January 2025

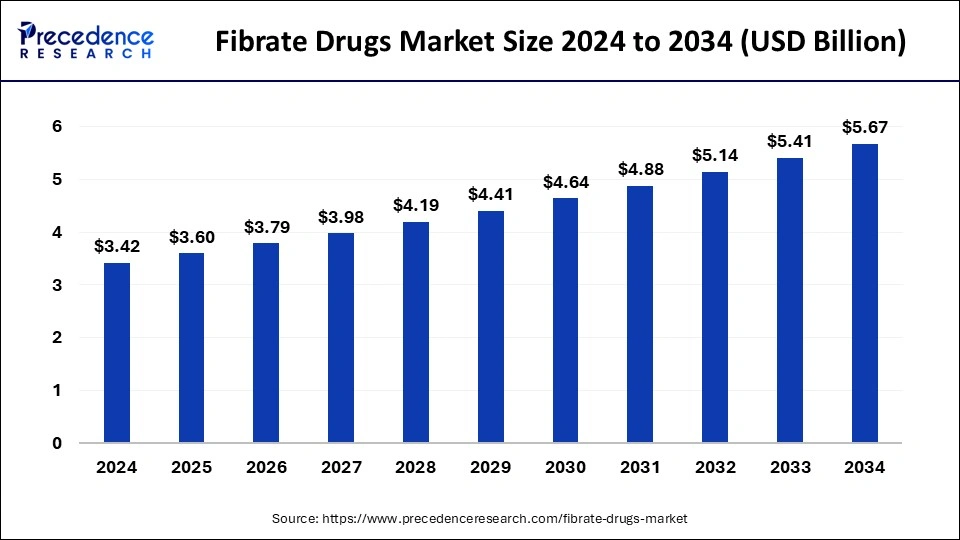

The global fibrate drugs market size is calculated at USD 3.60 billion in 2025 and is forecasted to reach around USD 5.67 billion by 2034, accelerating at a CAGR of 5.19% from 2025 to 2034. The North America fibrate drugs market size surpassed USD 1.33 billion in 2024 and is expanding at a CAGR of 5.21% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fibrate drugs market size was estimated at USD 3.42 billion in 2024 and is predicted to increase from USD 3.60 billion in 2025 to approximately USD 5.67 billion by 2034, expanding at a CAGR of 5.19% from 2025 to 2034. The global increase in the prevalence and incidence rate of cardiovascular disorders is anticipated to fuel the fibrate drugs market.

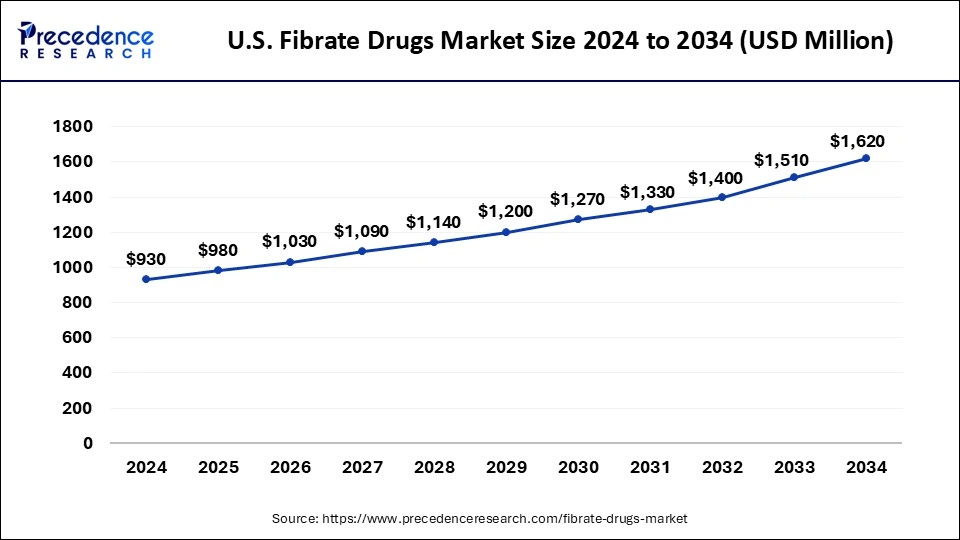

The U.S. fibrate drugs market size was exhibited at USD 930 million in 2024 and is projected to be worth around USD 1,620 million by 2034, poised to grow at a CAGR of 5.71% from 2025 to 2034.

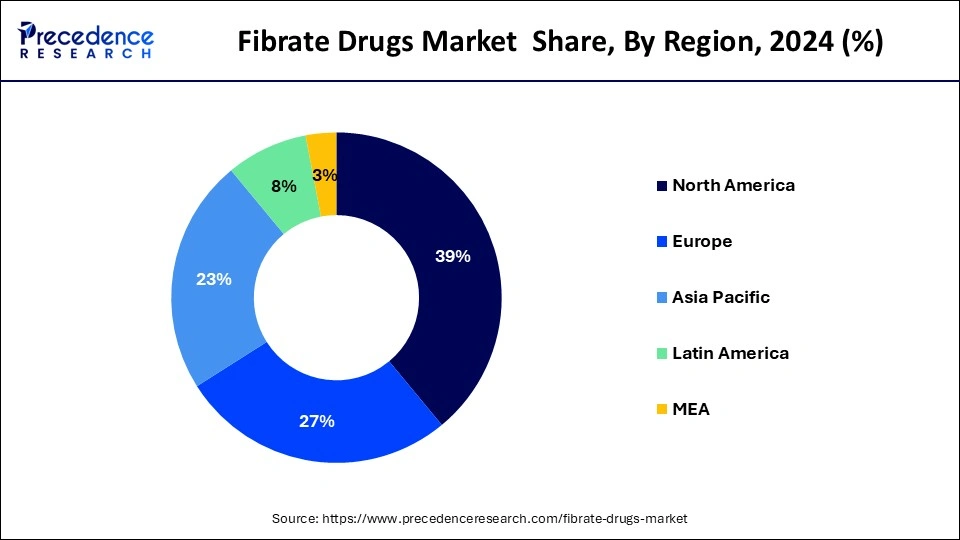

North America dominated the global fibrate drugs market in 2024. The North American market for fibrate drugs is forecasted to grow, driven by a well-established healthcare infrastructure, a high rate of cardiovascular diseases, and extensive use of fibrate treatments for lipid disorders. The growth is further boosted by the expanding presence of major market players and a rising number of product innovations in the region.

Europe is poised to show the fastest growth in the fibrate drugs market during the projected period. The increasing incidence of cardiovascular diseases and metabolic disorders in the region is driving the demand for effective lipid-lowering treatments. Fibrates, known for their ability to reduce triglyceride levels and boost HDL cholesterol, are becoming increasingly popular among healthcare professionals and patients alike.

Supportive regulatory policies, rising healthcare spending, and awareness campaigns are fueling the fibrate drugs market growth. As European countries emphasize preventive healthcare, the demand for fibrate medications is on the rise, which makes Europe a key player in the market's expansion.

Fibrate drugs are therapeutics classified as amphipathic carboxylic acids. They work by reducing triglyceride levels in the blood through the inhibition of hepatic extraction of free fatty acids, which enhances the activity of endothelial lipoprotein lipase. The growth of the fibrate drugs market is primarily driven by the rising prevalence of cardiovascular diseases globally.

The increasing number of overweight or obese individuals in developed countries, combined with sedentary lifestyles, contributes to cardiovascular disorders, further propelling the fibrate drugs market growth. Numerous clinical trials have shown that fenofibrate can elevate cholesterol and apolipoprotein levels.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.67 Billion |

| Market Size in 2025 | USD 3.60 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.19% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Product Type, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increasing prevalence of diabetes worldwide

Diabetes is associated with various quantitative changes in circulating lipids, such as elevated triglycerides, increased LDL, and reduced HDL levels. Key factors contributing to diabetes include declining physical activity, urbanization, an aging population, and a rising prevalence of obesity. As diabetes becomes more widespread, the demand for fibrate drugs is anticipated to grow in the coming years. Elevated blood sugar can lead to higher triglyceride levels and lower HDL cholesterol, which subsequently raises the risk of heart disease. These long-term risks linked to diabetes are expected to drive revenue growth in the fibrate drugs market through the forecast period.

Side effects of renal drugs

The adverse effects linked to renal drugs might hinder the growth of the global fibrate drugs market during the forecast period. Side effects like abdominal pain, leg cramps, headaches, and constipation can negatively impact market expansion. Additionally, the substantial costs associated with these medications pose a barrier to market growth. Expensive drugs such as Clofibrate, Gemfibrozil, and Fenofibrate can restrict market expansion due to their high prices.

Strategic collaborations and partnerships

Creating new fibrate formulations with improved safety and efficacy profiles aims to meet the unmatched needs of patients suffering from dyslipidemia. Expanding market presence in emerging economies with substantial patient populations and rising healthcare spending is also a key strategy. Forming strategic partnerships and collaborations for the development of combination therapies and personalized medicine approaches tailored to specific patient groups is important. Also, the integration of digital health technologies for patient monitoring and adherence to fibrate drug therapy can improve market penetration and patient outcomes.

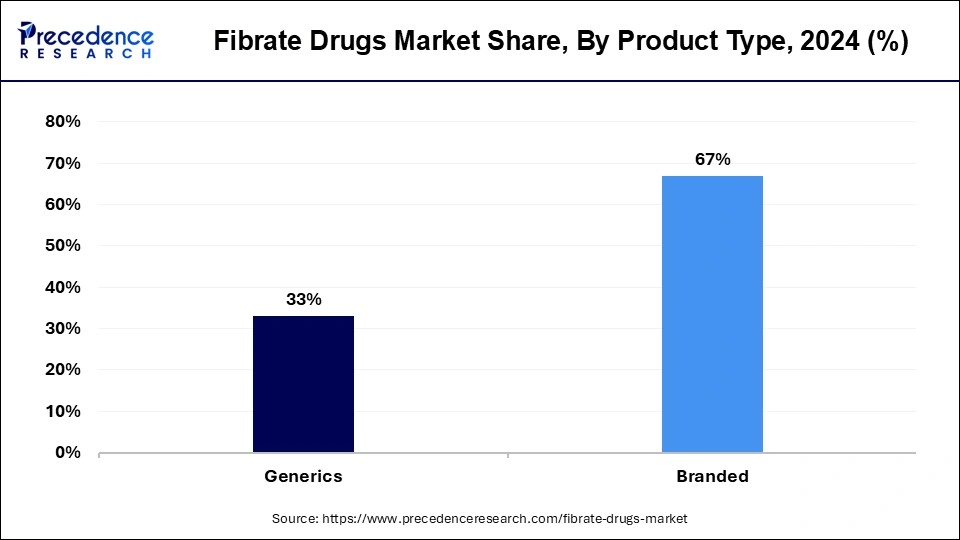

The branded segment dominated the fibrate drugs market in 2024. The increasing incidence of hyperlipidemia and associated cardiovascular diseases is driving up the demand for effective lipid-lowering drugs like fibrates. A branded medication is considered the 'innovator' or pioneer and is granted patent and exclusivity protections, which prevents immediate competition from generics. Generic drugs, however, must adhere to the same quality, strength, and purity standards as their branded counterparts. They offer the same benefits and effects.

The clofibrate segment dominated the market in 2024 and is anticipated to grow at the fastest rate in the fibrate drugs market during the forecast period. Clofibrate has largely lost favor due to safety concerns, particularly its link to higher cancer risk. Any potential resurgence in the global market would necessitate strong scientific evidence, regulatory backing, and a significant clinical need. Regulatory approvals for generic versions have increased market competition, further driving demand.

The hospital & retail pharmacy segment led the fibrate drugs market in 2024. Due to the broad availability and convenience for patients to obtain prescription medications, a greater number of individuals with cardiovascular and lipid-related conditions may result in increased hospital admissions by boosting the demand for fibrate drugs in hospital environments. Furthermore, hospitals might partner with pharmaceutical firms to ensure a continuous supply of fibrate medications and access to clinical trials or specialized formulations.

The online pharmacy segment is expected to show the fastest growth in the fibrate drugs market over the forecast period. Driven by the rising trend of digital healthcare, the ease of online prescription ordering, and the growing e-commerce sector, there is an increasing adoption of these services.

By Drug Type

By Product Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

March 2025

March 2025