March 2025

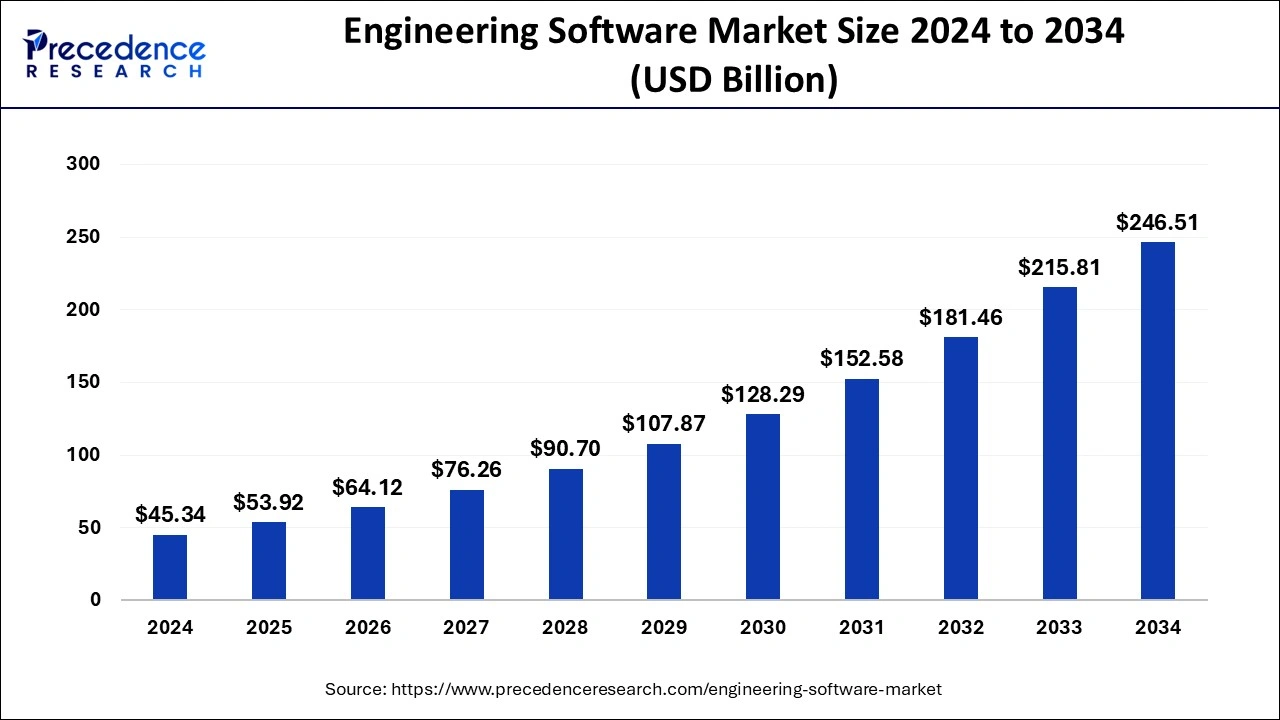

The global engineering software market size is calculated at USD 53.92 billion in 2025 and is forecasted to reach around USD 246.51 billion by 2034, accelerating at a CAGR of 18.45% from 2025 to 2034. The North America engineering software market size surpassed USD 15.87 billion in 2024 and is expanding at a CAGR of 18.47% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global engineering software market size was estimated at USD 45.34 billion in 2024 and is predicted to increase from USD 53.92 billion in 2025 to approximately USD 246.51 billion by 2034, expanding at a CAGR of 18.45% from 2025 to 2034.

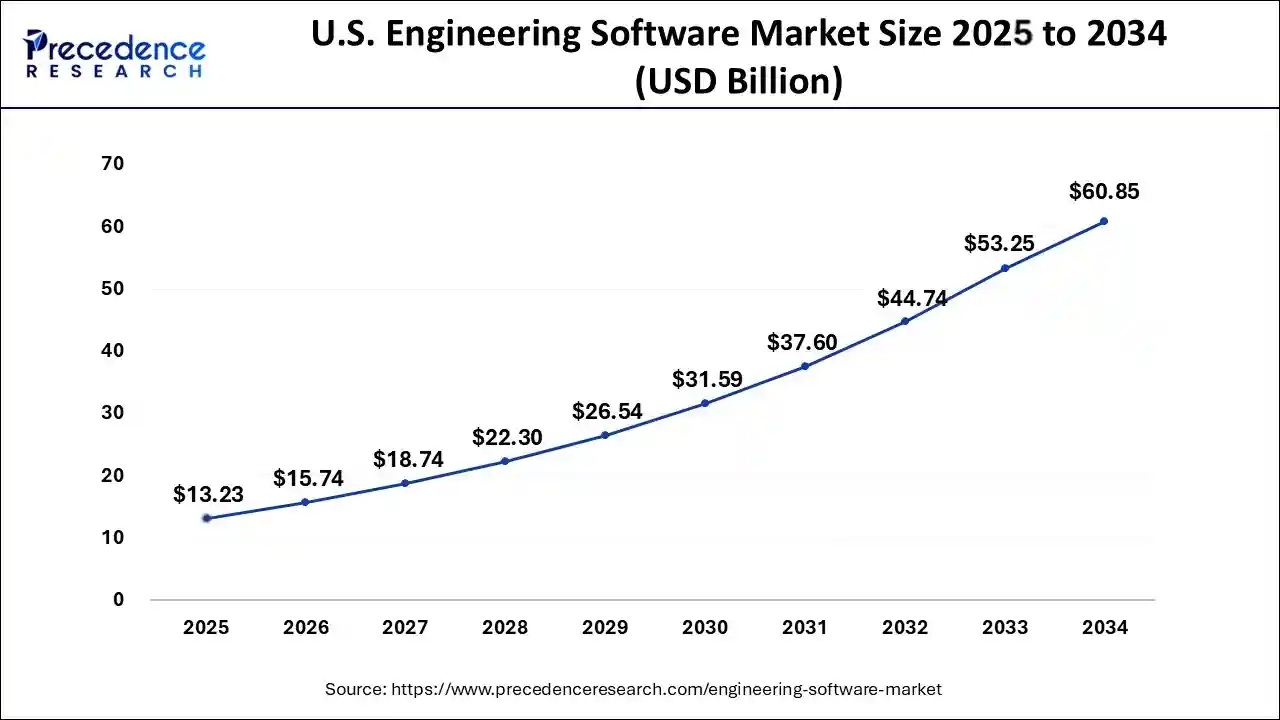

The U.S. engineering software market size was estimated at USD 11.12 billion in 2024 and is predicted to be worth around USD 60.85 billion by 2034 at a CAGR of 18.53% from 2025 to 2034.

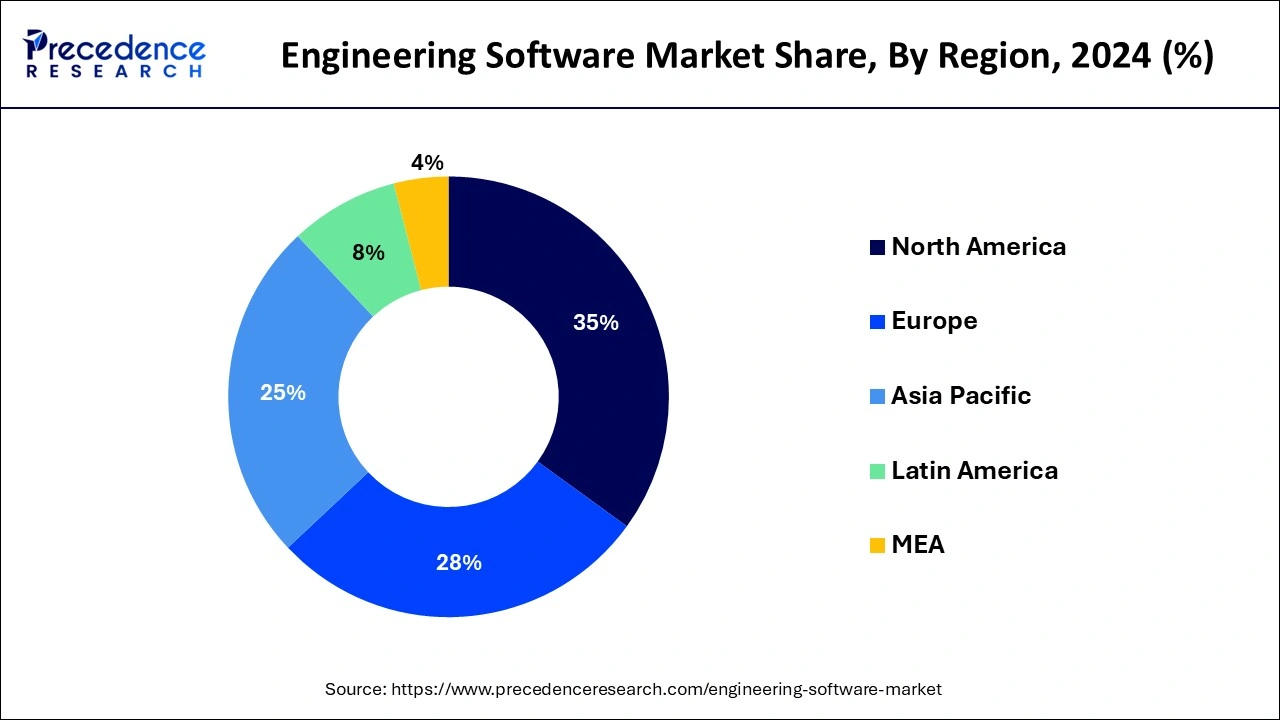

North America held a share of 35% in the engineering software market in 2024 due to several factors. Firstly, it boasts a robust technology infrastructure and a high level of technological adoption across industries, driving demand for advanced engineering software solutions. Additionally, North America is home to many leading engineering software vendors and research institutions, fostering innovation and product development. Moreover, the region's strong presence in key industries such as aerospace, automotive, and manufacturing further contributes to the significant market share, as these sectors heavily rely on engineering software for design, simulation, and analysis purposes.

Asia-Pacific is positioned for significant growth in the engineering software market due to several factors. Rapid industrialization, infrastructure development, and increasing investments in sectors like manufacturing, construction, and automotive are driving demand for advanced engineering solutions. Moreover, the emergence of emerging economies and the adoption of digital technologies are creating opportunities for software vendors to expand their presence in the region. With a growing focus on innovation and efficiency, Asia-Pacific countries are poised to become key contributors to the global engineering software market's growth in the coming years.

Meanwhile, Europe is experiencing notable growth in the engineering software market due to several factors. The region's strong emphasis on innovation and technological advancement, coupled with the increasing adoption of digital transformation initiatives across industries, is driving demand for engineering software solutions. Additionally, stringent regulatory requirements in sectors such as aerospace, automotive, and construction are fueling the need for advanced software tools to ensure compliance and optimize performance. Moreover, the growing focus on sustainability and environmental concerns is prompting companies to invest in engineering software for eco-friendly design and efficient resource utilization.

Engineering software refers to computer programs and applications specifically designed to assist engineers in various tasks related to designing, analyzing, and managing engineering projects. These software tools provide functionalities such as 3D modeling, simulation, drafting, and project management, helping engineers streamline their workflow and improve efficiency. They enable professionals in fields like mechanical, civil, electrical, and aerospace engineering to create detailed designs, run simulations to test performance, and collaborate with team members effectively.

Engineering software plays a crucial role in modern engineering practices, allowing engineers to visualize concepts, optimize designs, and ensure compliance with industry standards and regulations. From designing buildings and bridges to developing complex machinery and electronic systems, engineering software empowers engineers to bring their ideas to life and solve intricate engineering challenges efficiently.

Engineering Software Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 18.45% |

| Market Size in 2025 | USD 53.92 Billion |

| Market Size by 2034 | USD 246.51 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Deployment, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing complexity of engineering projects

The escalating complexity of engineering projects is a primary driver fuelling the demand for engineering software solutions. As engineering tasks become more intricate, traditional methods struggle to cope with the demands of modern design and analysis requirements. Complex projects, such as designing skyscrapers, developing sophisticated electronics, or optimizing intricate manufacturing processes, necessitate the use of advanced software tools. Engineering software offers capabilities like 3D modeling, simulation, and optimization, which are crucial for tackling complex design challenges effectively. These tools enable engineers to visualize intricate structures, analyze performance under various conditions, and iteratively refine designs to meet stringent requirements.

Moreover, as industries evolve and technology progresses, the need for specialized engineering software continues to grow. Whether it's designing next-generation aircraft, creating cutting-edge medical devices, or developing renewable energy systems, engineers rely on software to manage the complexities inherent in these projects. Consequently, the increasing complexity of engineering projects acts as a catalyst, propelling the demand for sophisticated engineering software solutions across various sectors and industries.

Concerns about data security and privacy

Concerns about data security and privacy act as significant restraints on the engineering software market demand for engineering software. With the increasing digitization of engineering processes and the reliance on cloud-based solutions, there is a growing apprehension about the vulnerability of sensitive engineering data to cyber threats and unauthorized access. Organizations, especially in sectors like aerospace, defense, and healthcare, where intellectual property is critical, are hesitant to adopt engineering software due to fears of data breaches and industrial espionage. This reluctance to embrace software solutions can impede the market's growth as companies prioritize safeguarding their proprietary information.

Furthermore, stringent regulations regarding data protection, such as GDPR in Europe and HIPAA in the United States, add complexity to the adoption of engineering software. Compliance with these regulations requires robust security measures and data encryption protocols, which can increase the cost and complexity of implementing engineering software solutions. As a result, organizations may hesitate to invest in software platforms that may pose compliance risks or fail to adequately protect their sensitive engineering data, thereby limiting the market demand for engineering software.

Integration of artificial intelligence (AI) and machine learning (ML) technologies

The integration of artificial intelligence (AI) and machine learning (ML) technologies presents significant opportunities in the engineering software market. These advanced technologies enhance the capabilities of engineering software by enabling predictive analytics, automated design optimization, and intelligent decision-making processes. AI and ML algorithms can analyze vast amounts of engineering data to identify patterns, optimize designs, and predict potential issues, thereby improving overall efficiency and performance in engineering workflows.

Furthermore, AI and ML integration fosters innovation by facilitating the development of autonomous engineering systems and intelligent assistants. Engineers can leverage AI-powered tools to automate repetitive tasks, such as simulation setup and parameter optimization, allowing them to focus on more complex and creative aspects of the design process. Additionally, AI-driven insights enable engineers to make data-driven decisions, leading to better-informed design choices and ultimately, superior engineering outcomes. As a result, the integration of AI and ML technologies creates opportunities for engineering software vendors to offer more advanced, intelligent solutions that meet the evolving needs of engineering professionals across various industries.

The software segment held the highest market share of 71% in 2024. In the engineering software market, the software segment comprises computer programs and applications specifically designed to assist engineers in various tasks related to designing, analyzing, and managing engineering projects. These software solutions include 3D modeling software, simulation tools, project management software, and specialized applications tailored to specific engineering disciplines such as mechanical, civil, and electrical engineering.

A significant trend in the software segment of the engineering software market is the increasing adoption of cloud-based solutions, which offer benefits such as accessibility, scalability, and collaboration. Additionally, there is a growing emphasis on integrating artificial intelligence (AI) and machine learning (ML) technologies into engineering software to enhance capabilities such as predictive analytics, automated design optimization, and intelligent decision-making processes.

The services segment is anticipated to witness rapid growth at a significant CAGR of 19.44% during the projected period. In the engineering software market, the services segment encompasses various offerings that support the implementation, customization, training, and maintenance of software solutions. These services include consulting, implementation, training, and technical support, aimed at helping organizations effectively deploy and utilize engineering software to meet their specific needs.

Recent trends in the services segment of the engineering software market include a growing demand for consulting services to assist companies in selecting the right software solutions, customization services to tailor software to unique requirements, and ongoing technical support to ensure smooth operation and optimization of software performance. Additionally, there is an increasing emphasis on training services to upskill employees and maximize the benefits derived from engineering software investments.

The on-premises segment has held 54% market share in 2024. The on-premises deployment segment in the engineering software market refers to software installations hosted locally within a company's infrastructure rather than on external servers or cloud platforms. This deployment model offers greater control and customization options, making it suitable for organizations with specific security or compliance requirements. However, recent trends indicate a gradual shift towards cloud-based solutions due to their scalability, cost-effectiveness, and ease of access, although on-premises solutions remain popular among certain industries with stringent data security concerns.

The cloud segment is anticipated to witness rapid growth over the projected period. In the engineering software market, the cloud segment refers to software solutions that are hosted and accessed remotely over the internet. These cloud-based engineering software platforms offer flexibility, scalability, and accessibility, allowing users to collaborate on projects from anywhere with an internet connection. A significant trend in this segment is the increasing adoption of software as a service (SaaS) models, where users pay a subscription fee to access the software on a cloud-based platform, reducing upfront costs and providing regular updates and support.

The product design & testing segment has held a 32% market share in 2024. In the engineering software market, the product design and testing segment focuses on software applications used to design, simulate, and test various products across industries. This segment includes tools for 3D modeling, virtual prototyping, and simulation analysis to ensure product performance and reliability. Trends in this segment include the integration of advanced simulation capabilities, such as finite element analysis and computational fluid dynamics, as well as the adoption of cloud-based platforms for collaborative design and testing processes.

The drafting & 3D modeling segment is anticipated to witness rapid growth over the projected period. Drafting software is used to create technical drawings and plans, typically in two dimensions (2D). It assists engineers in producing precise and detailed drawings for various purposes, including architectural designs, mechanical components, and electrical schematics. On the other hand, 3D modeling software allows engineers to create three-dimensional representations of objects or structures. It enables visualization, analysis, and simulation of complex designs, facilitating better understanding and communication of ideas. Trends in these segments include the integration of advanced features like parametric modeling, real-time rendering, and cloud-based collaboration tools to enhance productivity and efficiency in engineering workflows.

By Component

By Deployment

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

December 2024

February 2025

February 2025