May 2024

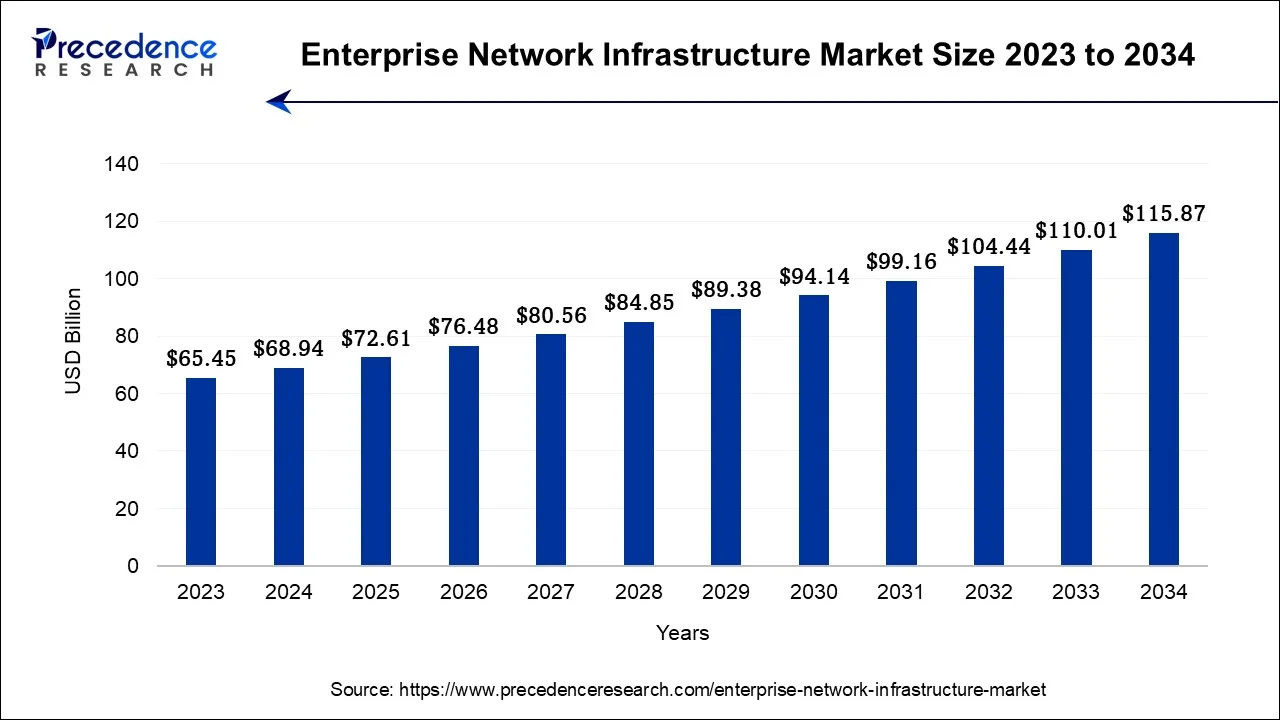

The global enterprise network infrastructure market size accounted for USD 68.94 billion in 2024, grew to USD 72.61 billion in 2025 and is projected to surpass around USD 115.87 billion by 2034, representing a healthy CAGR of 5.33% between 2024 and 2034. The North America enterprise network infrastructure market size is worth around USD 25.51 billion in 2024 and is expected to grow at a fastest CAGR of 5.46% during the forecast period.

The global enterprise network infrastructure market size accounted for USD 68.94 billion in 2024 and is projected to surpass around USD 115.87 billion by 2034, growing at a CAGR of 5.33% from 2024 to 2034.

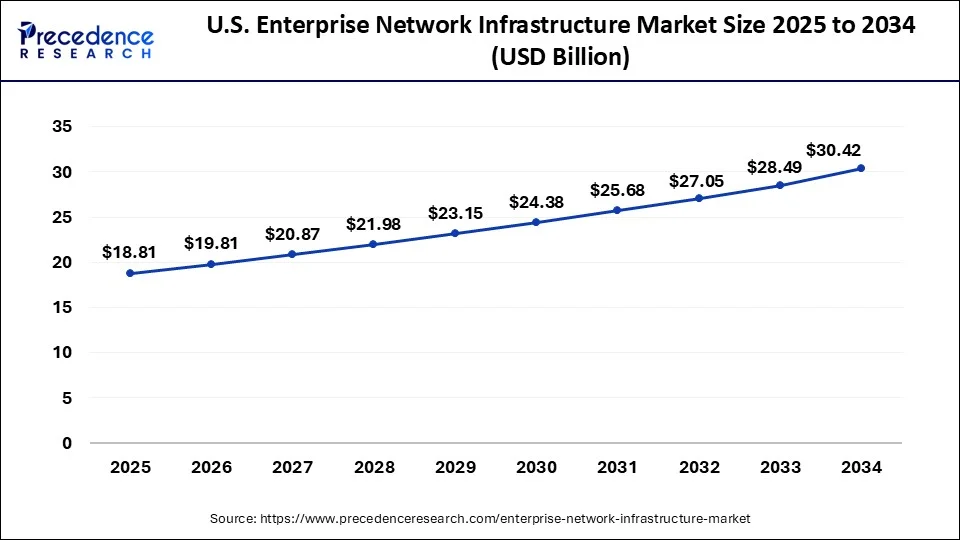

The U.S. enterprise network infrastructure market size was exhibited at USD 17.86 billion in 2024 and is projected to be worth around USD 30.42 billion by 2034, poised to grow at a CAGR of 5.47% from 2024 to 2034.

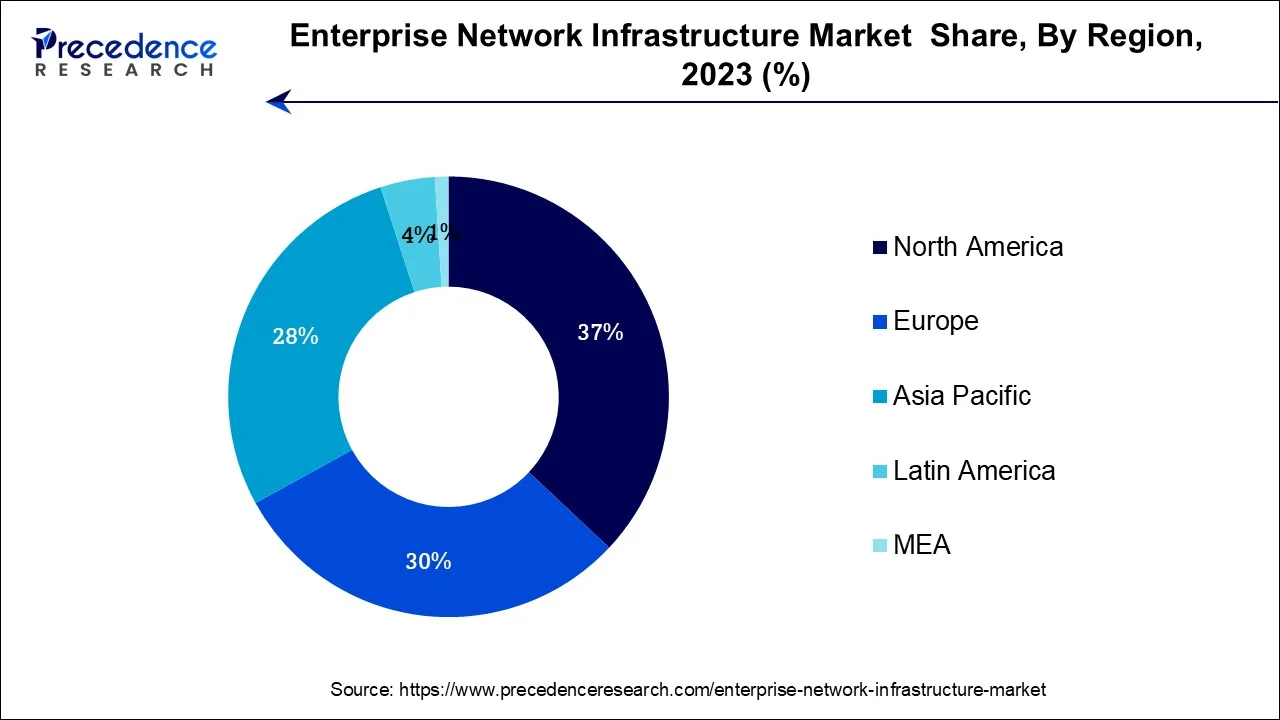

North America dominated the market in 2023, the region is expected to grow while maintaining the position during the forecast period. The acceptance of cutting-edge technologies, especially by multinational corporations is considered to support the growth of the market. The growing popularity of working from home is accelerating the development of routers and switches, which is predicted to propel the expansion of business network infrastructure in North America. The need for wireless access points also highlights how businesses are modernizing their internal infrastructure.

In addition, the organizations are focusing on the adoption of 5G networks, which promises significant growth for the market in North America to grow. Additionally, the rapid expansion of cloud-based services and solutions in the region is expected to act as a growth factor for the market.

Asia Pacific is expected to witness the significant rate of growth during the forecast period. Developing economies in India, Japan and China are expected to boost the acceptance of enterprise network infrastructure in the region. Businesses and organizations in Asia Pacific have started implementing advanced technologies, which promotes the market’s growth in the region. The potential to invest in large network systems with cloud computing solutions also acts as a growth factor for the market.

The enterprise network infrastructure market refers to the industry that provides the hardware, software, and services necessary to support the networking needs of large organizations or enterprises. This market encompasses a wide range of technologies and solutions. A network is a group of linked computers, and an enterprise network is one designed to handle the needs of a sizable business. This includes routers, switches, firewalls, access points, and other devices that form the physical and data link layers of a network. Enterprise networks are made up of the interactions between local area networks (LANs), wide area networks (WANs), and the cloud. Branch offices, Internet of Things devices, public and private clouds, data centers, and individual employees all demand dependable network connectivity in an organization. Unlike the internet, enterprise networks carry limited access to specific people.

The global enterprise network infrastructure market is expected to grow at a robust pace with the rapidly growing digitization and network infrastructure. The rapid adoption of cloud-based solutions in companies and organizations is also observed to support the market’s growth. As businesses update their network infrastructure to wireless systems, the market is expected to experience significant growth. The enterprise network infrastructure market is essential for businesses to maintain reliable, secure, and efficient communication and data exchange within their organizations and with external entities. It continually evolves to accommodate changing technology trends and the growing demands of modern businesses.

| Report Coverage | Details |

| Market Size by 2034 | USD 115.87 Billion |

| Market Size in 2024 | USD 68.94 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.33% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Industry, Enterprise, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for network maintenance

The market for enterprise network infrastructure is expanding significantly as a result of the increased focus on problem prevention and network upkeep. The necessity for a strong and dependable network infrastructure has become important in today's digital world, as organizations significantly rely on their networks to support communication, data sharing, and crucial activities. Organizations are investing in proactive measures like issue avoidance and network maintenance to maintain continuous network connectivity and reduce downtime.

The enterprise network infrastructure industry is expanding as a result of issue prevention. Businesses are now concentrating on recognizing and resolving possible issues before they worsen rather than waiting for network difficulties to emerge. This proactive approach aids in preventing expensive downtime, data breaches, and other disturbances involving networks. Organizations may constantly monitor their network performance, spot bottlenecks, and take preventative action to avoid any future problems by utilizing modern network monitoring tools and technologies.

This includes proactive network optimization, regular firmware updates, and security patches. Another important aspect boosting the market for enterprise network infrastructure is network maintenance. The network always performs at its peak level due to routine maintenance procedures. It entails activities including system backups, performance tweaking, security audits, and software and hardware updates. Organizations may identify and fix any underlying network issues by doing routine maintenance, which lowers the chance of unexpected failures and increases overall network reliability. Additionally, regular network maintenance extends the life of network hardware, lessens the frequency of repairs, and lowers overall expenses.

Security concerns in enterprise network infrastructure

Security issues are a big barrier to the market for enterprise network infrastructure in today's digital environment. Cyber security risks and attacks are becoming more prevalent, and they can have serious repercussions for organizations, such as data breaches, financial losses, reputational harm, and legal liability. Therefore, to guard against these dangers, network infrastructure must have strong security mechanisms. Access to sensitive information that is not allowed is one of the main security issues.

Businesses must make sure that the network infrastructure has reliable access restrictions, authentication procedures, and encryption standards. This aids in limiting access to sensitive information by unauthorized parties or harmful actors. The possibility of data breaches is a serious security issue. Huge volumes of sensitive data, including customer information, financial information, and intellectual property, are transmitted through and stored by networks. Any breach in network security could result in the theft or unauthorized disclosure of this priceless data. Therefore, to protect their network infrastructure, businesses deploy data encryption, secure communication protocols, intrusion detection systems, and firewalls. Enterprises also need to deal with the increased danger posed by malware, ransomware, and other types of malicious software. However, deploying network infrastructure is frequently more complicated and expensive when strong security measures are used.

Emergence of 5G and IoT

The rapid growth of the Internet of Things (IoT) and the emergence of fifth-generation (5G) wireless technologies have opened up a number of lucrative opportunities for the enterprise network infrastructure market. In comparison to earlier wireless technology generations, 5G networks provide faster data, lower latency, and increased capacity. Businesses can improve their operations in a number of ways using 5G. For instance, the use of 5G-powered IoT devices can increase automation, remote monitoring, and predictive maintenance in the manufacturing, transportation, and healthcare sectors.

To accommodate the increased traffic load caused by these devices' ability to generate and transmit enormous volumes of data, a reliable and scalable network infrastructure is needed. Virtual reality (VR) and augmented reality (AR), which have uses in training, remote collaboration, and immersive experiences, are also made possible by 5G's low latency and high reliability. The demand for cutting-edge network infrastructure is accelerated by the potential for these technologies to alter sectors including education, entertainment, and retail.

A strong network infrastructure is also required due to the growing number of IoT devices. Network connectivity is necessary for IoT devices like sensors, wearables, and smart appliances to exchange data and carry out operations. Enterprises need scalable, secure networks that can handle the large influx of IoT devices and efficiently manage the resulting data traffic.

The routers and switches held the dominating share of the market in 2023 the segment will continue to grow at a significant rate during the forecast period. In 2022. Routers are generally connected devices with two or more networks, enabling the transportation of data along with the network. As organizations start focusing on sophisticated broadband infrastructure, the segment is expected to grow at a robust pace. Whereas switches connect multiple devices in a specific network. Routers are capable of connecting while being wireless. As the dominance of cloud-based systems grow, this capability of routers will stay highlighted.

The enterprise telephony sector is predicted to have profitable expansion during the projection period. The demand for unified communication with the transmission of voice, fax and other information in multiple industries boost the growth of the segment. Workers from multiple industries are capable of interacting and communicating effectively with the enterprise telephony technology.

The information technology and telecommunication segment dominated the global market in 2023, the segment will continue to grow at a significant rate during the forecast period. The overall expansion of IT and communication industries promises significant growth for the segment to grow. Along with this, growing use of smartphones and other electronic devices along with digitization promotes the growth of the segment. Multiple developing countries have been focusing on building a strong IT infrastructure, this is another element to supplement the growth of the market. While utilizing smartphones, laptops and PCs in the organization, the information technology and telecommunication sector requires a strong network infrastructure and maintenance, this is expected to highlight the segment’s growth.

Over the forecast period, the healthcare segment is anticipated to have the greatest CAGR. Hospitals, ambulatory centers and diagnostic centers are investing in strong network infrastructure with the rising demand for remote health monitoring systems. Collaboration and partnerships between enterprise network infrastructure providers with hospitals and clinics create a significant opportunity for the segment to grow.

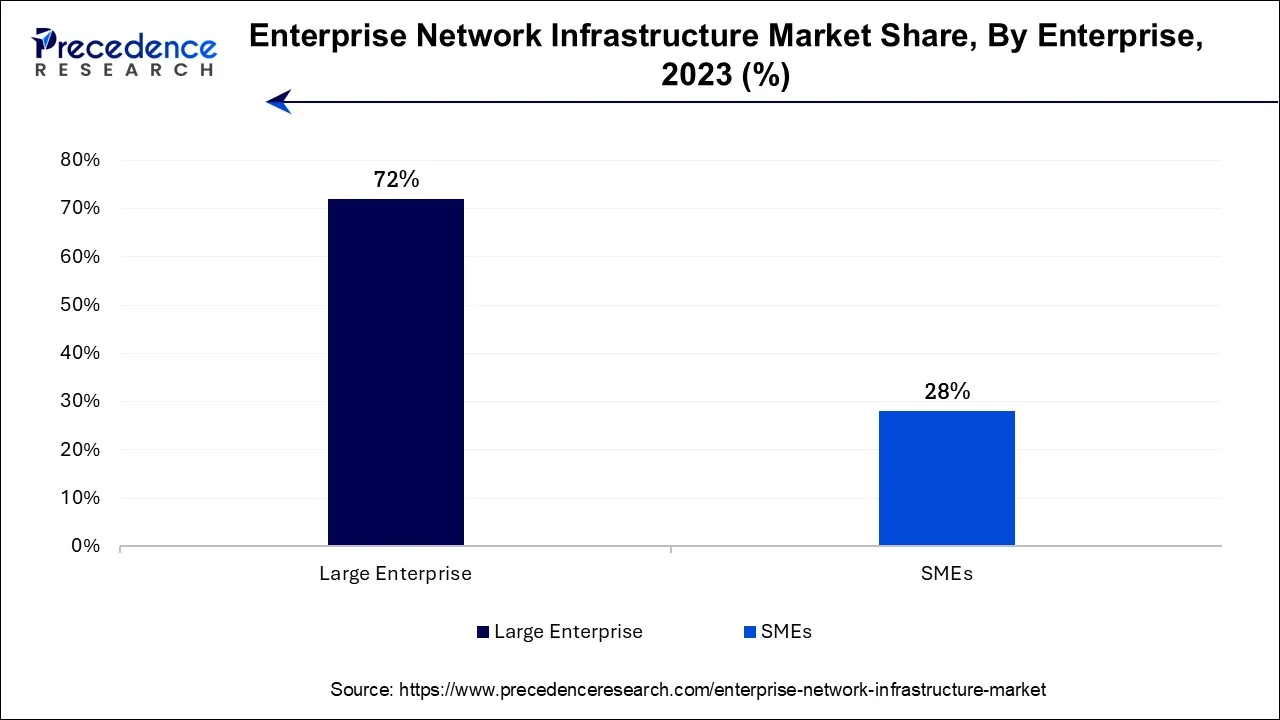

The large enterprise segment held the dominating share in the market in 2023, the segment is expected to sustain the position throughout the forecast period. Large enterprises generally have massive demand for precise and strong network infrastructure. In addition, the potential of large enterprises to invest in such services promotes the segment’s growth. Moreover, the presence of skilled professionals to install, operate and maintain these services create a major potential for large enterprises to grow. The rapid adoption of 5G networking for faster speed in large-scale enterprises or organizations supplements the segment’s growth.

The SMEs segment is expected to grow at a significant rate throughout the forecast period. The rising number of small-scale startups, especially in developing countries promotes the growth of the segment. In addition, multiple governments are promoting the adoption of digitization and cloud-based services with funds and subsidies for small-scale enterprises, this brings a potential for the segment to grow.

Segments Covered in the Report

By Technology

By Industry

By Enterprise

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

November 2024

November 2024

November 2024