January 2025

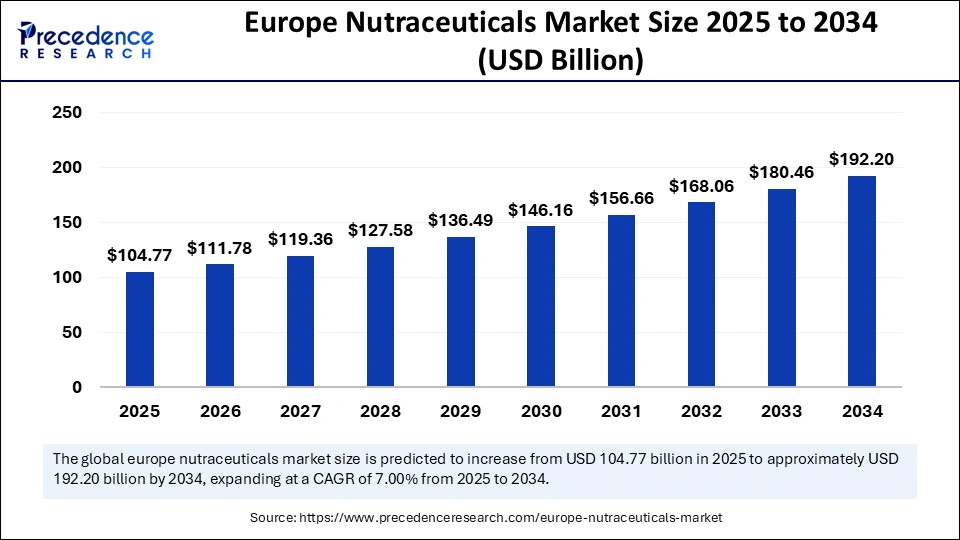

The europe nutraceuticals market size accounted for USD 104.77 billion in 2025 and is forecasted to hit around USD 192.20 billion by 2034, representing a CAGR of 7% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The europe nutraceuticals market size was calculated at USD 98.30 billion in 2024 and is predicted to increase from USD 104.77 billion in 2025 to approximately USD 192.20 billion by 2034, expanding at a CAGR of 7% from 2025 to 2034. The growth of the market is driven by the increasing health awareness, aging population, and the rising demand for preventative healthcare solutions.

Artificial Intelligence helps in developing personalized nutraceuticals. By analyzing individual health data, dietary patterns, and genetic variables, AI helps develop personalized nutrition plans and recommend tailored functional foods and supplements. With this degree of customization, the market is set to grow at a rapid pace. AI also helps in the development of novel nutraceuticals by optimizing formulations. Brands can develop targeted marketing strategies using AI. Moreover, they can better understand consumer behavior and market trends and optimize inventory management through AI technologies.

The Europe nutraceuticals market is experiencing rapid growth, driven by a health-conscious population increasingly focused on preventive healthcare and wellness. Functional foods, dietary supplements, and fortified beverages are in high demand among consumers, especially those who want to manage chronic conditions like obesity, diabetes, and cardiovascular diseases by improving digestion and increasing immunity. The growing consumer interest in natural and organic products further supports market growth.

With the growing geriatric population, the demand for nutraceuticals is rising to support bone health, mobility, and cognitive function, which is driving market growth. Product formulation innovations such as the use of plant-based ingredients and customized nutrition are drawing in a larger clientele, including younger consumers and fitness enthusiasts. The market's upward trajectory has been reinforced, and digital marketing has made products more accessible in different parts of the region.

| Report Coverage | Details |

| Market Size by 2034 | USD 192.20 Billion |

| Market Size in 2025 | USD 104.77 Billion |

| Market Size in 2024 | USD 98.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Form, Sales Channel,and Regions |

Rising Health and Wellness Awareness

European consumers are becoming more health conscious and placing a higher value on long-term vitality and well-being, which is driving the growth of the Europe nutraceuticals market. Social media has increased awareness among people about health and access to health-related information. People now understand the significance of gut health, immunity, nutrition, and balanced diets. To bridge nutritional gaps, they are actively incorporating nutraceuticals into their daily routine. Since wellness has evolved from a fad to a daily routine, there is a steady demand for functional foods and supplements. People are also becoming more aware of preventive care through workplace wellness initiatives and public health campaigns. Since immunity has taken center stage after the pandemic, the demand for nutraceuticals is rising.

Demand for Natural and Clean-label Products

There is a discernible trend toward natural products devoid of artificial additives. More consumers are carefully reading ingredients on labels and selecting products that support ethical and sustainable business practices. Superfoods, plant-based supplements, and ingredients from organic sources have become more popular. People believe that clean-label nutraceuticals are safer, more efficient, and ethical.

Environmentally friendly packaging and cruelty-free testing are increasingly important considerations. Certifications like Non-GMO, Vegan, and Organic enhance brand credibility. When products can be tracked from the point of origin to the store, consumer trust is increased.

High Product Cost and Affordability Issues

The high costs of nutraceuticals hamper the growth of the Europe nutraceuticals market. Expensive raw materials, stringent testing, and sophisticated manufacturing techniques are all necessary for the production of high-quality nutraceuticals, which drives up the final cost. The high costs of supplements and functional foods with clean labels, organic certifications, and sophisticated formulations create barriers for potential consumers. Regular purchases of these products are resisted by consumers in lower income brackets or cost-sensitive areas of Europe. The inability of insurance systems to cover nutraceuticals further restricts affordability. High costs also discourage repeating purchases. In times of inflation or economic downturn, consumers often cut back on their spending on nutraceuticals first. Price sensitivity impacts retail and online sales, particularly for smaller or more recent brands. Manufacturers are under pressure to maintain efficacy while striking a balance between cost-effectiveness and ingredient quality.

Risk of Misleading Claims and Low-quality Products

There is a deluge of products due to the growing demand for nutraceuticals, some of which are misrepresented or poorly regulated. To differentiate themselves in a crowded market, some businesses make inflated or unsubstantiated health claims. This undermines consumer confidence in nutraceuticals. Products that are subpar or fake, especially those that are sold online, might not satisfy EU quality standards. Trust becomes a significant obstacle to trial, particularly for those who are new. This makes respectable brands invest a lot of money in third-party testing certifications and strategies to increase their credibility. E-commerce platform flaws still permit low-quality imports to reach the European market despite regulatory efforts.

Innovation in Personalized Nutrition and Digital Health Integration

In Europe, personalized nutrition based on lifestyle, microbiome, and DNA analysis is becoming more and more popular. More customers are looking for supplements that are specifically designed to meet their health requirements. Technological advancements like wearables and AI-driven health apps allow users to monitor health metrics and receive personalized supplement recommendations. Nutraceutical businesses can work with digital health platforms, thanks to this convergence of technology and wellness. Additionally, this encourages client loyalty with long-term initiatives and subscription models. Customized ingredient dosage and packaging improved consumer satisfaction and brand value. As data-driven wellness gains popularity companies that provide customized solutions will be more competitive.

Growing Aging Population

The growing aging population creates immense opportunities in the Europe nutraceuticals market. There is a significant need for nutraceuticals aimed at older adults due to Europe's rapidly aging population. Products that promote cardiovascular wellness, bone strength, joint health, cognitive function, and vision are highly sought after. Additionally, this group is more likely to use nutraceuticals, which increases the likelihood of repeat purchases. Since older adults are more prone to chronic diseases, they require nutraceuticals.

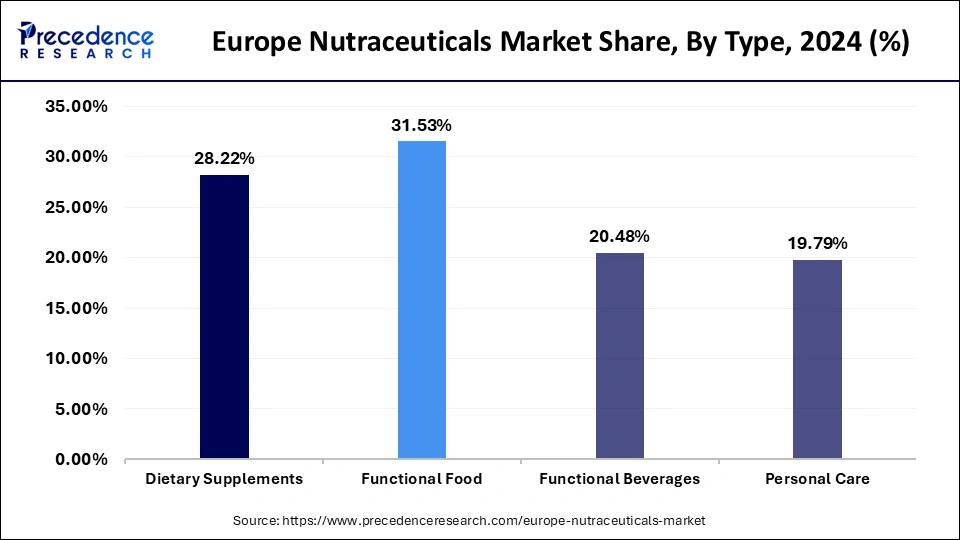

The functional food segment dominated the Europe nutraceuticals market with the largest share in 2024. This is mainly due to the increased incorporation of nutraceuticals into regular diets and the rising demand for natural health promotion food items among consumers. The use of products like fiber-rich snacks and probiotic yogurts is rising as preventive healthcare becomes more of a lifestyle priority. Health-conscious millennials and working professionals are looking for wholesome meal options. The rise in the prevalence of chronic conditions like diabetes, heart disease, and obesity is encouraging people to consume functional food that supports health. Plant-based ingredients and lower sugar content are examples of innovative product formulations. E-commerce and retailers have increased the accessibility to functional foods in both urban and rural communities.

The dietary supplement segment is expected to grow at the fastest rate in the coming years. The growth of the segment can be attributed to the changing dietary patterns. The demand for vitamins, minerals, protein powders, and botanical supplements is rising to meet specific health needs. The growing aging population is a major factor boosting the demand for dietary supplements. Older adults often face issues related to diet and nutrition. The rapid shift toward a proactive healthcare approach further boosts the growth of the segment.

The tablets segment dominated the Europe nutraceuticals market with the largest share in 2024. This is mainly due to the increased preference for tablets due to their long shelf life and precise dosages compared to powder. Customers heavily use tablets to provide vital nutrients in a convenient and regulated manner. They ensure a consistent intake of active ingredients like minerals, multivitamins, and herbal extracts. They have a strong market position because of their affordability and broad availability in pharmacies, supermarkets, and online marketplaces. Technological developments in pharmaceuticals have improved tablet coating, improving bioavailability, taste, and digestibility. Additionally, tables have the benefit of combining several ingredients into a single dosage, which makes them ideal for consumers who lead hectic lives. The demand for tablets is still high due to the rise in preventive health practices, particularly among older populations.

The oil segment is projected to grow at the fastest rate during the forecast period because of the growing demand for supplements containing omega-3, CBD, and herbal oils. Nutraceutical oils are preferred for their ability to absorb quickly and are suitable for people who have trouble swallowing pills. Due to their extensive use in supporting the health of the heart, brain, skin, and joints, nutritional oils are highly sought after. The rapid shift toward natural, plant-based ingredients is significantly boosting the need for cold-pressed and organic oils. The segment is expanding even faster, thanks to the availability of options like flavored drops, sprays, and blends designed for children and the elderly.

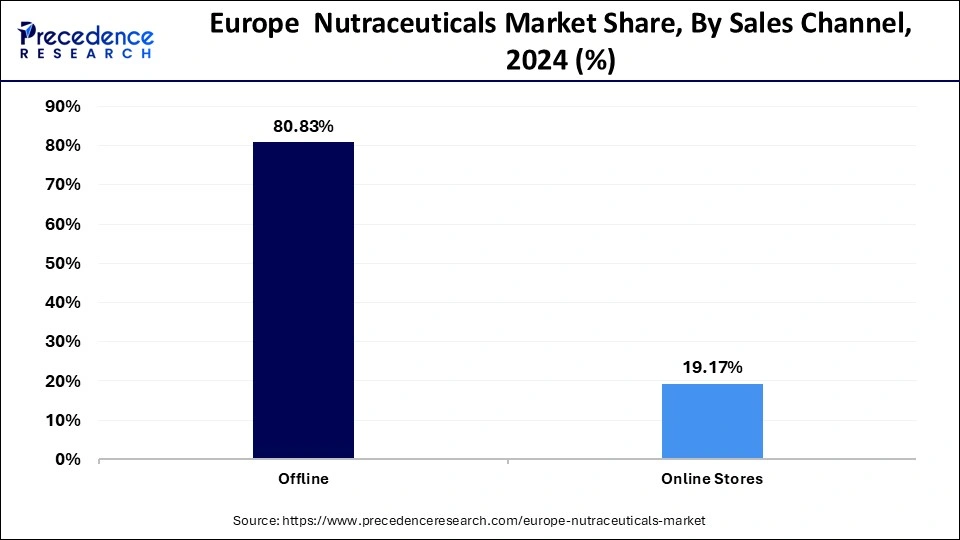

The offline segment dominated the Europe nutraceuticals market with the largest share in 2024, driven by customer confidence in physical retail establishments, such as supermarkets, pharmacies, and health food stores. In-person conversations are essential for fostering confidence in the choice and application of products. Well-established distribution channels and shelf visibility play a major role in consumer preference and brand recognition. Many customers still prefer traditional shopping because they are unfamiliar with digital platforms, especially those in older age groups. In-store promotions and sample trials are frequently offered by retailers to improve customer satisfaction and encourage purchases. Offline channels continue to dominate despite the growth of digital media because of their accessibility, legitimacy, and ability to provide individualized customer services.

The online segment is expected to grow at the fastest rate in the upcoming period due to the rising use of smartphones and the expansion of e-commerce throughout Europe. Convenient home delivery, a wider selection of products, and instantaneous price and review comparisons offered by online sales channels are attracting more customers. Social media influencers and wellness bloggers are supporting segmental growth. Digital health brands are improving customer engagement and retention through subscription models and customized supplement plans. Online sales channels allow customers to buy products from the comfort of their homes and provide an easy return policy. This flexibility encourages people to shop from online channels. The rapid expansion of online retail pharmacies further contributes to segmental growth.

Country Level Analysis

Germany is the largest nutraceutical market in Europe, driven by rising health awareness, high demand for personalized nutrition, and increasing demand for preventive wellness solutions. There is a rising demand for nutraceuticals due to the increased health consciousness among consumers. Supportive regulatory environments and heightened awareness of preventative health are boosting the preference for high-quality, certified products. The demand for probiotics, customized supplements, and functional foods is rising rapidly due to changing lifestyles.

The UK is another significant market. There is a high demand for dietary supplements and functional foods. The use of multivitamins and supplements tailored to specific conditions is rising, especially among the aging population. Moreover, France has a strong tradition of using natural remedies. Traditional treatments and natural health products are still widely used in the country. Therefore, the demand for botanical extracts and herbal supplements is increasing in France.

By Type

By Form

By Sales Channel

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

November 2024

February 2025