March 2025

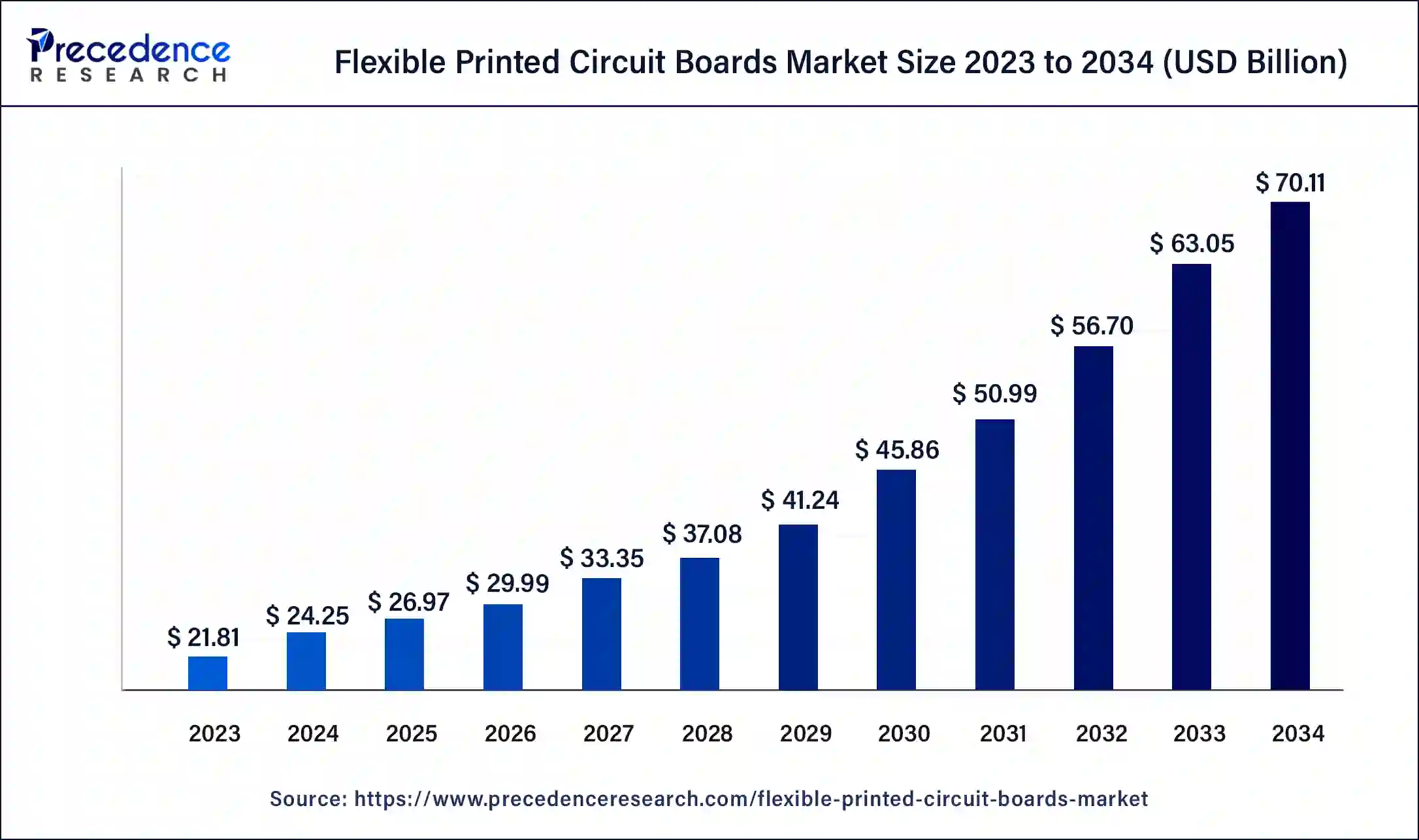

The global flexible printed circuit boards market size was USD 21.81 billion in 2023, estimated at USD 24.25 billion in 2024 and is expected to be worth around USD 70.11 billion by 2034, expanding at a CAGR of 11.20% from 2024 to 2034.

The global flexible printed circuit boards market size accounted for USD 24.25 billion in 2024 and is anticipated to reach around USD 70.11 billion by 2034, growing at a CAGR of 11.20% from 2024 to 2034.

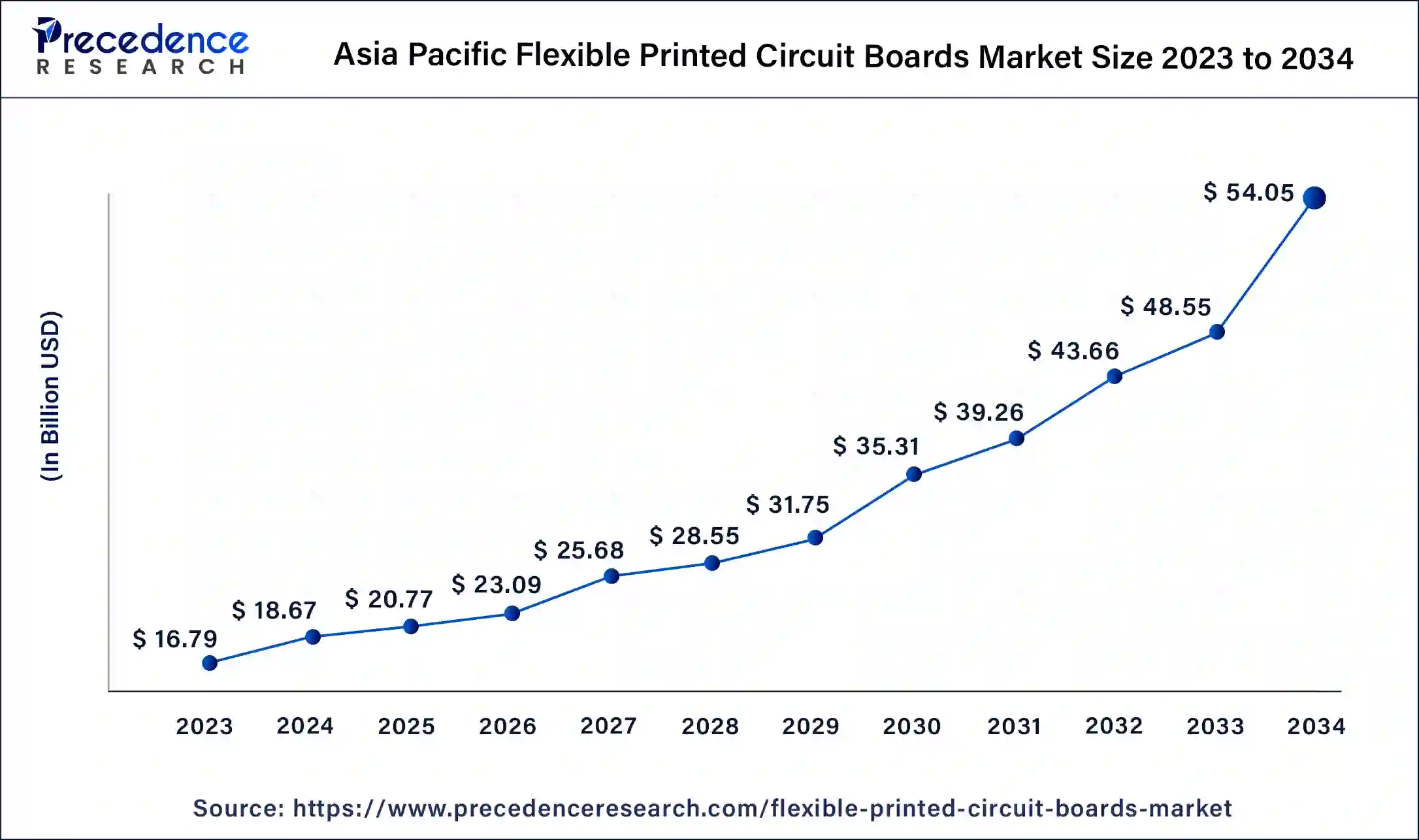

The Asia Pacific flexible printed circuit boards market size was valued at USD 16.79 billion in 2023 and is predicted to surpass around USD 54.05 billion by 2032, rising at a CAGR of 11.20% from 2023 to 2032.

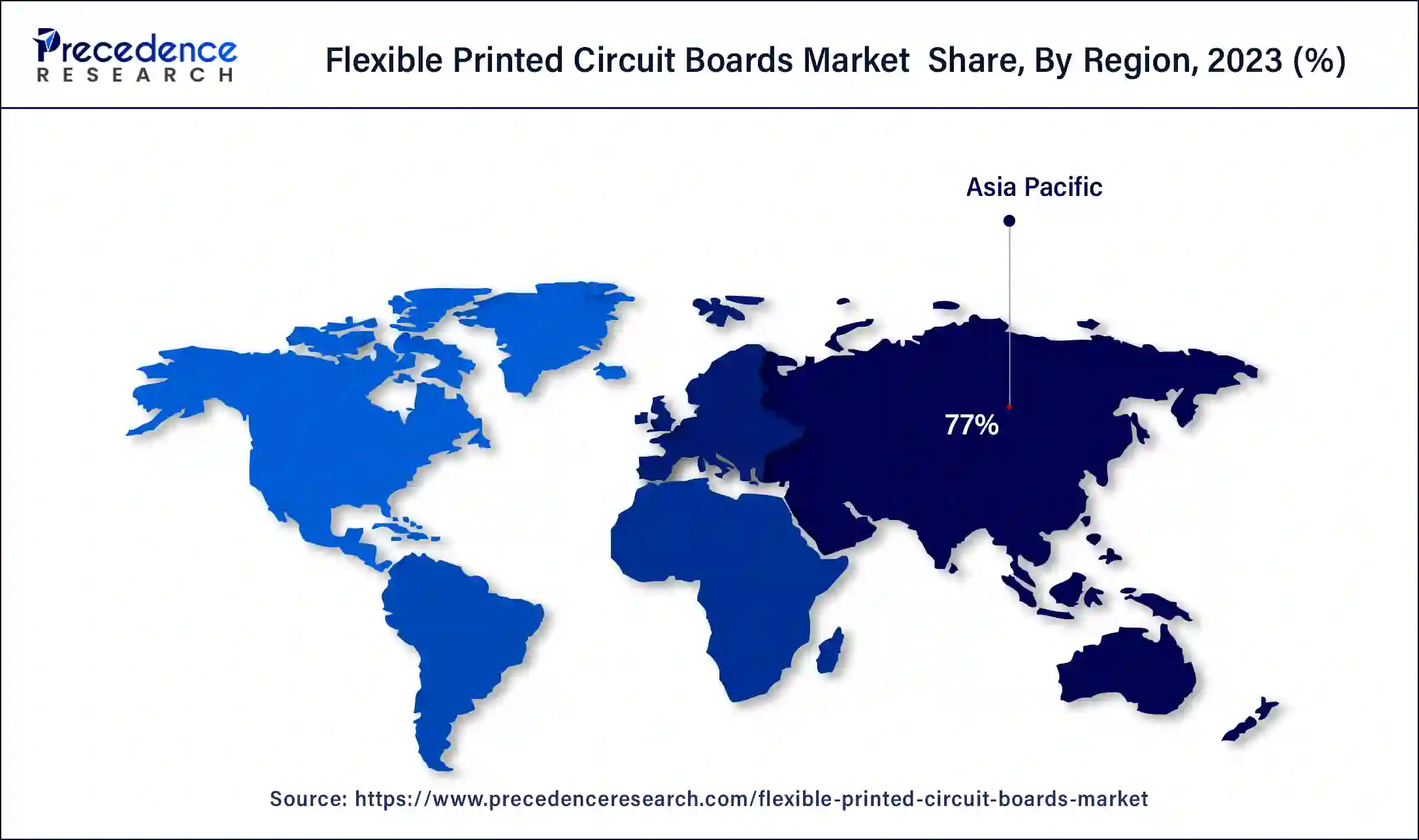

Asia-Pacific has held the largest revenue share 77% in 2023. Asia-Pacific dominates the flexible printed circuit boards market due to its robust electronics manufacturing ecosystem, led by countries like China, Japan, and South Korea. These nations are major hubs for consumer electronics production and assembly, driving the demand for FPCBs. The region's advanced technology infrastructure, skilled workforce, and favorable regulatory environment also contribute to its leadership in FPCB manufacturing. Additionally, the escalating adoption of smartphones, wearables, and other electronic devices in the region further amplifies the demand for flexible and lightweight circuit solutions, solidifying Asia-Pacific's significant market share.

North America is estimated to observe the fastest expansion. North America commands a significant share in the flexible printed circuit boards market due to the region's robust electronics industry, technological advancements, and early adoption of innovative technologies. The presence of key market players, substantial investment in research and development, and a high demand for flexible and compact electronic devices contribute to North America's dominance. Additionally, the region's emphasis on applications like automotive electronics, aerospace, and healthcare further propels the use of FPCBs, consolidating North America's leading position in the global market.

Flexible printed circuit boards (FPCBs) are a type of electronic interconnectivity solution known for their bendable and adaptable nature. Composed of flexible plastic materials such as polyimide, these boards provide a compact and lightweight alternative to traditional rigid circuit boards. FPCBs are ideal for applications where space constraints and complex geometries are a concern, allowing for efficient routing of connections in three-dimensional configurations.

Their flexibility allows them to seamlessly integrate into devices, reducing the need for bulky connectors and enhancing reliability by withstanding dynamic stresses. This makes FPCBs particularly valuable in industries like consumer electronics, automotive, and medical devices, where space-efficient and durable designs are essential. In summary, flexible printed circuit boards provide a cutting-edge solution for contemporary electronics, promoting creative design possibilities and improved functionality.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 11.20% |

| Market Size in 2023 | USD 21.81 Billion |

| Market Size in 2024 | USD 24.25 Billion |

| Market Size by 2034 | USD 70.11 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Miniaturization trend and consumer electronics boom

The miniaturization trend and consumer electronics boom synergistically drive the surging market demand for flexible printed circuit boards. As electronic devices continue to evolve, there is an increasing emphasis on miniaturization, with consumers demanding smaller, more lightweight products. FPCBs play a pivotal role in meeting this demand, offering a flexible and compact solution for intricate circuitry in devices with limited space.

The consumer electronics boom, marked by the widespread adoption of smartphones, wearables, and other portable gadgets, significantly amplifies the demand for FPCBs. These boards enable the design of sleeker and more sophisticated electronic devices, aligning with the preferences of modern consumers. The interplay of the miniaturization trend and consumer electronics boom positions FPCBs as a critical enabler of innovation, fostering their integration into a broad spectrum of electronic applications and driving sustained growth in the FPCB market.

Limited heat dissipation

Limited heat dissipation poses a significant restraint on the growth of the flexible printed circuit boards market. While FPCBs offer unparalleled flexibility and adaptability, their ability to dissipate heat is generally lower compared to rigid boards. In applications where efficient thermal management is crucial, such as high-performance computing or power electronics, the constraints on heat dissipation can impede the adoption of FPCBs.

Thermal limitations may lead to concerns over overheating, potentially compromising the performance and reliability of electronic systems. This restriction becomes particularly pronounced in industries that demand rigorous thermal control, limiting the applicability of FPCBs in certain critical applications. As electronic devices continue to push the boundaries of performance, addressing the challenge of limited heat dissipation becomes imperative for FPCBs to expand their market presence in diverse sectors and applications.

Wearable electronics

FPCBs are crucial for wearable healthcare devices that monitor vital signs, deliver therapies or aid in diagnostics. The healthcare wearable market's growth presents a substantial opportunity for FPCB manufacturers. The expanding market for wearable electronics, driven by consumer demand for smartwatches, fitness trackers, and other connected devices, creates a continuous demand for FPCBs. This growth provides opportunities for innovation and market expansion in the flexible printed circuit boards sector.

In 2023, the double-sided PCB segment had the highest market share of 45% based on the type. Double-Sided PCBs in the flexible printed circuit boards market refer to circuits featuring conductive traces on both sides of the flexible substrate. These boards offer enhanced design flexibility and increased circuit density. The double-sided FPCB segment is witnessing a notable trend towards greater integration in compact electronic devices. The demand for thinner and more lightweight products is driving the adoption of double-sided FPCBs, enabling manufacturers to achieve higher functionality in limited space and contributing to the overall growth of the FPCB market.

The multilayer circuit segment is anticipated to expand at a significant CAGR of 12% during the projected period. Multilayer circuits are a type of flexible printed circuit board characterized by the stacking of multiple conductive layers separated by insulating substrates. These boards allow for intricate and dense circuit designs in a compact form factor. A growing trend in the FPCB market is the increasing adoption of multilayer configurations. This trend is driven by the need for enhanced functionality in compact electronic devices, such as smartphones and IoT devices, where multilayer FPCBs enable the integration of complex and sophisticated circuitry.

According to the end-use, the IT and telecom segment has held 34% revenue share in 2023. The IT and Telecom segment in the flexible printed circuit boards market encompasses the use of these circuits in a range of devices such as smartphones, networking equipment, and communication devices. Trends in this segment include the increasing demand for FPCBs in 5G-enabled devices, where the boards provide compact and efficient connectivity solutions. Additionally, the trend towards miniaturization in IT and telecom equipment drives the adoption of FPCBs, allowing manufacturers to design sleeker and more feature-rich devices with flexible and space-efficient circuitry.

The consumer electronics segment is anticipated to expand fastest over the projected period. The consumer electronics segment in the flexible printed circuit boards market encompasses devices such as smartphones, tablets, wearables, and gaming consoles. A notable trend in this segment is the increasing demand for compact and lightweight designs, driving the adoption of FPCBs due to their flexibility and space-efficient attributes. As consumer preferences lean towards sleeker and more advanced electronic gadgets, FPCBs enable manufacturers to achieve innovative and intricate circuitry layouts, positioning them as a vital component in the evolution of consumer electronics.

Segments Covered in the Report

By Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

August 2024

September 2024

December 2024