January 2025

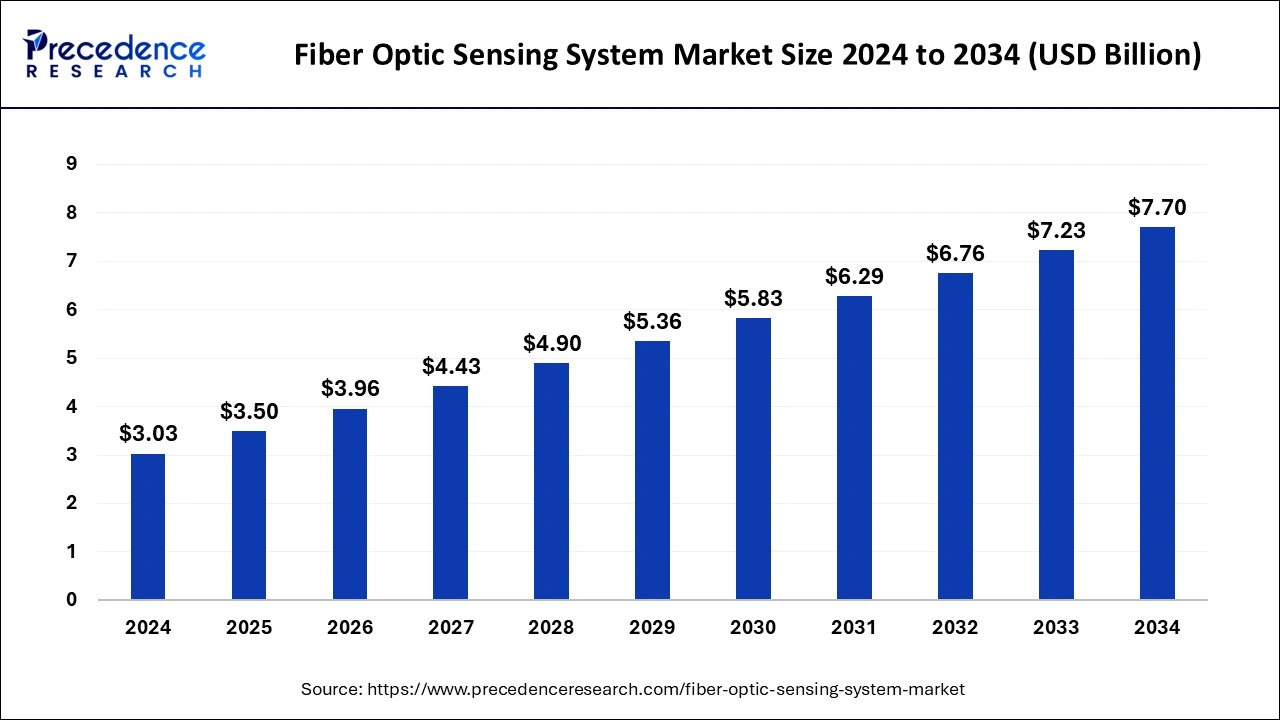

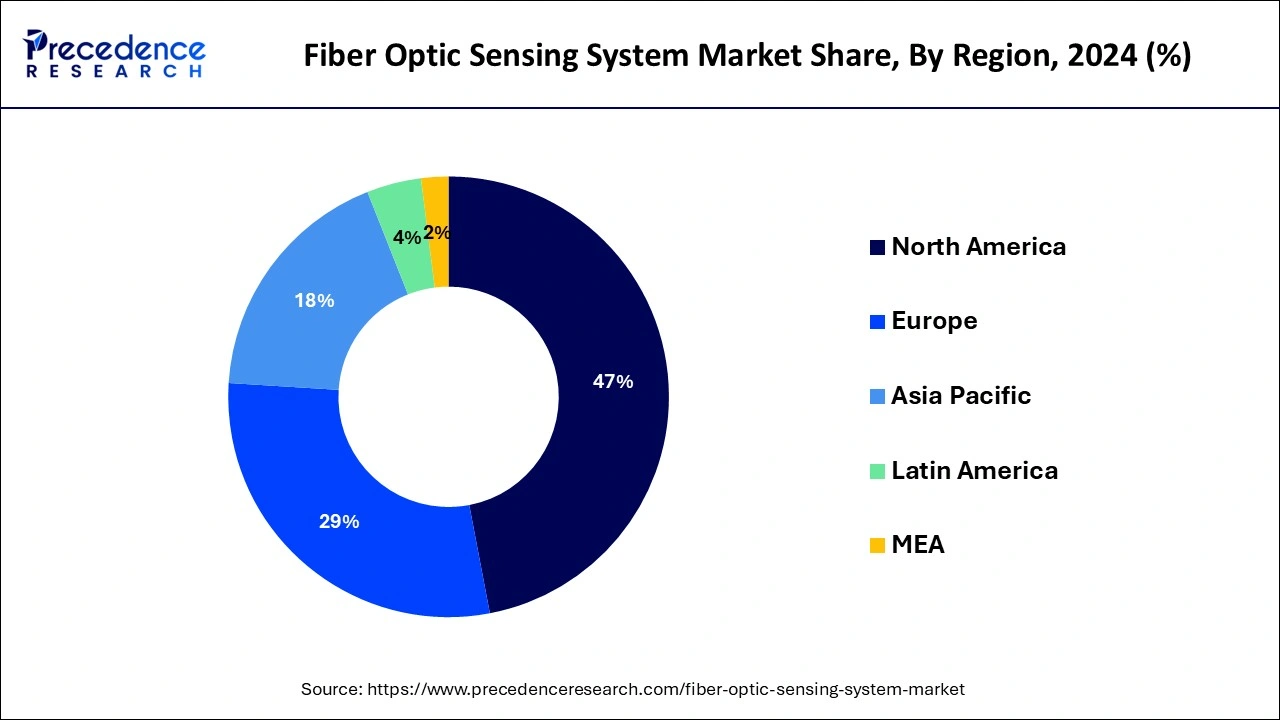

The global fiber optic sensing system market size is calculated at USD 3.50 billion in 2025 and is forecasted to reach around USD 7.70 billion by 2034, accelerating at a CAGR of 9.78% from 2025 to 2034. The North America fiber optic sensing system market size surpassed USD 1.42 billion in 2024 and is expanding at a CAGR of 9.79% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fiber optic sensing system market size was estimated at USD 3.03 billion in 2024 and is predicted to increase from USD 3.50 billion in 2025 to approximately USD 7.70 billion by 2034, expanding at a CAGR of 9.78% from 2025 to 2034.

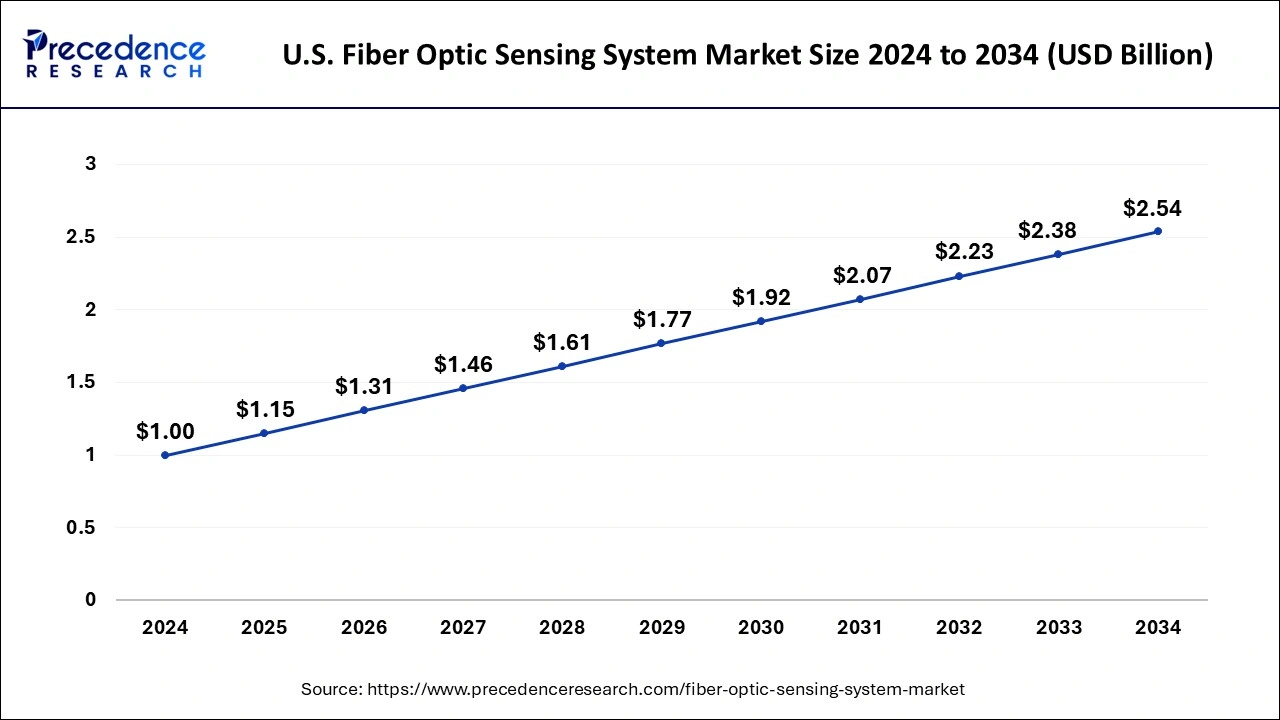

The U.S. fiber optic sensing system market size was estimated at USD 1 billion in 2024 and is anticipated to reach around USD 2.54 billion by 2034, growing at a CAGR of 9.81% from 2025 to 2034.

North America held the largest share of 47% in the fiber optic sensing system market in 2024, primarily due to the development of technologically advanced fiber-optic sensors in sectors like healthcare and automotive. Leading manufacturers in the region are also focusing on expanding their distribution networks, which is expected to further drive market growth.

Europe is expected to experience consistent growth in CAGR, fueled by the sustained demand for precise fiber optic temperature sensors in various industrial applications. The presence of established manufacturers like Calex Electronics Limited, Proximion AB, Scaime, Althen sensors & control, among others, contributes to the steady growth trajectory across European nations.

The fiber optic sensing system market encompasses the industry involved in the design, production, distribution, and utilization of sensing systems based on fiber optic technology. These systems utilize optical fibers as the sensing element to detect and measure various physical parameters such as temperature, strain, pressure, vibration, and acoustic signals. Fiber optic sensing systems offer several advantages over traditional sensing technologies, including high sensitivity, immunity to electromagnetic interference, ability to cover large areas over long distances, and suitability for harsh environments. They find applications in diverse industries such as oil and gas, civil engineering, aerospace, healthcare, automotive, and security.

The market includes a wide range of products and solutions, including distributed fiber optic sensing systems, point-based fiber optic sensors, interrogators, signal processing software, and related components.

Companies involved in this market include manufacturers of fiber optic components, sensing systems integrators, technology developers, system integrators, and service providers. The growth of the fiber optic sensing system market is driven by increasing demand for real-time monitoring and diagnostics in critical infrastructure, growing adoption of smart structures and IoT applications, rising investments in oil and gas exploration and production activities, and expanding applications in industries such as aerospace, automotive, and healthcare. Additionally, advancements in fiber optic technology and the development of innovative sensing techniques contribute to market expansion and technological evolution.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.78% |

| Market Size in 2025 | USD 3.50 Billion |

| Market Size by 2034 | USD 7.70 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Types and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand in the automotive industry

The demand for fiber optic sensing systems is on the rise in the automotive industry, driven by their highly desirable features such as high heat resistance, noise immunity, and flexible light transmission. These technologies are anticipated to be integrated into various electronic control systems in vehicles to measure movement and direction accurately. Temperature management is crucial in the development and testing of electric and hybrid vehicles, as the performance and aging of key components rely heavily on temperature distribution and the prevention of internal hot spots. Thus, there is a growing need for faster and more accurate temperature measurement throughout the electric vehicle product development stages.

Fiber optic sensing system technologies are gaining momentum in electric and hybrid vehicle testing due to their electromagnetic field immunity, rapid response, durability, compact size, high precision, and safety features, while promoting the growth of the fiber optic sensing system market.

Additionally, the Indian automotive industry aims to increase vehicle exports by five times. This trajectory is expected to have a positive impact on the fiber optic sensing system market in the coming years.

High cost associated with this technology

Fiber optic sensing systems play a critical role for companies in monitoring challenging work environments and obtaining real-time data with high accuracy. The market for these systems is expanding due to their numerous advantages, including their precision and reliability in data collection. However, one major hurdle hindering broader adoption is the high cost associated with this technology, making it inaccessible for many companies seeking real-time monitoring and sensing solutions. Moreover, the installation and maintenance expenses of fiber optic sensing systems are considerable, further complicating their implementation. Consequently, the elevated cost of these systems presents a significant restraint to fiber optic sensing system market growth.

Growing demand for wireless technology

The increasing reliance on wireless technology stems from its ability to facilitate seamless communication and connectivity across various environments. In today's dynamic work landscape, where remote work and flexible arrangements are becoming more common, wireless technology serves as the backbone for enabling remote collaboration, data sharing, and real-time communication. This trend is particularly evident in the fiber optic sensing systems market, where the demand for wireless solutions is driven by the need for flexibility, scalability, and mobility.

Wireless technology enables employees to stay connected and productive regardless of their physical location. With the proliferation of mobile devices and the ubiquity of Wi-Fi networks, individuals can access critical data, applications, and resources from virtually anywhere. This level of flexibility not only enhances workforce efficiency but also fosters innovation and collaboration across teams and organizations.

Moreover, wireless technology extends beyond traditional office settings to encompass various aspects of daily life. From smart homes and IoT devices to public spaces and transportation systems, wireless connectivity enables seamless integration and communication between diverse systems and devices. This interconnected ecosystem presents numerous opportunities for fiber optic sensing systems to enhance monitoring, surveillance, and data collection across different environments. However, while the demand for wireless technology continues to grow, challenges such as security concerns, bandwidth limitations, and infrastructure requirements remain. Addressing these challenges is essential to unlocking the full potential of wireless technology and ensuring its seamless integration into everyday life and business operations. As technology evolves and connectivity becomes more pervasive, the role of wireless solutions in driving innovation and efficiency across industries, including the fiber optic sensing system market, will continue to expand.

The fiber bragg grating optic sensors segment dominated the fiber optic sensing system market, accounting for 45% of the market share in 2024. The fiber bragg grating (FBG) optic sensors segment is driven by offering high sensitivity and accuracy for measuring parameters like strain, temperature, pressure, and vibration. FBG sensors are immune to electromagnetic interference (EMI) and can multiplex multiple sensors along a single optical fiber, enabling distributed sensing over long distances. They are reliable and durable, with minimal drift and long-term stability, making them suitable for harsh environments. Ongoing advancements in FBG sensor technology, coupled with industry standards mandating reliable sensing solutions, contribute to their widespread adoption across industries, driving market growth.

The phase modulated fiber optic sensors segment is projected to witness a rapid CAGR during the forecast period due to their unique capabilities and advantages. PM-FOS offer high sensitivity and accuracy in measuring various parameters such as temperature, strain, pressure, and acoustic signals. One of the key advantages of PM-FOS is their ability to achieve distributed sensing over long distances with minimal signal degradation. They utilize phase modulation techniques to encode information, enabling precise measurements even in challenging environments with high noise levels or electromagnetic interference.

Additionally, PM-FOS exhibit excellent immunity to environmental factors like temperature variations and mechanical stress, ensuring reliable and consistent performance over time. As industries increasingly demand robust and accurate sensing solutions for critical applications, the versatility and reliability of PM-FOS make them a preferred choice, driving their adoption and contributing to the overall growth of the fiber optic sensing system market.

The transportation and automotive segment dominated the market with 27% market share in 2024, due to their growing demand for advanced monitoring and sensing technologies. In these industries, fiber optic sensing systems play a crucial role in ensuring the safety, efficiency, and reliability of various operations and components. In transportation, including railways, bridges, tunnels, and pipelines, fiber optic sensors are utilized to monitor structural health, detect potential defects or damages, and assess environmental conditions such as temperature and strain. Likewise, in the automotive sector, fiber optic sensing systems are integrated into vehicles to enable real-time monitoring of critical parameters like temperature, pressure, and vibration, enhancing vehicle performance, safety, and durability.

The increasing emphasis on smart transportation infrastructure, intelligent vehicles, and autonomous driving further drives the adoption of fiber optic sensing systems in the transportation and automotive sectors. As these industries continue to prioritize innovation and efficiency, the demand for advanced sensing solutions is expected to rise, thereby fueling the growth of the fiber optic sensing system market.

The oil and gas segment is poised to experience the fastest CAGR during the forecast period. The oil and gas industry is driven by leveraging these systems for enhanced operational efficiency, safety, and production optimization. Fiber optic sensors are widely used for monitoring pipelines, wellbores, and other critical infrastructure, providing real-time data on factors like temperature, pressure, and strain. This proactive monitoring helps in early detection of potential issues, minimizing risks and preventing downtime. The adoption of fiber optic sensing systems is also driven by the industry's focus on optimizing production processes, complying with regulatory requirements, and ensuring environmental sustainability. Therefore, the oil and gas segment’s commitment to operational safety and efficiency contributes significantly to the growth of the fiber optic sensing system market.

By Types

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

November 2024

January 2025