December 2024

Fintech as a Service Market (By Type Payment: Fund Transfer, Loan, Others; By Technology: API, Artificial Intelligence, RPA, Blockchain, Others; By End-use: Banks, Financial Lending Companies, Insurance, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

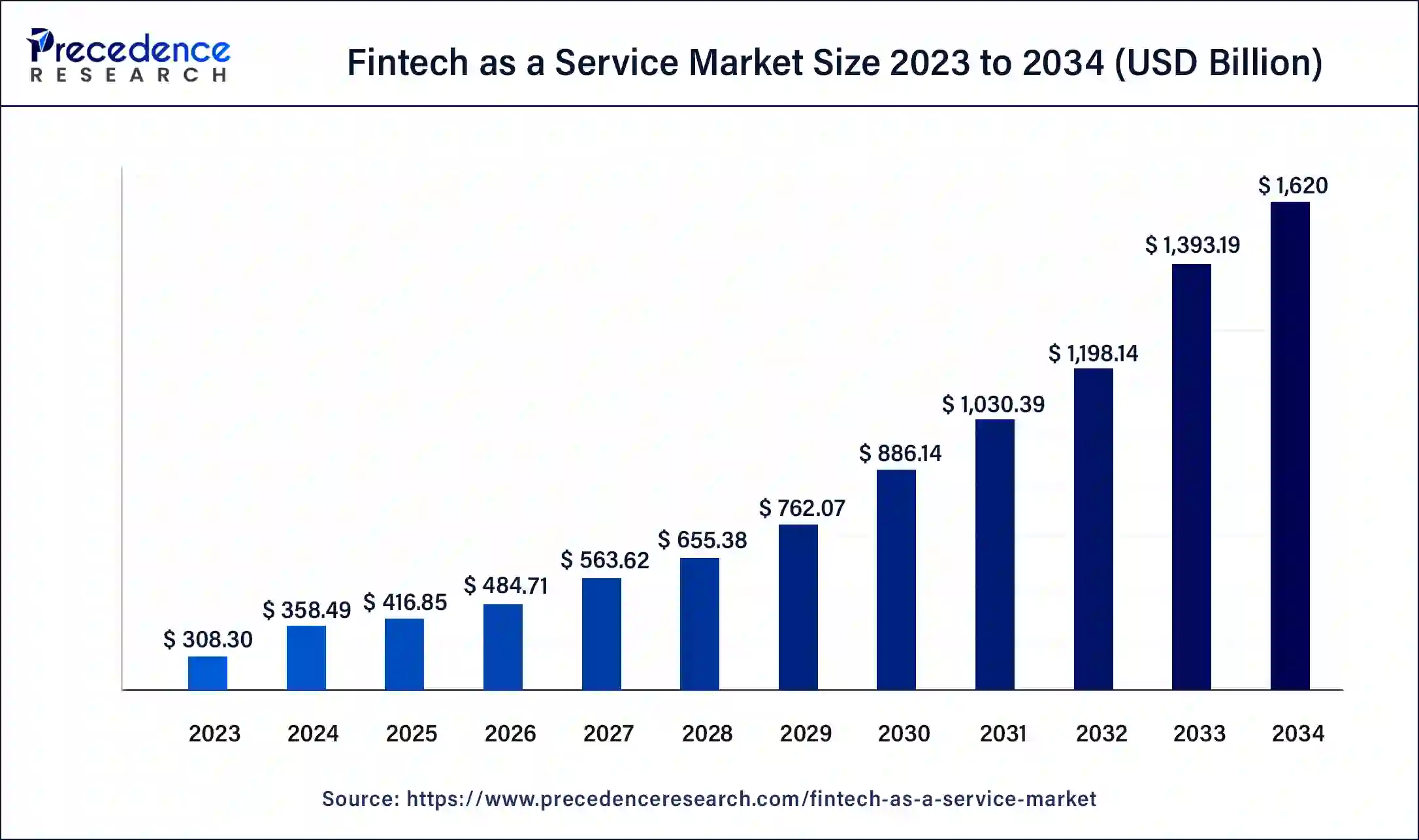

The global fintech as a service market size was USD 308.30 billion in 2023, calculated at USD 358.49 billion in 2024 and is expected to reach around USD 1,620 billion by 2034. The market is expanding at a solid CAGR of 16.27% over the forecast period 2024 to 2034. The North America fintech as a service market size reached USD 107.91 billion in 2023. Increasing demand for digital banking and financial services, made accessible through growing digital technology penetration among consumers and businesses, is leading to growth in the market.

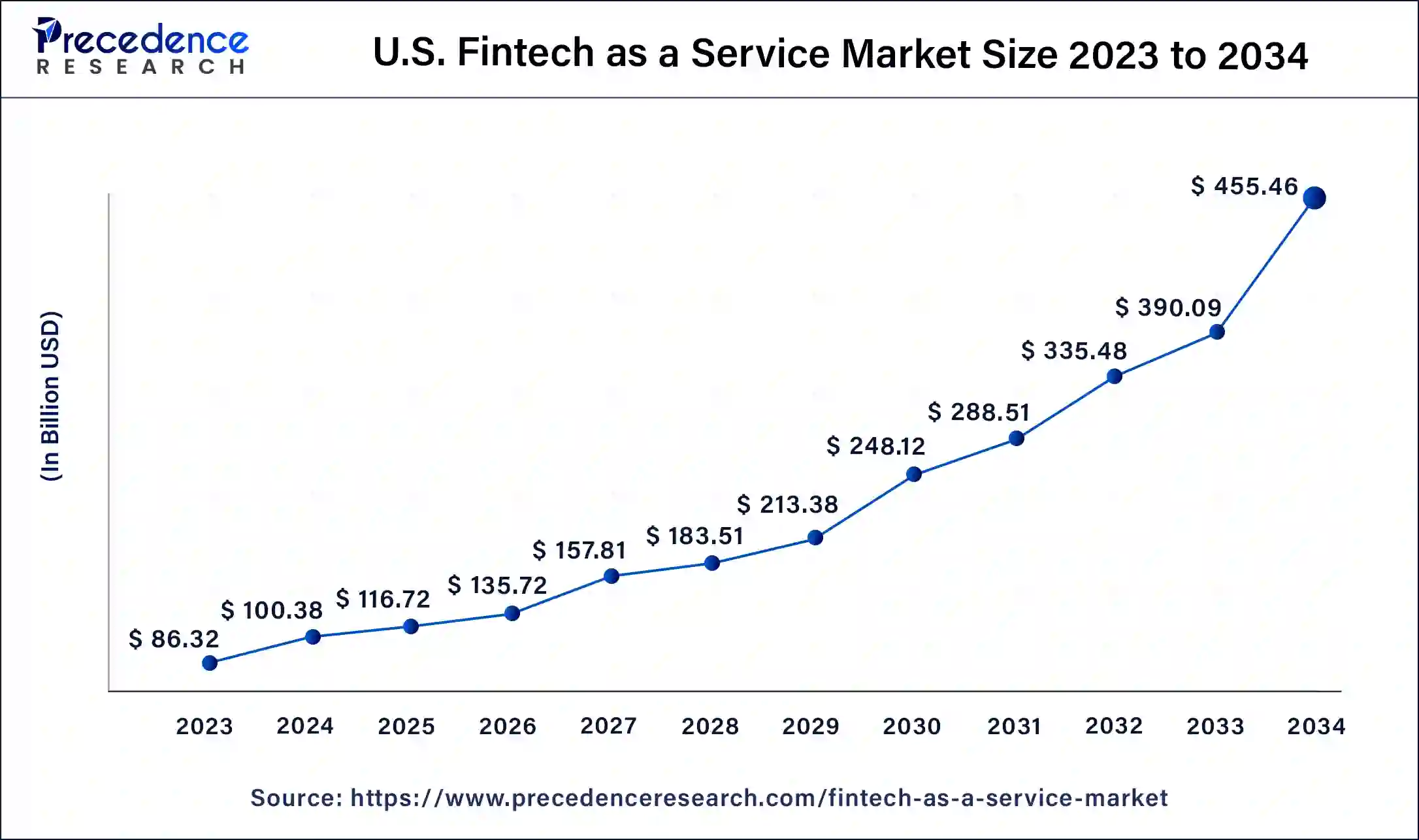

The U.S. fintech as a service market size was exhibited at USD 86.32 billion in 2023 and is projected to be worth around USD 455.46 billion by 2034, poised to grow at a CAGR of 16.32% from 2024 to 2034.

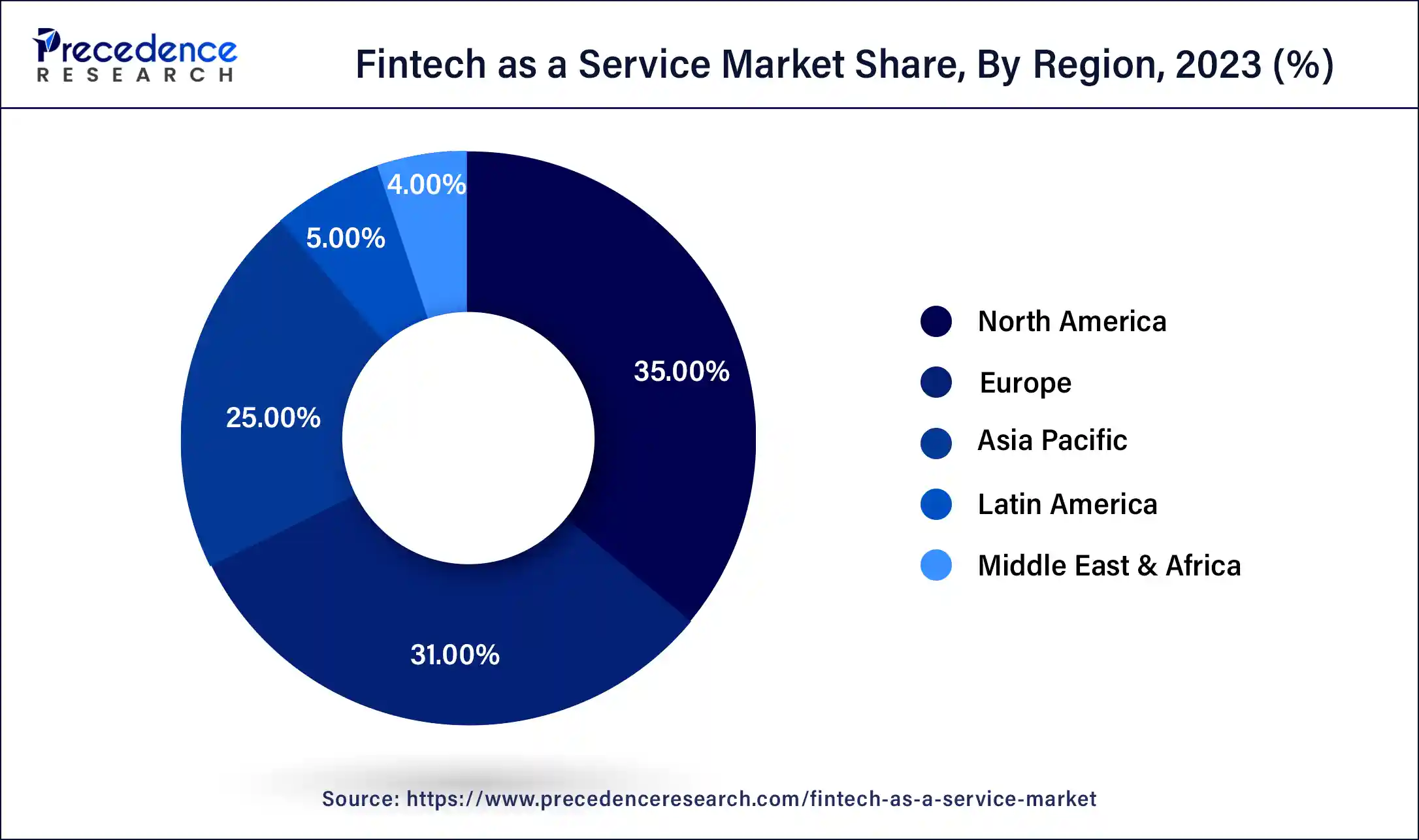

North America dominated the fintech as a service market in 2023 due to the region’s large population with access to sophisticated internet infrastructure and tech innovation ecosystem. The U.S. is home to several well-established financial institutions in cities like New York. Silicon Valley also serves as a mecca for new fintech startups. Laissez-faire regulatory frameworks and a well-established financial service sector have led to the region becoming a hub for the fintech as a service market.

Asia Pacific is expected to see the fastest CAGR over the forecast period. The growing adoption of fintech services in countries like China, India, and Japan and the rise of e-commerce are spurring significant growth in fintech firms in the region. The region’s large population is a potentially huge market for fintech companies looking to expand their consumer base. Governments and venture capitalists have led several fintech initiatives to promote digital payment services in the region.

The fintech as a service market is also seeing notable growth in Europe. Recent developments like Brexit have shifted the key players in the region. Prior to Brexit, the United Kingdom was a prominent name in European fintech, with London serving as a hub for several key players. However, today, many fintech companies have moved out into countries like Malta, Lithuania, Germany, and the Netherlands. The advent of Payment Services Directive 2.0 (PSD2) has accelerated fintech innovation and development in the region, and a growing level of digitalization has led to the easier adaptation of fintech services, especially in Western Europe. Online banking is fast becoming one of the most popular payment methods in the region.

Fintech as a Service refers to companies that offer technology to deliver financial products and services to consumers through software. Some examples of solutions offered by fintech as a service company include digital wallets, peer-to-peer lending platforms, payment processing services, and, more recently, AI-driven advisors and fraud detection. These services aim to ease or automate financial transactions by using software and the Internet.

The fintech as a service market has experienced steady growth in the past few years due to several advantages offered by businesses operating in the space. Fintech, as a service company, helps unify payment and financial management services through scalable API networks worldwide. Despite the many advantages, fintech service companies are susceptible to cyberattacks and have to navigate regulatory complexities arising from changing rules for financial institutions across different countries. The increasing adoption of smartphones and the internet worldwide provides opportunities for fintech service companies to connect with remote populations. The rise of AI and machine learning also provides several opportunities for innovation in the fintech as a service market.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,620 Billion |

| Market Size in 2023 | USD 308.30 Billion |

| Market Size in 2024 | USD 358.49 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 16.27% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type Payment, Technology, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing number of online transactions and a switch to core banking

The global increase in smartphone penetration and advances in wireless technology have made services such as digital payments and open banking popular. According to a 2022 survey by the Pew Research Center across 18 countries, a median of 93% of people reported using the Internet. Meanwhile, a median of 85% of people surveyed said they owned a smartphone. This unprecedented access to technology has boosted demand for fintech services to invest, borrow, transfer, and save funds digitally. The rise of e-commerce with giants like Amazon and Alibaba has also substantially increased the number of online transactions, leading to high demand for quick and easy payment platforms worldwide.

Rise of cloud computing technology

The advent of cloud computing technology has transformed fintech as a service market, offering unparalleled accessibility and scalability to business operations. Compared to traditional brick-and-mortar outlets, providing cloud-based services has several advantages. Cloud computing allows fintech service companies to adapt to changing demand and deploy new services easily. This allows them to manage workloads accordingly and optimize costs efficiently. Cloud-based fintech also allows businesses to provide personalized services and tailor them to their regional customers through data-driven insights, leading to higher customer engagement and retention.

Data privacy concerns

Fintech service companies collect a large amount of sensitive personal data, including financial records, bank statements, loan history, credit scores, and other important financial information. This makes the industry highly susceptible to cybercrime. Fintech service companies require protection from both external and internal attackers intending to steal data using a variety of methods like Phishing, Ransomware, and Distributed Denial of Service attacks to breach or through security measures. Businesses are widely adopting end-to-end encryption, blockchain, and multi-factor authentication mechanisms to maintain data privacy and restrict access to even internal employees. Keeping security systems updated, maintaining robust network infrastructure capable of handling traffic, and implementing proper traffic monitoring systems are some of the ways fintech service companies can ensure low disruption of services.

AI-integration and blockchain

Fintech service companies are increasingly looking to integrate artificial intelligence and blockchain technology to manage security and provide customer service. A blockchain is an unchangeable, transparent ledger that makes recording, managing, and storing transaction information more secure. The implementation of blockchain allows fintech service companies to selectively share data in the business network. Due to the unique characteristics of blockchains, the smart contracts created are deterministic and tamper-proof, boosting trust and efficiency. While smaller chains may be susceptible to alteration-based cyberattacks, it is nearly impossible on Bitcoin and other larger blockchains.

Fintech service companies are also increasingly employing AI-powered chatbots to make consumers’ inquiries and applications for financial services easier. Modern chatbots incorporate machine learning technology to self-learn based on an artificial neural network. Training these AI chatbots on data sets increases their response accuracy, allowing fintech service companies to take a more cost-effective approach to customer service.

The payment segment dominated the fintech as a service market in 2023. The global shift towards digital and cashless transactions due to widespread internet access is driving demand in the segment. The popularity of digital wallet services like Apple Pay or Google Wallet is enabling users to conduct quick, contactless transactions through API software. Sellers are also increasingly adopting online payment systems to accept payments. E-commerce platforms like Amazon are also increasingly tapping into fintech service solutions to conduct business and handle a large number of transactions.

The fund transfer segment is expected to be the fastest-growing in the forecast period. Growing globalization and interconnectivity are leading to increasing demand for international remittance services, mobile wallets, and peer-to-peer payments. End-to-end cross-border payment solutions are being widely adopted by businesses and consumers to make payments cheaper, faster, and more transparent. Contemporary fintech service providers are looking to capitalize on changing customer demand in emerging economies to provide wider financial inclusion. These factors are fuelling growth in this segment of the fintech as a service market.

The blockchain segment held the largest share of the fintech as a service market in 2023. Several fintech companies are switching to decentralized finance through smart contracts on big blockchains. Storing data and recording transactions on blockchains offer several advantages. Blockchains provide decentralized, immutable, and transparent ledgers, which offer increased security. The demand for open and secure financial transaction ledgers to meet growing customer needs has boosted growth in the segment.

The artificial intelligence segment is set to be the fastest-growing in the fintech as a service market during the forecast period. Several fintech service providers are turning to machine learning, predictive analytics, and natural language processing models to analyze consumer data to improve processing times and decision-making. The implementation of AI in fintech also leads to better regulatory compliance and enhances the overall end-user experience.

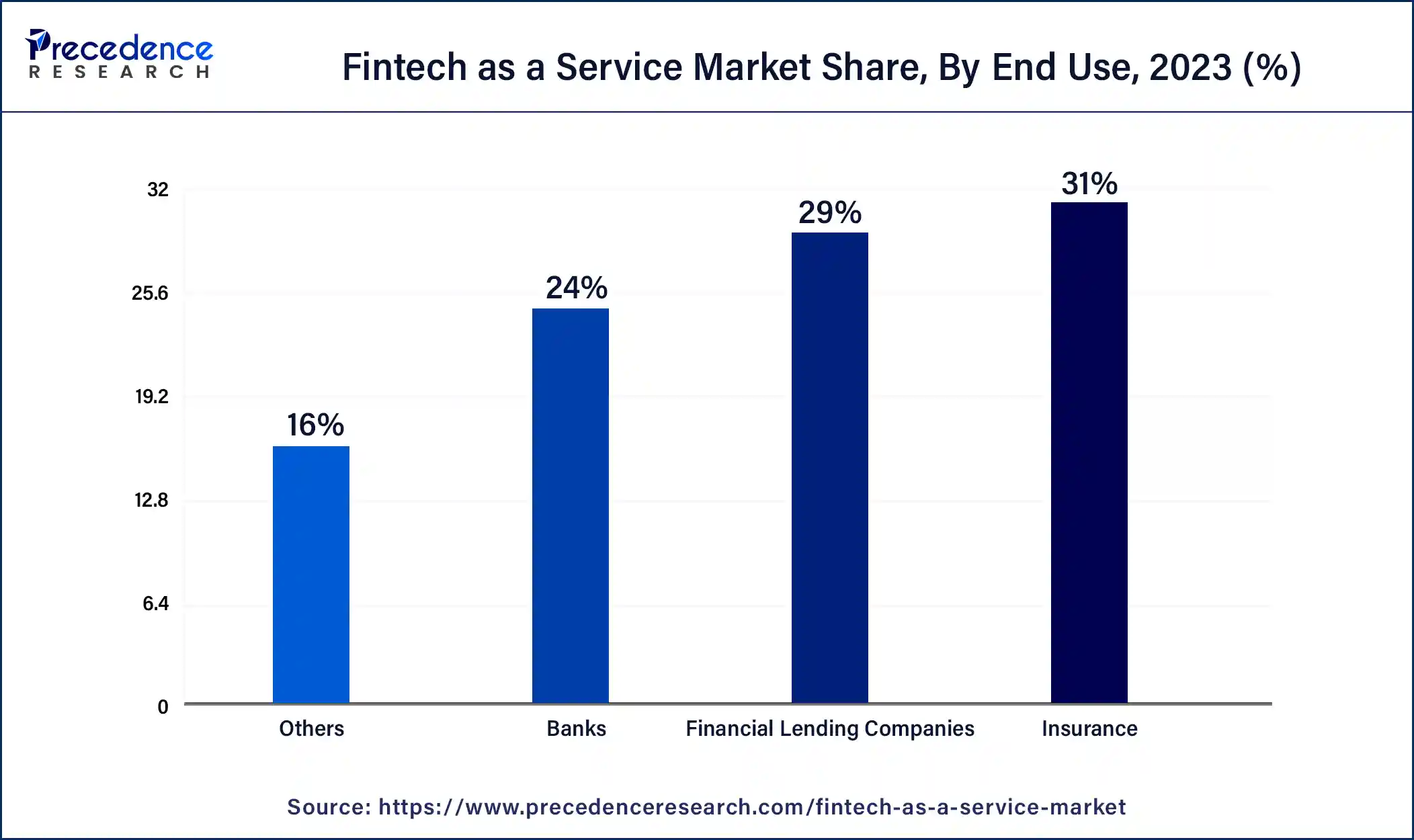

The insurance sector dominated the global fintech as a service market. The growing use of fintech solutions in the insurance segment, including virtual underwriting, digital claims processing, policy, and risk management, has led to the segment-leading along end-users. Insurance companies are increasingly turning to big data analytics, AI, and automation to enhance the overall customer experience and provide quick and efficient services. Fintech service providers are allowing insurance companies to personalize insurance plans while reducing costs and streamlining their offerings.

The financial lending companies segment is expected to witness the fastest growth in the forecast period between 2024 and 2034. Growing consumer consciousness around financial instruments and the demand for digital portfolio management services is expected to spur demand in the segment. Using big data and secure API connections, lenders can access thousands of data points about borrower habits, allowing them to speed up lending decisions. Fintech services also power peer-to-peer lending solutions, allowing for increasingly global financial connectivity.

Segments Covered in the Report

By Type Payment

By Technology

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

December 2024

January 2025