Lysine Market Size and Forecast 2025 to 2034

The global lysine market size accounted for USD 1.40 billion in 2024 and is predicted to increase from USD 1.51 billion in 2025 to approximately USD 3.08 billion by 2034, expanding at a CAGR of 8.23% from 2025 to 2034. Increasing demand for protein-rich diets is the key factor driving market growth. Also, the rising awareness regarding the benefits of lysine coupled with the technological advancements in lysine production can fuel market growth further.

Lysine Market Key Takeaways

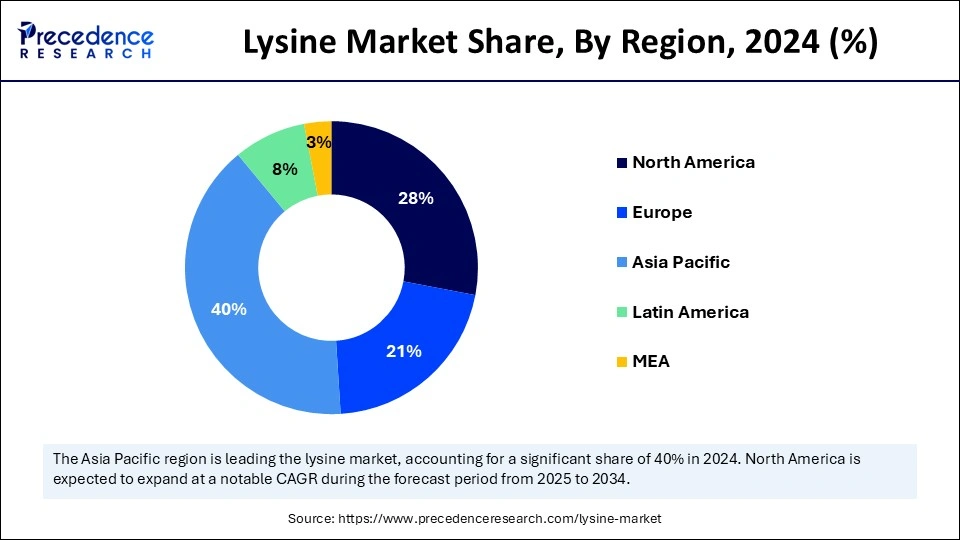

- Asia Pacific dominated the global market with the largest market share of 40% in 2024.

- North America is expected to grow at a significant CAGR over the studied period.

- By form, the powder segment contributed the highest market share in 2024.

- By form, the granules segment is anticipated to grow at the fastest CAGR over the projected period.

- By application, the animal feed segment captured the biggest market share in 2024.

- By application, the pharmaceuticals segment is expected to grow at the fastest CAGR over the forecast period.

Impact of Artificial Intelligence (AI) on Amino Acid Nutritional Supplement

The integration of artificial intelligence in amino acid nutritional supplements is substantially impacting marketing strategies, product development, and consumer engagement. AI-powered data analytics in the lysine market are being used to process consumer trends and preferences, allowing manufacturers to make their product offerings efficiently. Furthermore, AI in the production process improves production effectivity, decreases overall operational costs, and maintains constant product quality, fulfilling the global market demand.

- In May 2024, AlphaFold 3, a new AI model developed by Google DeepMind and Isomorphic Labs. Predicts the structure and interactions of all of life's molecules. To build on AlphaFold 3's potential for drug design, Isomorphic Labs is already collaborating with pharmaceutical companies to apply it to real-world drug design challenges and, ultimately, develop new life-changing treatments for patients.

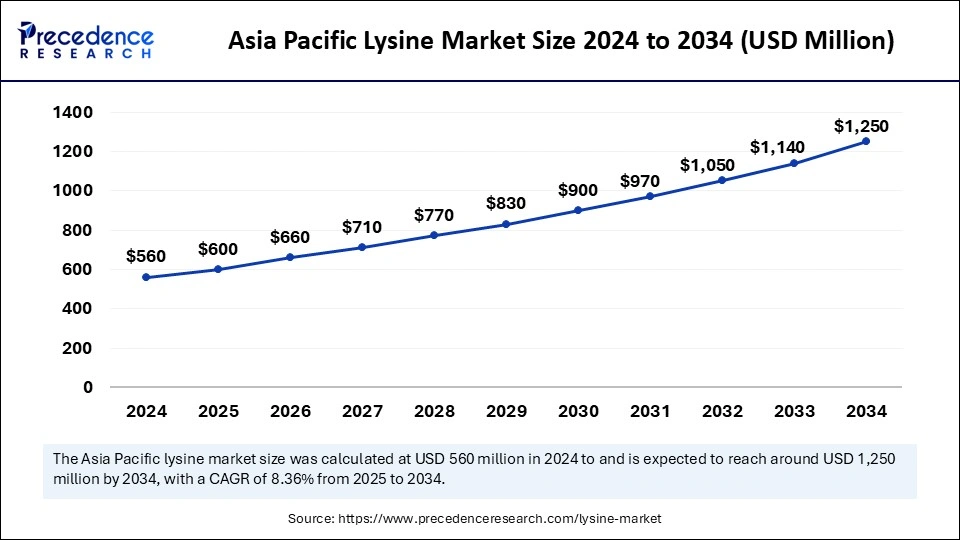

Asia Pacific Lysine Market Size and Growth 2025 to 2034

The Asia Pacific lysine market size was exhibited at USD 560 million in 2024 and is projected to be worth around USD 1.25 billion by 2034, growing at a CAGR of 8.36% from 2025 to 2034.

Asia Pacific dominated the lysine market in 2024. The dominance of the region can be attributed to the increasing demand for ready-to-eat foods and rapidly shifting urban lifestyle trends. In Asia Pacific, China led the market owing to the increasing disposable income and surging population growth in the country. Also, the nation's escalating pharmaceutical industry is optimizing the demand for lysine to produce many supplements and drugs.

- In May 2024, the European Commission launched an anti-dumping investigation into lysine imports from China. This is an amino acid present in dietary supplements.

North America is expected to grow at a significant pace in the lysine market over the studied period. The growth of the region can be credited to the presence of a strong pharmaceutical infrastructure coupled with the growing health consciousness among the majority of the population in the region. In North America, the U.S. led the market due to rising demand for dairy and meat products. Furthermore, the consumers in the region increasingly seek lysine-rich diets because of their various health benefits.

Market Overview

Lysine is an α-amino acid, acting as a key component of proteins. It is slightly different from acid. It contains one amino group, a carboxylic acid group, and another amino group that is positively charged. Natural sources such as lean beef, cheese, shellfish, nuts, chicken, pig, soy, lentils, legumes, and beans contain plenty of lysine. Lysine is essential for calcium absorption and collagen formation in the body. Lysine hydrochloride is produced on a huge scale by the fermentation process of sugar.

Lysine Market Growth Factors

- The surge in global meat consumption, especially among developing countries, is expected to drive lysine market growth shortly.

- Increasing population and growing lysine affluence can propel market growth soon.

- The growing demand for personal hygiene products, pet food, and other medications can boost market growth further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.08 Billion |

| Market Size in 2025 | USD 1.51 Billion |

| Market Size in 2024 | USD 1.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.23% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form Powder, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Surge in risk factors associated with protein deficiency

The increasing incidence of many health issues related to protein deficiency is the major factor driving the lysine market. Consumers globally are increasingly becoming aware of their healthy dietary habits. In addition, a protein deficiency can cause conditions like Kwashiorkor and Marasmus. There is a big risk of extreme emaciation and a long-term negative energy balance, which can lead to muscle wasting and fat exhaustion, negatively impacting many people's health.

- In May 2024, the European Commission said it had begun an anti-dumping investigation into Chinese imports of lysine, an amino acid that plays a key role in human and animal diets. The decision came after "a complaint from the EU industry containing evidence of unfair trading practices" by Chinese producers, a commission spokesperson said.

Restraint

Stringent regulatory requirements

Lysine market players have to face challenging and costly businesses to fulfill the strict regulatory demand and secure permits, which sometimes pose a hurdle for the companies who opt to launch new lysine products. Moreover, changing consumer tastes, such as moving toward natural and plant-based diets, may have a negative impact on market growth. This sudden shift might affect the livestock sector, which will then impact the amount of lysine required inanimal feed.

Opportunity

Growth of poultry and livestock industries

Increasing urbanization, incomes, and shifting dietary habits fuel substantial opportunities in the global lysine market. China is the biggest producer and consumer of poultry and pork products. The government's efforts to industrialize and modernize the agricultural field have resulted in substantial advancements in poultry production facilities. Furthermore, nations such as Brazil and Mexico have recently seen substantial growth in South America's poultry and livestock sectors. This growth in the emerging regional market can impact market growth positively.

- In May 2023, Evonik launched a new generation of Biolys, a proven source of lysine for livestock feeds. The new Biolys formulation contains 62.4% L-lysine (an 80% ratio to Lysine HCl) compared to the current version's 60% L-lysine (a 77% ratio to Lysine HCl). The product also contains valuable components resulting from its fermentation process, as well as additional nutrients and energy that further benefit livestock such as swine or poultry.

Type Insights

The L-lysine hydrochloride (HCL) segment held the largest share of 42.30% in the 2024 lysine market. The l-lysine hydrochloride, a salt formation of merge important main amino acid l-lysine with hydrochloric acid, is a common base formation of lysine in pharmaceutical and dietary applications. It's a highly adopted space in the gym sector for its solubility and stability to free lysine. It is also used in feed additives and animal nutrition. This lysine type is bolstering health development in the animal stock and human dietary system if considered appropriately.

The L-lysine sulphate segment is expected to grow at a CAGR of 6.90% during the forecast period. The is a compound formation by merging amino acid l-lysine with sulfuric acid. The development of l-lysine sulphate consists of synthesizing it via chemical synthesis or fermentation and then progressively improving its properties with additives similar to amaranth dye. This segment is steadily evolving with the protein-balancing (ingredients) demand in the protein supplement sector.

Grade Insighhts

The feed grade segment held the largest share of 78.50% in the 2024 lysine market. The feed grade, especially l-lysine sulphate and l-lysine HCL, is an essential amino acid supplement mainly used in animal feed. The growth and development of animal feed have significantly improved the provision of healthy dietary options for animals in their grain-based diets. The production rate increases with the rising demand for the amino acid supplement, which eventually elevates the lysine industry's growth globally.

The pharmaceutical-grade segment is expected to grow at a CAGR of 7.50% during the forecast period. This segment's lysine development aims to produce lysine that is qualitative and holds purified standards. It contributes to drug development and improves medications. Lysine in pharmaceutical grade helps to control quality measures and purify techniques to provide efficacy and safety in pharmaceutical applications. This segment is emerging with the increased prevalence of disease and contributes to immunotherapy.

Form Insights

The encapsulated segment is expected to grow at a CAGR of 6.80% during the forecast period. The encapsulation of lysine, mainly of l-lysine, is a technique used for absorption in the intestines. The encapsulation focuses on providing lysine to the lower digestive tract. This encapsulated formation elevates nutritional value. It is a secondary approach to the lysine market. The demand for nutritional food or protein supplements is rising among health health-conscious population, so the demand for this market is also accelerating.

Lysine Market Companies

- Global Bio-chem Technology Group Company Limited

- Ajinomoto Co. Ltd.

- Cheil Jedang Corp

- ADM

- Evonik

- COFCO Biochemical

- Juneng Golden Corn Co. Ltd.

- Changchun Dacheng Industry Group Co.,ltd

- KYOWA HAKKO BIO CO., LTD.

- Cargill

Latest Announcement by Market Leaders

- In September 2024, Ajinomoto Co., Inc. and Danone announced a global strategic partnership aimed at reducing multiple sources of greenhouse gas (GHG) emissions from the milk supply chain. This initiative utilizes Ajinomoto Co's solution AjiPro-L, an innovative and world-leading lysine formulation, which, in addition to aiding in the absorption of the amino acid, is also highly cost-effective and a broad-ranging GHG reduction method in the market.

- In April 2024, German chemical company Evonik announced the inauguration of its new office and R&D premises, Evonik India Research Hub (EIRH), in Thane on April 23, 2024. The company said the inauguration ceremony was attended by the Consul General of the Federal Republic of Germany in Mumbai - Dr. Achim Fabig. Evonik currently employs approximately 850 employees in India in its three entities.

Recent Developments

- In January 2023, CJ CheilJedang Corp. announced plans to launch a new lysine product for use in human nutrition. The product, called Lys-O-Mega, is a high-quality lysine supplement aimed at meeting the growing demand for protein-rich foods in the health and wellness market.

- In June 2022, Natural food production and consumption of animal-based goods are increasing as a result of consumer preference. The use of plant-based feed additives in animal nutrition has tremendous expansion potential. Cargill, the world's largest agricultural firm, has announced that it has entered into a legally binding agreement to buy Delacon, the industry's preeminent provider of phytogenic additives derived from plants.

Segments Covered in the Report

By Type

- L-Lysine Hydrochloride (HCl)

- L-Lysine Monohydrate

- L-Lysine Sulfate

- Other Lysine Derivatives

By Grade

- Feed Grade

- Food Grade

- Pharmaceutical Grade

By Form

- Powder

- Liquid

- Granules

- Encapsulated

By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content