January 2025

Food Antioxidants Market (By Type: Synthetic, Natural; By Form: Dry, Liquid; By Application: Meat & Poultry, Bakery & Confectionery, Fats & oil, Fish, Pet Food, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

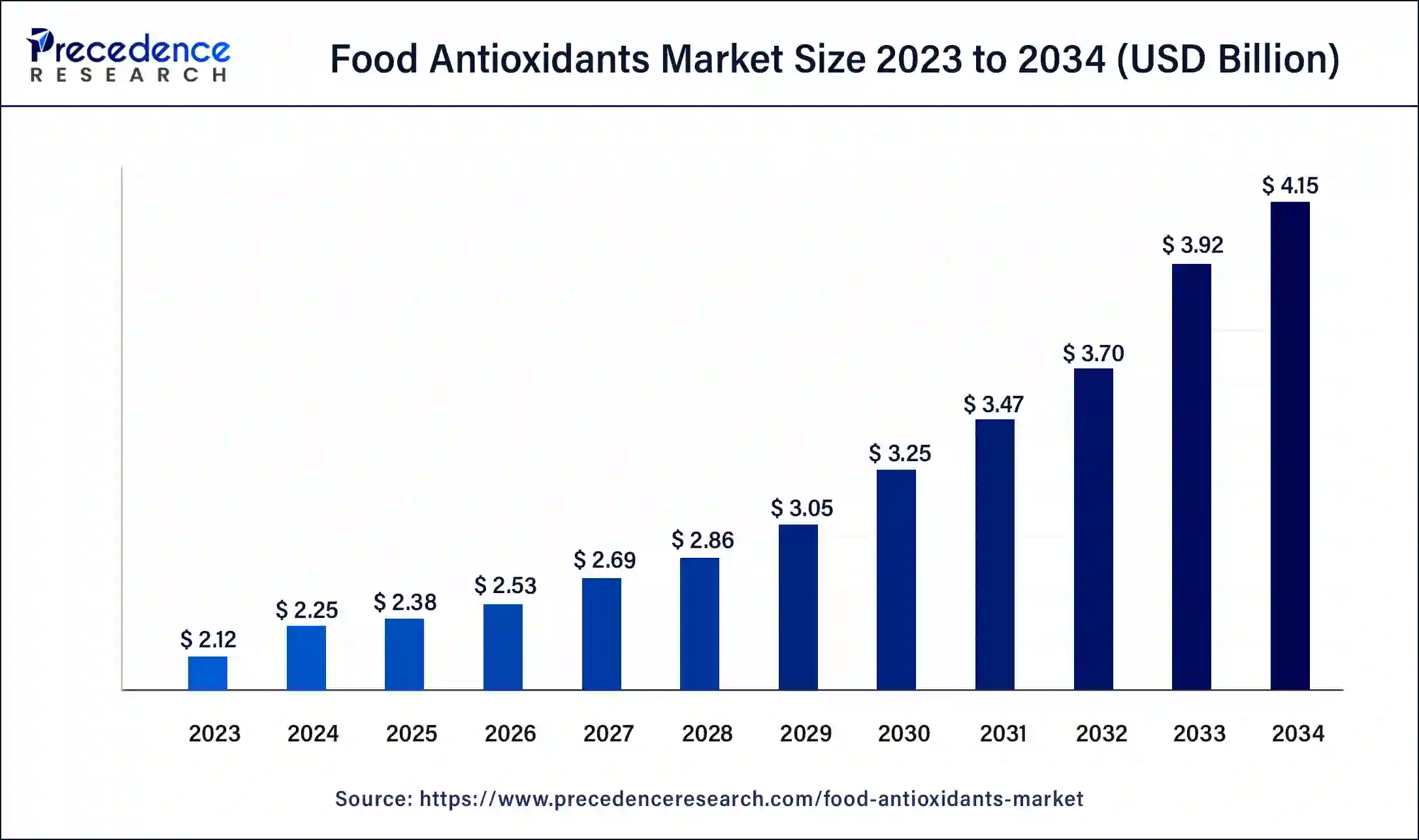

The global food antioxidants market size was USD 2.12 billion in 2023, calculated at USD 2.25 billion in 2024 and is expected to reach around USD 4.15 billion by 2034, expanding at a CAGR of 6.32% from 2024 to 2034.

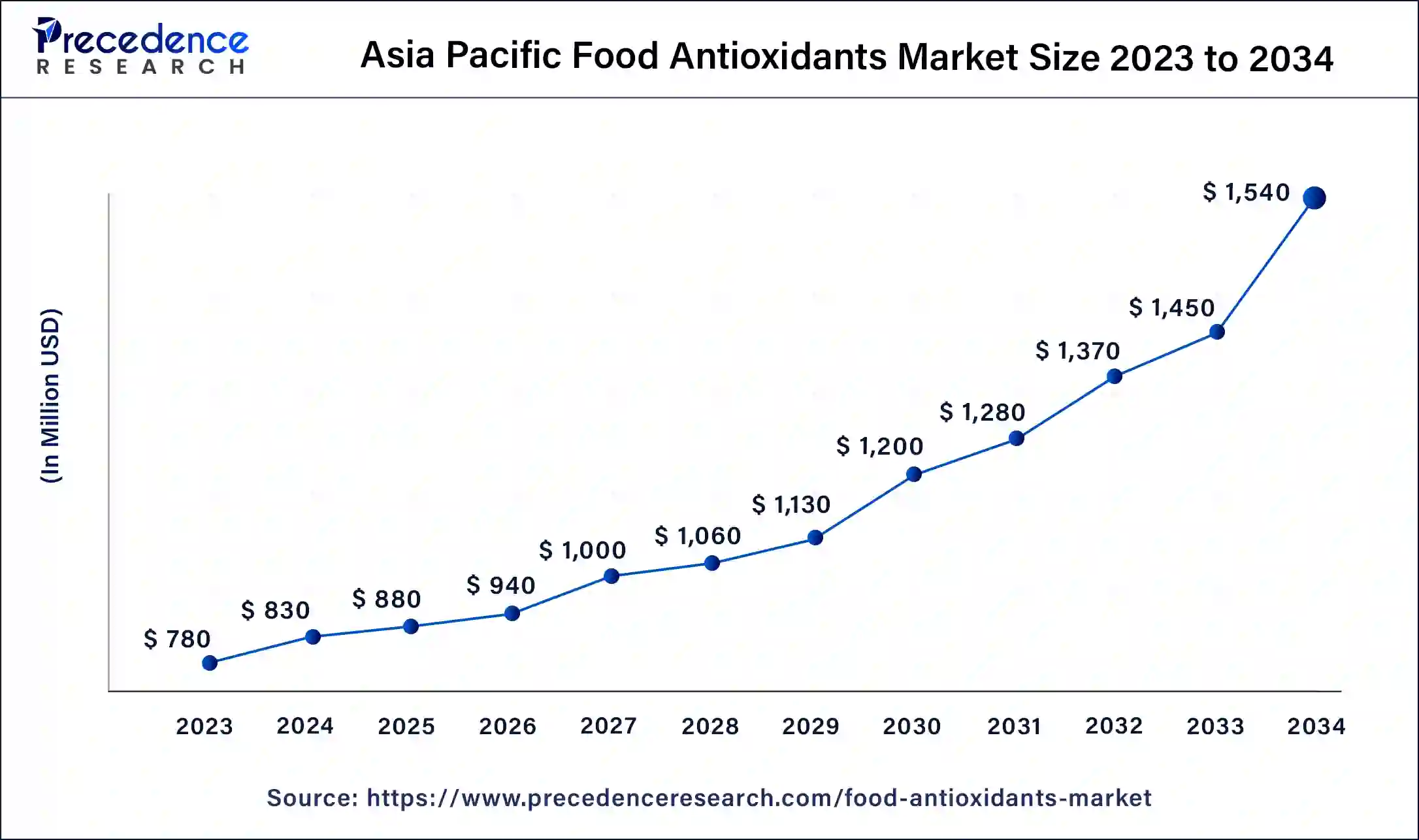

The Asia Pacific food antioxidants market size was estimated at USD 780 million in 2023 and is predicted to be worth around USD 1,540 million by 2034, at a CAGR of 7% from 2024 to 2034.

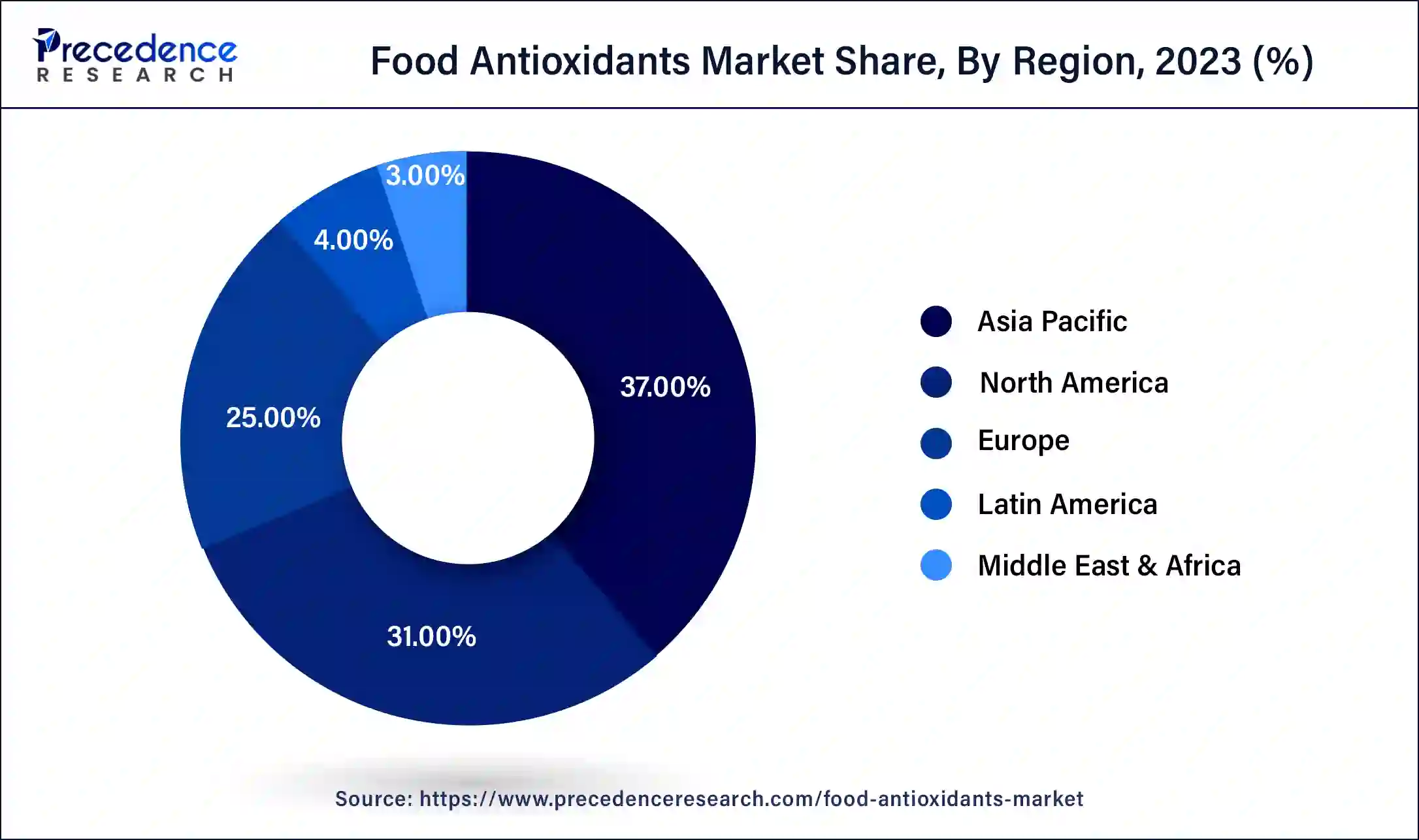

Asia Pacific held the largest share of the market in 2023 driven by a population that is increasingly health-conscious and enjoys higher disposable incomes. Consequently, there is a growing demand for functional foods and products enriched with antioxidants, catering to the health and wellness aspirations of consumers.

The region's diverse culinary traditions offer unique opportunities to infuse antioxidants into a wide array of dishes and snacks, appealing to consumers seeking dietary variety. Additionally, there's a noticeable trend towards the use of natural antioxidants, aligning with the regional preference for clean label and minimally processed food options, which further propels the market growth.

In the food antioxidants market in Europe, there is a strong emphasis on clean label and natural ingredients. Consumers prioritize food products that are minimally processed and free from artificial additives. This trend drives the demand for natural antioxidants derived from botanical sources. Regulatory bodies in Europe also play a pivotal role in shaping the market by enforcing stringent food safety and labeling regulations, prompting manufacturers to invest in compliance and innovation to meet consumer preferences for cleaner, healthier food options.

North America is observed to grow at the fastest rate during the forecast period. In North America, the food antioxidants market is marked by the continued growth of natural and clean label products. Health-conscious consumers are driving the demand for antioxidant-rich foods and beverages, and there is a notable focus on transparency in ingredient lists. Additionally, the region is witnessing a surge in functional foods and nutraceuticals incorporating antioxidants to address specific health needs. The regulatory landscape in North America encourages innovation in antioxidant formulations that cater to the clean label and health-oriented preferences of consumers.

The food antioxidants market comprises natural or synthetic compounds that inhibit the oxidation of food products, preventing spoilage and preserving their quality. The Food Antioxidants Market revolves around substances that inhibit oxidation, preserving the quality and extending the shelf life of various food products.

These antioxidants, often natural or synthetic compounds, are added to prevent rancidity, discoloration, and flavor degradation. They find extensive use in the food and beverage industry, enhancing the stability of fats, oils, and other ingredients in processed foods. The market is driven by increasing consumer demand for clean label and minimally processed foods, alongside growing awareness of the health benefits associated with antioxidants, making them a vital component in food preservation and product quality maintenance.

| Report Coverage | Details |

| Market Size By 2034 | USD 4.15 Billion |

| Market Size in 2023 | USD 2.12 Billion |

| Market Size in 2024 | USD 2.25 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Form, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing processed food demand and natural antioxidants

The surging demand for processed and convenience foods is a prominent driver of the food antioxidants market. As consumers lead busier lives, the reliance on packaged and processed foods has grown. These foods often contain fats, oils, and other ingredients that are prone to oxidation and spoilage. Antioxidants play a pivotal role in extending the shelf life and maintaining the quality of these products. Whether it's preventing rancidity in snacks, preserving the color of frozen meals, or safeguarding the texture of baked goods, antioxidants are integral in ensuring processed foods remain fresh and appealing. As this demand continues to rise, so does the need for effective antioxidants, thus fueling market growth.

The shift towards natural antioxidants derived from herbs, spices, and botanical sources is a key driver in the food antioxidants market. Consumers are increasingly seeking clean labels and minimally processed food options, and the demand for natural antioxidants aligns with these preferences. Natural antioxidants not only offer the health benefits associated with plant-based compounds but also cater to the consumer's desire for transparency and simpler ingredient lists. As consumers prioritize health and wellness, the market sees a surge in the demand for natural antioxidants to replace synthetic alternatives in a variety of food products. This trend propels the market forward, creating opportunities for manufacturers to meet consumer demands for cleaner, more wholesome food options.

Natural resource limitations and cost considerations

Natural antioxidants, often derived from botanical sources, can be subject to limitations due to factors such as climate change and environmental sustainability. Fluctuations in the availability of these resources can lead to challenges in sourcing a consistent and reliable supply of natural antioxidants. Climate variations and ecological issues may impact the growth and harvesting of plants used in antioxidant production, leading to potential shortages. This can constrain manufacturers in their efforts to meet the increasing demand for clean labels and natural antioxidant solutions, affecting the market's ability to fully capitalize on this trend.

Developing and incorporating antioxidants into food products while maintaining cost-effectiveness can be a significant restraint in the food antioxidants market. The manufacture of top-tier natural antioxidants often entails substantial expenses, encompassing sourcing, processing, and rigorous testing. This presents a conundrum for manufacturers as consumers progressively gravitate towards products featuring clean labels and natural constituents.

Striking a balance between fulfilling these consumer demands and maintaining competitive pricing can be a formidable challenge. This dilemma is especially pronounced for small and medium-sized manufacturers, who may encounter difficulties in adopting costly natural antioxidant solutions without substantially elevating the overall production costs, thereby potentially constraining their market competitiveness and overall profitability.

Rising health consciousness, functional foods and Nutraceuticals

The food antioxidants market is experiencing a substantial upswing in demand due to the growing population of health-conscious consumers. These individuals are increasingly committed to making more health-conscious dietary choices. Antioxidants, acknowledged for their ability to combat oxidative stress and promote overall well-being, have gained widespread recognition.

Consequently, consumers actively seek out food and beverage products enriched with these beneficial compounds. This surging health consciousness serves as a catalyst, propelling manufacturers to integrate antioxidants into a diverse array of products, including snacks, beverages, and dietary supplements. This integration not only addresses consumer preferences but also fuels a robust demand in the market for antioxidant-infused offerings.

The trend towards functional foods and nutraceuticals has become a cornerstone of the food antioxidants market. Antioxidants are key components in these products, which are designed to provide specific health benefits beyond basic nutrition. From antioxidant-infused energy bars to supplements targeting heart health, these functional foods and nutraceuticals leverage the antioxidant properties to meet consumers' wellness objectives. As this market segment continues to expand, the demand for antioxidant-rich ingredients rises, creating opportunities for both ingredient suppliers and manufacturers to cater to consumers' growing appetite for foods that promote health and well-being.

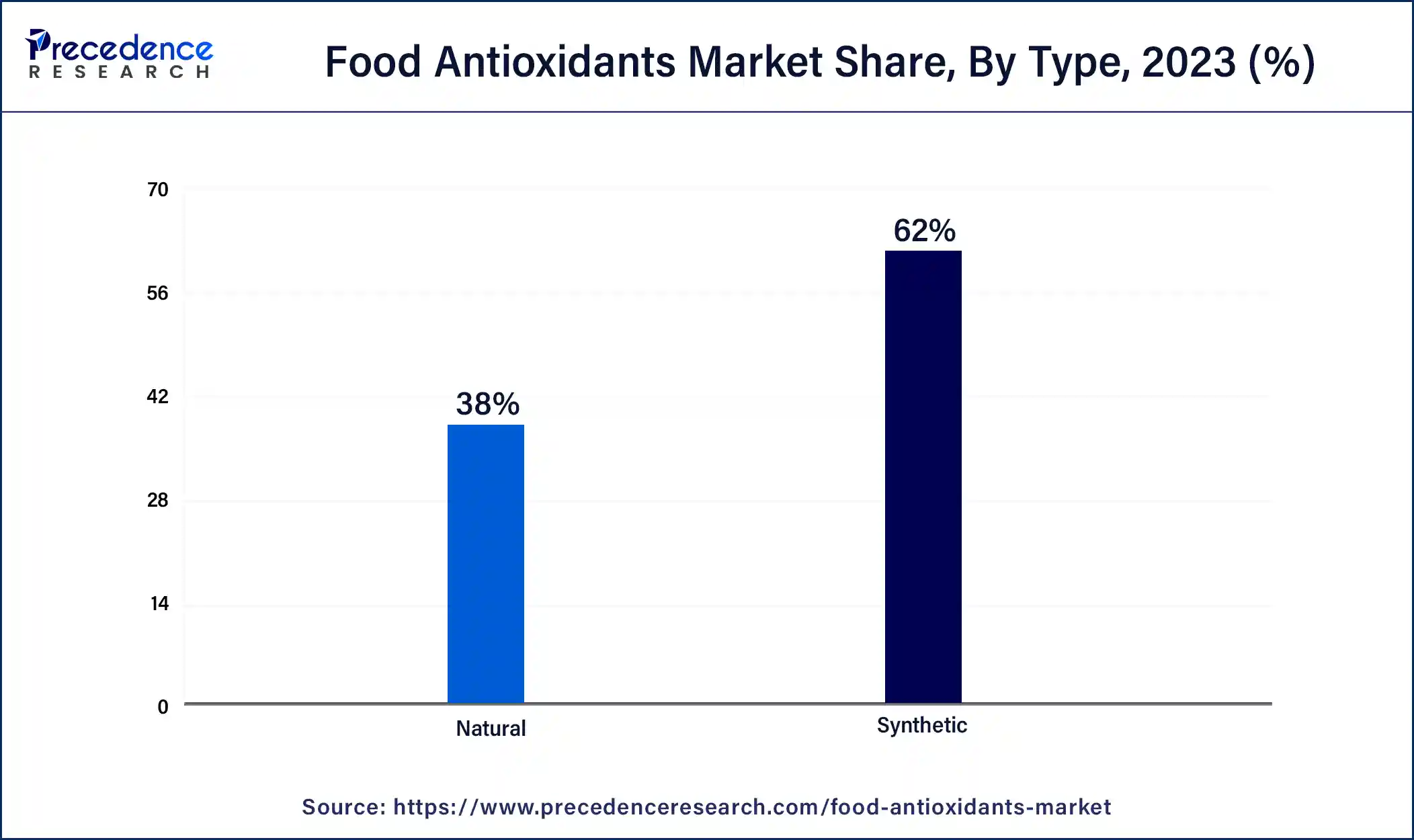

The synthetic segment has held a 58% revenue share in 2023. Synthetic antioxidants are chemically formulated compounds used in the food antioxidants market to prevent oxidation and prolong the shelf life of various products. These antioxidants are cost-effective and highly efficient. However, due to the growing consumer preference for natural ingredients and clean labels, there is a trend towards reducing the use of synthetic antioxidants in favor of natural alternatives.

The natural segment is anticipated to expand at a significant CAGR of 8.7% during the projected period. Natural antioxidants are derived from plant sources, herbs, and spices. They are favored for their clean label appeal and health benefits. A prominent trend in the food antioxidants market is the increasing use of natural antioxidants to meet the demand for clean-label and minimally processed food products. This trend aligns with consumers' preferences for healthier and more natural food options.

The dry segment held the largest share of 75% in 2023. Dry food antioxidants, typically in the form of powders or granules, are gaining traction in the food antioxidants market. This trend aligns with the increasing demand for shelf-stable products, such as dry snacks and processed goods. Dry antioxidants offer stability and convenience in applications where liquid forms may not be as suitable. They are particularly favored in the bakery and snack industry for their ease of incorporation into dry mixes.

The liquid segment is projected to grow at the fastest rate over the projected period. The liquid form of food antioxidants, often as emulsions or oils, continues to be a preferred choice for products like beverages, dressings, and cooking oils. These antioxidants offer ease of dispersion and even distribution within liquid matrices, ensuring efficient protection against oxidation. The liquid form is seeing innovation with the development of water-soluble antioxidants to cater to consumer preferences for cleaner labels and reduced oil content in certain applications.

The meat and poultry segment had the highest market share of 37% in 2023 based on the application. In the food antioxidants market, the application of antioxidants in meat and poultry products is primarily geared towards preserving the quality and extending the shelf life of these perishable items. A notable trend is the increasing consumer preference for clean labels and natural antioxidants in meat products. This trend aligns with the demand for minimally processed foods. Manufacturers are also experimenting with innovative antioxidant formulations to ensure the freshness and safety of meat and poultry products, catering to evolving consumer preferences for healthier and safer options.

The bakery and confectionery segment is anticipated to expand at the fastest rate over the projected period. Antioxidants play a crucial role in the bakery and confectionery sector by preventing the oxidation of fats, oils, and ingredients in these products. A prominent trend is the use of natural antioxidants, like tocopherols and rosemary extract, to replace synthetic alternatives. This transition aligns with the clean label movement as consumers seek baked goods and confectioneries made with wholesome, natural ingredients. Additionally, antioxidants are employed to maintain the color and texture of these products, meeting consumer expectations for appealing and high-quality bakery and confectionery items.

Recent Developments

Segments Covered in the Report

By Type

By Form

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

September 2024

January 2025