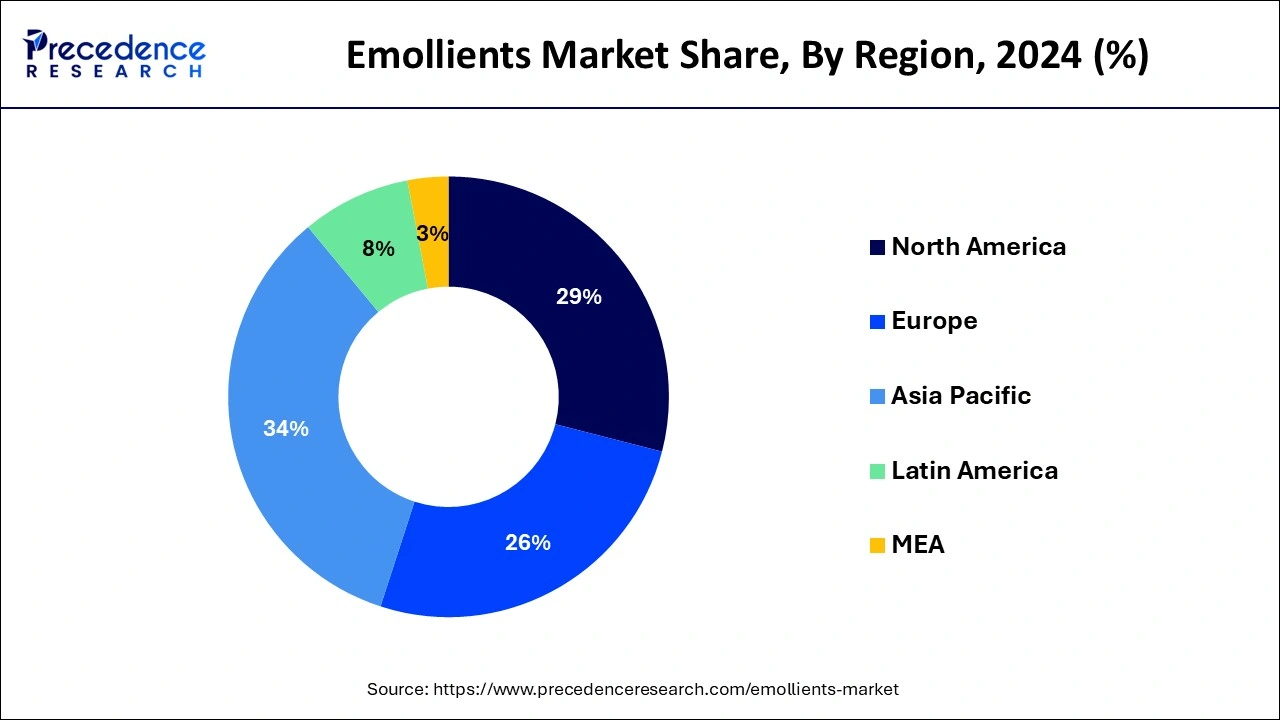

Asia Pacific dominated the global emollients market in 2024 and is expected to maintain its leadership position in the coming years. The growth in this region can be attributed to evolving fashion preferences and a growing trend among people to enhance their appearance in Asian countries. Also, the presence of major product manufacturers and suppliers in the region will continue to drive market trends.

North America is poised to experience rapid growth in the global emollients market over the forecast period. This surge is linked to the increasing demand for cosmetics and personal care products in the United States. The market's expansion in North America is driven by shifting consumer lifestyles, a growing emphasis on wellness and beauty, and changing purchasing habits. Additionally, the rising consumer expenditure on anti-aging and skincare cosmeceuticals contributes to the growth of the region's global market.

Emollients are substances that help the skin to keep soft, hydrated, and calm. They come in various forms, like creams, lotions, or gels, and are used to treat skin conditions like burns, rashes, or dry and itchy skin. They can also be used to make stools softer and easier to pass, helping with constipation. Cosmetics containing emollients may also include other ingredients like antioxidants, perfumes, or preservatives. One can find emollients in products like shaving creams, hair tonics, skin cleansers, and sunscreens. The growing popularity of beauty products among young people and the increasing global population are driving the expansion of the emollients market. Emollient esters, which are long-lasting and versatile, are particularly helpful in creating various types of cosmetics.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 4.70% |

| Market Size in 2025 | USD 1.84 Billion |

| Market Size in 2024 | USD 1.75 Billion |

| Market Size by 2034 | USD 2.77 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Form, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wide range of adoption

The emollients market has experienced significant growth due to their widespread use in cosmetics, skincare, fragrances, haircare, and toiletries. Emollients, particularly those derived from natural sources like plants and animals, are becoming increasingly popular as consumers seek more natural ingredients. Industries that use emollients, such as esters and fatty acids, are experiencing high demand due to their desirable properties and easy availability. Additionally, shifting lifestyles and growing awareness of personal grooming are driving the expansion of the global emollient market.

Stringent regulations

The global emollients market expansion may face challenges due to fluctuations in raw material prices and strict regulations in various countries. Laws requiring transparency about chemical ingredients and their origins can hinder the development of the emollient industry. Additionally, regulations concerning potentially toxic cosmetic ingredients may slow down market growth. Furthermore, the availability of affordable green products that serve as alternatives to emollients could also impede the expansion of the global emollient industry.

Benefits of offer by emollient

Emollients offer numerous sustainable benefits to personal care formulations and address complex challenges in cosmetic production. Hair care and skincare products are experiencing high demand in the personal care sector, which drives market growth. Factors such as an aging population and increased use of cosmetic products among younger generations contribute to this growth. Suppliers and chemical manufacturers are smoothly meeting the rising demand for emollient ingredients across various sectors, including dental care, hair care, and skincare. The expanding men's grooming market also significantly impacts the global emollient industry. Furthermore, the growing preference for organic and natural products in the personal care industry is expected to boost the emollients market further in the coming years.

The emollients market in 2024 was mainly dominated by the liquid segment. Emollients are versatile for various personal care products, and they are commonly found in liquid form. Natural emollients, such as fatty acids, oils, and lipids, are naturally liquid. Synthetic emollients, like butylene glycol and capric/caprylic triglyceride, are also available in liquid form and are widely used in the liquid formulations of skincare products like creams, lotions, moisturizers, and shampoos. These factors contribute to the significant presence of liquid emollients in the global market.

The solid segment is anticipated to grow at the fastest rate over the forecast period. Many companies in the industry are providing semi-solid, powdered, and waxy-solid emollients to personal care and cosmetics manufacturers. They are focusing on developing solid personal care products that have a longer shelf life and are easier to handle.

The skincare segment dominated the emollients market share in 2024. The rise in consumer demand for skincare items like moisturizers, creams, and lotions is a key factor behind this trend. Moreover, the growing popularity of plant-based emollients in the personal care sector is contributing to the market's expansion. Many manufacturers are creating innovative products using plant-derived oils to offer effective personal care solutions to consumers.

The hair care segment is expected to grow at the fastest rate during the projected period. The growth of the hair care segment in the global emollients market is driven by increasing consumer awareness of beauty and personal care. This heightened awareness is leading to greater demand for hair care products such as conditioners, shampoos, masks, creams, and hair gels.

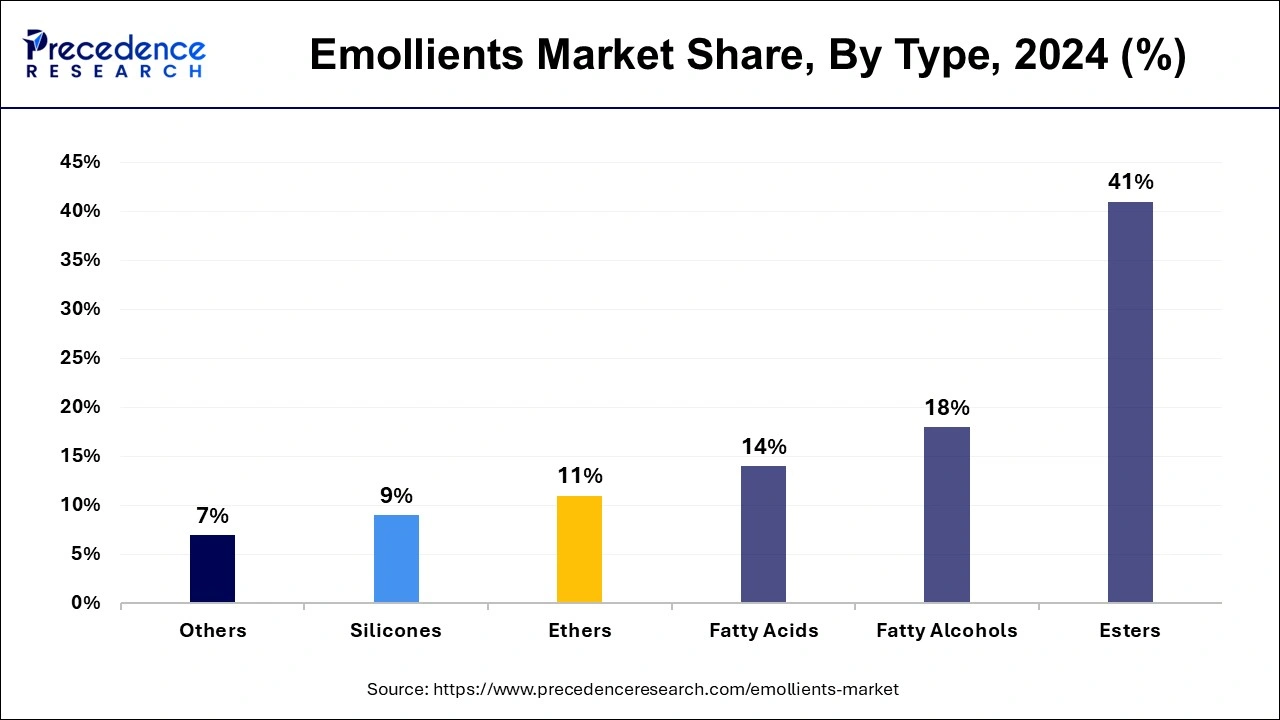

The easter segment dominated the emollients market in 2024. Esters like C12-15 alkyl benzoate, isopropyl myristate, acetyl palmitate, and myristic myristate are commonly used in making personal care emollients. The construction of this manufacturing facility was intended to cater to the growing demand in the personal care market of the Asia Pacific region.

The fatty acid segment is projected to experience the fastest growth during the forecast period. This growth is attributed to the unique properties of fatty acids as emollients, which can effectively hydrate the skin by locking in moisture and reducing moisture loss to the surrounding environment. Common fatty acids used in emollients include sterols, glycerides, and phospholipids.

By Type

By Form

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client