November 2024

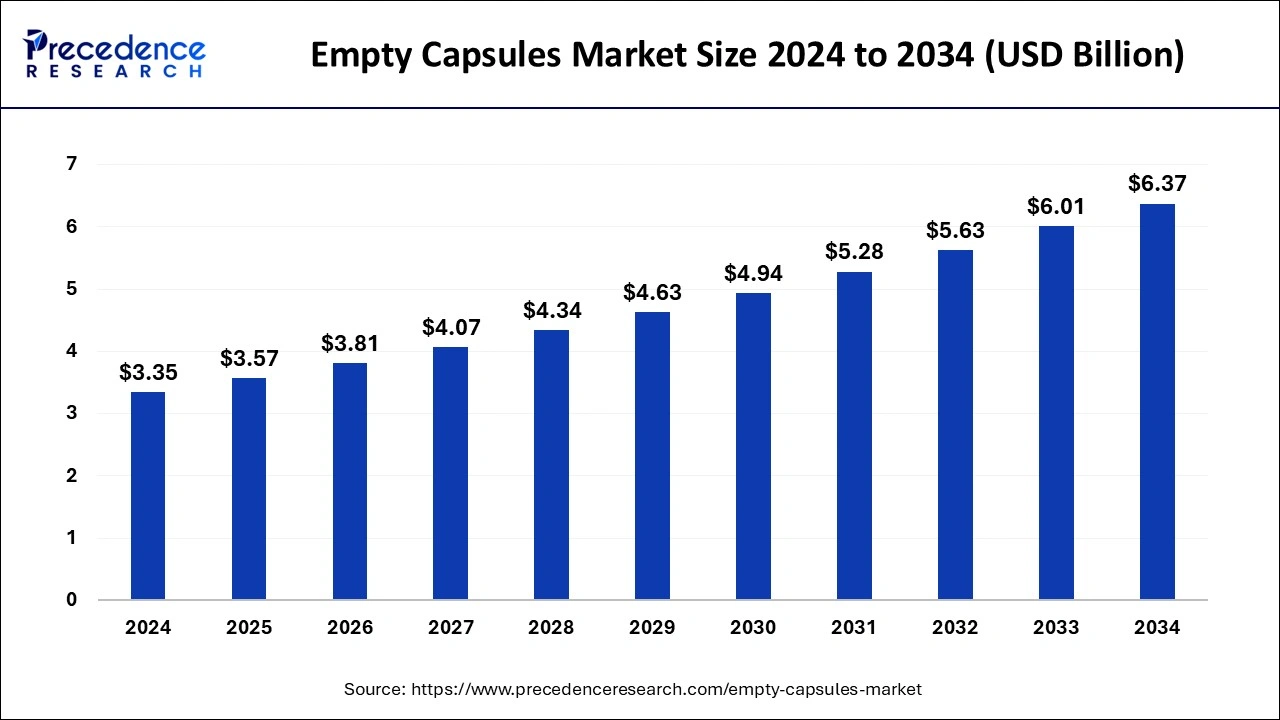

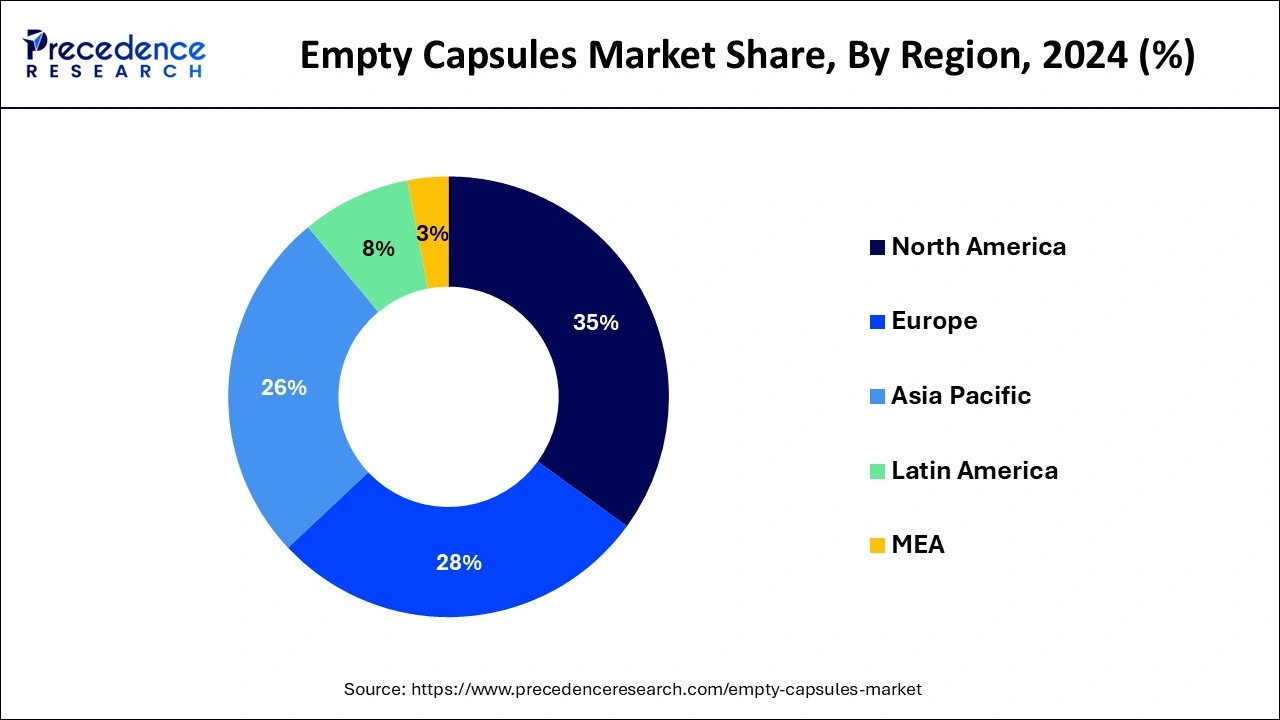

The global empty capsules market size is calculated at USD 3.57 billion in 2025 and is forecasted to reach around USD 6.37 billion by 2034, accelerating at a CAGR of 6.64% from 2025 to 2034. The North America empty capsules market size surpassed USD 1.17 billion in 2024 and is expanding at a CAGR of 6.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global empty capsules market size was estimated at USD 3.35 billion in 2024 and is predicted to increase from USD 3.57 billion in 2025 to approximately USD 6.37 billion by 2034, expanding at a CAGR of 6.64% from 2025 to 2034. The rising demand for dietary supplements and the adoption of capsule-based drugs are driving the growth of the market.

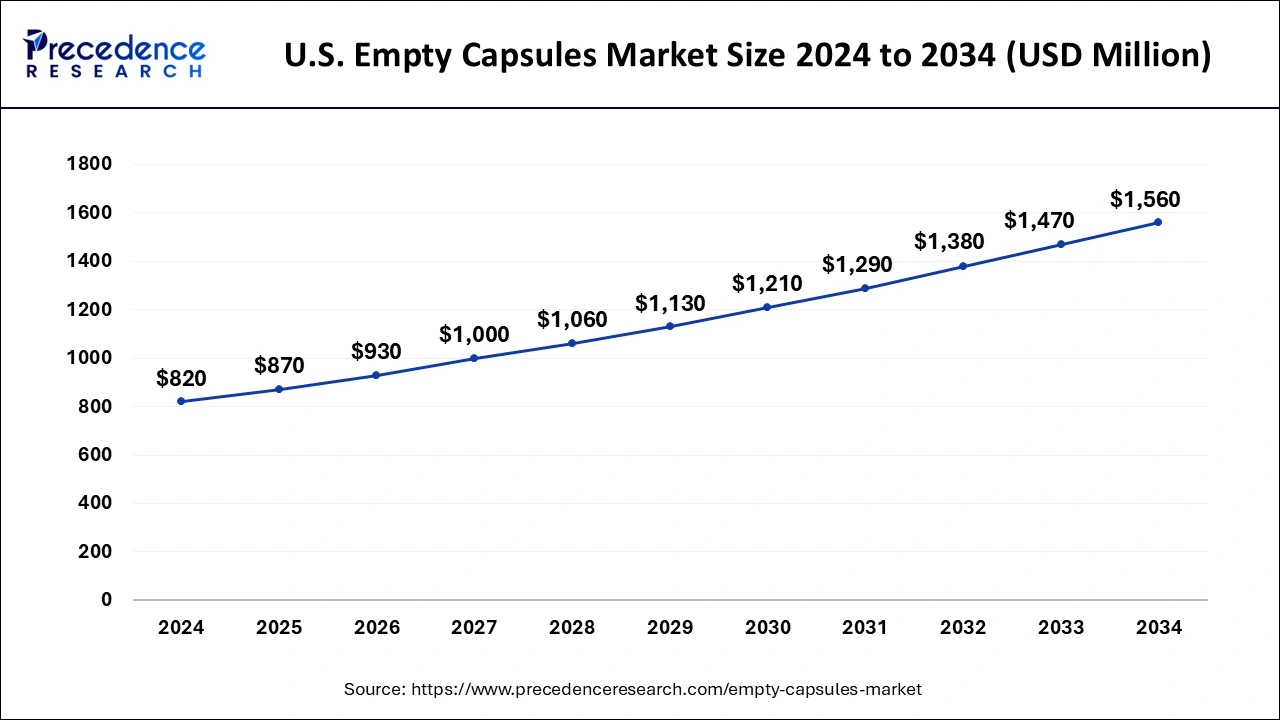

The U.S. empty capsules market size was estimated at USD 820 million in 2024 and is projected to surpass around USD 1,560 million by 2034 at a CAGR of 6.68% from 2025 to 2034.

North America led the empty capsules market with the largest market size in 2024. The growth of the market in the region is attributed to the well-developed healthcare infrastructure and the rising number of pharmaceutical industries that led to the higher demand for empty capsules for drug packaging.

The increasing investments in research and development activities in the development of the pharmaceutical industry and for the latest drug launch drive the expansion of the pharmaceutical industry. The rising prevalence of chronic diseases in the population due to unhealthy lifestyles and the environment also contributes to the expansion of diseases and the demand for effective medicinal treatment. Thus, all these factors collectively contribute to the growth of the region's market.

Asia Pacific is expected to witness the fastest growth in the empty capsules market during the forecast period. The growth of the market in the region is expected to increase due to the rising investments in healthcare infrastructural development by the regional governments. The rising population around the region is one of the major reasons for the expanding healthcare and pharmaceutical industry and the rising geriatric population that is more likely to get the illnesses and diseases that drive the demand for long-term, medicinal treatment, which is further propelling the demand for the empty capsules market in the region.

Capsules are one of the types of medicines made from gelatin, cellulose, and polysaccharides. The capsule contains various types of drug formations, such as solid, liquid, and powder forms, that are made for swallowing. The drugs that are packed in the capsule may irritate the gastric mucosa and esophagus, volatilize easily, taste bad, decompose in saliva, or should be inhaled into the trachea. The packing of the active ingredient into the capsule prevents all these irritations and protects it from degradation and damaging organs and the respiratory tract. Based on consumer preference trends and clinical requirements, these capsules can be made soft and hard using a variety of materials.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.64% |

| Market Size in 2025 | USD 3.57 Billion |

| Market Size by 2034 | USD 6.37 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Functionality, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of capsule drug formation for disease as well as health supplements market

The increasing prevalence of chronic diseases such as cancer, cardiovascular disease, gastrointestinal diseases, diabetes, etc., is driving the expansion of the drug market. The increasing adoption of the drug in capsule formation due to its better effects and easy intake drives the growth of the empty capsules market.

Along with therapeutic applications, the rising consumption of dietary supplements by people who come in capsule drug form leads to the increased demand for empty capsules in the market. The rising awareness about healthy lifestyles and dietary supplements for healthy gut health and the removal of skin issues contribute to the growth of the empty capsules market.

Shortage of raw materials and cost-related constraints

The shortage of raw materials, such as gelatin, and the fluctuating prices of the raw materials are restraining the growth of the empty capsules market. In adverse conditions like economic crises, deteriorating trade relationships, or global healthcare situations as faced during the COVID pandemic, there is an acute shortage of raw materials along with limited funds. As the capsule has little to no effect on the mechanism of the active ingredient, pharmaceuticals tend to sway away from capsule-based delivery. Moreover, a sudden surge in prices of raw materials in response to growing demand and a broken supply chain further hinders market growth.

The rising potential of the pharmaceutical sector

The rising investment by the major private and government institutions in the development of the pharmaceutical sector is contributing to the growth of the market. The increasing research and development activities in the expansion of the market, product launches, and the latest drug development enhance the demand for empty capsules for the storage of drugs inside it for better consumption by the consumers. Additionally, the integration of technologies in the pharmaceutical manufacturing units for the improvement in quality and production drives the growth opportunities for the empty capsules market.

The gelatin segment dominated the empty capsules market in 2024. The growth of the segment is attributed to the rising use of the gelatine substance for capsule making due to its properties that drive demand for the segment. Water and gelatin are the two primary constituents of gelatin capsules. They are made from animal collagen, which is entirely different from those derived from plants.

Some types of gelatine capsules used in medicinal use are clear gelatin capsules, flavored gelatin capsules, and enteric-coated gelatin capsules. The gelatin capsules come in sizes of 5 to 000. Size 5 is the smallest size of the gelatin capsules, and size 000 is the biggest size of gelatin capsules. Each of them is used depending on the diameter of the capsules.

The immediate release segment is projected to witness the fastest growth in the empty capsules market during the forecast period. The system of oral medication delivery comprises solid dose forms, including immediate release and traditional forms. For the past few decades, a variety of acute and chronic disease therapies have been used in traditional dosage forms, such as capsules, solids, pills, powder, solutions, emulsions, and aerosols.

Using super disintegrants such as sodium starch glycolate (Primogel, Explotab), polyvinylpyrrolidone (PVP), etc., that enable rapid tablet disintegration after administration is the fundamental method employed in the development of immediate-release solid dosage forms. A variety of methods, such as direct compression and wet granulation, can be used to formulate it.

The antibiotics & antibacterial segment dominated the empty capsules market. The growth of the segment is attributed to the rising prevalence of chronic diseases and infectious diseases caused by bacteria. Antibiotics are a class of medications that are crucial for treating bacterial infections.

Medical practitioners utilize them to treat a variety of illnesses, including skin infections, urinary tract infections, meningitis, pneumonia, and strep throat. Some types of antibiotics used in the various symptoms of infections are Beta-lactam Antibiotics, Aminoglycosides, Sulfonamides, Quinolones, Macrolides, Nitroimidazole antibiotics, Tetracyclines, Lincosamides, Oxazolidinones and Lipoglycopeptides, and Glycopeptides.

The pharmaceutical companies segment held the largest share in the empty capsules market. The growth of the segment is attributed to the increasing expenditure and investments in the healthcare and pharmaceutical industry, which are driving the demand for the market the rising prevalence of chronic diseases that drives the demand for effective treatment and medication that drives the demand for empty capsules for the packing the drug which is on the form of power of liquid that contributed in the expansion of the empty capsules market. The increasing investments in the pharmaceutical industry by the public and private sectors are driving the expansion of the pharmaceutical industry.

By Type

By Functionality

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

March 2025

June 2024