February 2025

The global food grade ammonium carbonate market size is accounted at USD 345.02 million in 2025 and is forecasted to hit around USD 910.88 million by 2034, representing a healthy CAGR of 11.39% from 2025 to 2034. The North America market size was estimated at USD 105.31 million in 2024 and is expanding at a CAGR of 11.55% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Million), with 2024 as the base year.

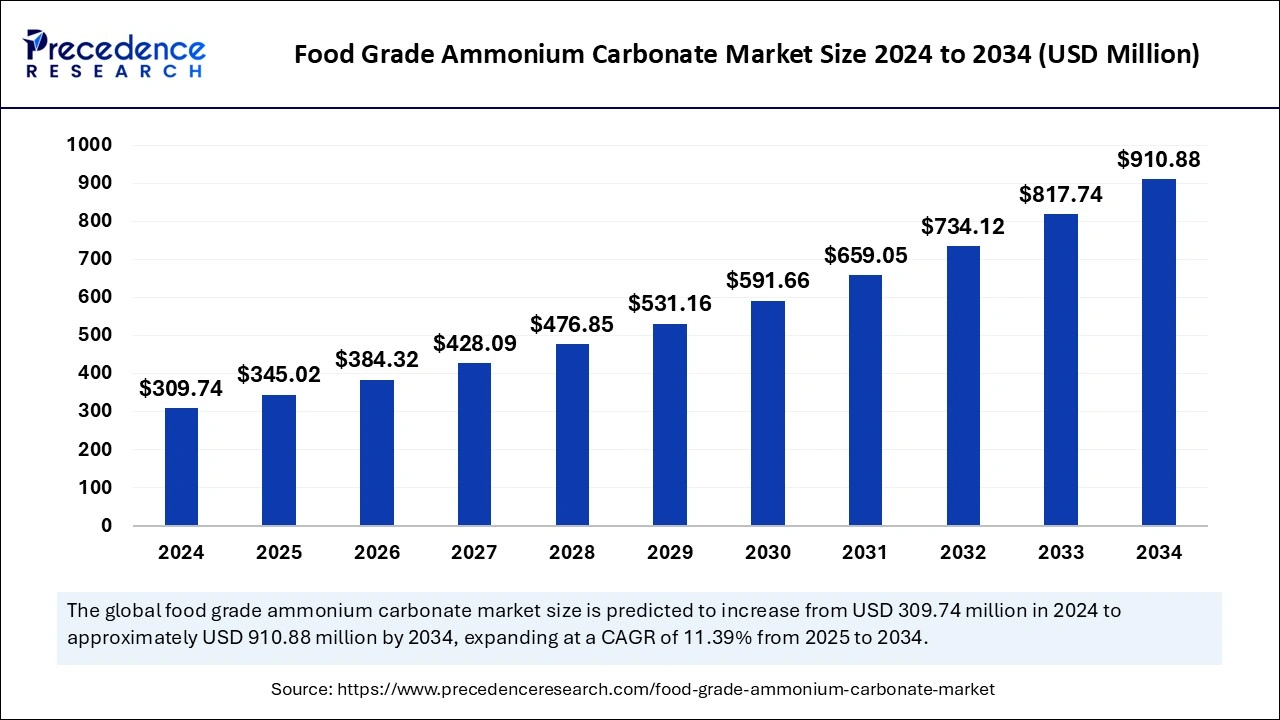

The global food grade ammonium carbonate market size was calculated at USD 309.74 million in 2024 and is predicted to reach around USD 910.88 million by 2034, expanding at a CAGR of 11.39% from 2025 to 2034. The global market growth is attributed to the rising innovation in confectionery and the expansion of meat and dairy processing.

By ensuring high-quality standards and enhancing production efficiency, the integration of artificial intelligence technologies is transforming the global food grade ammonium carbonate market. AI-generated analytics helps to improve consistency in product quality, reduce operational costs, and streamline manufacturing processes. These advancements allow more precise control over ingredient production and formulation conditions and result in better reliability and performance.

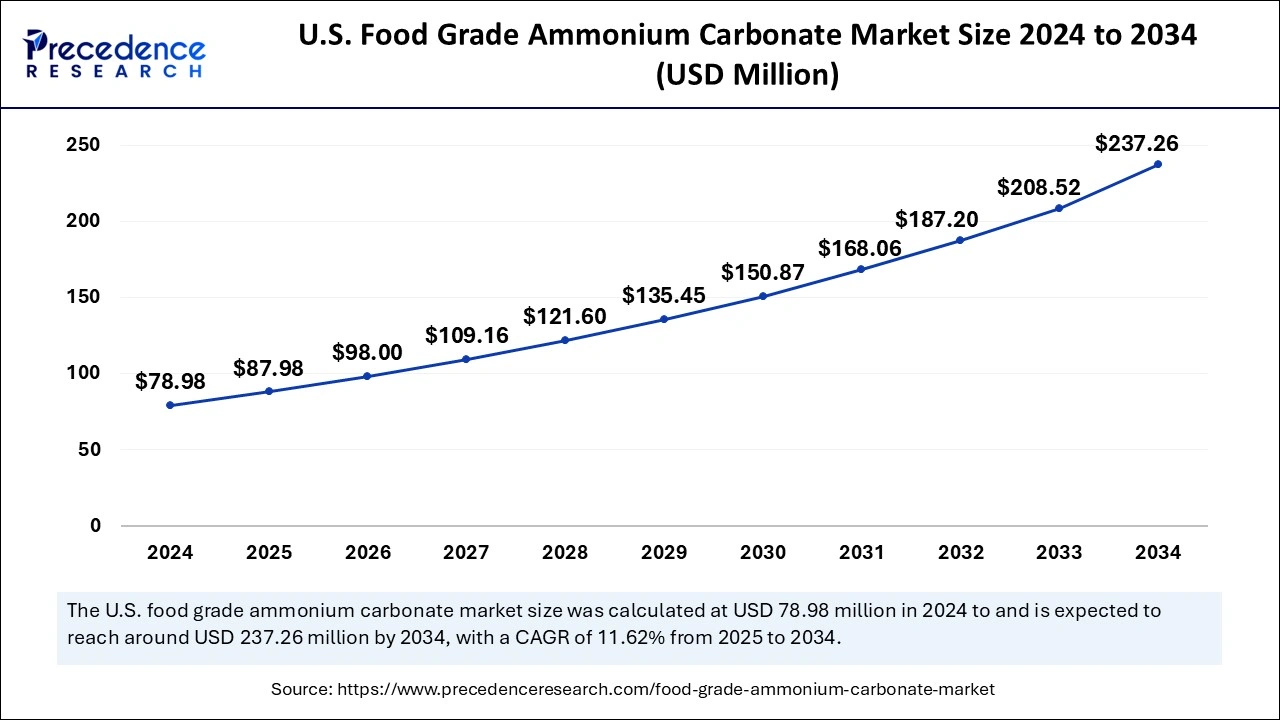

The U.S. food grade ammonium carbonate market size was evaluated at USD 78.98 million in 2024 and is projected to be worth around USD 237.26 million by 2034, growing at a CAGR of 11.62% from 2025 to 2034.

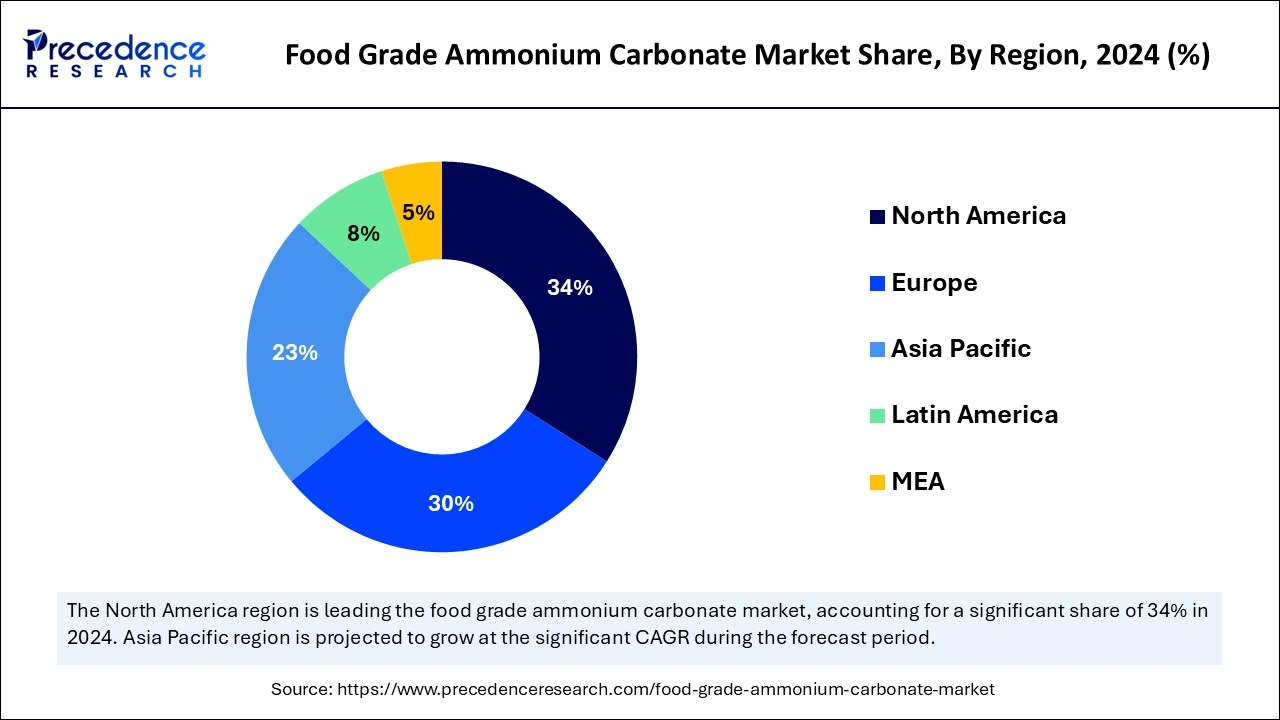

North America dominated the global food grade ammonium carbonate market in 2024. The market growth in the region is attributed to the high demand for bakery and confectionery products and the well-developed food processing industry. The prevalence of food quality and safety standards in the region is also a major factor driving the market growth. The U.S. and Canada are the major countries that dominated the market growth. The increasing demand for natural and clean-label ingredients and the large bakery industry is expected to drive the market in the U.S.

Asia Pacific is expected to grow at the fastest rate in the food grade ammonium carbonate market during the forecast period. The food grade ammonium carbonate market growth in the region is attributed to the increasing disposable incomes of consumers, the expanding bakery and confectionery industry, rapid industrialization, and urbanization. China, India, Japan, and South Korea are the fastest growing countries in the market growth. Furthermore, the growing middle-class population is accelerating the demand for high-quality food products in these countries.

The food grade ammonium carbonate market is primarily fueled by the rising demand for confectionery and bakery products. The bakery sector has seen substantial growth as consumer preferences shift towards ready-to-eat products and convenience foods. Ammonium carbonate is widely used in crackers, cookies, and a variety of pastries. In addition, the increasing disposable income of consumers, especially in developing countries, is driving the demand for bakery products.

Additionally, the major factor driving the market growth is the expanding food and beverage industry. This compound finds applications in several food processing techniques, such as stabilization and fermentation. Due to its compliance and non-toxic nature with food safety standards, the increasing global trend towards organic and healthier food options is inspiring the use of food grade ammonium carbonate. Furthermore, the increasing trend towards natural and clean-label ingredients in pharmaceuticals is also inspiring manufacturers.

| Report Coverage | Details |

| Market Size by 2025 | USD 345.02 Million |

| Market Size in 2024 | USD 309.74 Million |

| Market Size by 2034 | USD 910.88 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.39% |

| Leading Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased government regulation

The increasingly strict government regulations on food alternatives, such as ammonium carbonate, are integrated into major markets. Leading to better processes by manufacturers to ensure safety, the quality control standards have been enhanced. In addition, manufacturers are increasing their production capabilities in response to rising demands, particularly in developing markets. This includes upgrading existing ones and constructing new plants to increase output levels for food grade ammonium carbonate market demand.

Eco-friendly production focus

There is an increasing significance in reducing the environmental effect of ammonium carbonate production. Various companies have started investing in green methods and technologies, such as the use of waste-minimizing techniques and renewable energy sources to produce sustainable products. In addition, manufacturers are creating innovative packages that minimize environmental pollution and preserve the quality of food grade ammonium carbonate.

Stringent standards and regulations

The increasingly strict regulations and standards are the major challenges hindering market growth. Regulatory bodies such as EFSA (European Food Safety Authority) and the FDA (Food and Drug Administration) impose stringent regulations on the use of food alternatives to guarantee consumer safety, particularly in terms of obtaining necessary certifications and approvals. In addition, any updates or changes to regulatory standards can pose compliance barriers for manufacturers and further restrain the growth of the food grade ammonium carbonate market.

The increasing demand for natural and organic food products

The increasing demand for natural and organic food products is the major opportunity driving the market growth. There is an increasing preference for clean-label and natural ingredients as consumer awareness related to the health effects of synthetic alternatives continues to grow. This advanced trend is especially evident in emerging regions such as Europe and North America, where customers want to pay a premium for safe and high-quality food products.

The expansion of the confectionery and bakery industry in developing countries is another opportunity for the food grade ammonium carbonate market. The rising middle-class population in emerging regions is continuously seeking ready-to-eat products and convenience foods, accelerating the market demand. By developing products tailored to preferences and local tastes and expanding their presence in developing markets, manufacturers can capitalize on this trend.

The powder segment dominated the global food grade ammonium carbonate market growth in 2024. The market is segmented into crystals, granules, and powder. The powder form of food grade is commonly used in the confectionery and bakery industry. The powder segment has a fine texture, which enables uniform distribution and easy mixing of batter and dough, resulting in improved product quality and consistent leavening. Due to its incorporation and ease of handling into various medicinal formulations, the powder form is also preferred in pharmaceuticals.

The granules segment is expected to expand significantly during the forecast period. As compared to powder form, granular form reduces dust generation and offers better flow properties making it appropriate for use in automated food processing equipment. In addition, granules provide more precise control of recipes in ammonium carbonate and are easy to measure and handle. This trend is vital for maintaining product consistency.

The bakery and confectionery segment held the largest food grade ammonium carbonate market share in 2024. The market is segmented into food and beverage, pharmaceuticals, bakery and confectionery, and others. The segment growth is attributed to the changing, rising disposable income, rapid urbanization, and expansion of the bakery and confectionery industry in emerging countries. This has led to its widespread use as a leavening agent, and the segment is the largest consumer of food grade ammonium carbonate. In addition to baked products such as pastries, crackers, and cookies, ammonium carbonate provides the essential texture and lift. Furthermore, the increasing demand for bakery products is fueled by changing consumer preferences and lifestyles.

The pharmaceuticals segment is expected to grow at the fastest rate during the forecast period. Pharmaceuticals play an important role in the formulation of various medicinal products, such as inhalants, expectorants, and antacids. The food grade ammonium carbonate is utilized for its stabilizing and buffering properties, in the pharmaceutical industry. In addition, the segment growth is attributed to the increasing focus on healthcare and the rising prevalence of chronic diseases. Furthermore, there is an increasing trend towards clean-label and natural ingredients in pharmaceuticals.

The supermarket segment dominated the global food grade ammonium carbonate market in 2024. The market is segmented into specialty stores, supermarkets/hypermarkets, online stores, and others. The segment growth is attributed to the increasingly widespread presence of retail chains across suburban and urban areas. The supermarkets' retail chains provide a wide range of products, such as food alternatives, and make them a convenient shopping destination for customers. Along with promotional offers and attractive pricing, the presence of dedicated sections for confectionery and baking ingredients further drives the segment.

The online stores segment is expected to grow rapidly during the forecast period. The segment growth is driven by factors such as the rising popularity of convenience and e-commerce. Along with the availability of a wide range of options, the ability to purchase and browse ducts from the comfort of one's home has made online stores a preferred choice for various customers. In addition, the increasing availability of detailed customer reviews and product information on online platforms aids customers in making informed decisions.

By Product Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

October 2024

January 2025