January 2025

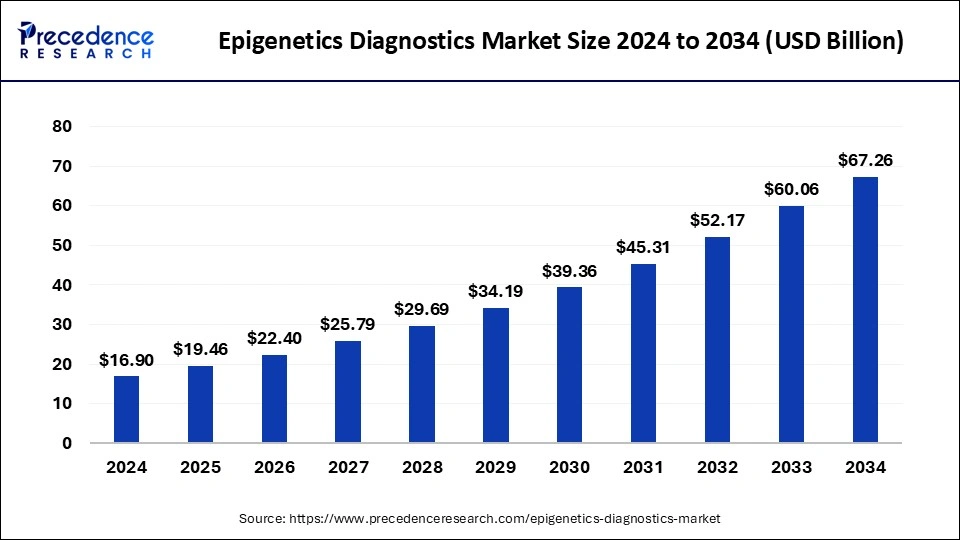

The global epigenetics diagnostics market size is accounted at USD 19.46 billion in 2025 and is forecasted to hit around USD 67.26 billion by 2034, representing a CAGR of 14.81% from 2025 to 2034. The North America market size was estimated at USD 6.59 billion in 2024 and is expanding at a CAGR of 14.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global epigenetics diagnostics market size accounted for USD 16.90 billion in 2024 and is predicted to increase from USD 19.46 billion in 2025 to approximately USD 67.26 billion by 2034, expanding at a CAGR of 14.81% from 2025 to 2034. The rising prevalence of chronic diseases, an aging population, and the resulting rising investment in the research and development of epigenetics are driving the epigenetics diagnostics market.

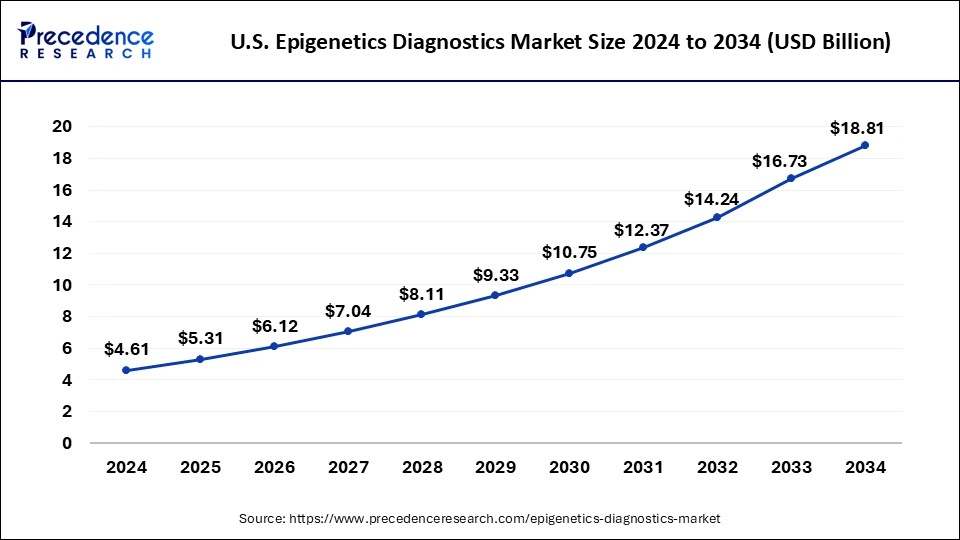

The U.S. epigenetics diagnostics market size was evaluated at USD 4.61 billion in 2024 and is projected to be worth around USD 18.81 billion by 2034, growing at a CAGR of 15.10% from 2025 to 2034.

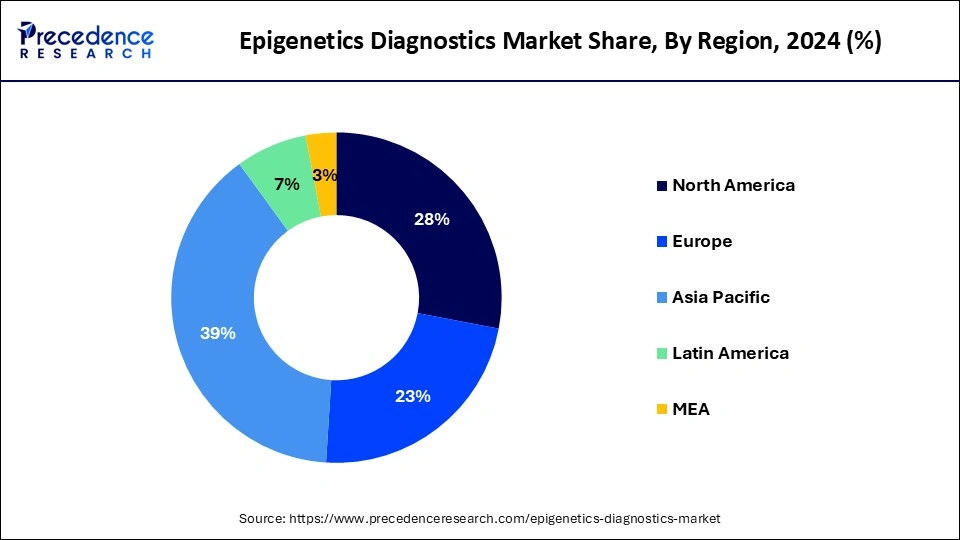

North America held the largest share of the epigenetics diagnostics market in 2024. The region is observed to sustain the position during the forecast period. Large-scale investments from governments, biotechnology, and pharmaceutical companies are driving demand in the region. North America also boasts a highly developed healthcare infrastructure and a robust research ecosystem, which promotes innovation in epigenetic diagnostic technology. The rising demand for cancer treatments is pushing further research and development investment in the region.

Asia Pacific is observed to grow at the fastest pace in the epigenetics diagnostics market during the forecast period. The growing incidence of cancers, a rise in medical tourism, and increased investment in R&D activities by the government is pushing growth, particularly in China and India. The region has the highest incidence of liver and stomach cancers with prostate cancer becoming one of the leading male cancers in some Asian countries. The growing adoption of epigenetics in developing economies will boost regional market growth during the forecast period. Increasing regulatory support for precision medicine and diagnostics in countries like China and Japan encourages the adoption of innovative epigenetics technologies. Regulatory frameworks that promote research and development also attract investment in the region.

Epigenetics diagnostics enable personalized treatment strategies by identifying patient-specific biomarkers and therapeutic targets. This approach is crucial for improving treatment outcomes and reducing healthcare costs associated with trial-and-error therapies. Integration of epigenetics data into electronic health records (EHRs) and healthcare systems facilitates data-driven decision-making and supports the adoption of precision medicine approaches across the region.

The epigenetics diagnostics market offers solutions and services that involve the study of modifications to DNA and related proteins that change gene expressions without altering the genetic sequencing. Epigenetic diagnostics involves analyzing markers such as DNA methylation and histone modification, providing insights into an individual’s disposition towards certain diseases like cancer, predicting progression, and developing personalized treatments. Epigenetic changes that affect cellular and physiological phenotypic traits result from normal development or environmental factors.

The epigenetics diagnostics market has seen substantial growth in the past decade due to a rise of funding into the research and development of epigenetics fuelled by the high prevalence of cancers, and the growing popularity of personalized medicine due to technological advancements in next-generation sequencing (NGS), high-throughput DNA methylation arrays, and single-cell epigenomics platforms.

The complexity of epigenetic data interpretation, lack of skilled professionals and the high cost of installation and maintenance of new technologies restrict growth in the epigenetics diagnostics market.

| Report Coverage | Details |

| Market Size by 2034 | USD 67.26 Billion |

| Market Size in 2025 | USD 19.46 Billion |

| Market Size in 2024 | USD 16.90 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.81% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Technology, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising instances of cancer and auto-immune disorders

A rapidly aging population and rising risk factors associated with socioeconomic development, obesity, and changes to people’s exposure to risk factors like air pollution are causing a rise in global incidences of cancer, cardiovascular conditions, and auto-immune diseases. According to the WHO, over 35 million new cancer cases are expected in 2050, marking a significant 77% increase from in 2022. Three major cancer types; lung, breast, and colorectal cancers are seeing a significant spike.

DNA methylation, RNA regulation, and histone modification have largely been the focus of epigenetics diagnostic research. Certain aberrant methylations of the MLH1 mismatch repair gene predispose individuals to develop cancer. Some autosomal dominant familial cancer syndromes like Lynch syndrome or hereditary non-polyposis colorectal cancer (HNPCC) are caused by heterozygous germline mutations. Epigenetic silencing of crucial tumour suppressors and DNA repair genes has been identified as causing the development of sporadic cancers.

These discoveries have led to a rise in demand for accurate diagnosis and personalized treatment plans, thereby fueling the necessity for next-generation sequencing, which is crucial in tumour profiling. These factors are fuelling medical research in the epigenetics diagnostic space and the development of potential drug targets and develop more effective therapies.

Increased R&D Investments by Governments and Pharmaceutical Companies

An increase in research and development funding in the pharmaceutical industry and public health sector by governments in oncology and neurology is spurring progress in epigenetic diagnosis. The significant rise in the global frequency of chronic and terminal conditions is prompting pharmaceutical companies to outsource drug discovery services to specialized providers to increase efficiency.

Advancements in bioinformatics and high-throughput screening is helping create large chemical libraries at a fraction of the earlier cost and furthering research in DNA methylation, histone modifications, and non-coding RNA expression. The integration of AI and machine learning technologies is also making optimizing drug design and predicting drug metabolization at a faster and more accurate rate.

Complexity of Epigenetic Data Interpretation and Lack of Trained Professionals

Epigenetic data is complex and requires significant expertise to accurately interpret. The need for advanced analytical methodologies and computational tools necessitates highly trained professionals. The wide variety of epigenetic alterations owing to the multidimensional nature of epigenetic data makes it difficult to isolate important signals.

The complex interactions of epigenetic alterations also further complicate analysis. Extracting relevant insights that can help develop therapies and insights for diagnosis needs professionals with a strong background in biotechnology as well as advanced statistical methods. The need for this multidisciplinary collaboration restricts growth in the epigenetics diagnostics market.

High Costs of Epigenetic Technology

Epigenetic technology is still a nascent sector and still has prohibitive costs for installation, operation, and maintenance. While epigenetic technology has found some traction in North America and Europe, its cost remains high, with few emerging economies able to afford the hefty price tag. For instance, the cost of tumour-based molecular assays like ConfirmMDx used to detect prostate cancer remains high at $206 per individual core, or $2061 for a 10-core biopsy. The total cost of repeated prostate biopsies in the United States can go up to USD 2,864,142. These significant costs dissuade the commercial adoption of epigenetic diagnostic techniques.

Development of Cost-Effective Technologies through AI and Machine Learning

The increasing adoption of AI and machine learning in particular, in the healthcare and biotechnology industries is improving the accuracy and efficiency of diagnostic testing. With the help of AI and Deep Learning, CNN (convolutional neural network) analysis of large amounts of genetic data such as GWAS (genome-wide association study), and EWAS (epigenome-wide association study) is expedited. For instance, the recently developed EWASplus computational method uses machine learning to extend EWAS coverage to the entire genome and is used to predict Alzheimer's disease-related traits in central pattern generators associated with the disease.

Mergers and Collaborations will help build Cost-Effective and Sustainable Business Models

The high cost of research and collaboration in the epigenetics space is prompting established companies to form partnerships or merge with start-ups looking to develop a sustainable business model in the diagnostics market. For instance, French biopharmaceutical company Ipsen acquired Epizyme, Inc. The merger led to Ipsen’s acquisition of Tazverik (tazemetostat), a chemotherapy-free EZH2a inhibitor which was granted approval by the U.S. Food and Drug Administration (FDA). The medication is used to treat relapsed or refractory follicular lymphomas.

The reagents segment accounted for the largest share in epigenetics diagnostics market in 2024. Reagents come in two major categories; namely DNA modifiers and histones. These include PCR reagents, electrophoresis reagents, primers, buffers, and nucleic acid reagents widely used in epigenetics research. The widespread use of reagents in epigenetics research has driven growth in this sector of the epigenetics diagnostics market.

The kits segment is the fastest growing segment with a CAGR during the forecast period. The demand for epigenetic kits has been fuelled by a rise in cases of cancer and other chronic diseases for their use in screening and developing therapeutic treatments. The growing number of commercially available epigenetic kits and an increasing number of companies involved in the research and development of more sophisticated kits are pushing growth in the segment.

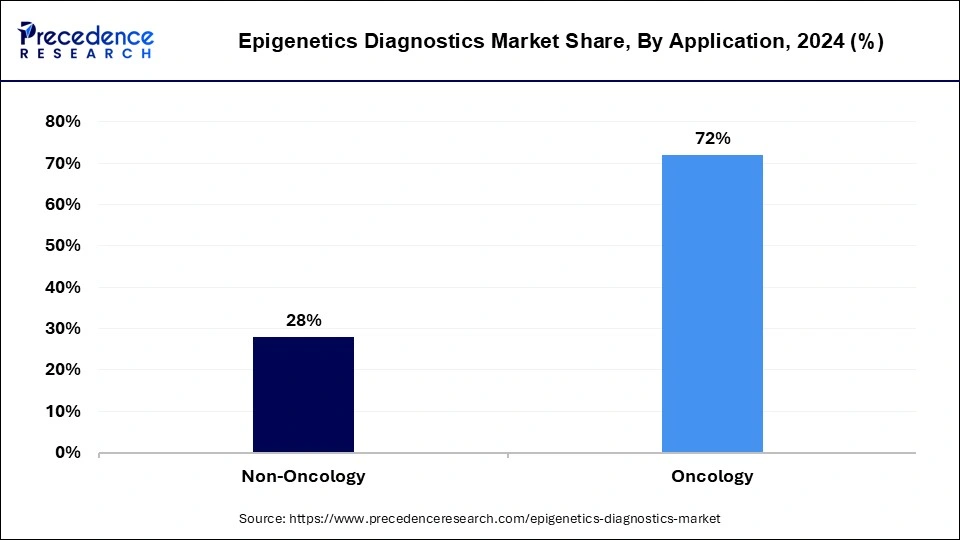

The oncology segment held the largest share of the epigenetics diagnostics market in 2024. Epigenetic research into the Human papillomaviruses (HPVs) which causes cervical cancers and subsets of vulval, anal, oral, and penile cancers has been boosted by the rising cases of these cancers. The rising prevalence of various types of cancers is driving growth in the segment. Innovations and commercialization of existing drugs in the space in the coming years are expected to drive growth in the segment.

The non-oncology segment by application is observed to grow at a notable rate during the forecast period. The rise of epigenetic diagnostics research and development programs by governments and pharmaceutical companies to identify epigenetic markers associated with diseases like Alzheimer’s and other neurodegenerative disorders as well as infectious diseases like Kaposi Sarcoma.

The DNA methylation segment held the largest share of the epigenetics diagnostic industry with a share in 2024. DNA methylation is a universal mechanism that suppresses gene expression in several ways and regulates histone modification and gene expression regulation by non-coding RNAs. The process involves transferring a methyl group onto the C5 position of the cytosine to form 5-methylcytosine, thereby regulating gene expression by recruiting proteins involved in gene repression and inhibiting transcription factor binding to DNA. Technological advancements in recent years are making it easier to assess DNA methylation in a genome.

The histone acetylation segment is expected to see the fastest growth in the forecast period in the epigenetics diagnostics market. The process regulates chromatin dynamics, gene silencing, cell cycle progression, DNA replication, and repair as well as nuclear import. Unlike methylation, acetylation neutralizes the positive charges on the lysine residues, leading to relaxing electrostatic interactions between histones and DNA. acetylation also recruits effector proteins, contributing to chromatin decondensation and higher accessibility to the transcription machinery. These factors contribute to several research and development efforts in acetylation to improve efficacy.

By Product

By Application

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

December 2024

September 2024